This version of the form is not currently in use and is provided for reference only. Download this version of

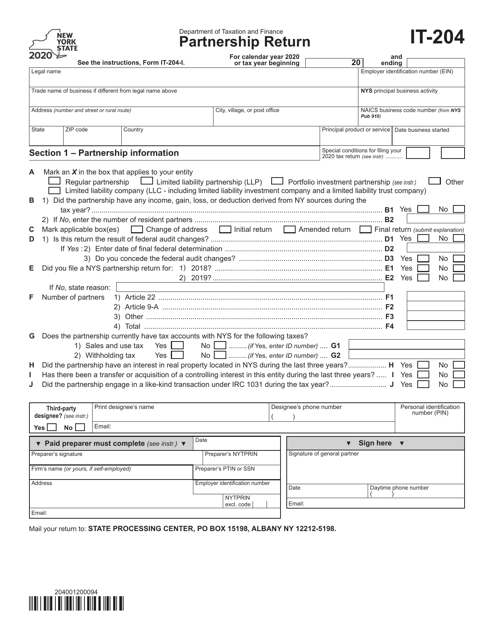

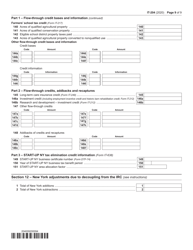

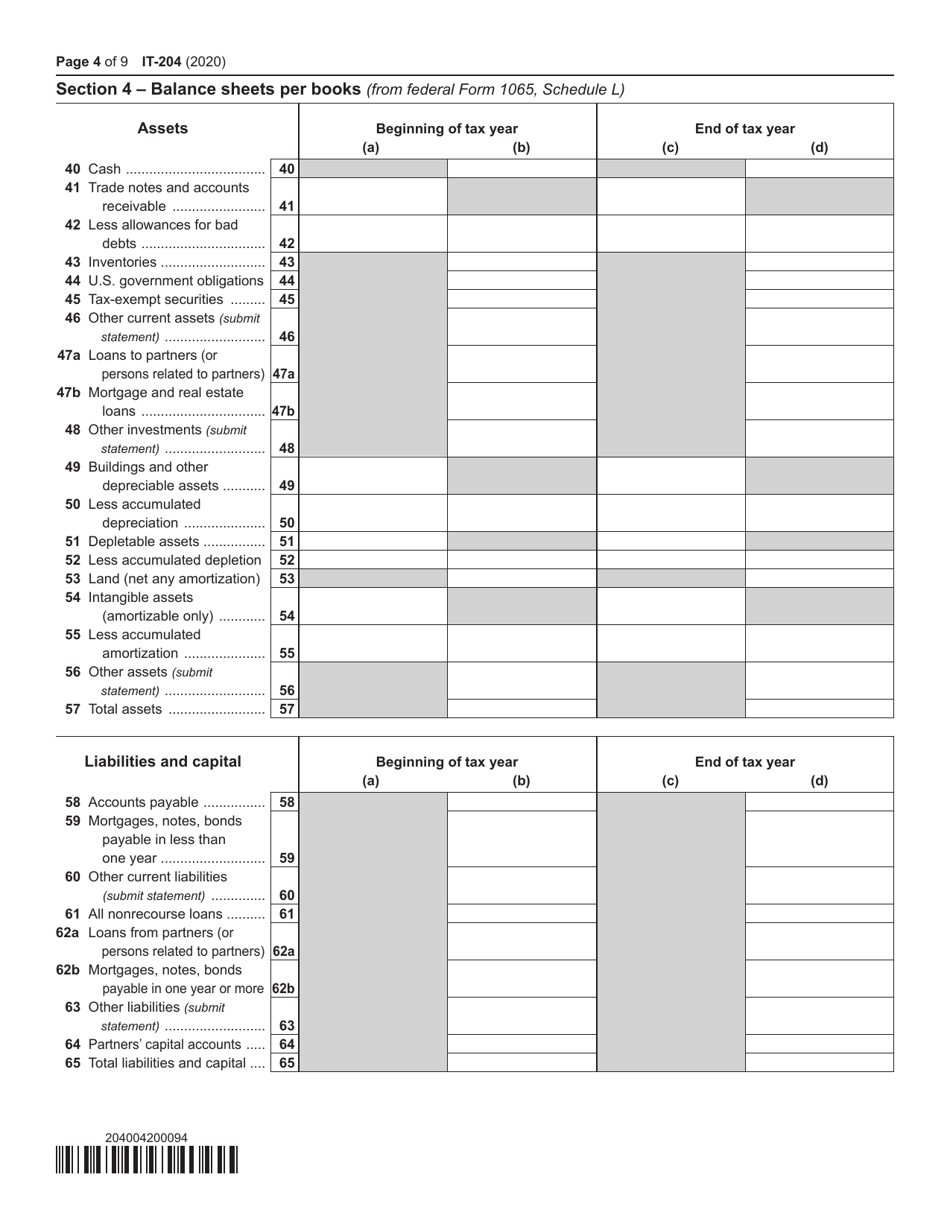

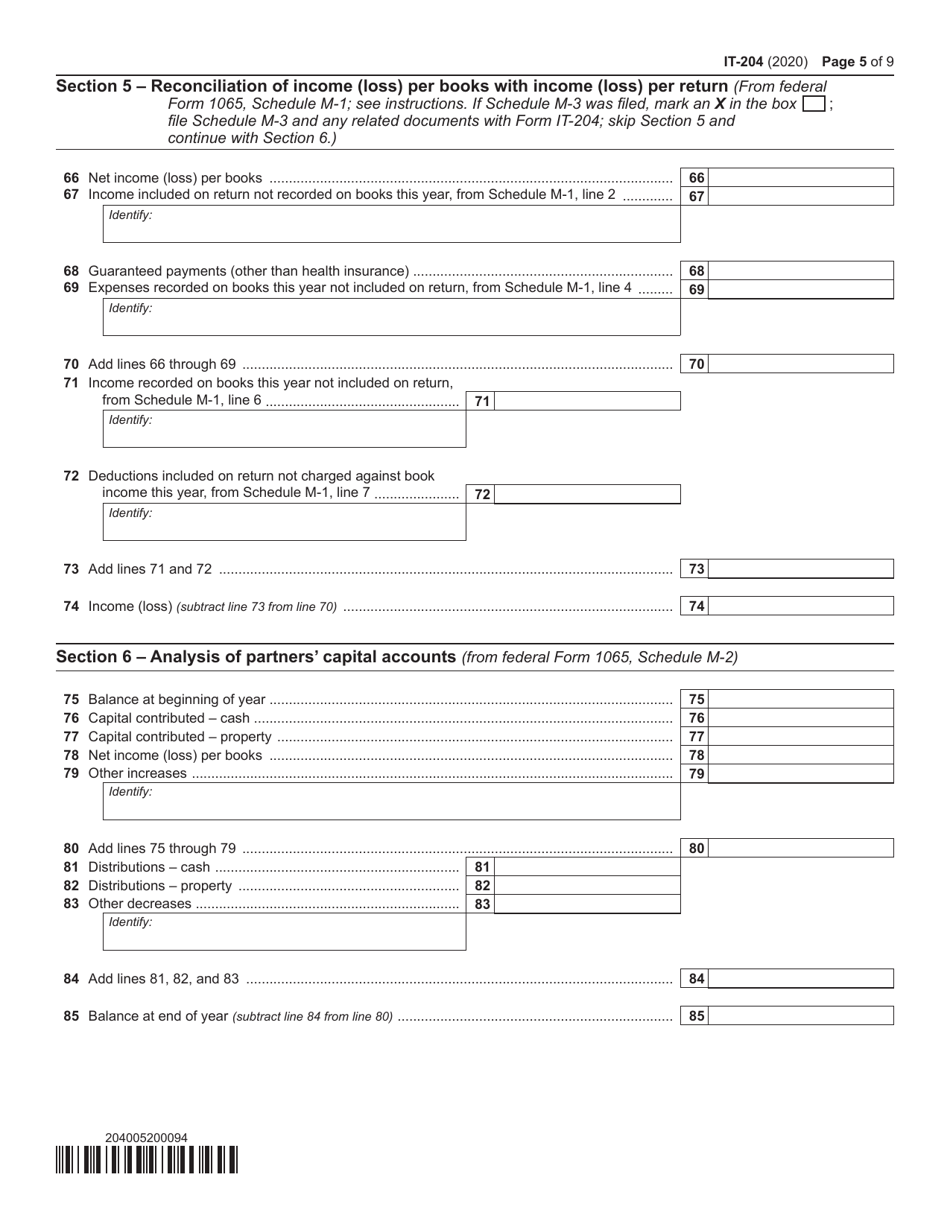

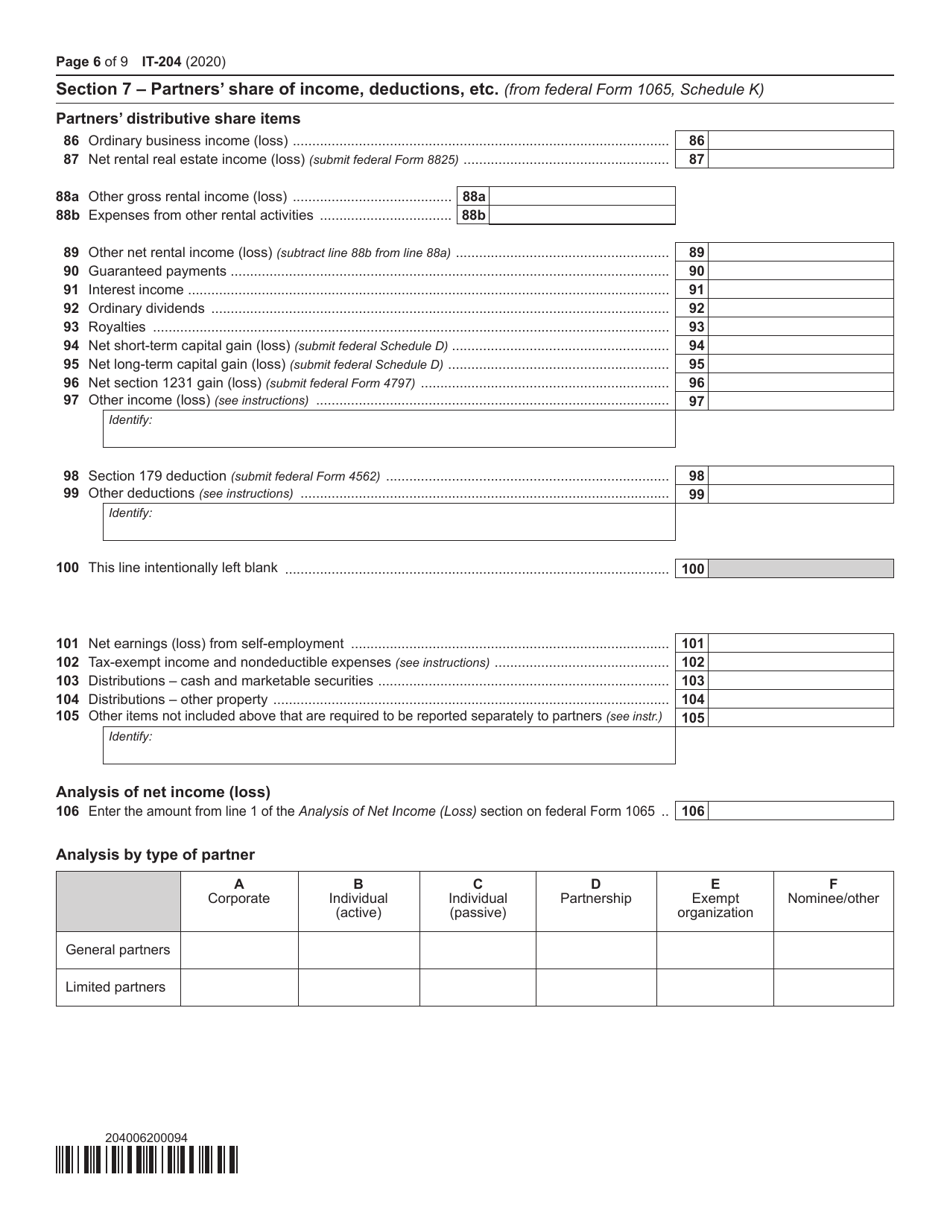

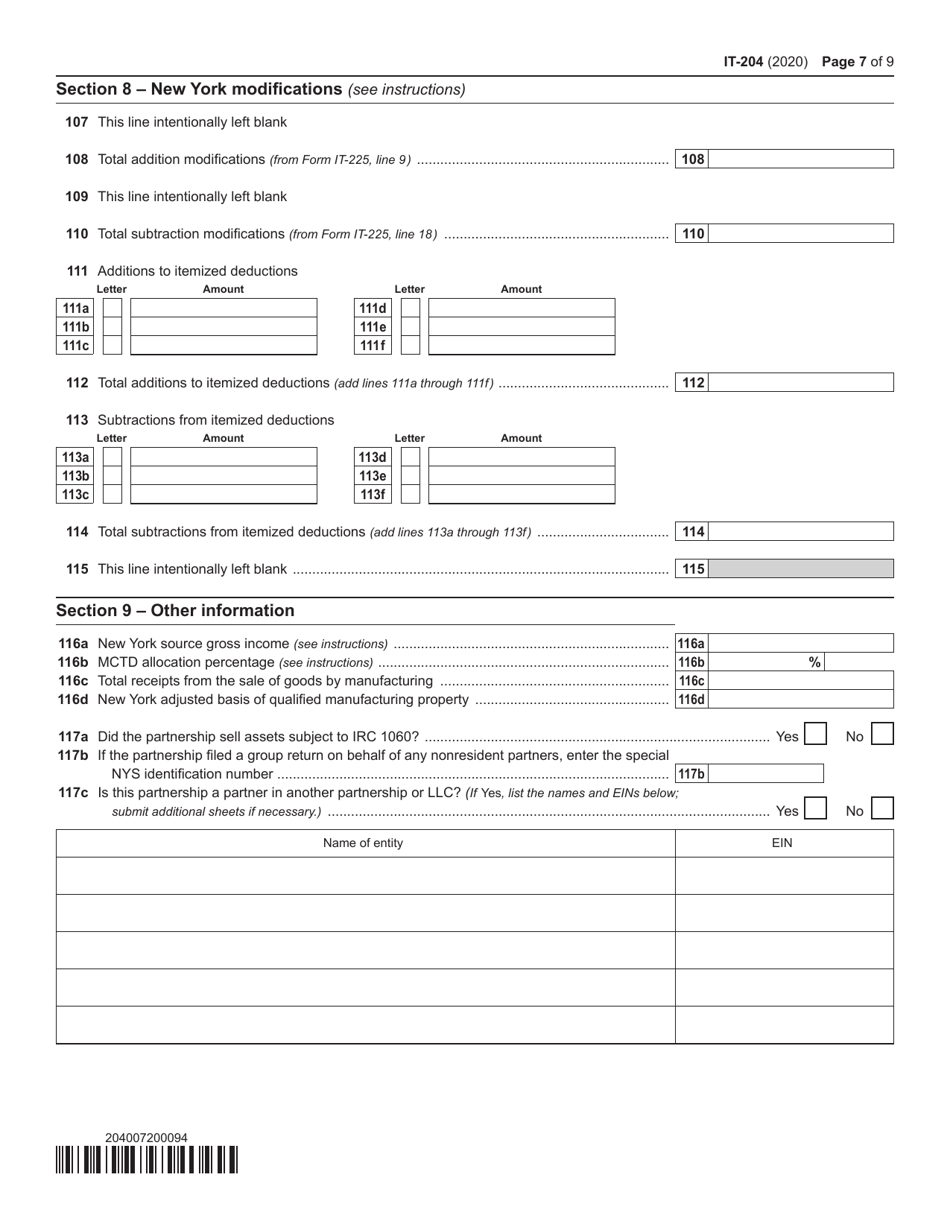

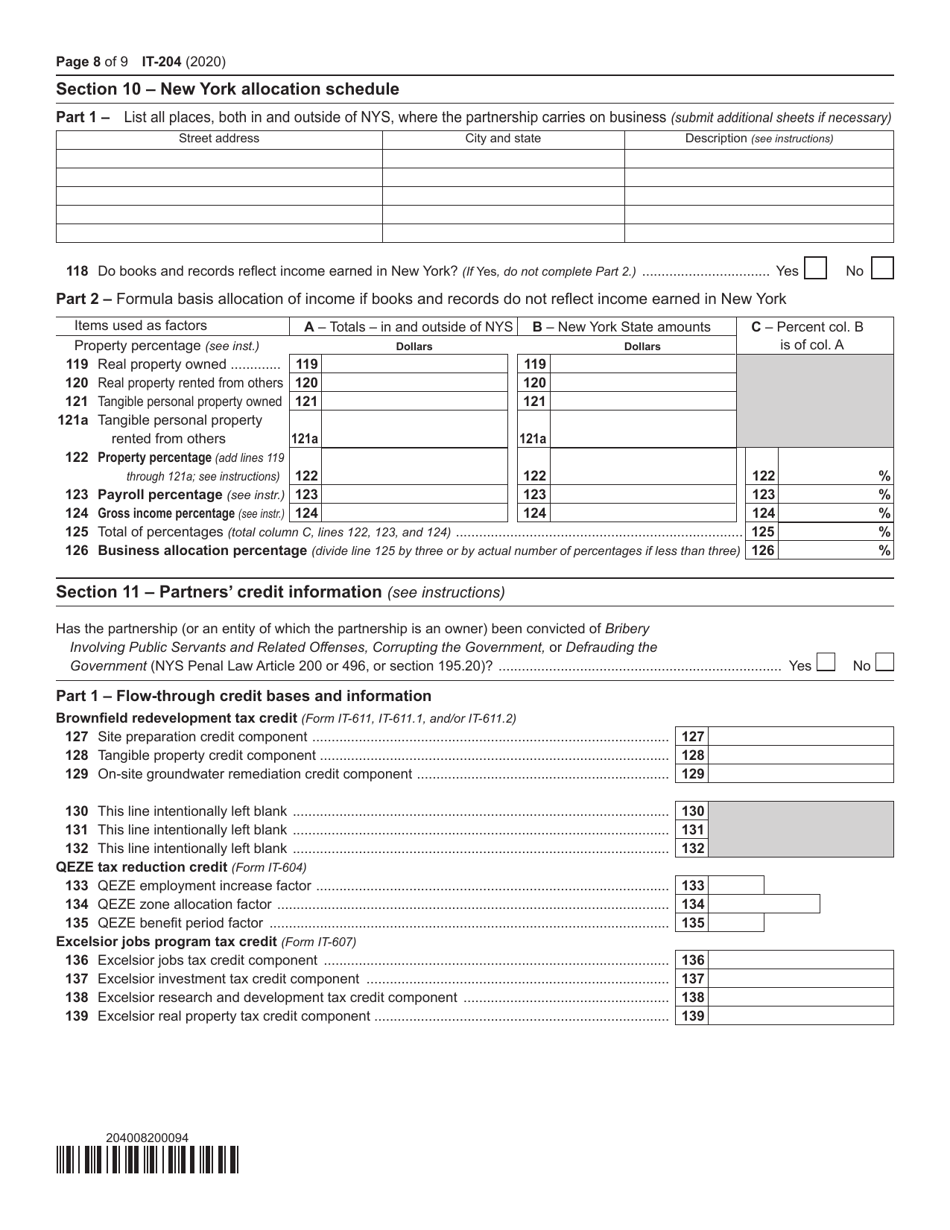

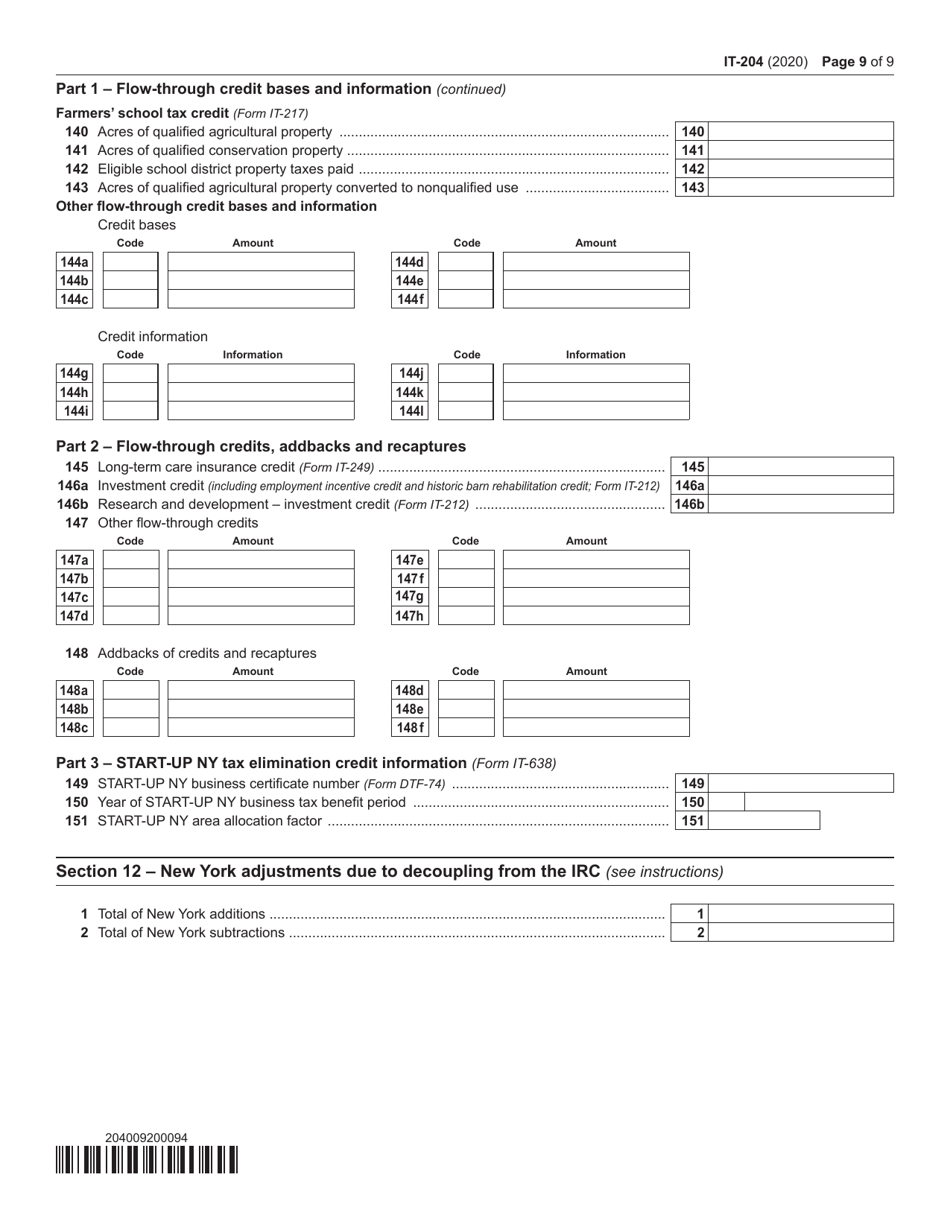

Form IT-204

for the current year.

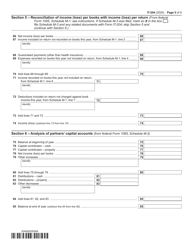

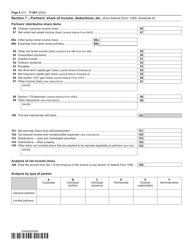

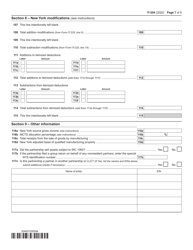

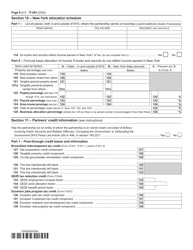

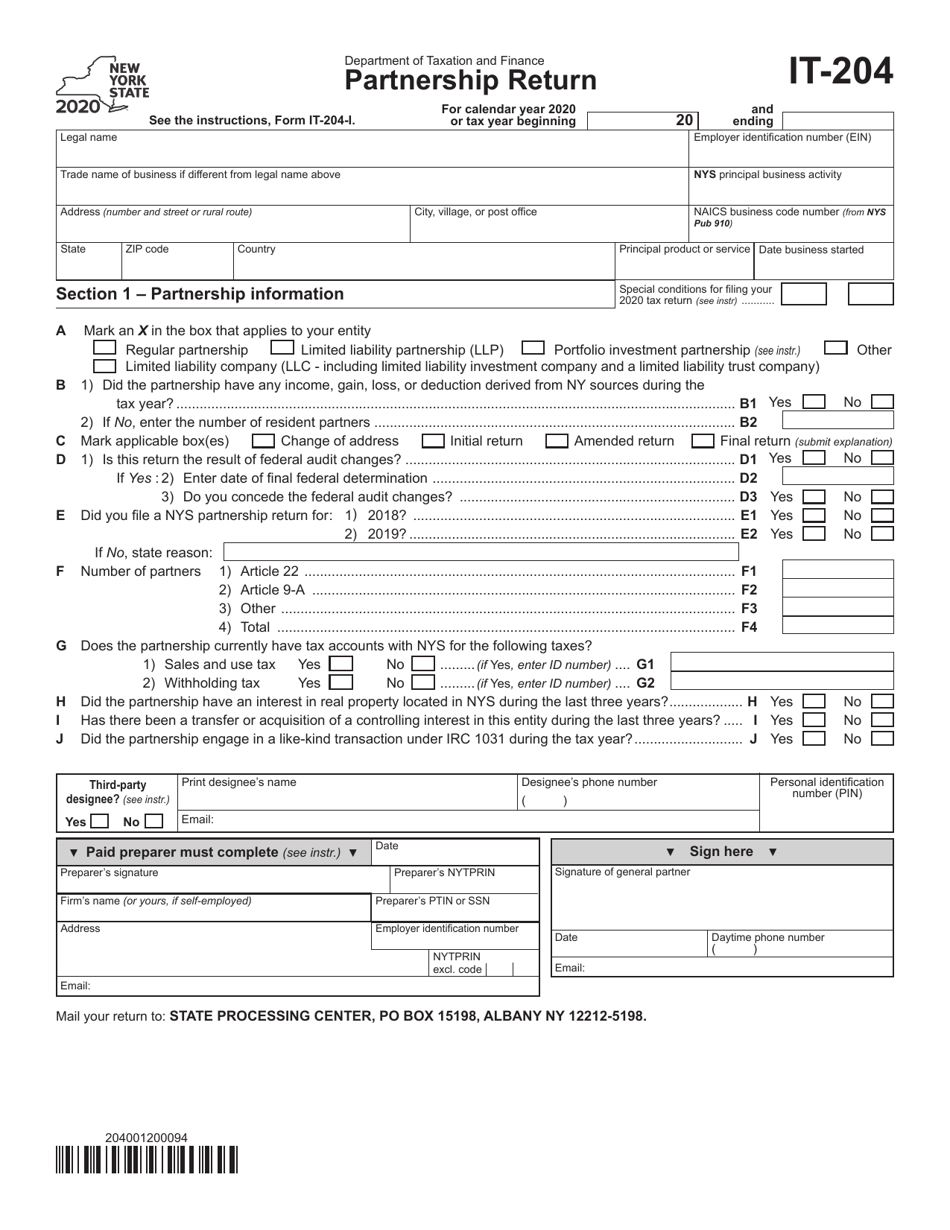

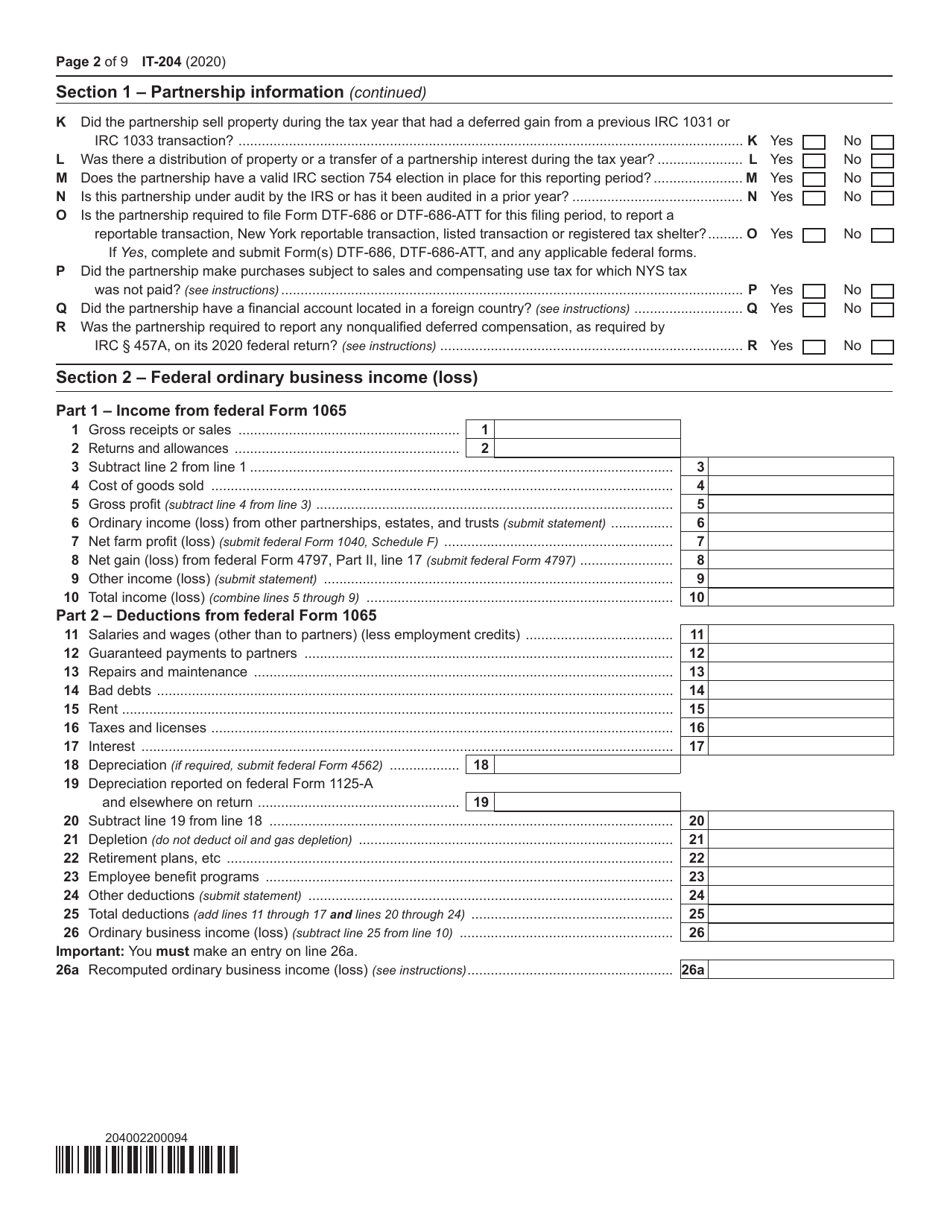

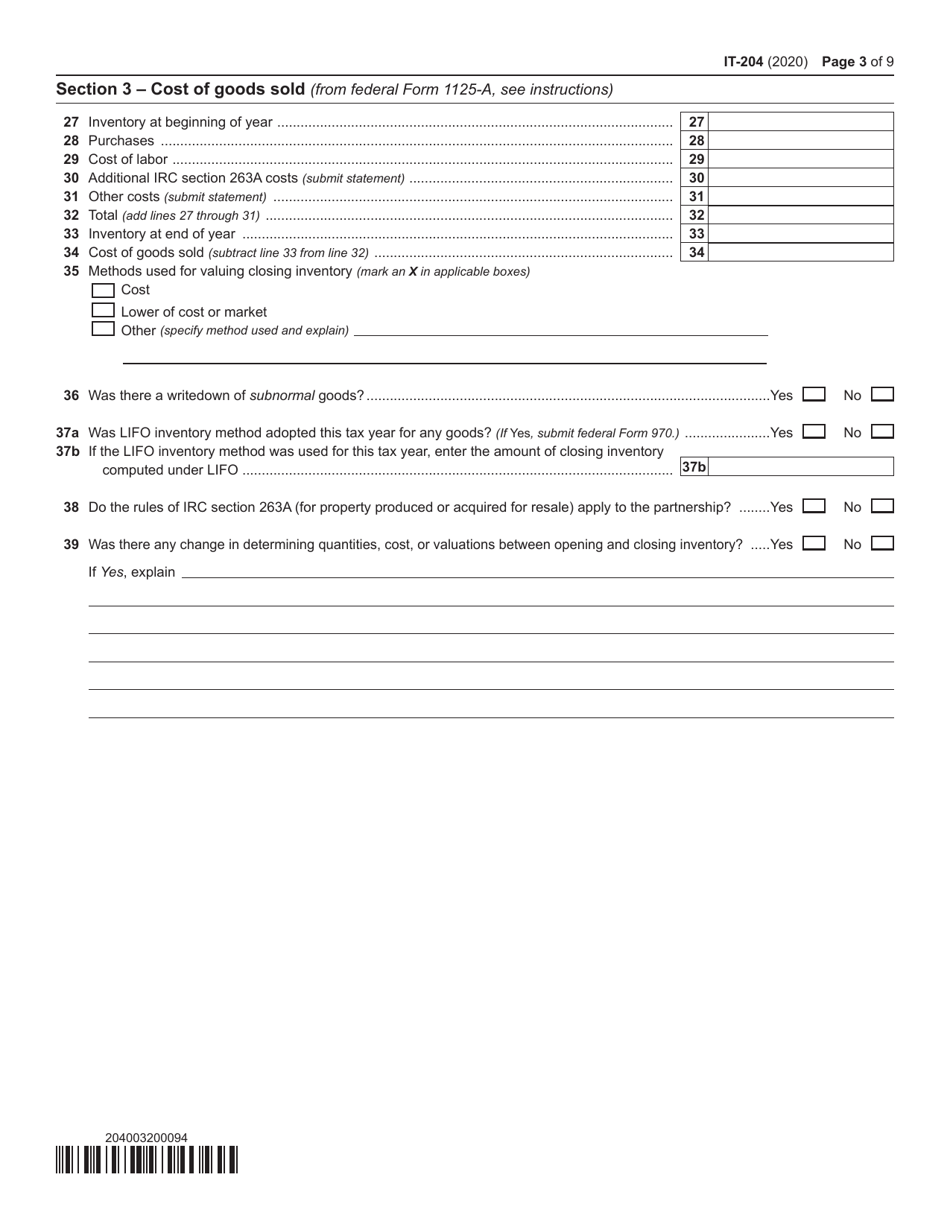

Form IT-204 Partnership Return - New York

What Is Form IT-204?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204?

A: Form IT-204 is the Partnership Return for New York.

Q: Who needs to file Form IT-204?

A: Partnerships in New York need to file Form IT-204.

Q: What is the purpose of Form IT-204?

A: Form IT-204 is used to report partnership income, deductions, and credits in New York.

Q: When is Form IT-204 due?

A: Form IT-204 is generally due on April 15th, or the 15th day of the fourth month following the end of the partnership's tax year.

Q: Are there any filing fees for Form IT-204?

A: No, there are no filing fees for Form IT-204.

Q: Can Form IT-204 be filed electronically?

A: Yes, Form IT-204 can be filed electronically using approved tax software or through a tax professional.

Q: What should I include with my Form IT-204?

A: You should include all required schedules, attachments, and supporting documentation with your Form IT-204.

Q: How do I amend a filed Form IT-204?

A: To amend a filed Form IT-204, you must file a new Form IT-204 with the amended information and check the 'Amended' box on the form.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.