This version of the form is not currently in use and is provided for reference only. Download this version of

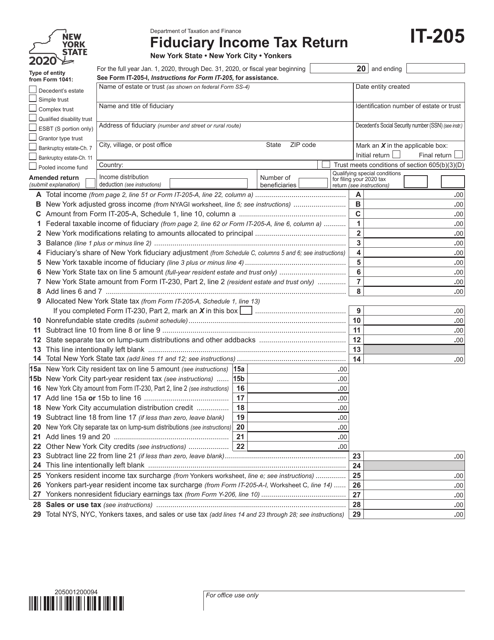

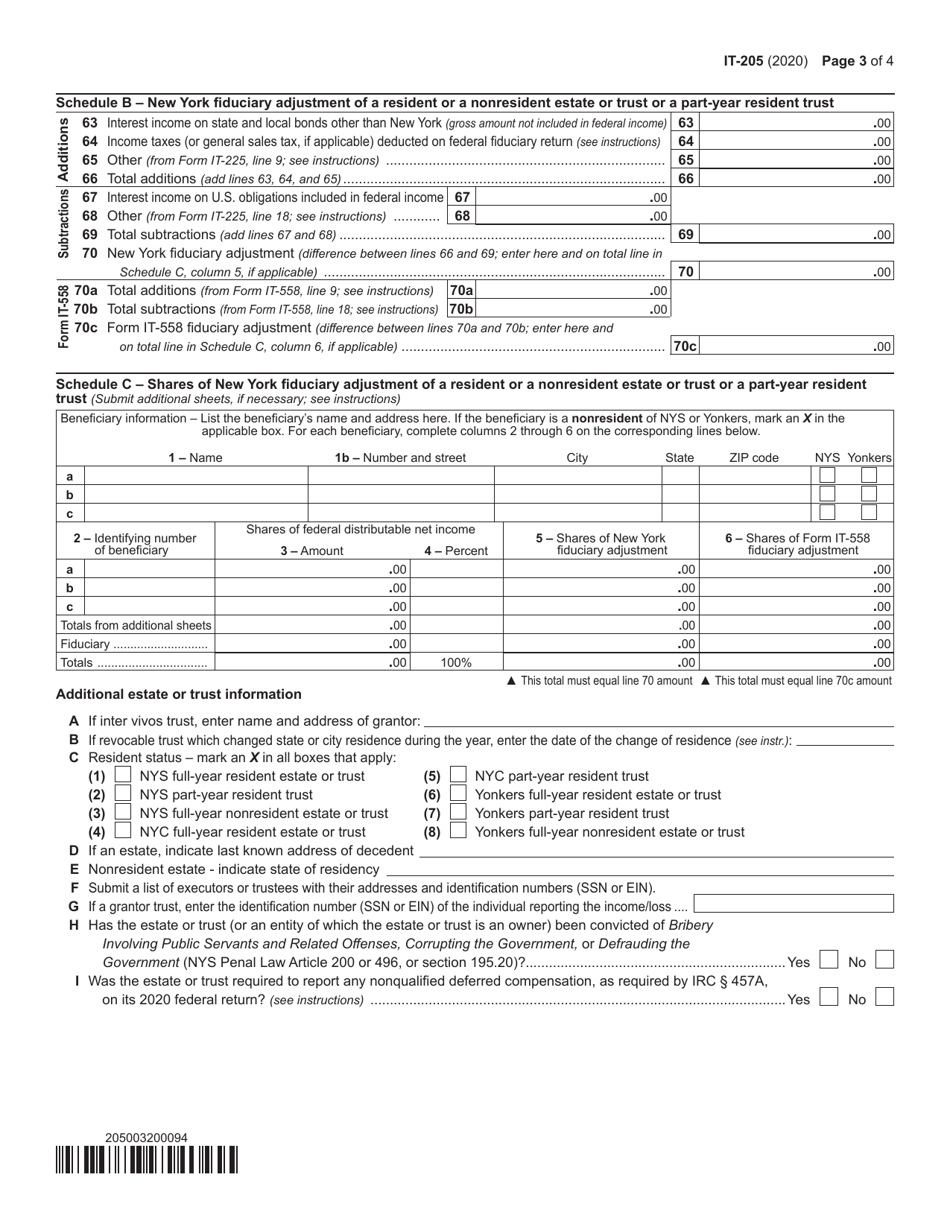

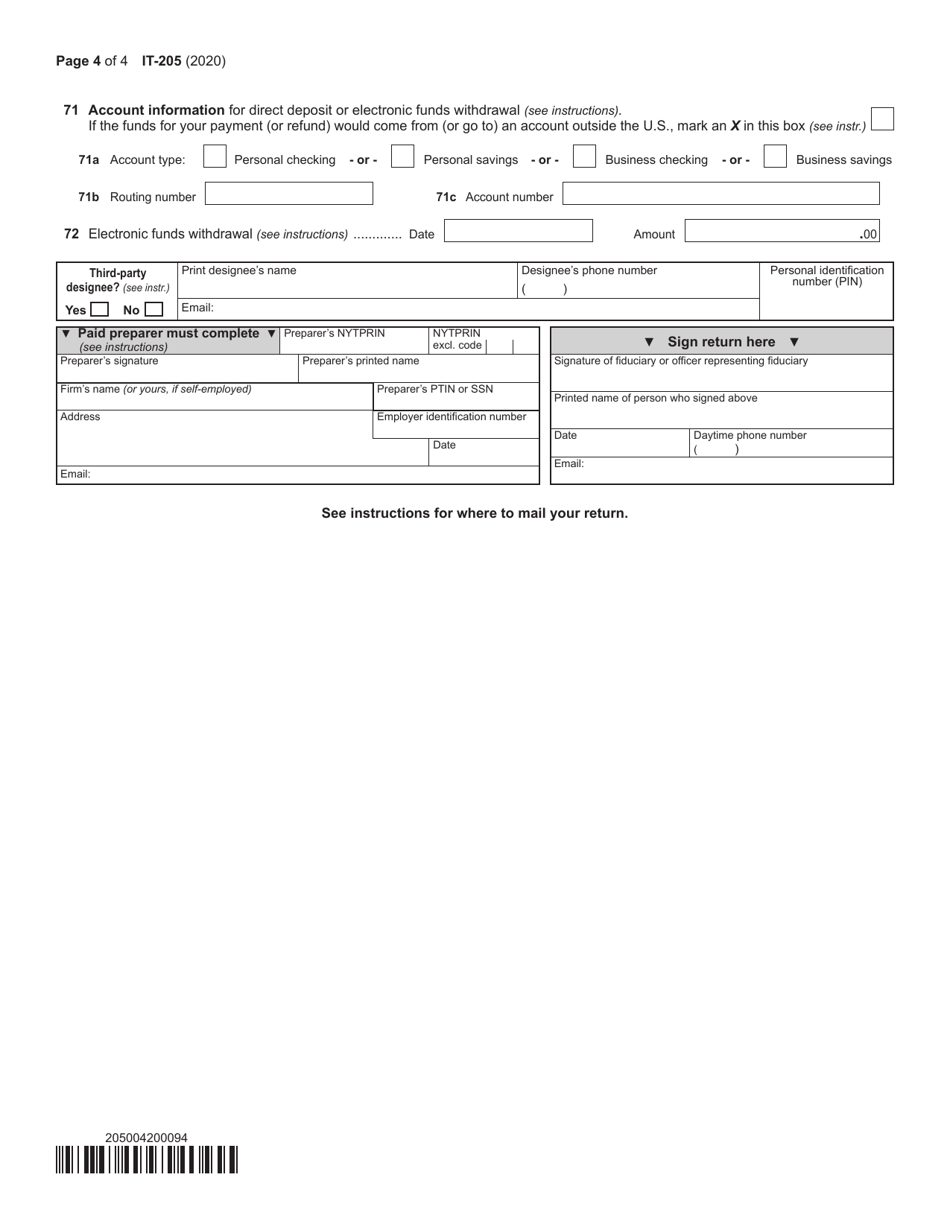

Form IT-205

for the current year.

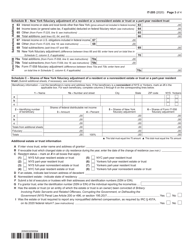

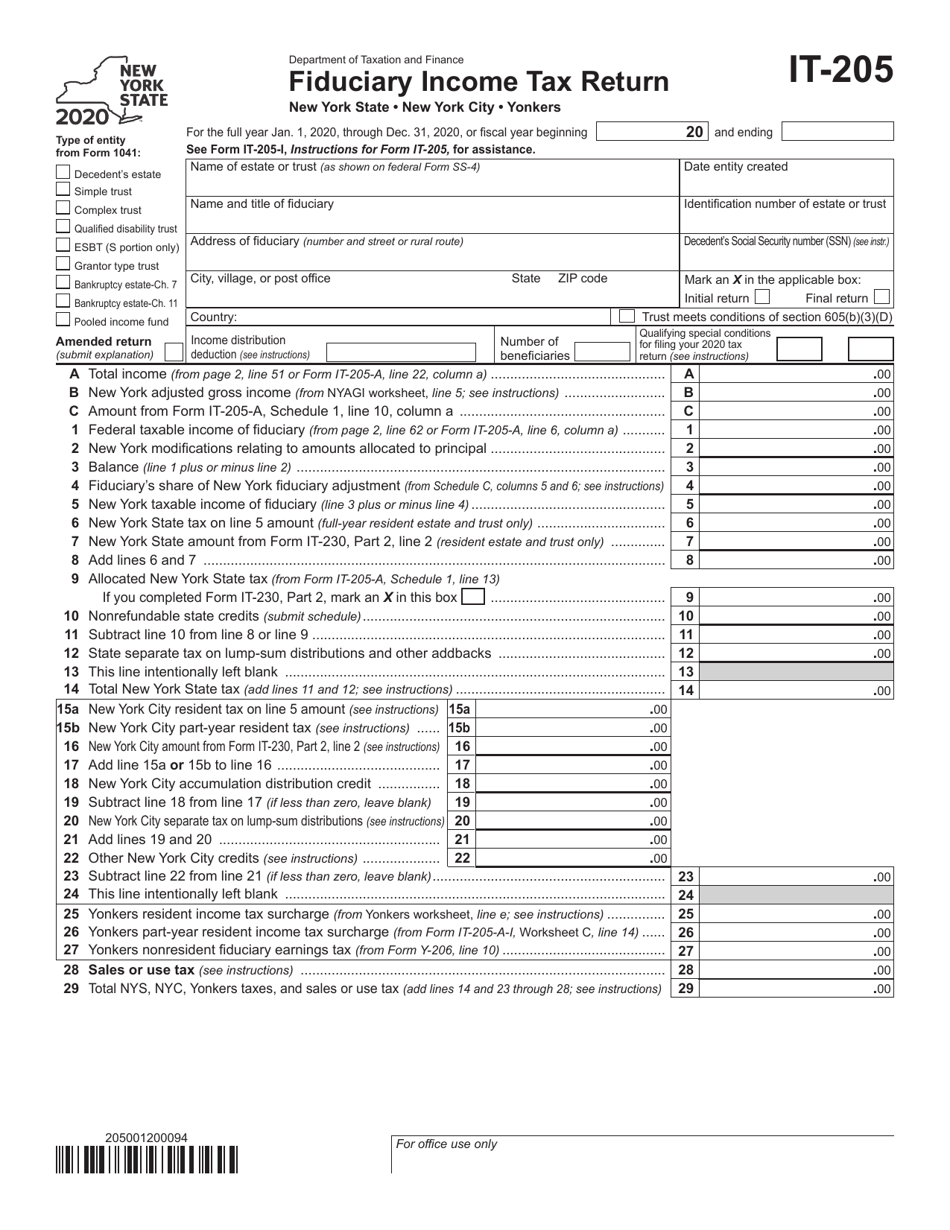

Form IT-205 Fiduciary Income Tax Return - New York

What Is Form IT-205?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205?

A: Form IT-205 is the Fiduciary Income Tax Return for residents of New York.

Q: Who needs to file Form IT-205?

A: Form IT-205 is for individuals acting as fiduciaries of an estate or trust in New York.

Q: When is the deadline to file Form IT-205?

A: The deadline to file Form IT-205 is generally April 15th, or the 15th day of the fourth month following the close of the tax year.

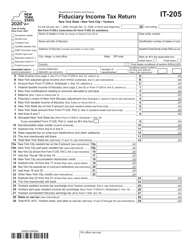

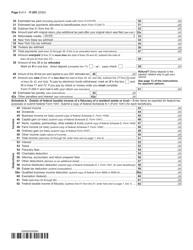

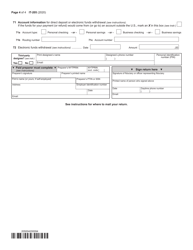

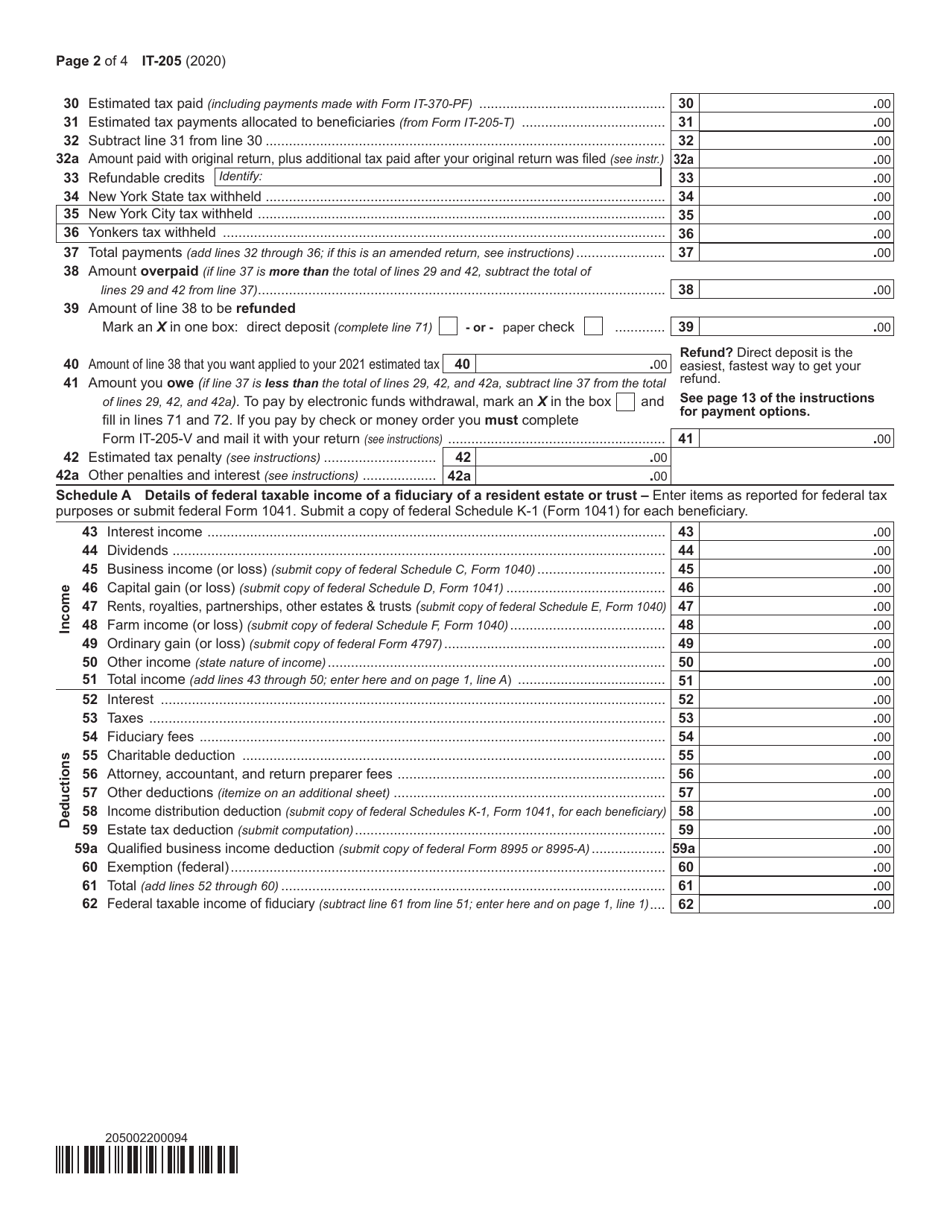

Q: What information is required to complete Form IT-205?

A: To complete Form IT-205, you will need information about the estate or trust, income received, deductions, and credits.

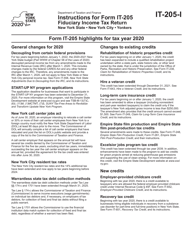

Q: Are there any special instructions or considerations for filing Form IT-205?

A: Yes, there are specific instructions provided by the New York State Department of Taxation and Finance that must be followed when completing and filing Form IT-205.

Q: Are there any penalties for not filing Form IT-205?

A: Yes, there may be penalties for failing to file Form IT-205 or for filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.