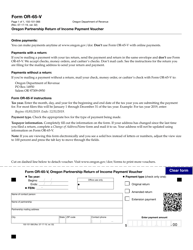

This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-65 (150-101-065)

for the current year.

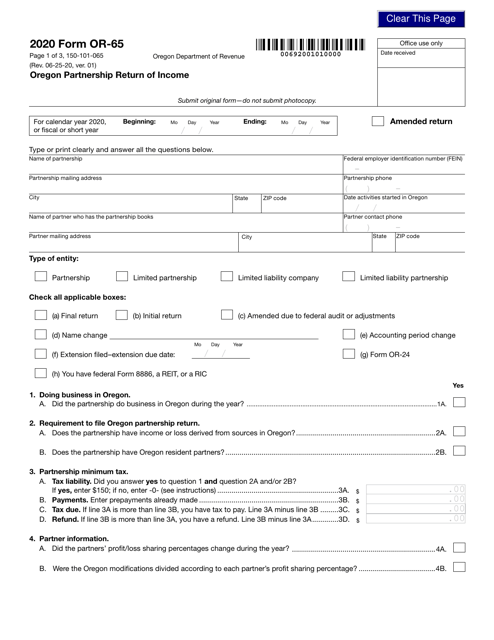

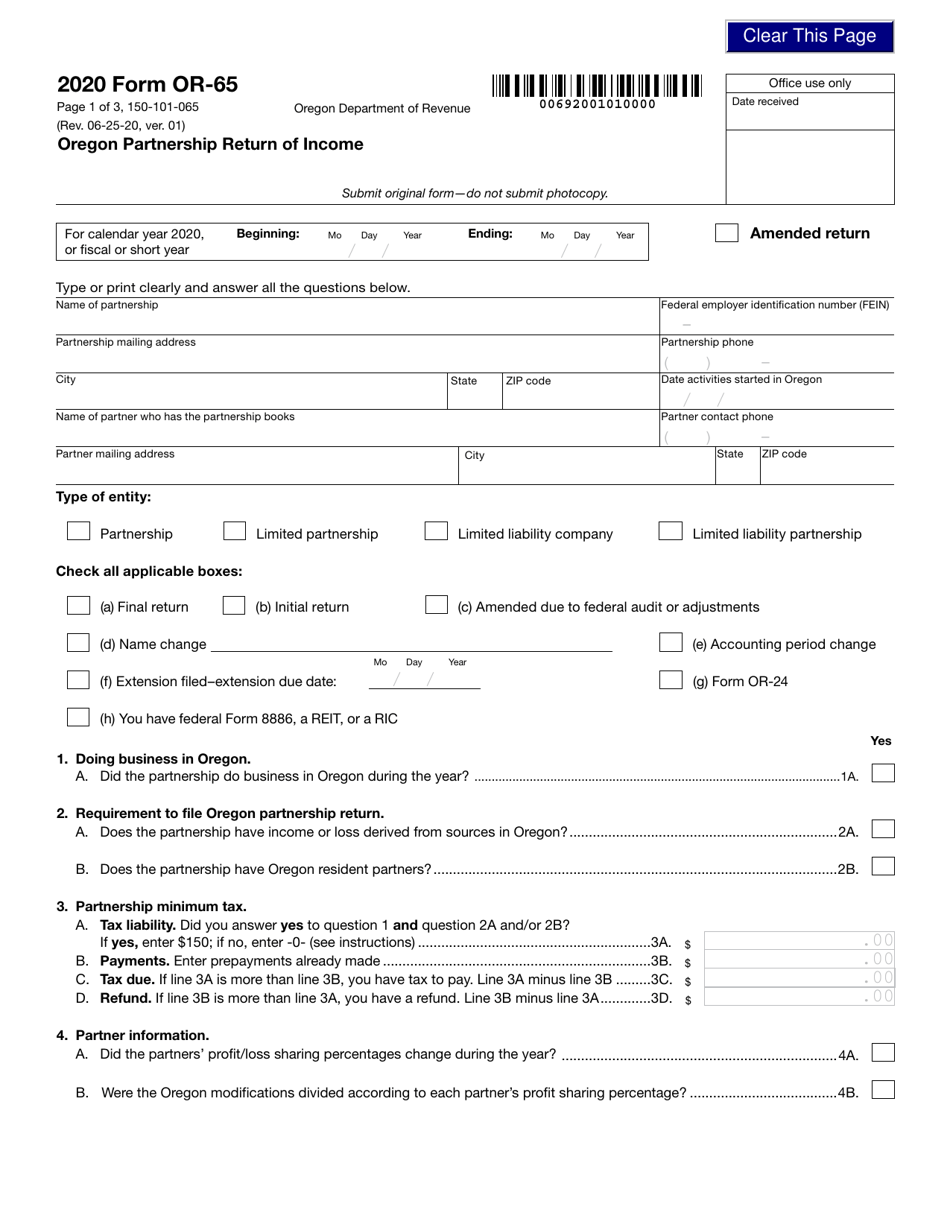

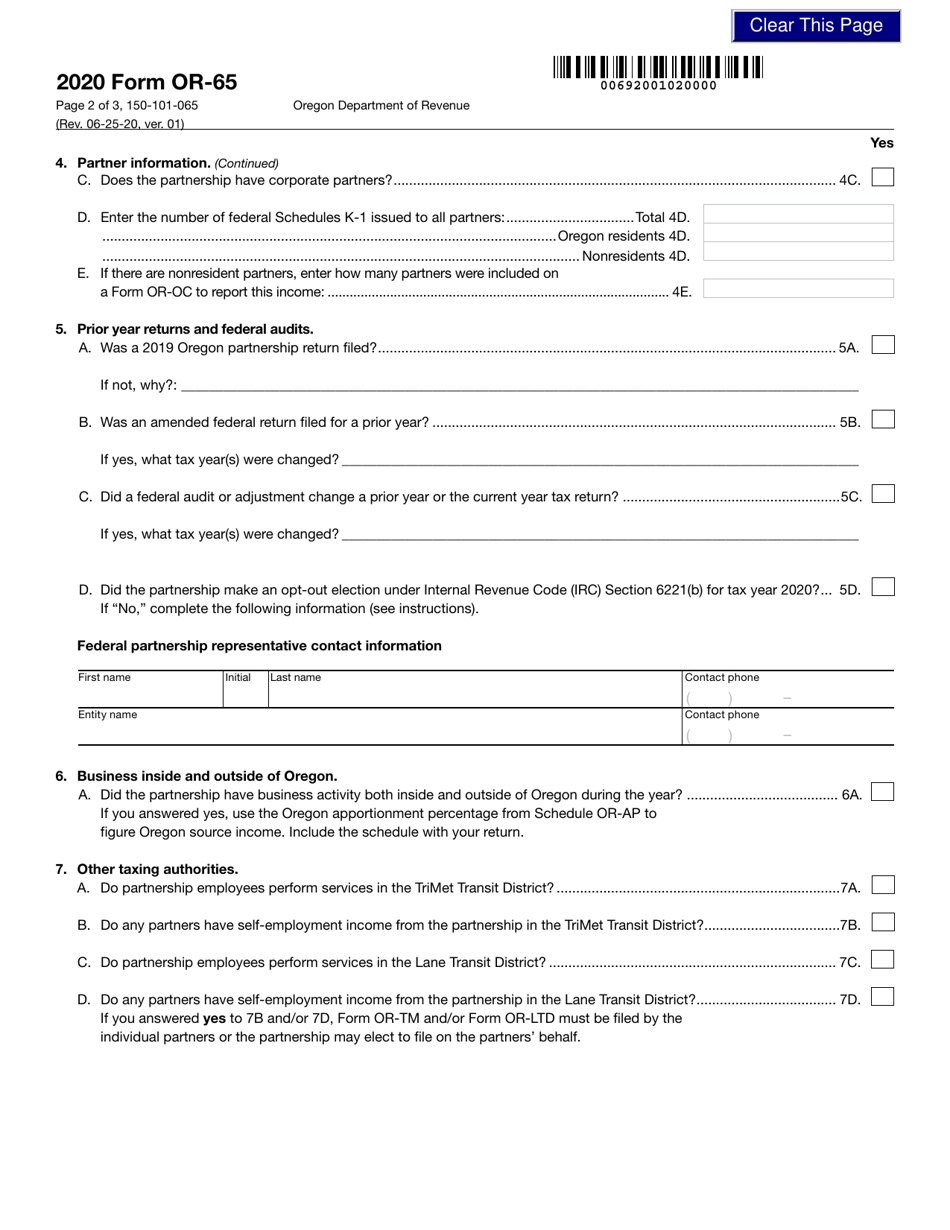

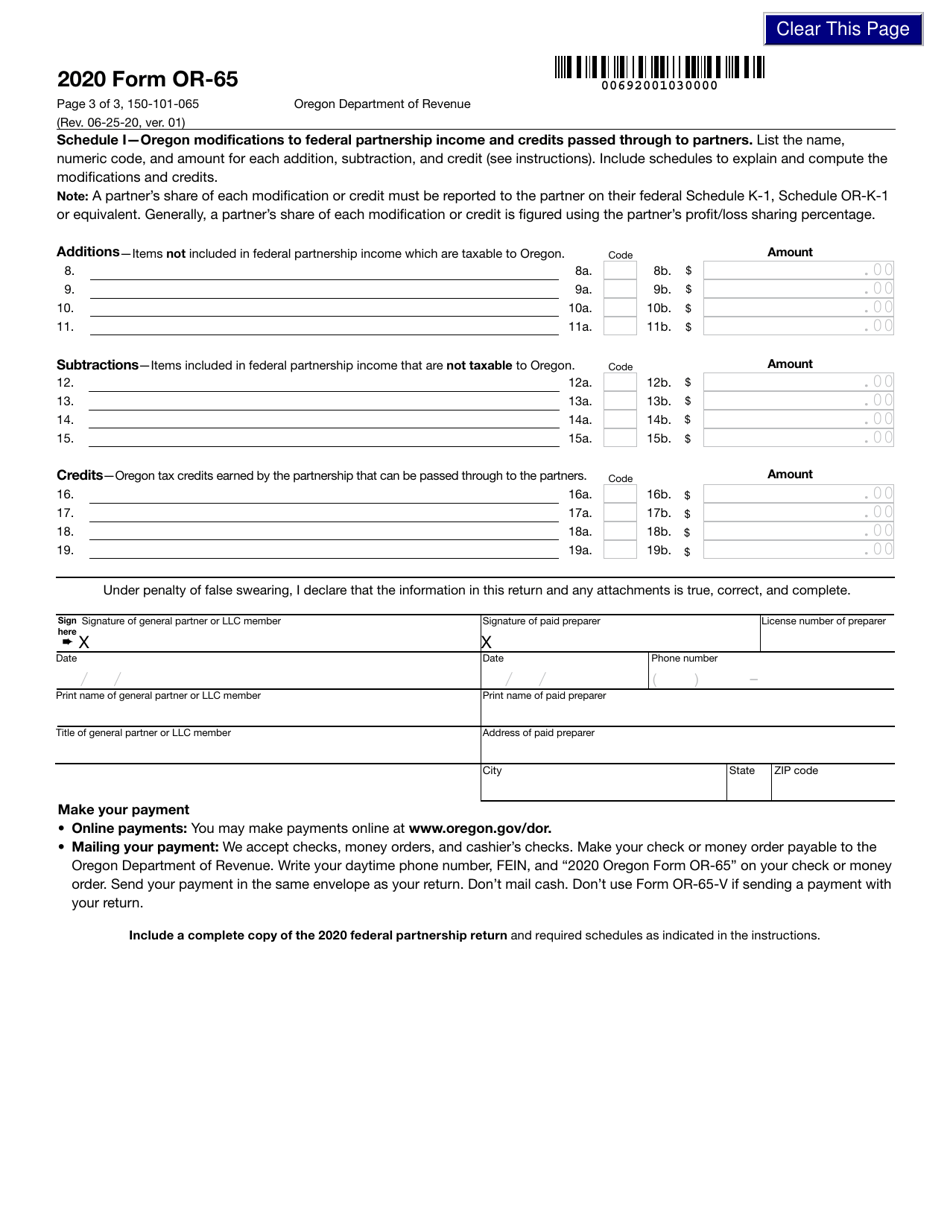

Form OR-65 (150-101-065) Oregon Partnership Return of Income - Oregon

What Is Form OR-65 (150-101-065)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-65?

A: Form OR-65 is the Oregon Partnership Return of Income for partnerships in Oregon.

Q: Who needs to file Form OR-65?

A: Partnerships that operate in Oregon need to file Form OR-65 to report their income.

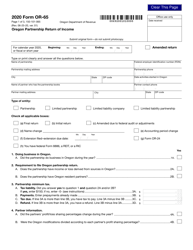

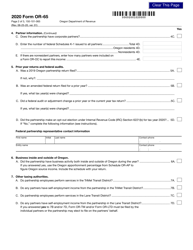

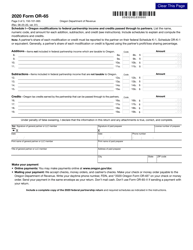

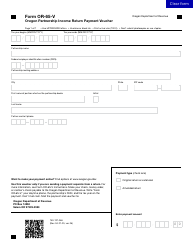

Q: What information is required on Form OR-65?

A: Form OR-65 requires partnership information, income details, deductions, and credits.

Q: When is Form OR-65 due?

A: Form OR-65 is due on the 15th day of the third month after the end of the tax year.

Q: Are there any penalties for not filing Form OR-65?

A: Yes, there are penalties for not filing Form OR-65 or filing it late. It's important to meet the deadline to avoid penalties.

Q: Do I need to attach any additional documents to Form OR-65?

A: You may need to attach supporting documents such as schedules or forms for certain deductions or credits. Check the instructions for Form OR-65 for more details.

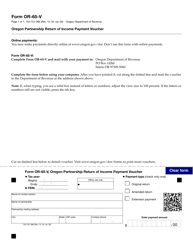

Form Details:

- Released on June 25, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-65 (150-101-065) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.