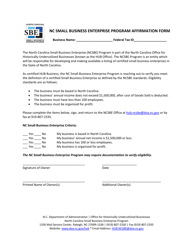

Form NC-NPA Nonresident Partner Affirmation - North Carolina

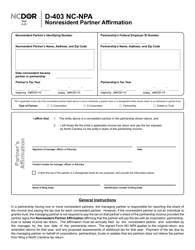

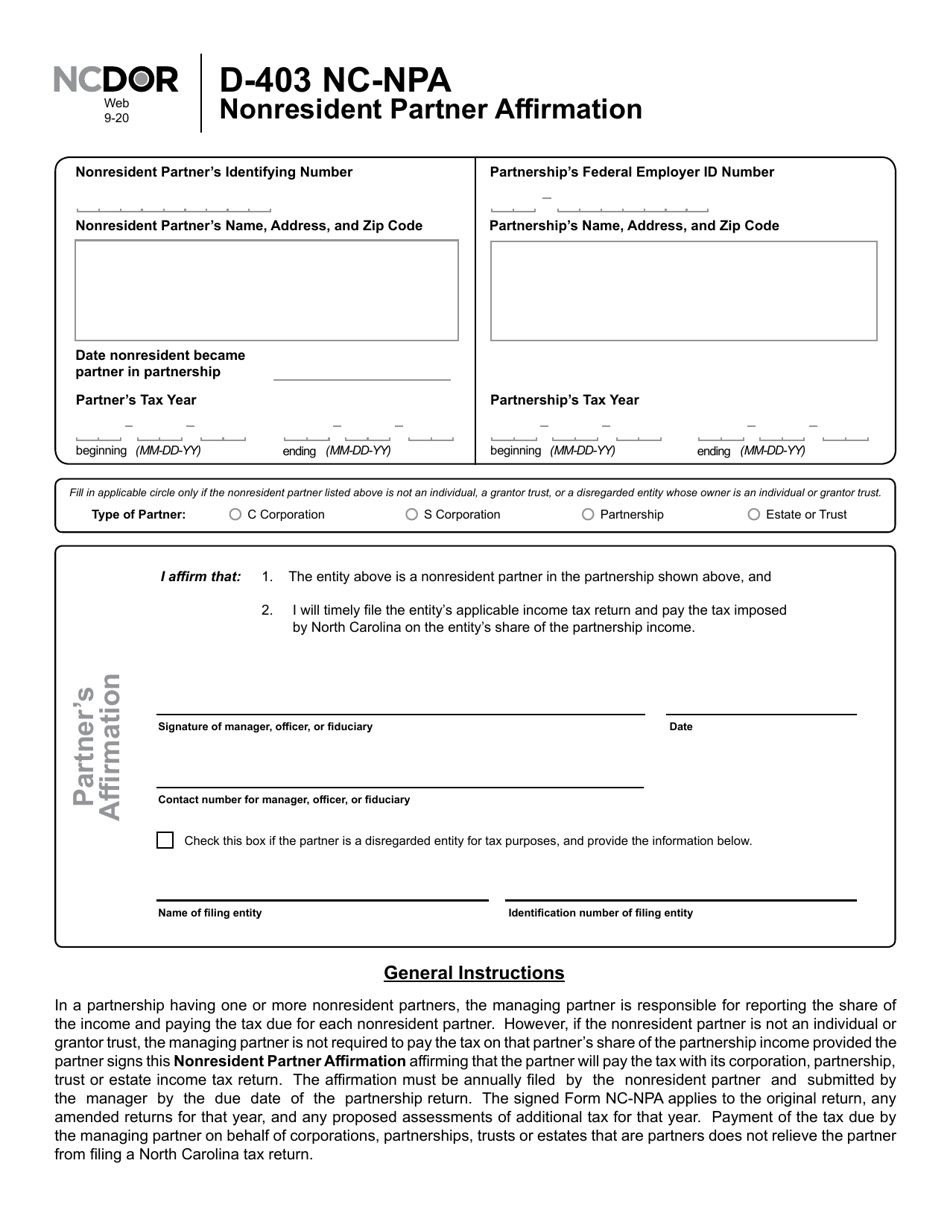

What Is Form NC-NPA?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form NC-NPA?

A: Form NC-NPA is the Nonresident Partner Affirmation form used in North Carolina.

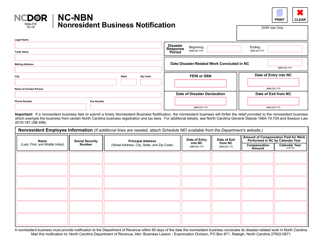

Q: Who needs to file Form NC-NPA?

A: Nonresident partners who derive income from North Carolina sources need to file Form NC-NPA.

Q: What is the purpose of Form NC-NPA?

A: Form NC-NPA is used to report and affirm the nonresident partner's share of income derived from North Carolina sources.

Q: What information do I need to complete Form NC-NPA?

A: You will need to provide your personal details, information about the partnership, and details of your North Carolina income.

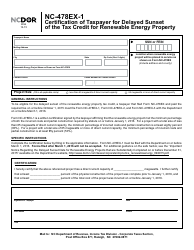

Q: When is the deadline to file Form NC-NPA?

A: Form NC-NPA is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form NC-NPA?

A: Yes, there are penalties for late filing, so it's important to submit the form on time to avoid any penalties or interest.

Q: Do I need to include any supporting documents with Form NC-NPA?

A: No, you do not need to include any supporting documents with Form NC-NPA. However, you should keep all relevant records and documents for your own records.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

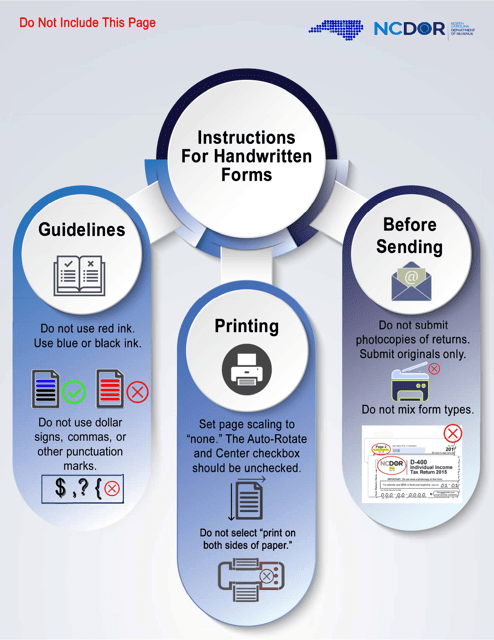

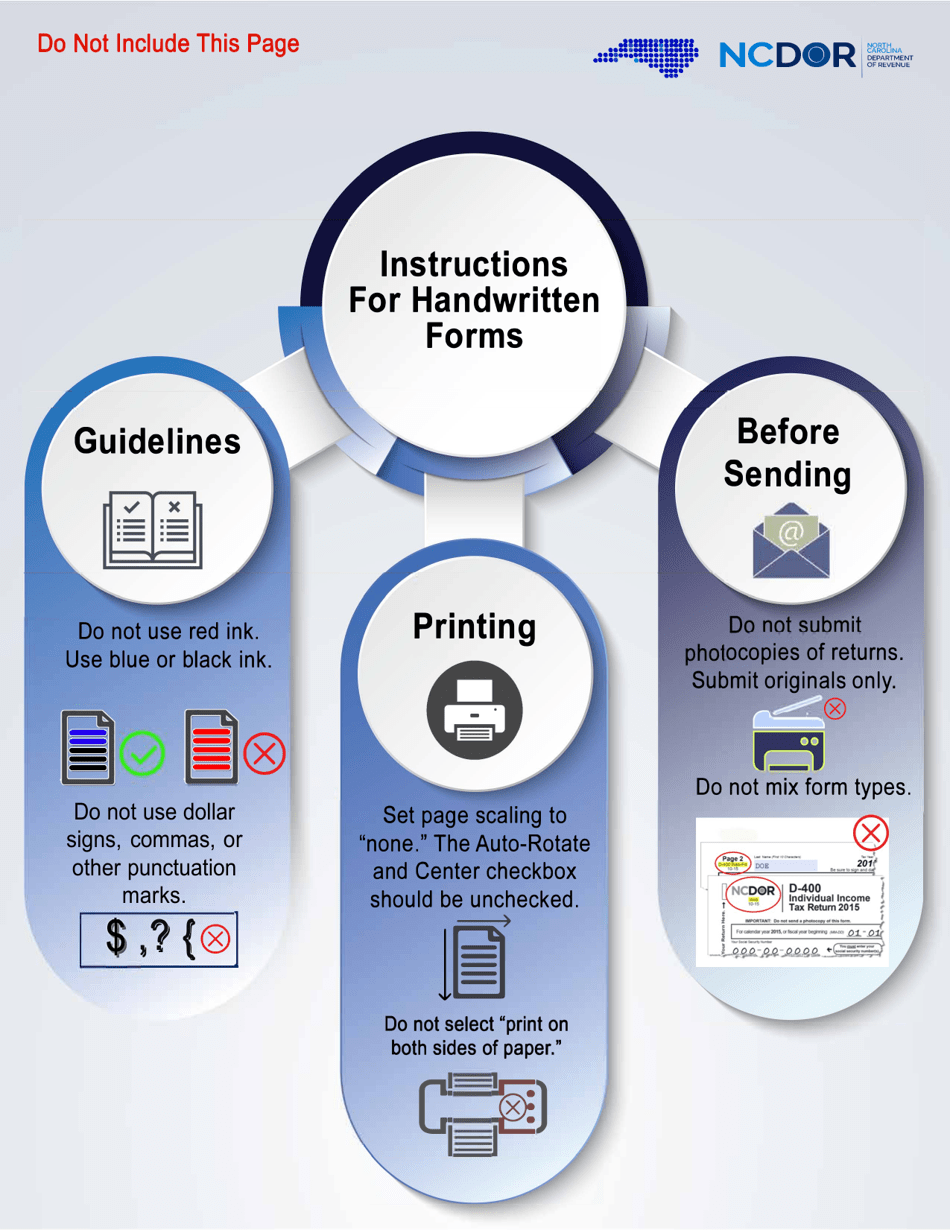

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-NPA by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.