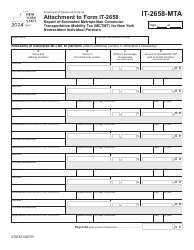

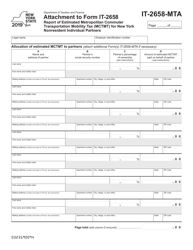

This version of the form is not currently in use and is provided for reference only. Download this version of

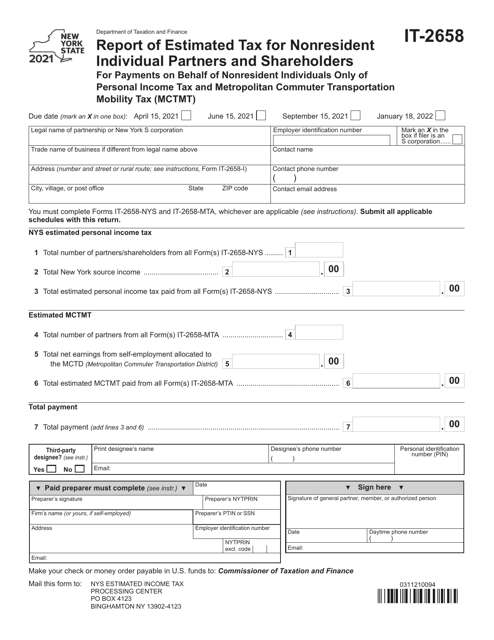

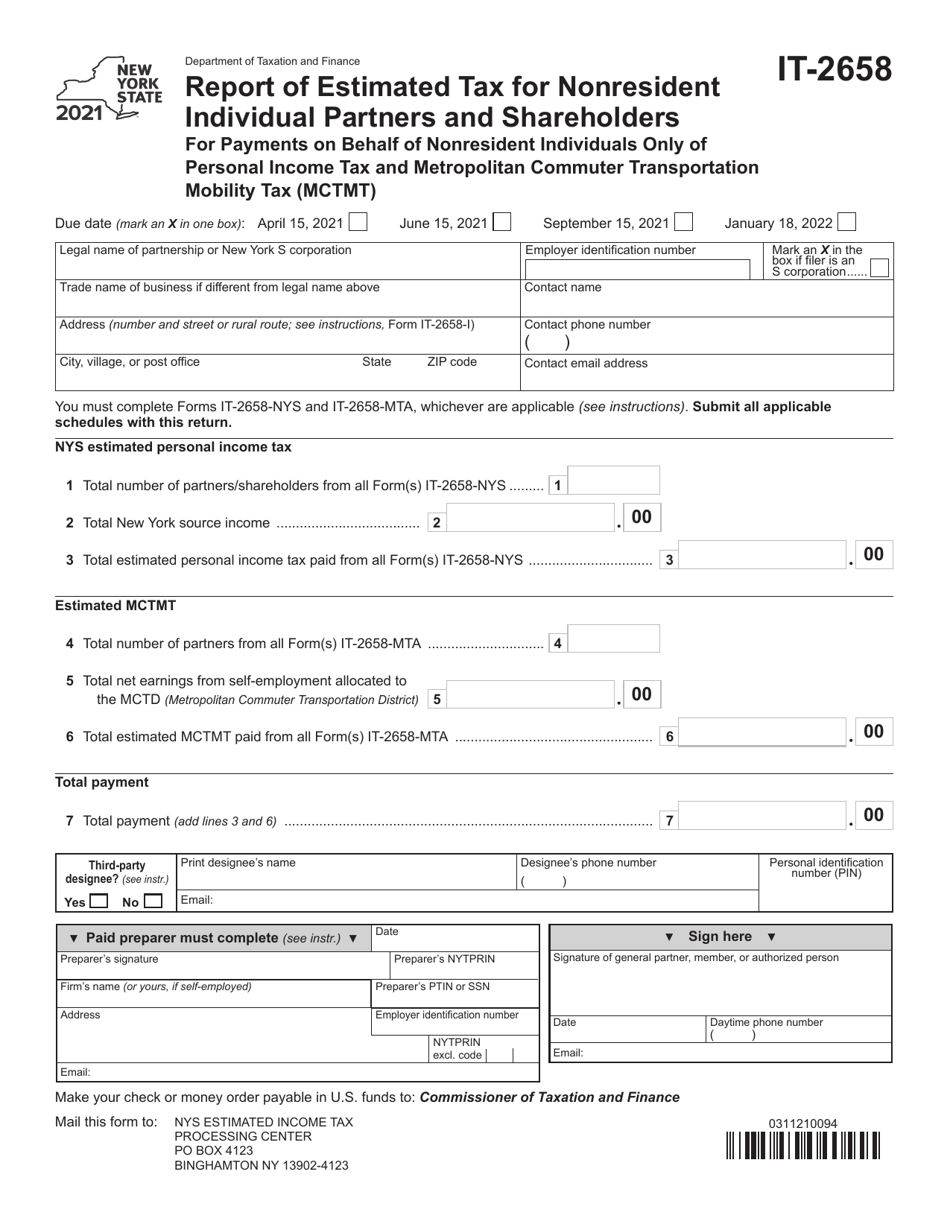

Form IT-2658

for the current year.

Form IT-2658 Report of Estimated Tax for Nonresident Individual Partners and Shareholders - New York

What Is Form IT-2658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2658?

A: Form IT-2658 is a report of estimated tax for nonresident individual partners and shareholders in New York.

Q: Who needs to file Form IT-2658?

A: Nonresident individual partners and shareholders in New York who are required to make estimated tax payments.

Q: What is the purpose of Form IT-2658?

A: The purpose of Form IT-2658 is to report and pay estimated income tax on income derived from New York sources for nonresident individual partners and shareholders.

Q: When is Form IT-2658 due?

A: Form IT-2658 is due on a quarterly basis, with the first payment due on April 15th, and subsequent payments due on June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form IT-2658?

A: Failure to file Form IT-2658 or pay the estimated tax can result in penalties and interest being imposed by the New York State Department of Taxation and Finance.

Q: Can I make changes to Form IT-2658 after I've filed it?

A: Yes, you can file an amended Form IT-2658 if any changes need to be made to your estimated tax payment.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.