This version of the form is not currently in use and is provided for reference only. Download this version of

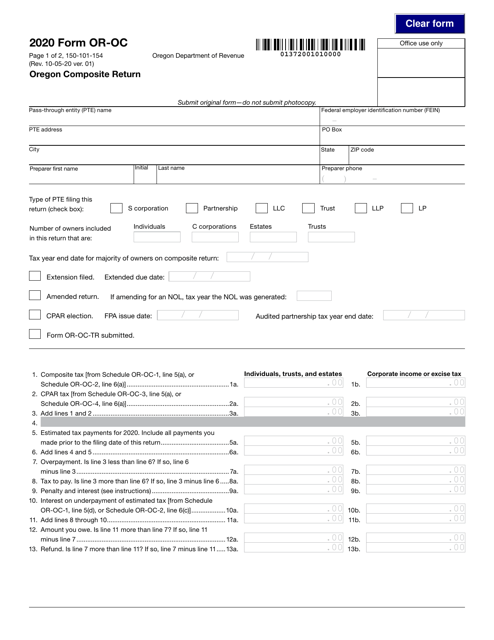

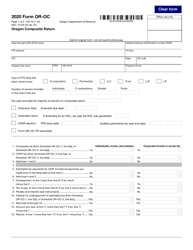

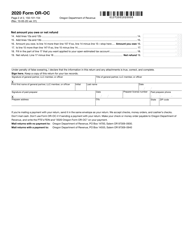

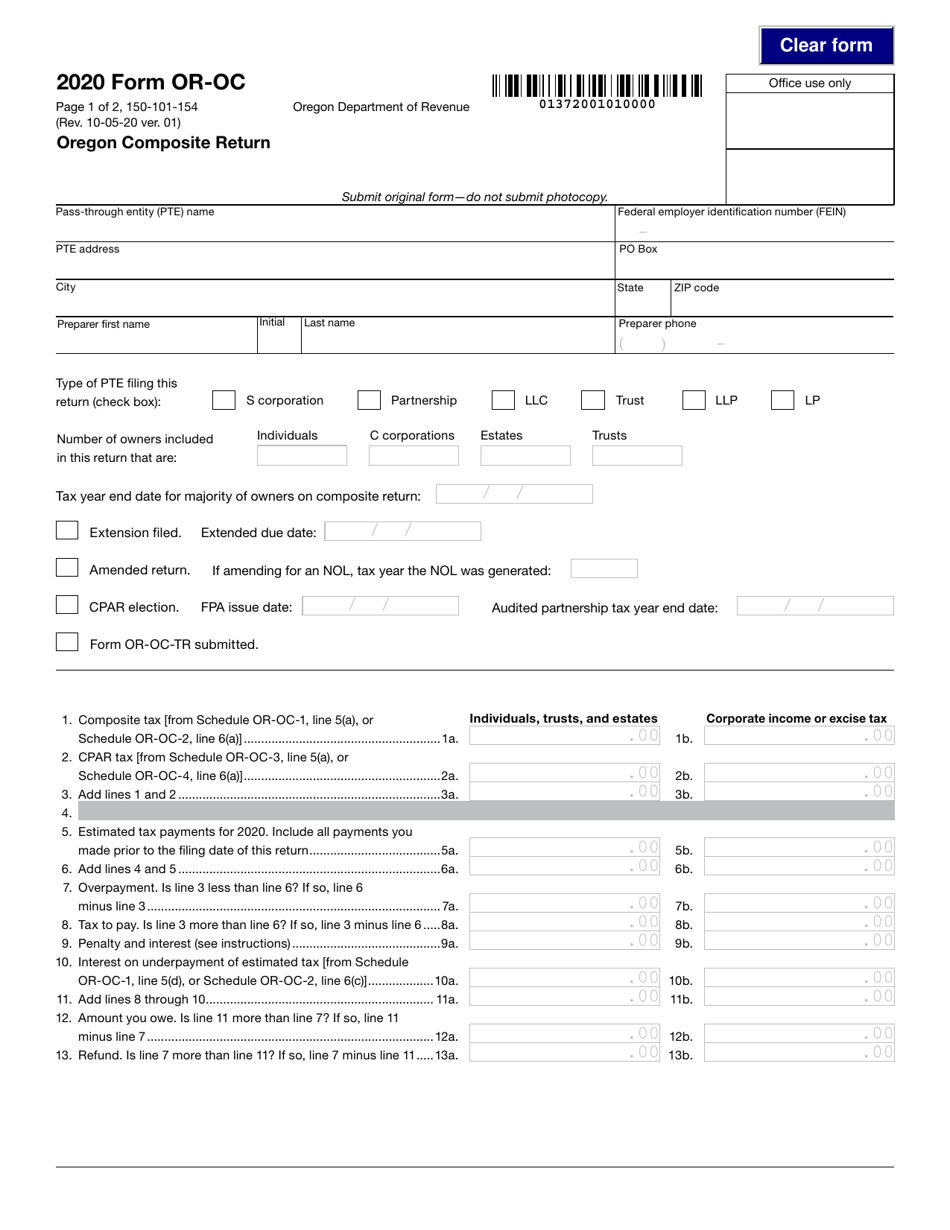

Form OR-OC (150-101-154)

for the current year.

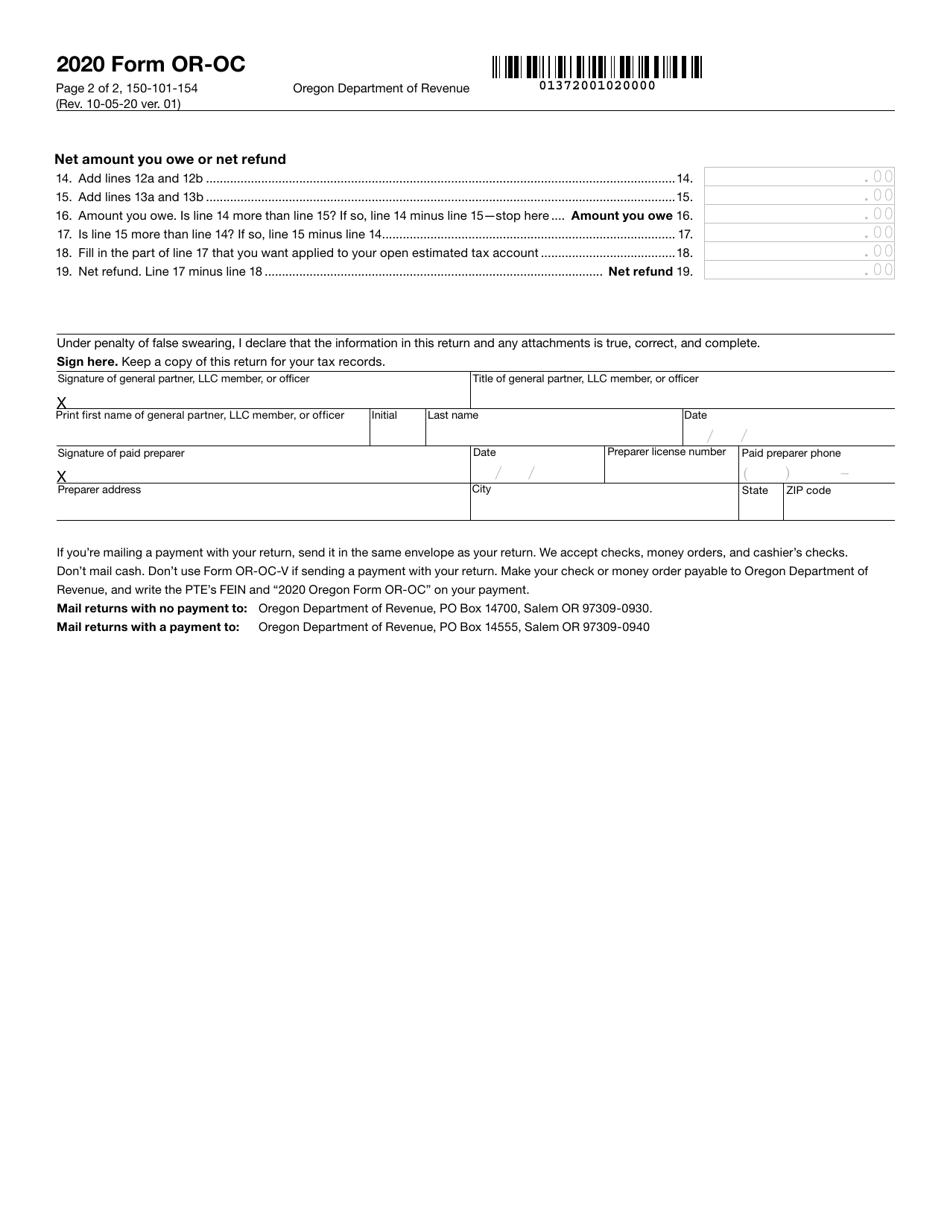

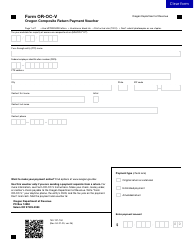

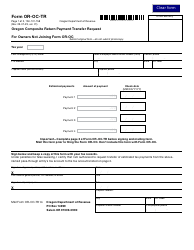

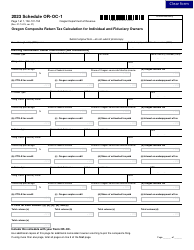

Form OR-OC (150-101-154) Oregon Composite Return - Oregon

What Is Form OR-OC (150-101-154)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-OC?

A: Form OR-OC is the Oregon Composite Return used by partnerships or S corporations to report the income, deductions, and credits of nonresident owners or shareholders.

Q: Who needs to file Form OR-OC?

A: Partnerships or S corporations with nonresident owners or shareholders need to file Form OR-OC.

Q: What is the purpose of filing Form OR-OC?

A: The purpose of filing Form OR-OC is to report the Oregon income, deductions, and credits of nonresident owners or shareholders.

Q: Is there a deadline for filing Form OR-OC?

A: Yes, Form OR-OC must be filed by the 15th day of the third month following the close of the tax year.

Q: Can Form OR-OC be filed electronically?

A: No, Form OR-OC cannot be filed electronically. It must be filed by mail.

Q: Are there any penalties for late filing or failure to file Form OR-OC?

A: Yes, penalties may apply for late filing or failure to file Form OR-OC. It is important to file the form timely to avoid penalties.

Form Details:

- Released on October 5, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-OC (150-101-154) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.