This version of the form is not currently in use and is provided for reference only. Download this version of

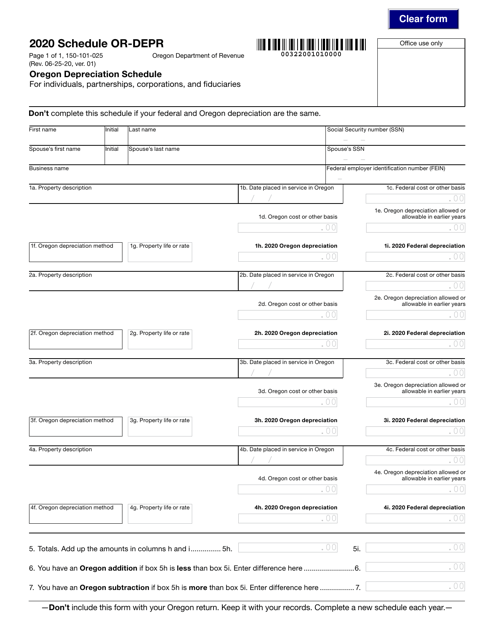

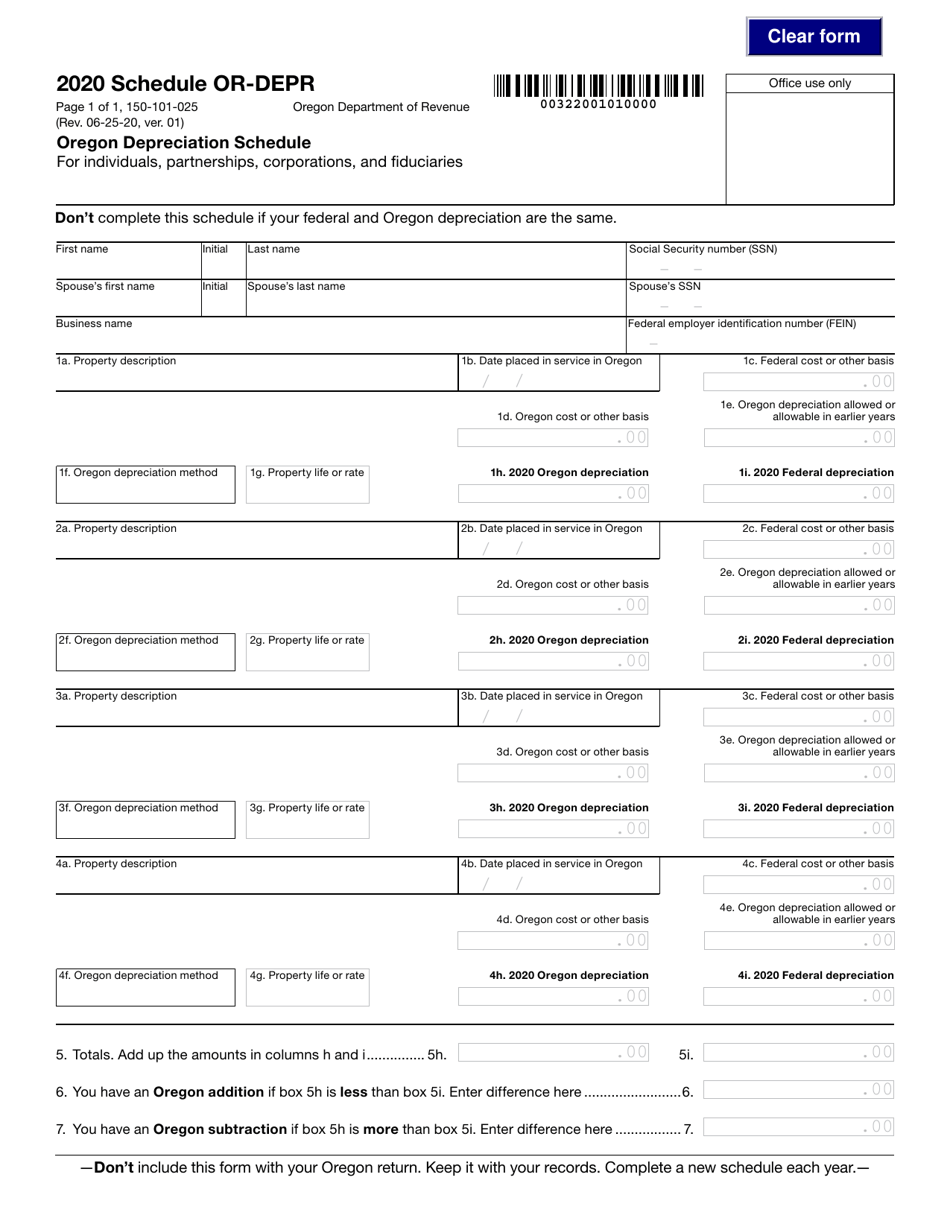

Form 150-101-025 Schedule OR-DEPR

for the current year.

Form 150-101-025 Schedule OR-DEPR Oregon Depreciation Schedule - Oregon

What Is Form 150-101-025 Schedule OR-DEPR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-025?

A: Form 150-101-025 is the Oregon Depreciation Schedule.

Q: What is the purpose of Schedule OR-DEPR?

A: The purpose of Schedule OR-DEPR is to report depreciation expenses for Oregon tax purposes.

Q: Who needs to file Schedule OR-DEPR?

A: Individuals and businesses in Oregon who have depreciable assets that qualify for depreciation deductions need to file Schedule OR-DEPR.

Q: What information is required on Schedule OR-DEPR?

A: Schedule OR-DEPR requires information about the depreciable assets, including the type of asset, date acquired, cost, recovery period, and other relevant details.

Q: Is Schedule OR-DEPR specific to Oregon residents?

A: Yes, Schedule OR-DEPR is specific to residents and businesses in Oregon.

Q: When is Schedule OR-DEPR due?

A: Schedule OR-DEPR is generally due by the same deadline as your Oregon tax return, which is usually April 15th.

Q: Are there any penalties for not filing Schedule OR-DEPR?

A: Yes, failure to file Schedule OR-DEPR or providing false or misleading information may result in penalties and interest.

Q: Can Schedule OR-DEPR be filed electronically?

A: Yes, you can file Schedule OR-DEPR electronically if you are e-filing your Oregon tax return.

Form Details:

- Released on June 25, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-025 Schedule OR-DEPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.