This version of the form is not currently in use and is provided for reference only. Download this version of

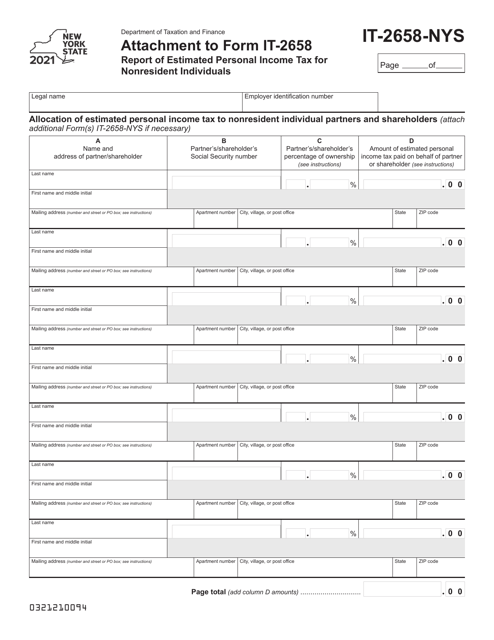

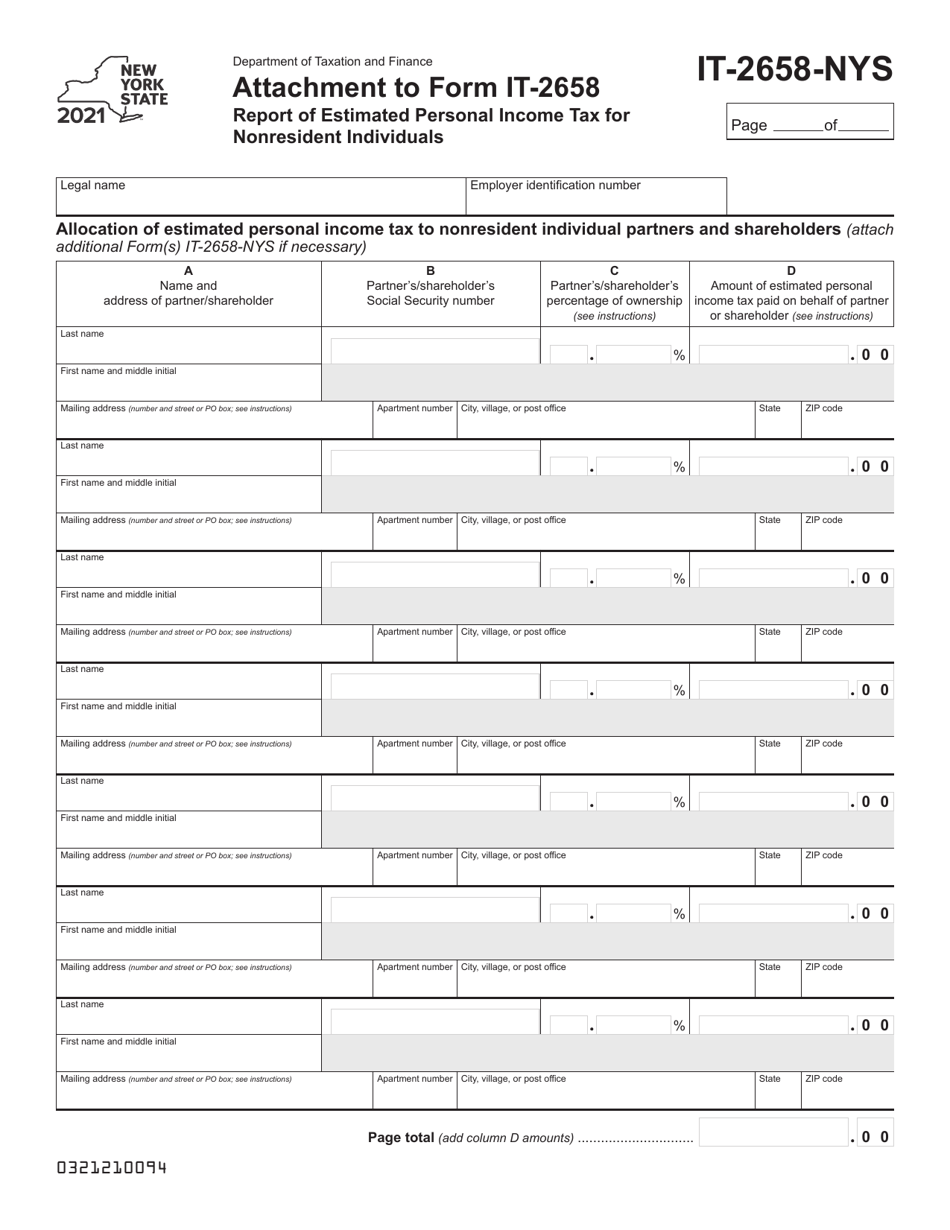

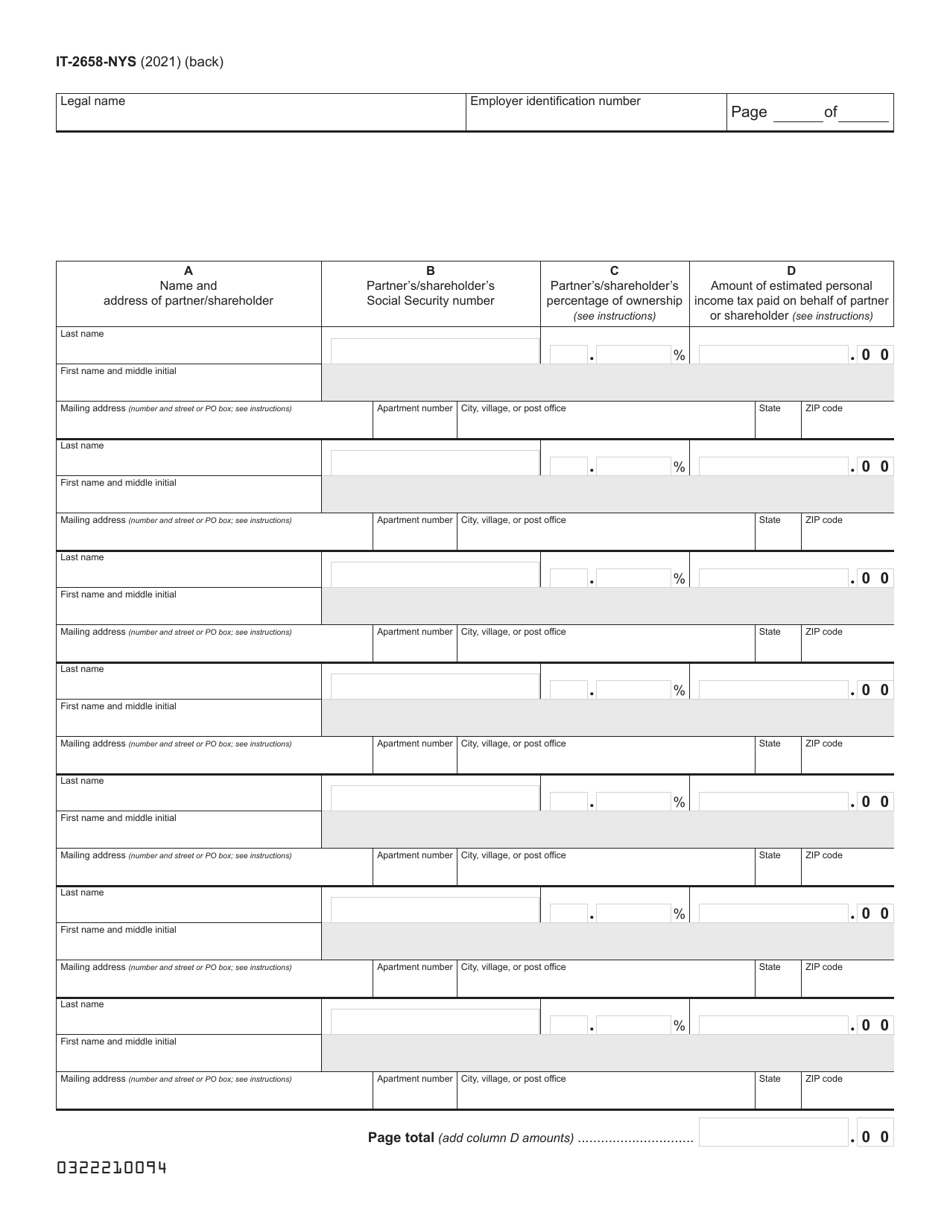

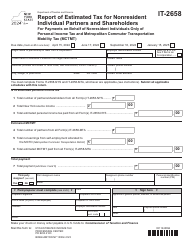

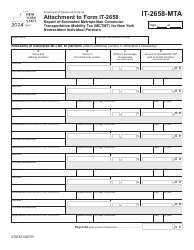

Form IT-2658-NYS

for the current year.

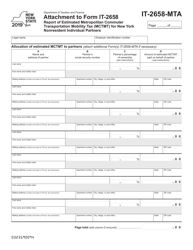

Form IT-2658-NYS Report of Estimated Personal Income Tax for Nonresident Individuals - New York

What Is Form IT-2658-NYS?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2658-NYS?

A: Form IT-2658-NYS is a report used by nonresident individuals in New York to file their estimated personal income tax.

Q: Who needs to file Form IT-2658-NYS?

A: Nonresident individuals who earn income in New York and want to pay their estimated personal income tax are required to file Form IT-2658-NYS.

Q: What is the purpose of filing Form IT-2658-NYS?

A: Filing Form IT-2658-NYS allows nonresident individuals to report and pay their estimated personal income tax to the state of New York.

Q: When is Form IT-2658-NYS due?

A: Form IT-2658-NYS is due on a quarterly basis. The due dates are April 15th, June 15th, September 15th, and January 15th of the following year.

Q: Are there any penalties for not filing Form IT-2658-NYS?

A: Yes, failing to file Form IT-2658-NYS or paying the estimated personal income tax may result in penalties and interest charges.

Q: Do I need to attach any documents to Form IT-2658-NYS?

A: Generally, no additional documents need to be attached to Form IT-2658-NYS. However, you should keep records of your estimated tax payments for your own records.

Q: Can I file Form IT-2658-NYS if I am a resident of New York?

A: No, Form IT-2658-NYS is specifically for nonresident individuals to report their estimated personal income tax in New York. If you are a resident of New York, you should use a different form to file your taxes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658-NYS by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.