This version of the form is not currently in use and is provided for reference only. Download this version of

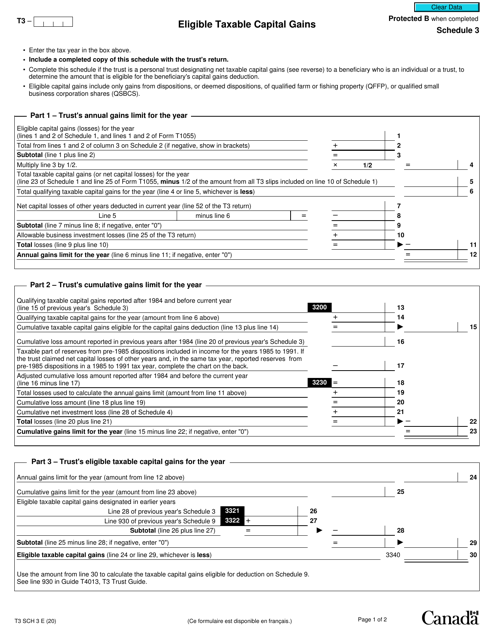

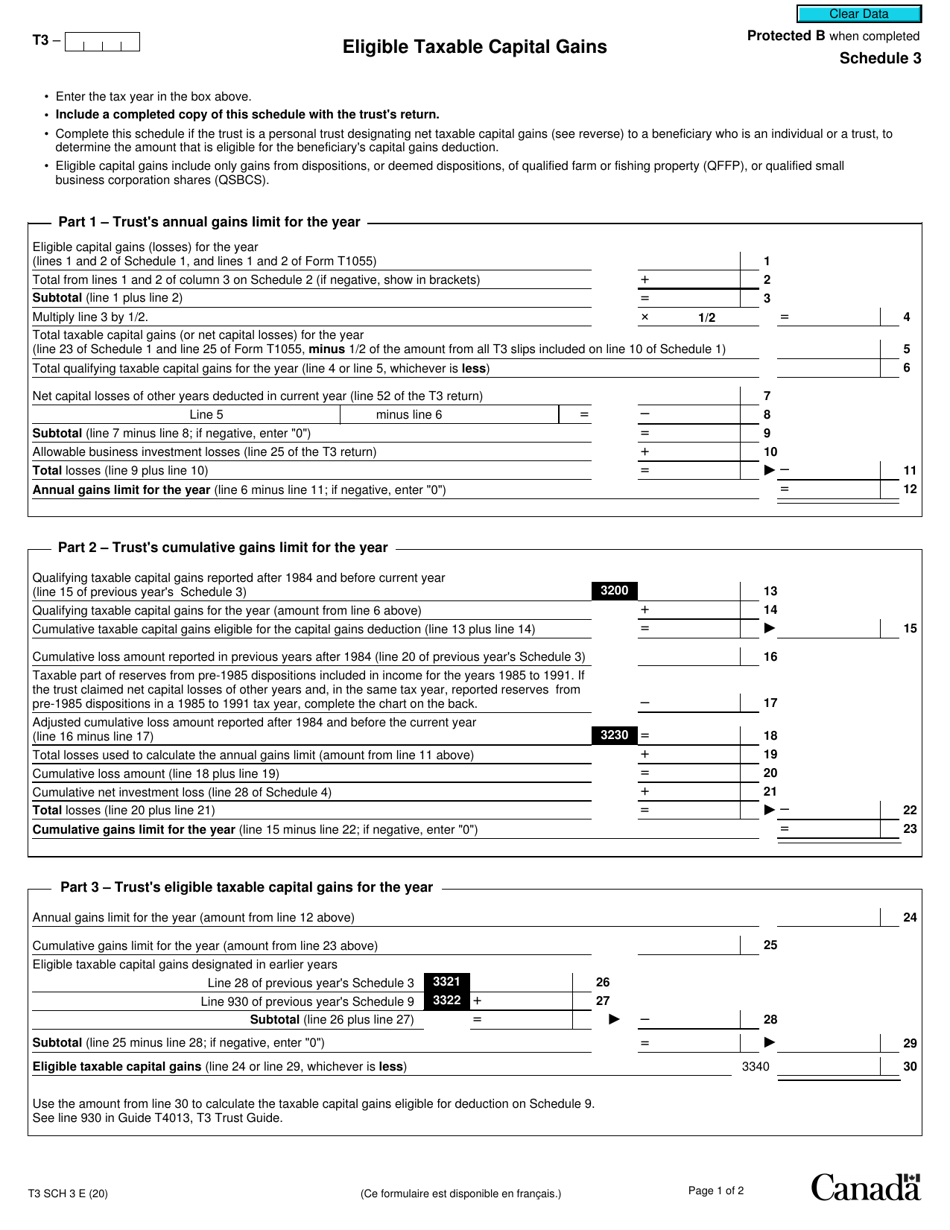

Form T3 Schedule 3

for the current year.

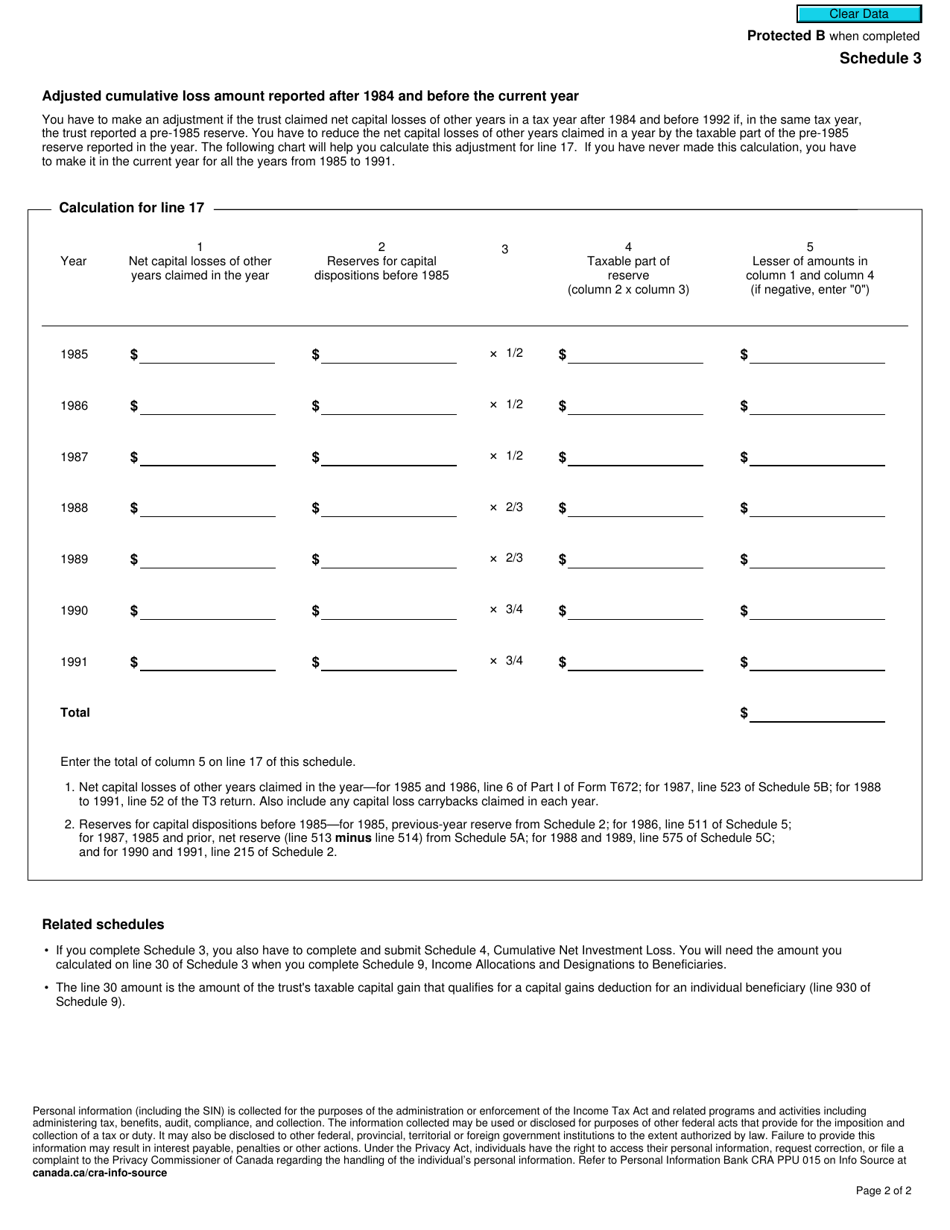

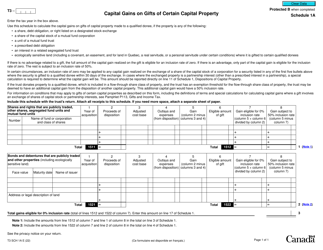

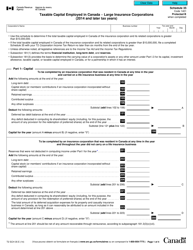

Form T3 Schedule 3 Eligible Taxable Capital Gains - Canada

Form T3 Schedule 3 - Eligible Taxable Capital Gains is used in Canada to report capital gains and losses on certain investments such as stocks, mutual funds, and real estate. This form is filed as part of the T3 Trust Income Tax and Information Return for Estates and Trusts.

Individuals or corporations who have eligible taxable capital gains in Canada file the Form T3 Schedule 3.

FAQ

Q: What is Form T3 Schedule 3?

A: Form T3 Schedule 3 is a tax form in Canada used to report eligible taxable capital gains.

Q: What are eligible taxable capital gains?

A: Eligible taxable capital gains are the gains you make from selling certain types of properties, such as real estate or investments, and are subject to tax.

Q: Who needs to file Form T3 Schedule 3?

A: Individuals who have eligible taxable capital gains during the tax year need to file Form T3 Schedule 3.

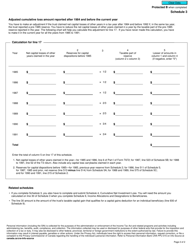

Q: How do I complete Form T3 Schedule 3?

A: To complete Form T3 Schedule 3, you need to provide information about the property sold, the sale price, the adjusted cost base, and any expenses related to the sale.

Q: When is Form T3 Schedule 3 due?

A: Form T3 Schedule 3 is due on the same date as your income tax return, which is typically April 30th for most individuals.