This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-403

for the current year.

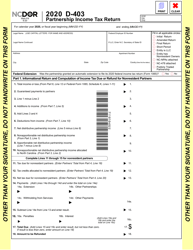

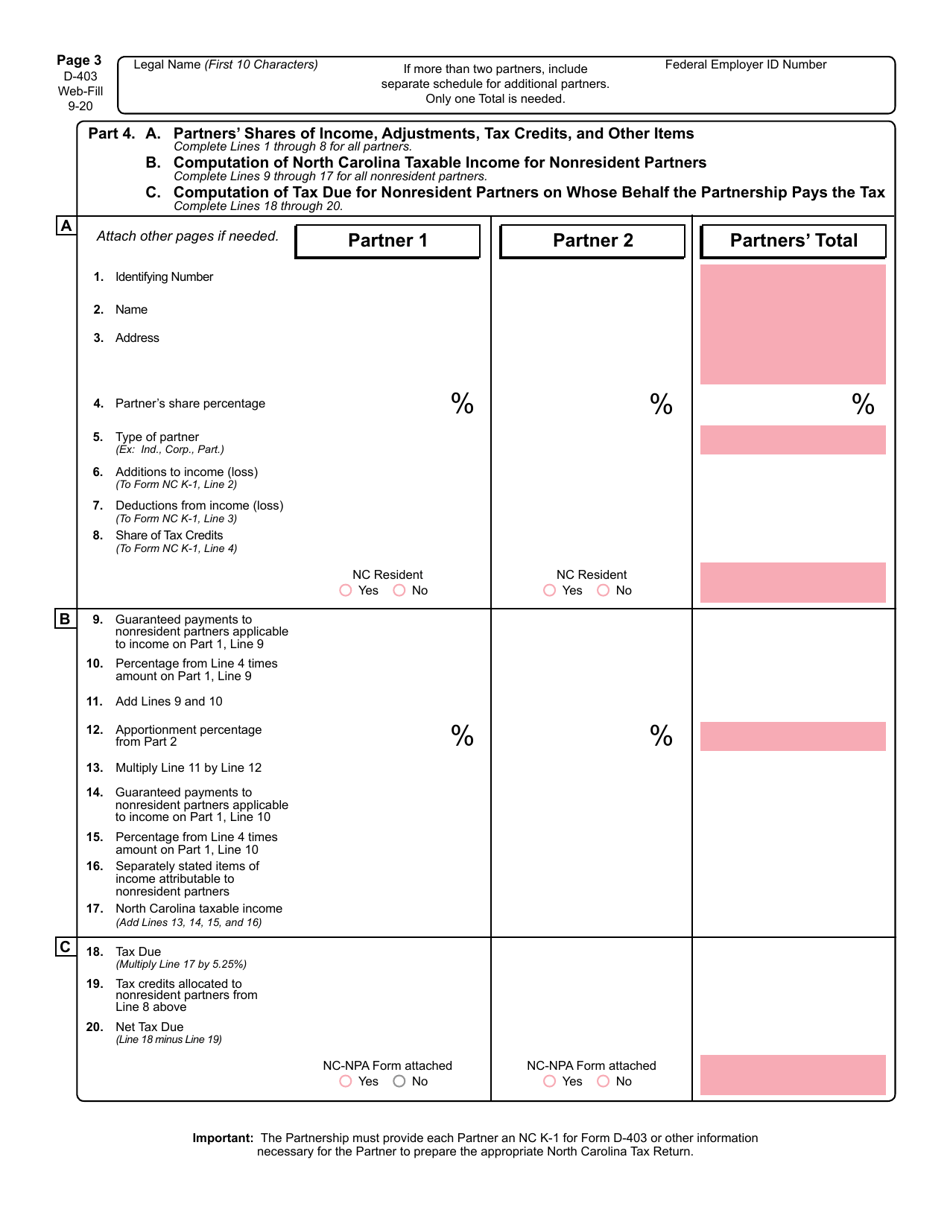

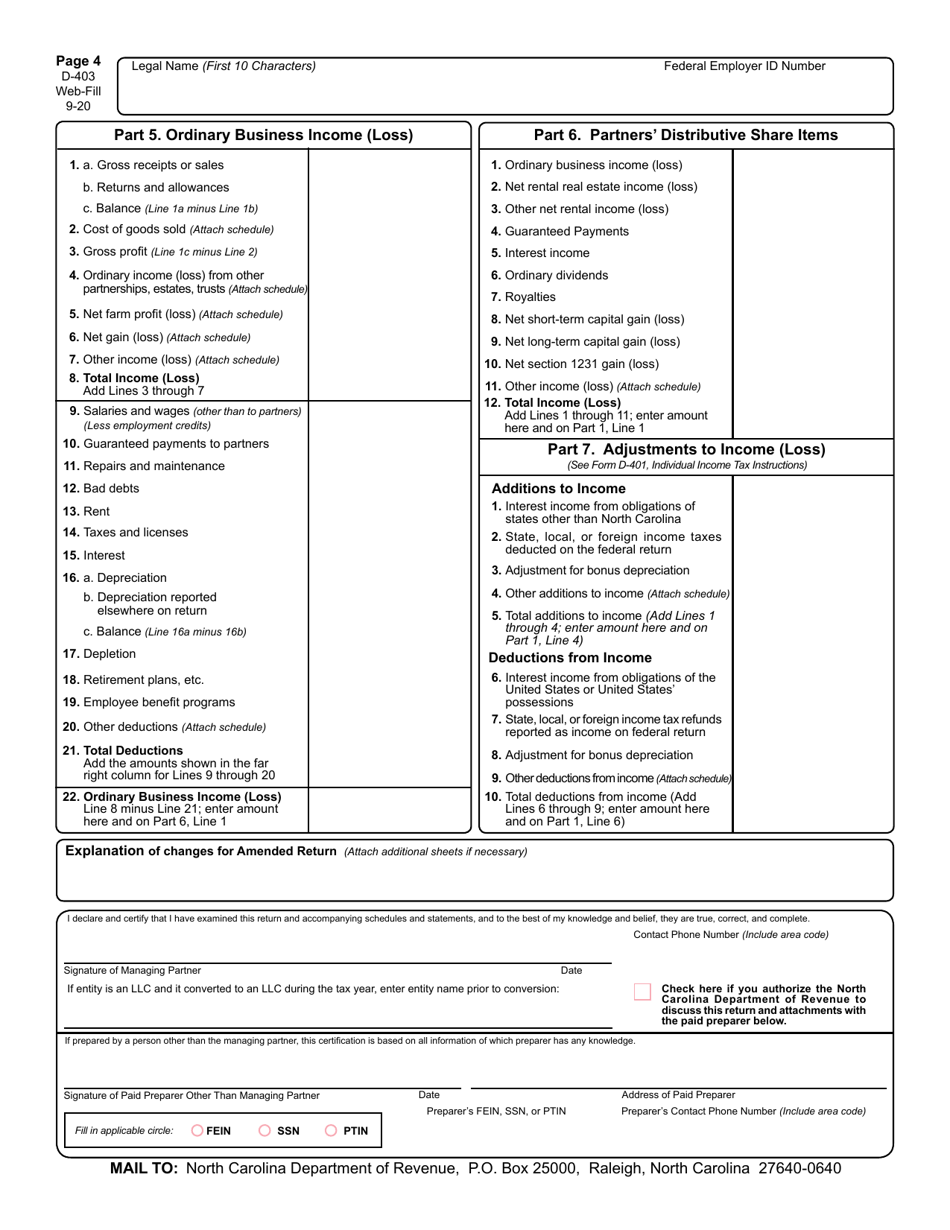

Form D-403 Partnership Income Tax Return - North Carolina

What Is Form D-403?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

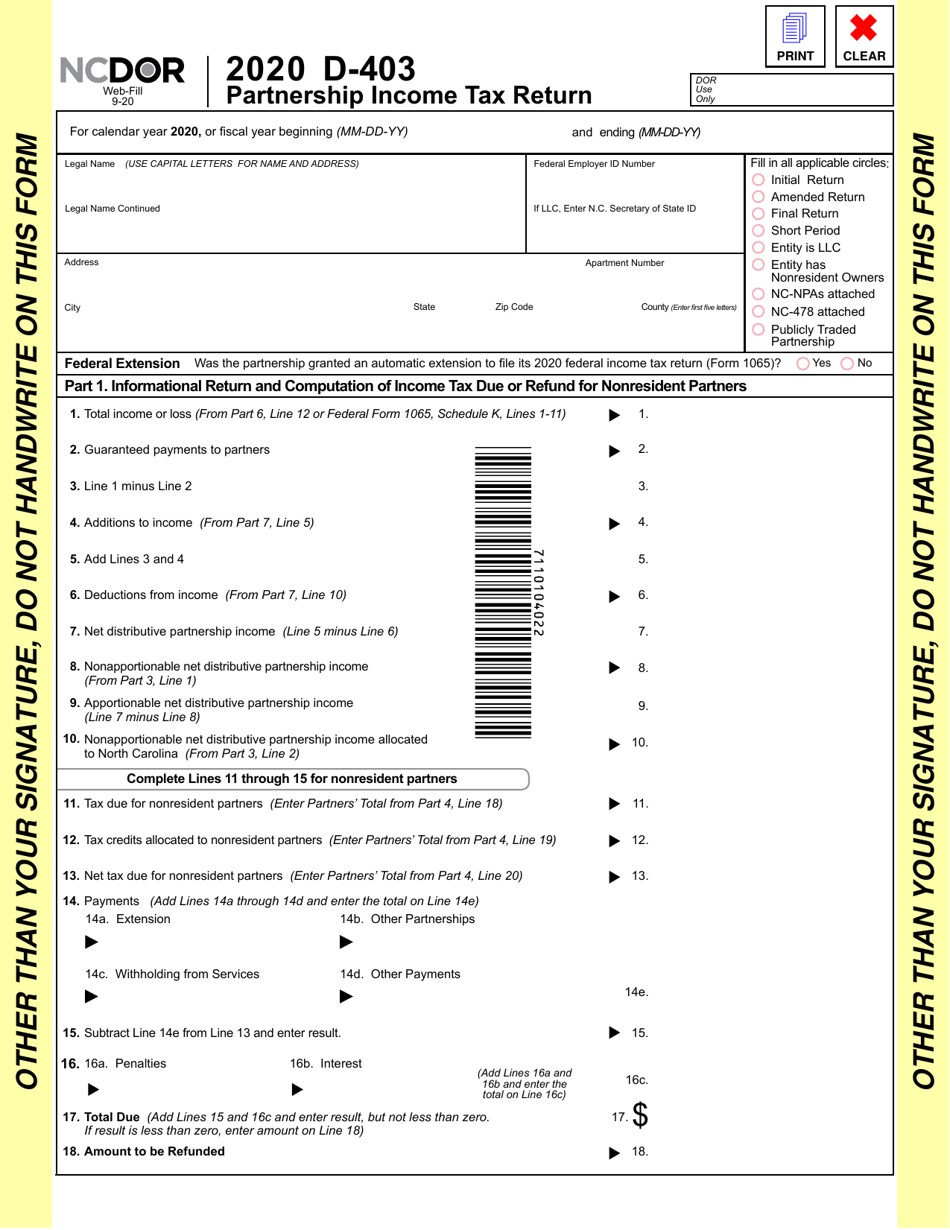

Q: What is Form D-403?

A: Form D-403 is the Partnership Income Tax Return used in North Carolina.

Q: Who needs to file Form D-403?

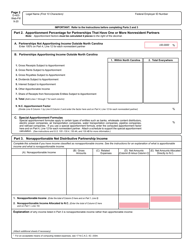

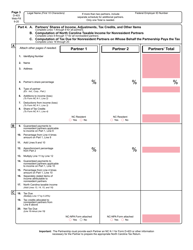

A: Partnerships that have income, deductions, or credits from sources within North Carolina need to file Form D-403.

Q: When is the deadline to file Form D-403?

A: The deadline to file Form D-403 is on or before the 15th day of the fourth month following the close of the partnership's taxable year.

Q: Are there any filing extensions available for Form D-403?

A: Yes, partnerships can request an extension to file Form D-403. However, any tax due must still be paid by the original due date.

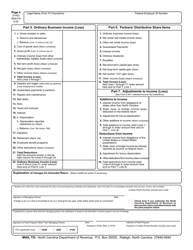

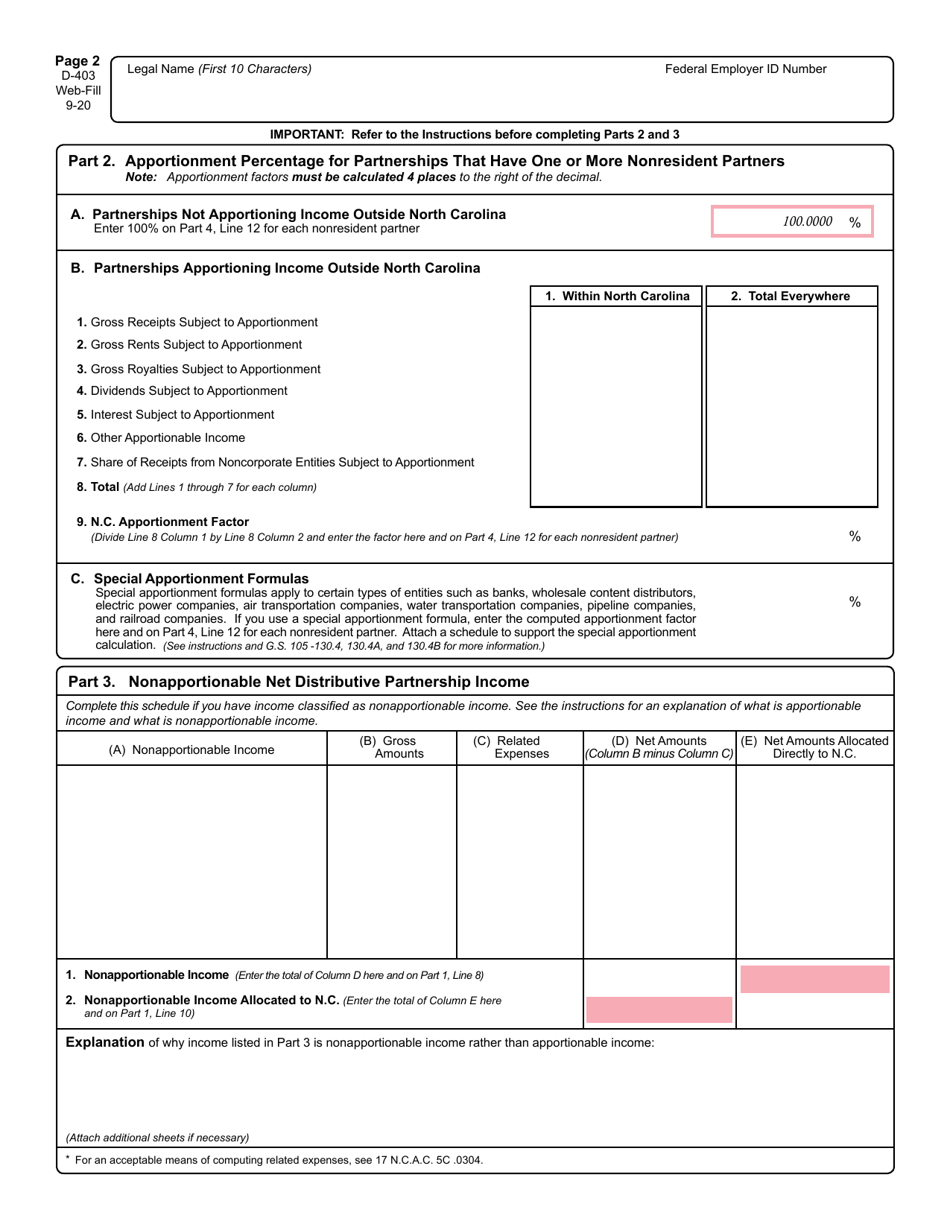

Q: What information is required to complete Form D-403?

A: To complete Form D-403, you will need information about the partnership's income, deductions, credits, and other relevant financial information.

Q: Can Form D-403 be filed electronically?

A: Yes, partnerships can choose to file Form D-403 electronically using the North Carolina Department of Revenue's eFile system.

Q: Is there a separate form for North Carolina state partnership taxes?

A: No, Form D-403 is the only form required to report partnership income tax in North Carolina.

Q: Do partnerships in North Carolina need to pay estimated taxes?

A: Partnerships in North Carolina are not required to make estimated tax payments.

Q: What should I do if I have additional questions about Form D-403?

A: If you have additional questions about Form D-403, you can contact the North Carolina Department of Revenue for assistance.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

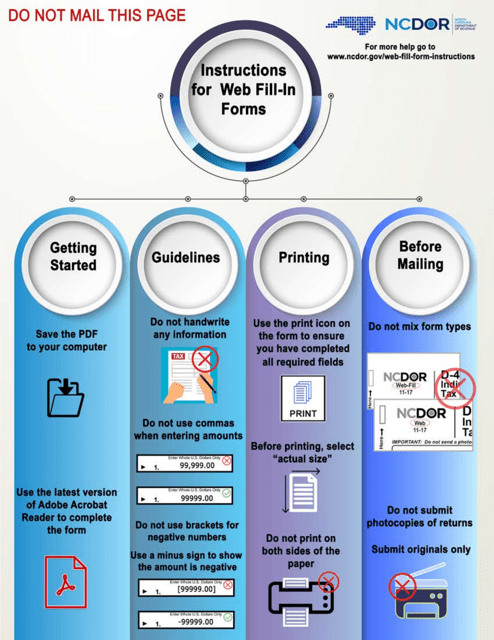

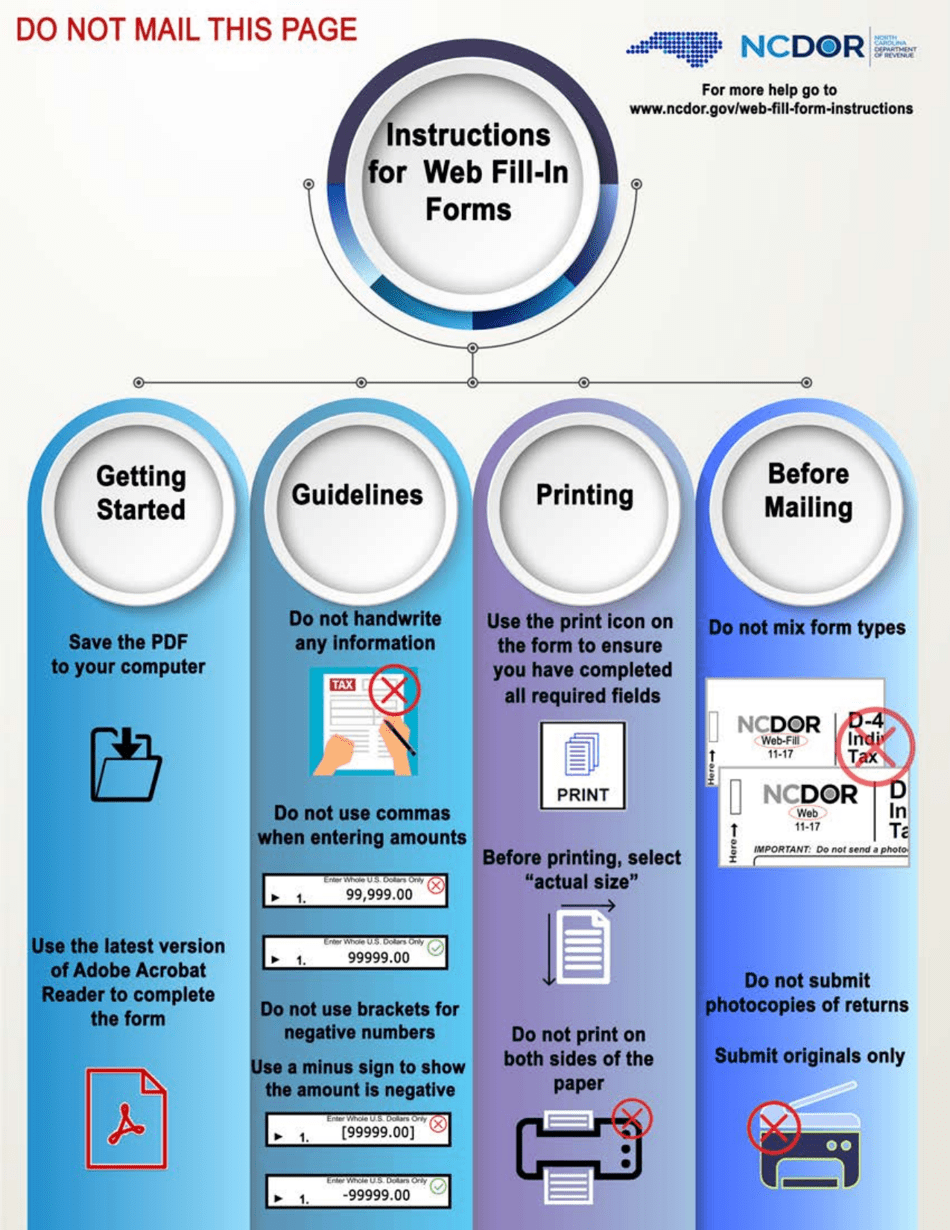

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.