This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC552

for the current year.

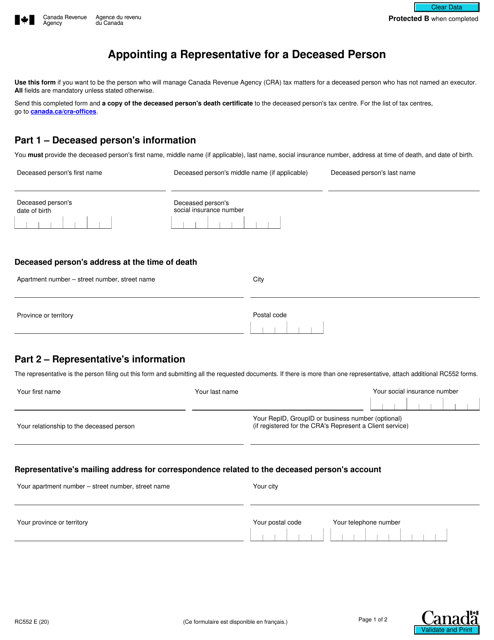

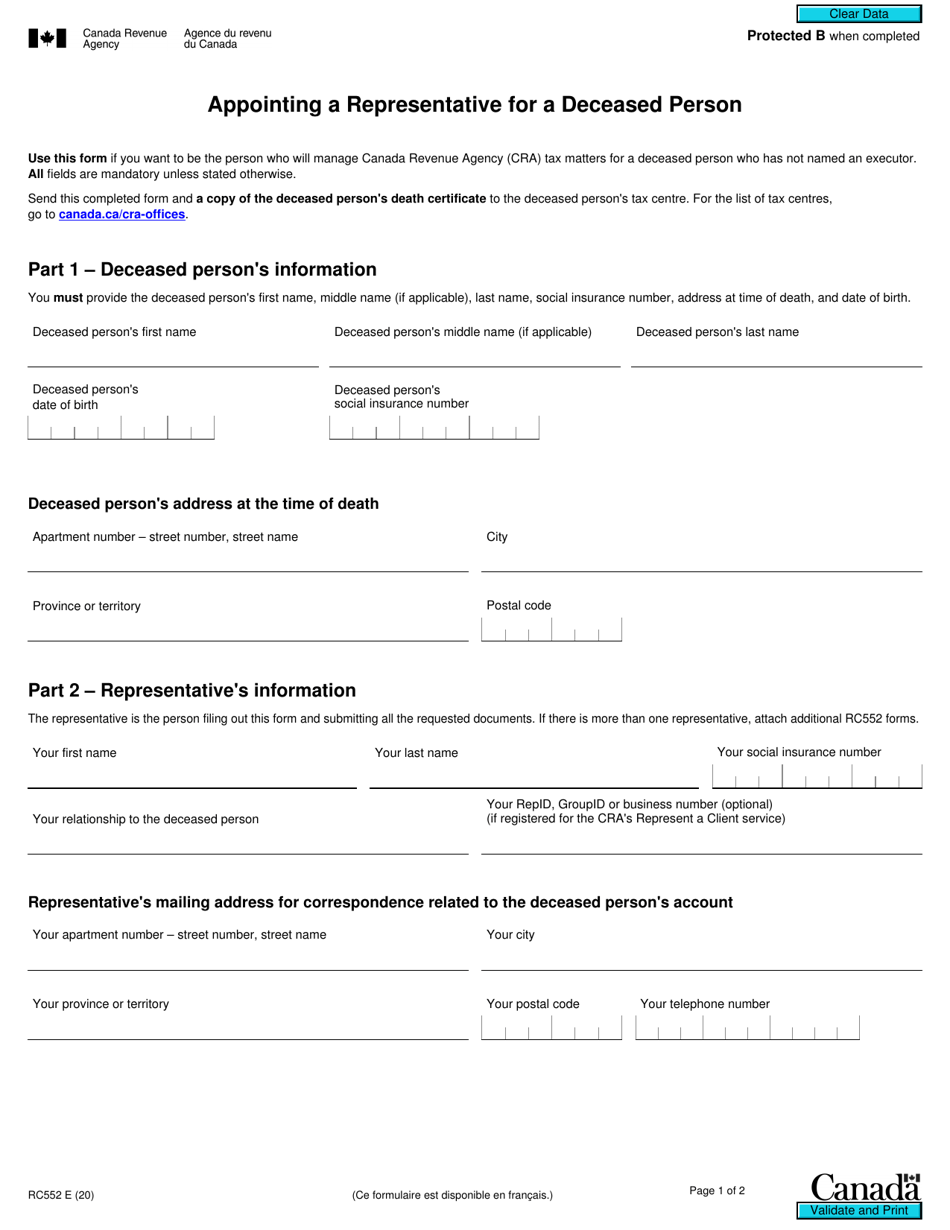

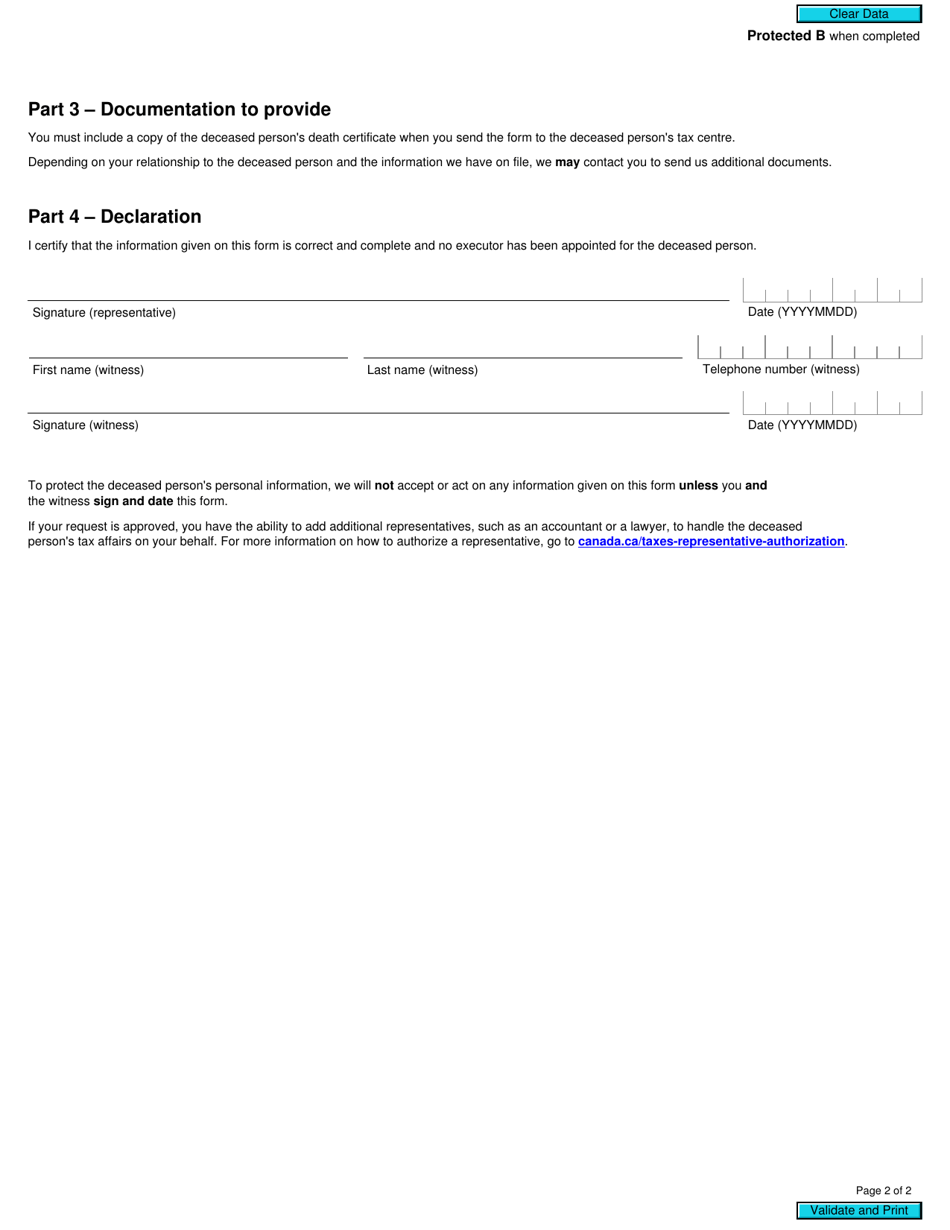

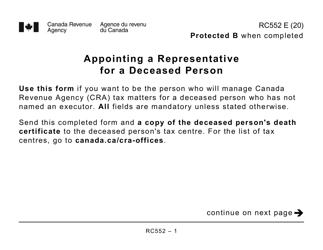

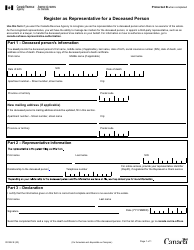

Form RC552 Appointing a Representative for a Deceased Person - Canada

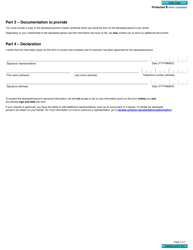

The Form RC552, "Appointing a Representative for a Deceased Person," in Canada is used to authorize someone to act on behalf of a deceased individual for tax-related matters. It allows the representative to communicate with the Canada Revenue Agency (CRA) and handle tax-related responsibilities on behalf of the deceased person.

The executor or administrator of the deceased person's estate files the Form RC552 in Canada.

FAQ

Q: What is Form RC552?

A: Form RC552 is a document used in Canada to appoint a representative for a deceased person.

Q: Who needs to fill out Form RC552?

A: The executor or legal representative of the deceased person must fill out Form RC552.

Q: What is the purpose of Form RC552?

A: The purpose of Form RC552 is to appoint someone to represent a deceased person for tax purposes.

Q: Can anyone be appointed as a representative using Form RC552?

A: No, only certain individuals can be appointed as representatives using Form RC552, such as the executor of the estate or a legal representative.

Q: Do I need to submit Form RC552 to the CRA?

A: Yes, once filled out, Form RC552 must be submitted to the Canada Revenue Agency (CRA) for processing and approval.

Q: Is there a deadline for submitting Form RC552?

A: There is no specific deadline for submitting Form RC552, but it is recommended to do so as soon as possible after the appointment of the representative.

Q: Can I make changes to the appointment of the representative after submitting Form RC552?

A: Yes, you can make changes to the appointment of the representative by submitting a new Form RC552 to the Canada Revenue Agency (CRA).

Q: What happens after Form RC552 is approved?

A: Once Form RC552 is approved by the Canada Revenue Agency (CRA), the appointed representative will have the authority to act on behalf of the deceased person for tax-related matters.

Q: What if I have more questions about Form RC552?

A: If you have more questions about Form RC552, you can contact the Canada Revenue Agency (CRA) for assistance.