This version of the form is not currently in use and is provided for reference only. Download this version of

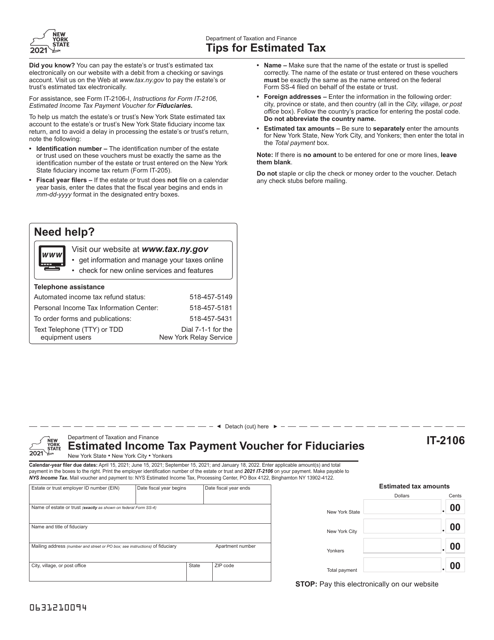

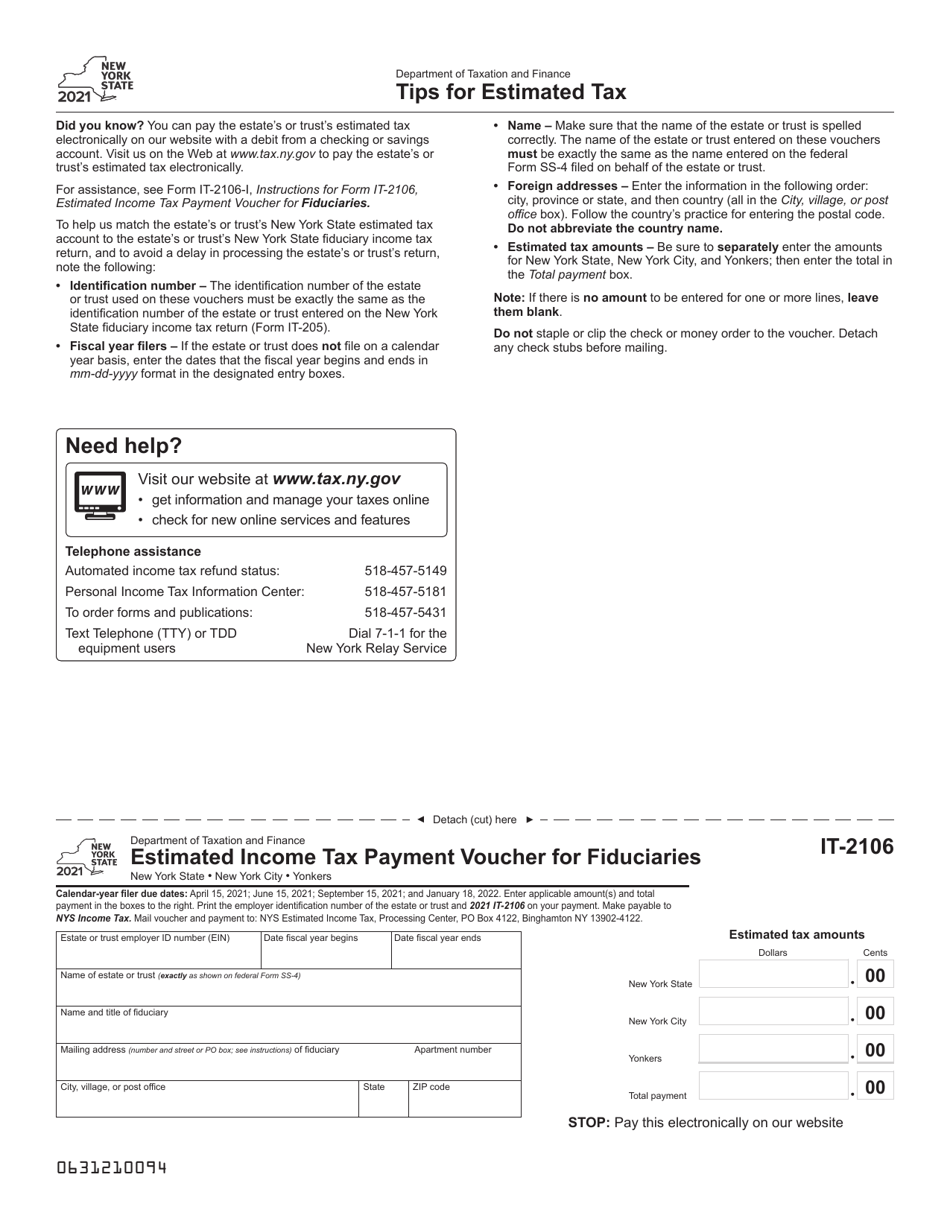

Form IT-2106

for the current year.

Form IT-2106 Estimated Income Tax Payment Voucher for Fiduciaries - New York

What Is Form IT-2106?

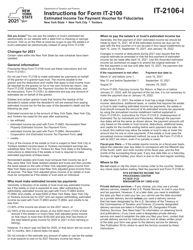

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2106?

A: Form IT-2106 is an Estimated Income Tax Payment Voucher for Fiduciaries in New York.

Q: Who needs to file Form IT-2106?

A: Fiduciaries in New York who are making estimated income tax payments.

Q: What is the purpose of Form IT-2106?

A: The purpose of Form IT-2106 is to facilitate estimated income tax payments for fiduciaries in New York.

Q: What information is required on Form IT-2106?

A: Form IT-2106 requires information such as the fiduciary's name, address, fiduciary identification number, estimated income, and estimated tax liability.

Q: When is Form IT-2106 due?

A: Form IT-2106 is due on the same date as the fiduciary's federal income tax return, which is generally April 15th.

Q: Can I file Form IT-2106 electronically?

A: No, Form IT-2106 cannot be filed electronically and must be submitted by mail.

Q: What happens if I don't file Form IT-2106?

A: Failure to file Form IT-2106 or pay the estimated income tax may result in penalties and interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2106 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.