This version of the form is not currently in use and is provided for reference only. Download this version of

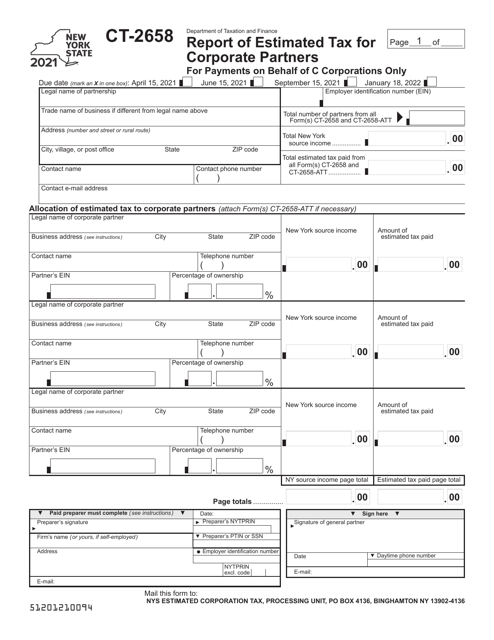

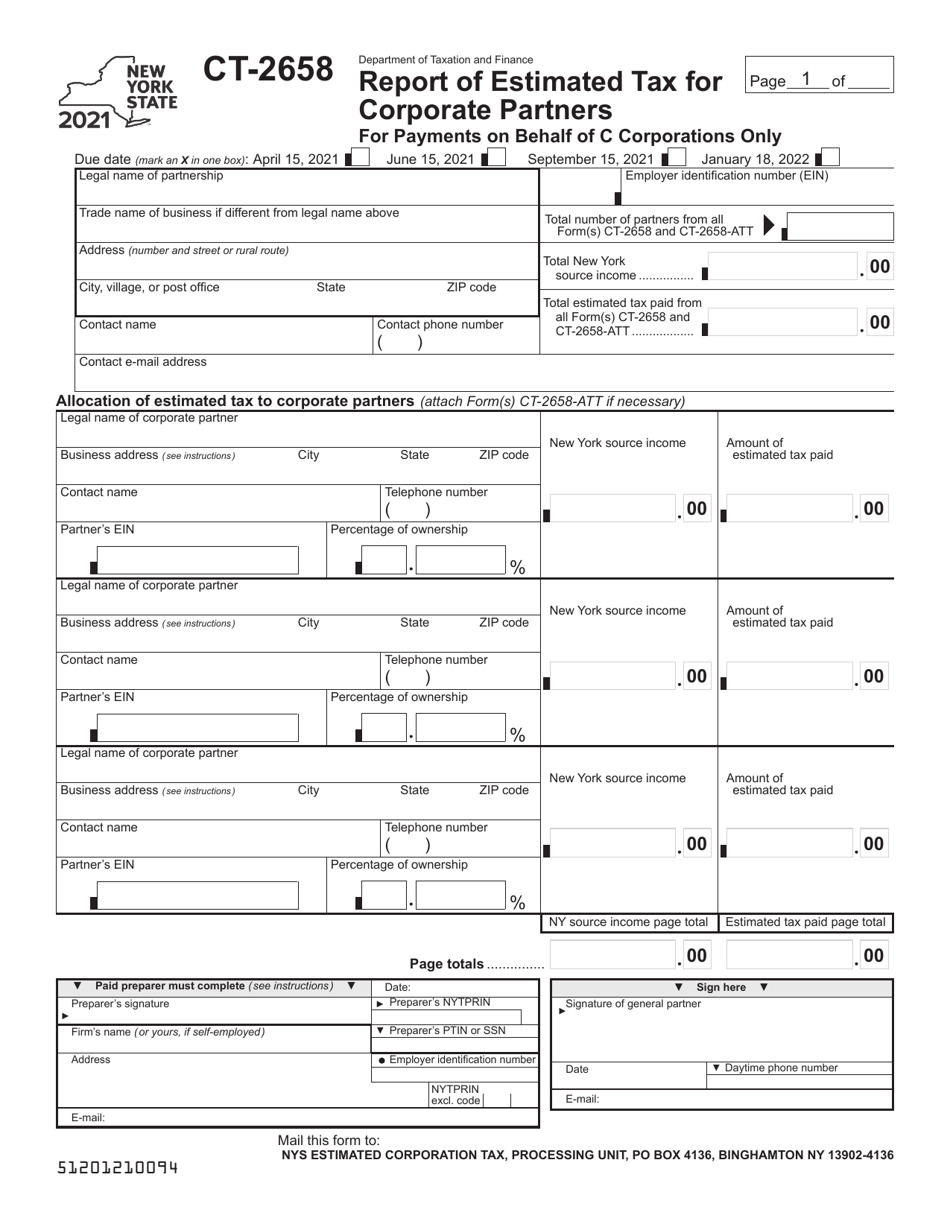

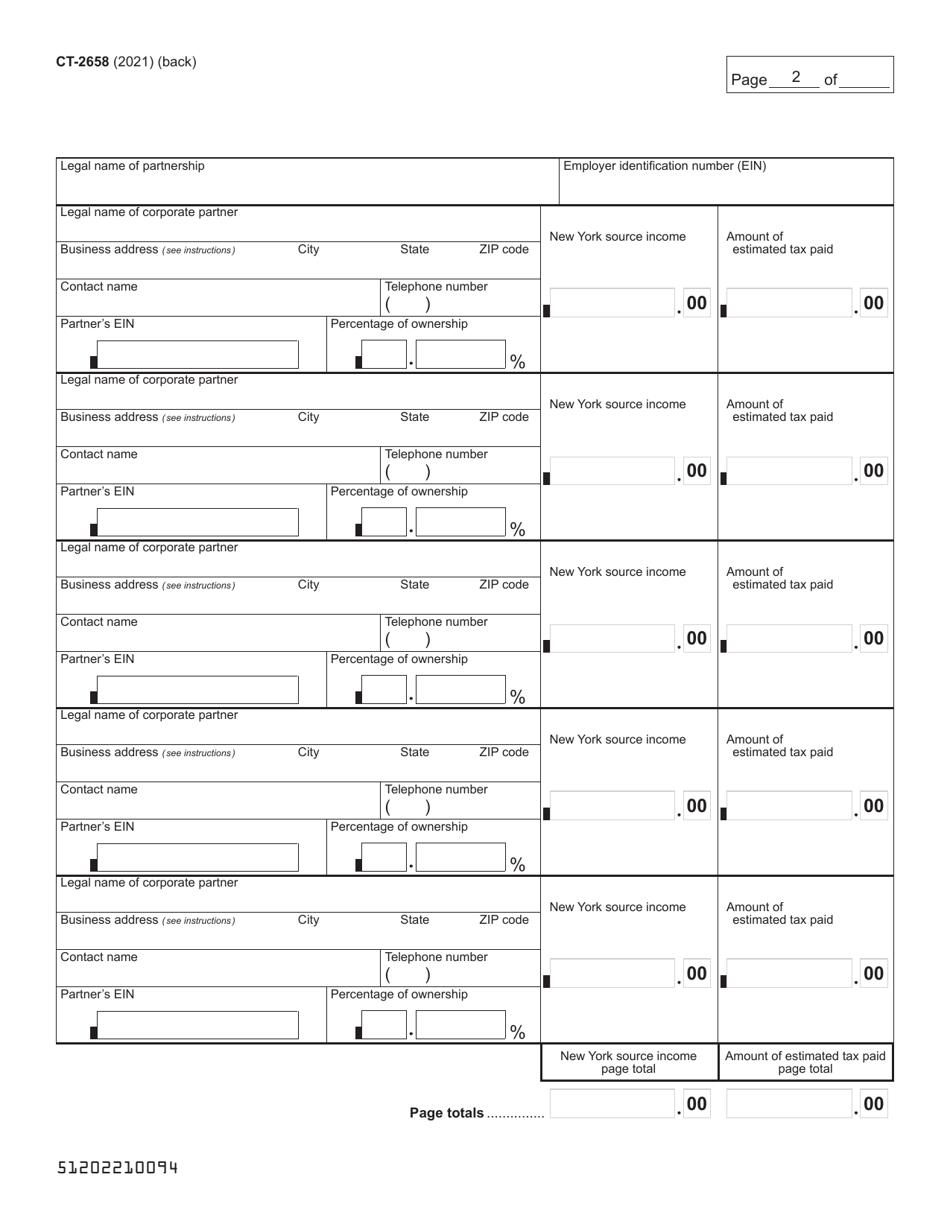

Form CT-2658

for the current year.

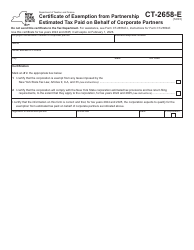

Form CT-2658 Report of Estimated Tax for Corporate Partners - New York

What Is Form CT-2658?

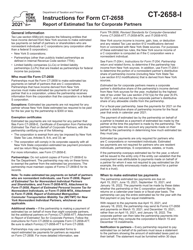

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-2658?

A: Form CT-2658 is the Report of Estimated Tax for Corporate Partners in New York.

Q: Who needs to file Form CT-2658?

A: Corporate partners who have a New York tax liability may need to file Form CT-2658.

Q: What is the purpose of Form CT-2658?

A: Form CT-2658 is used to report and pay estimated tax for corporate partners in New York.

Q: When is Form CT-2658 due?

A: Form CT-2658 is generally due on a quarterly basis, with specific due dates provided on the form.

Q: Are there any penalties for not filing Form CT-2658?

A: Failure to file or pay the estimated tax may result in penalties and interest charges.

Q: Can I file Form CT-2658 electronically?

A: Yes, electronic filing options are available for Form CT-2658.

Q: Is Form CT-2658 only applicable to corporate partners?

A: Yes, Form CT-2658 is specifically for corporate partners and not for individuals or other entities.

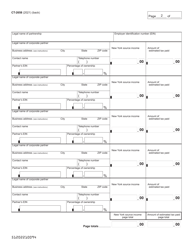

Q: What information do I need to complete Form CT-2658?

A: You will generally need information about your partnership and its tax liabilities to complete Form CT-2658.

Q: Can I amend Form CT-2658 if I make a mistake?

A: Yes, if you made an error on a previously filed Form CT-2658, you can file an amended form to correct it.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.