This version of the form is not currently in use and is provided for reference only. Download this version of

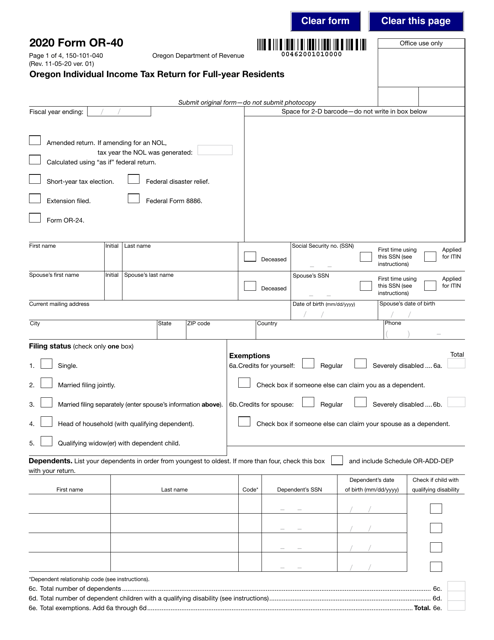

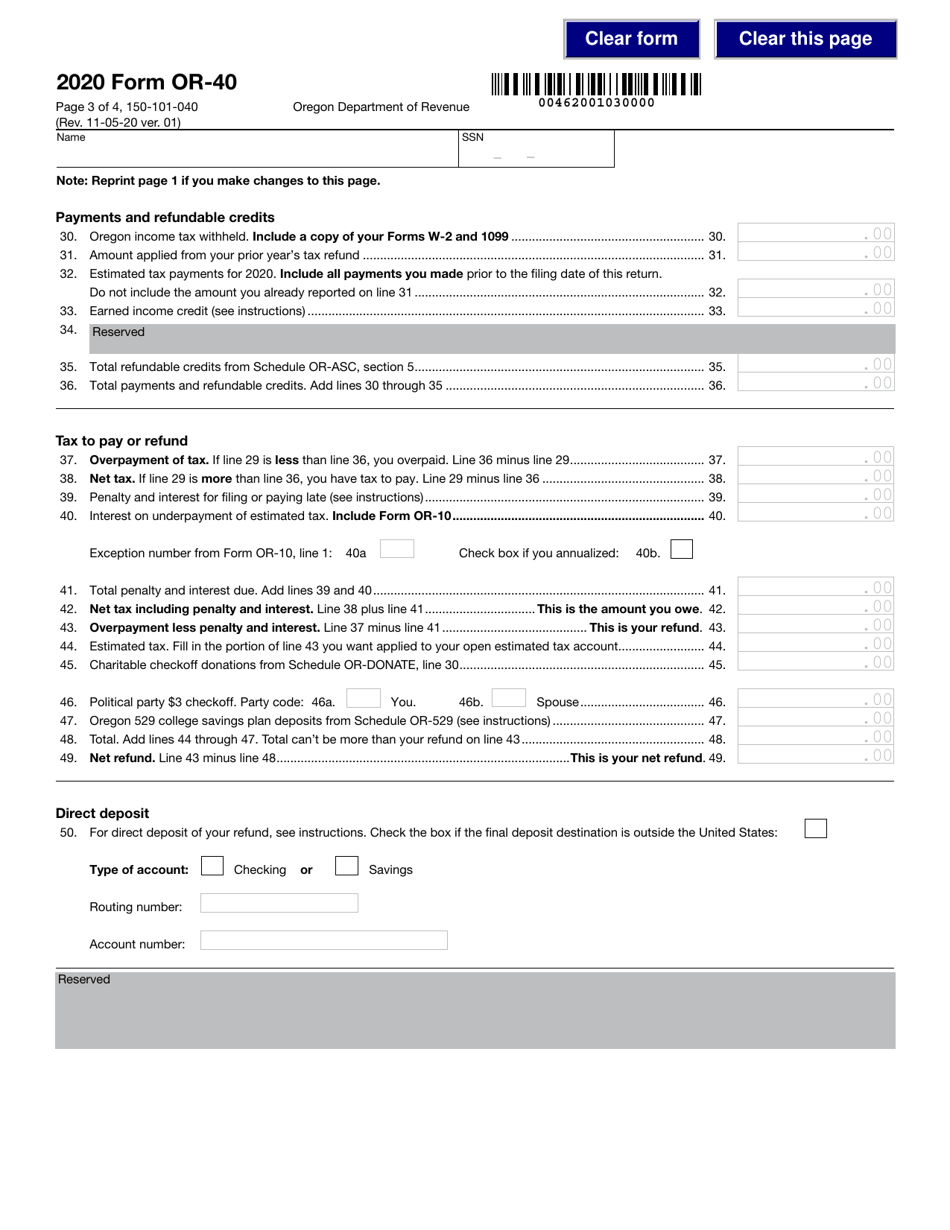

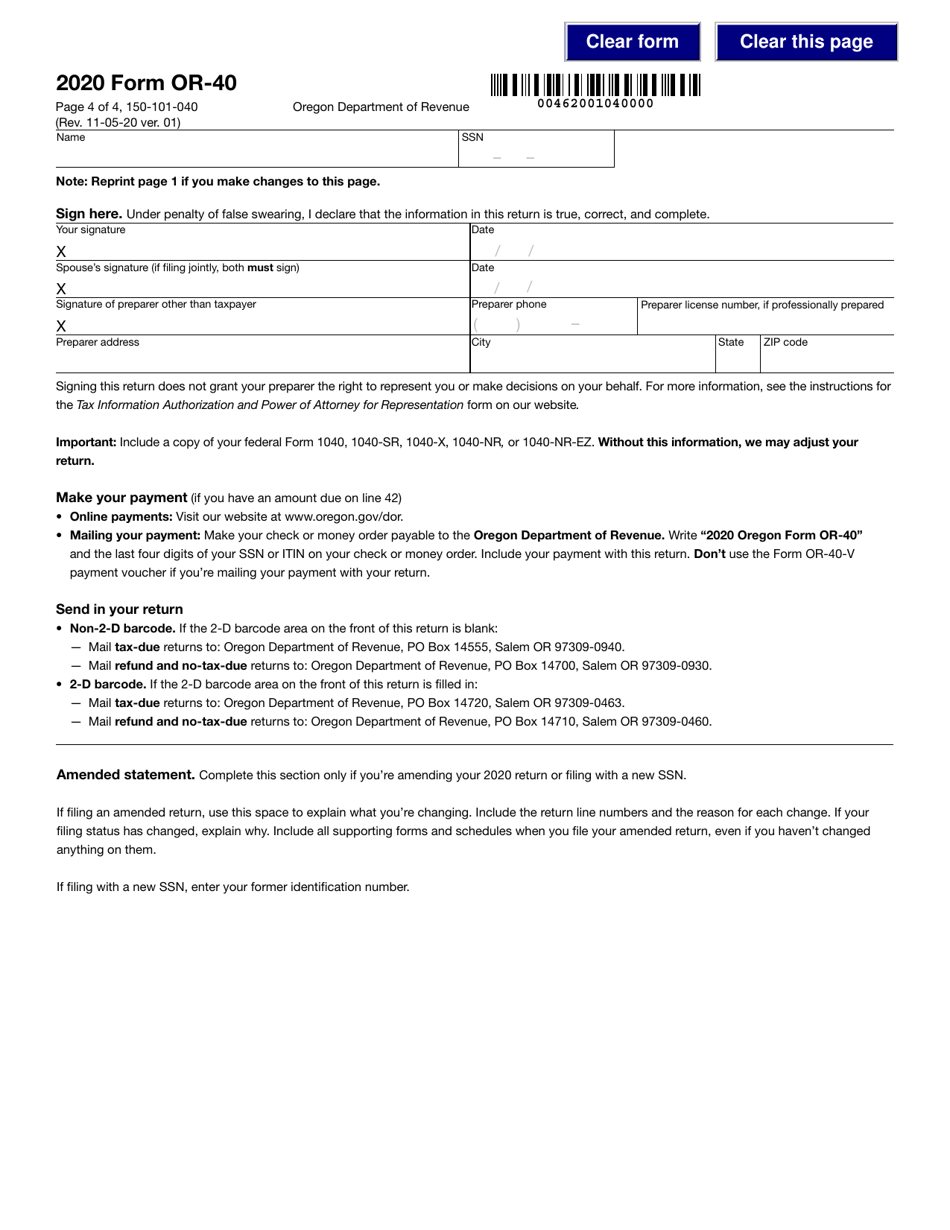

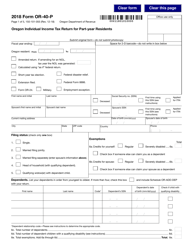

Form OR-40 (150-101-040)

for the current year.

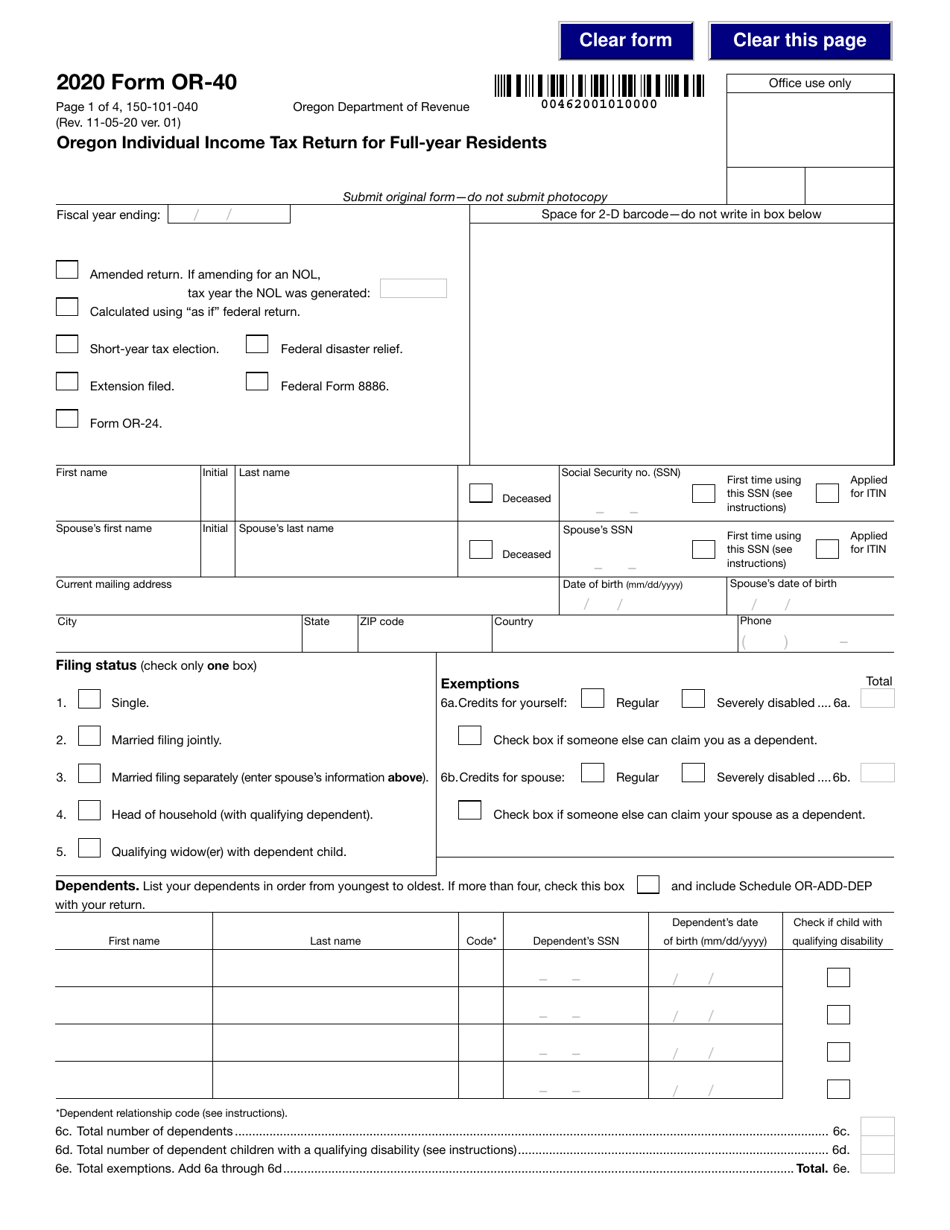

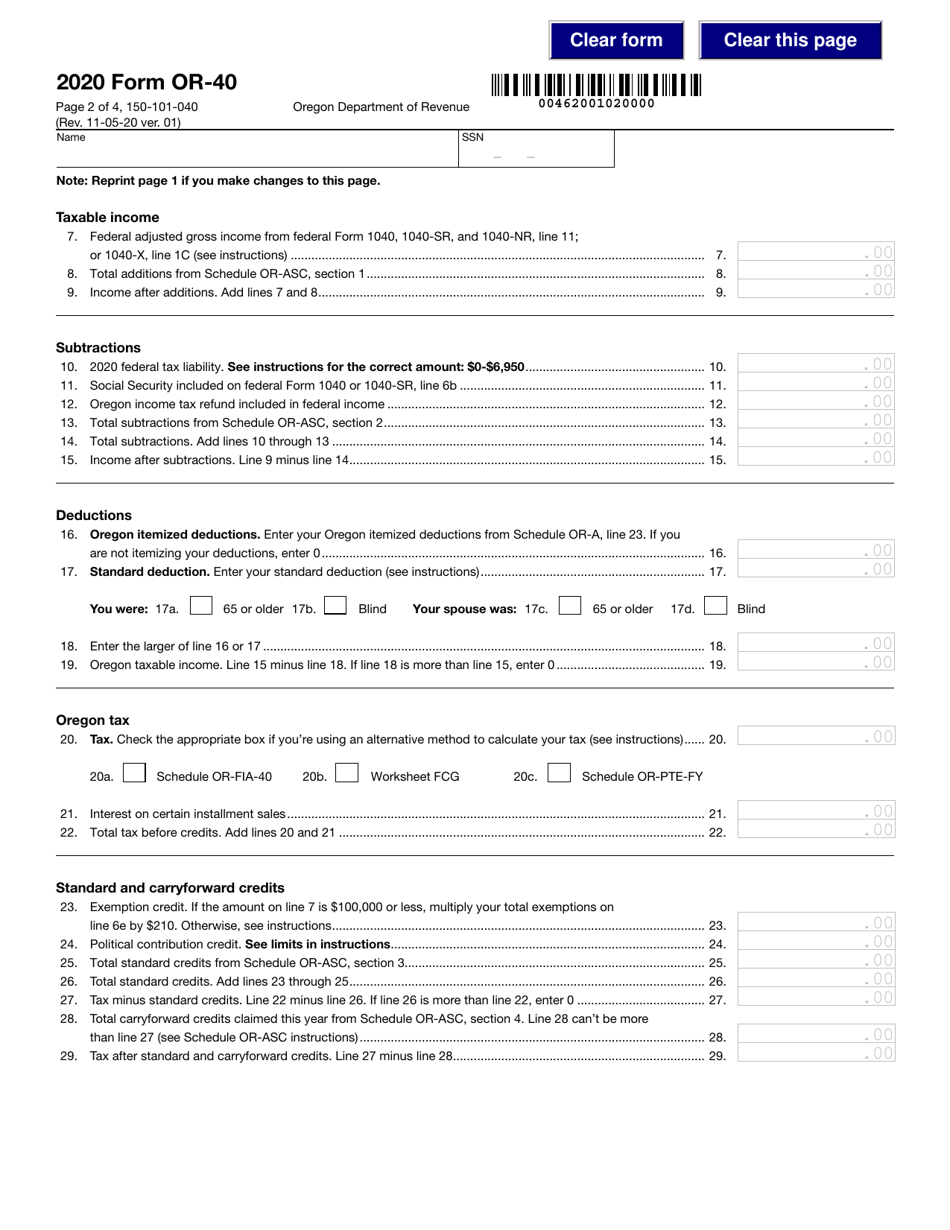

Form OR-40 (150-101-040) Oregon Individual Income Tax Return for Full-Year Residents - Oregon

What Is Form OR-40 (150-101-040)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-40?

A: Form OR-40 is the Oregon Individual Income Tax Return for Full-Year Residents in Oregon.

Q: Who should use Form OR-40?

A: Full-year residents of Oregon should use Form OR-40 to file their state income tax returns.

Q: What is the purpose of Form OR-40?

A: The purpose of Form OR-40 is to report and pay the state income tax you owe to the state of Oregon.

Q: When is the deadline to file Form OR-40?

A: The deadline to file Form OR-40 is usually April 15th, but it may vary depending on the tax year.

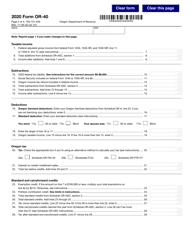

Q: Do I need to include any attachments with Form OR-40?

A: You may need to attach certain documents such as W-2 forms and other income statements with Form OR-40.

Q: Can I file Form OR-40 electronically?

A: Yes, you can file Form OR-40 electronically using the Oregon e-file system or other authorized e-file providers.

Q: What if I can't pay the full amount of tax owed?

A: If you can't pay the full amount of tax owed, you should still file Form OR-40 on time and explore payment options like installment agreements or requesting a payment plan.

Q: What if I need more time to file Form OR-40?

A: If you need more time to file Form OR-40, you can request an extension by filing Form OR-40-V.

Q: Can I get help with filling out Form OR-40?

A: Yes, you can seek assistance from tax professionals or use tax preparation software to help you fill out Form OR-40 accurately.

Form Details:

- Released on November 5, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40 (150-101-040) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.