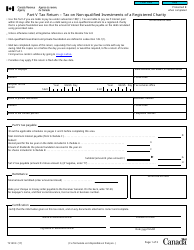

This version of the form is not currently in use and is provided for reference only. Download this version of

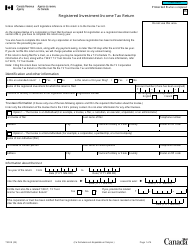

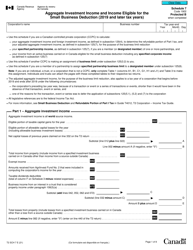

Form T3RI

for the current year.

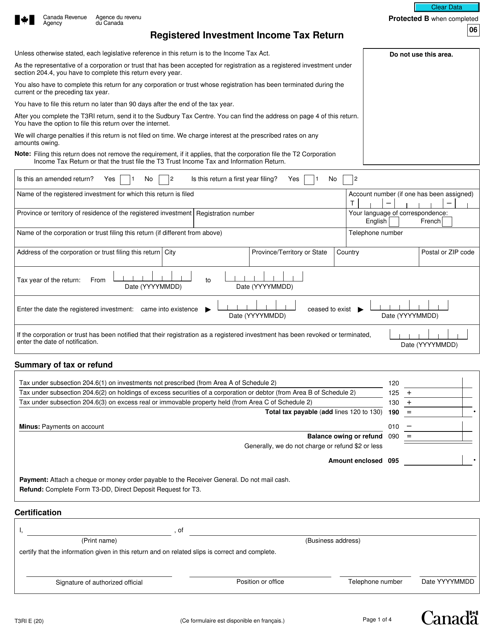

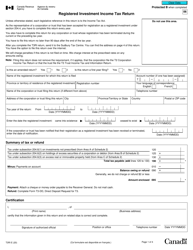

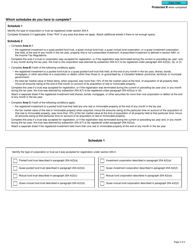

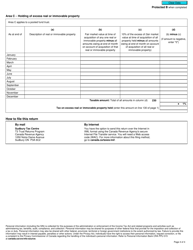

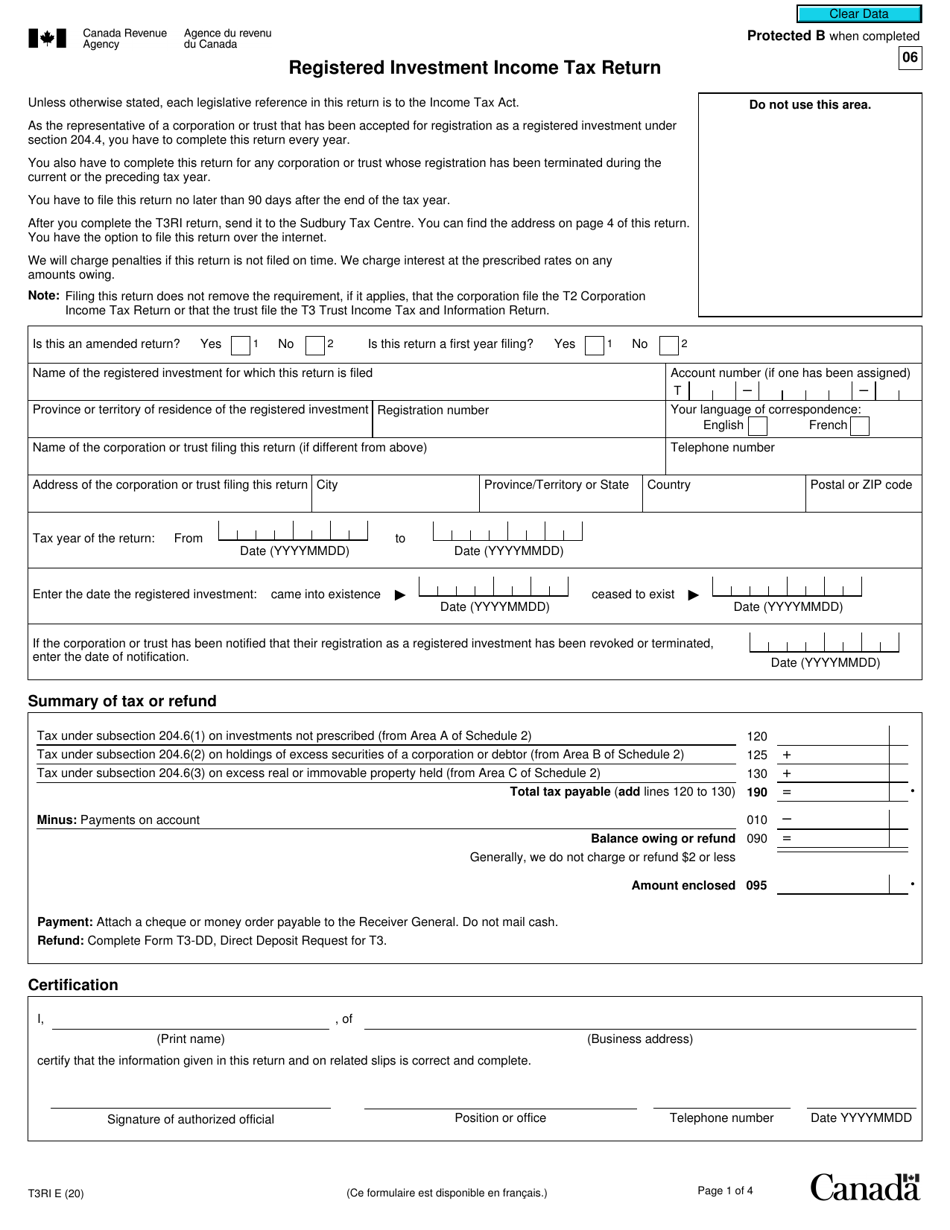

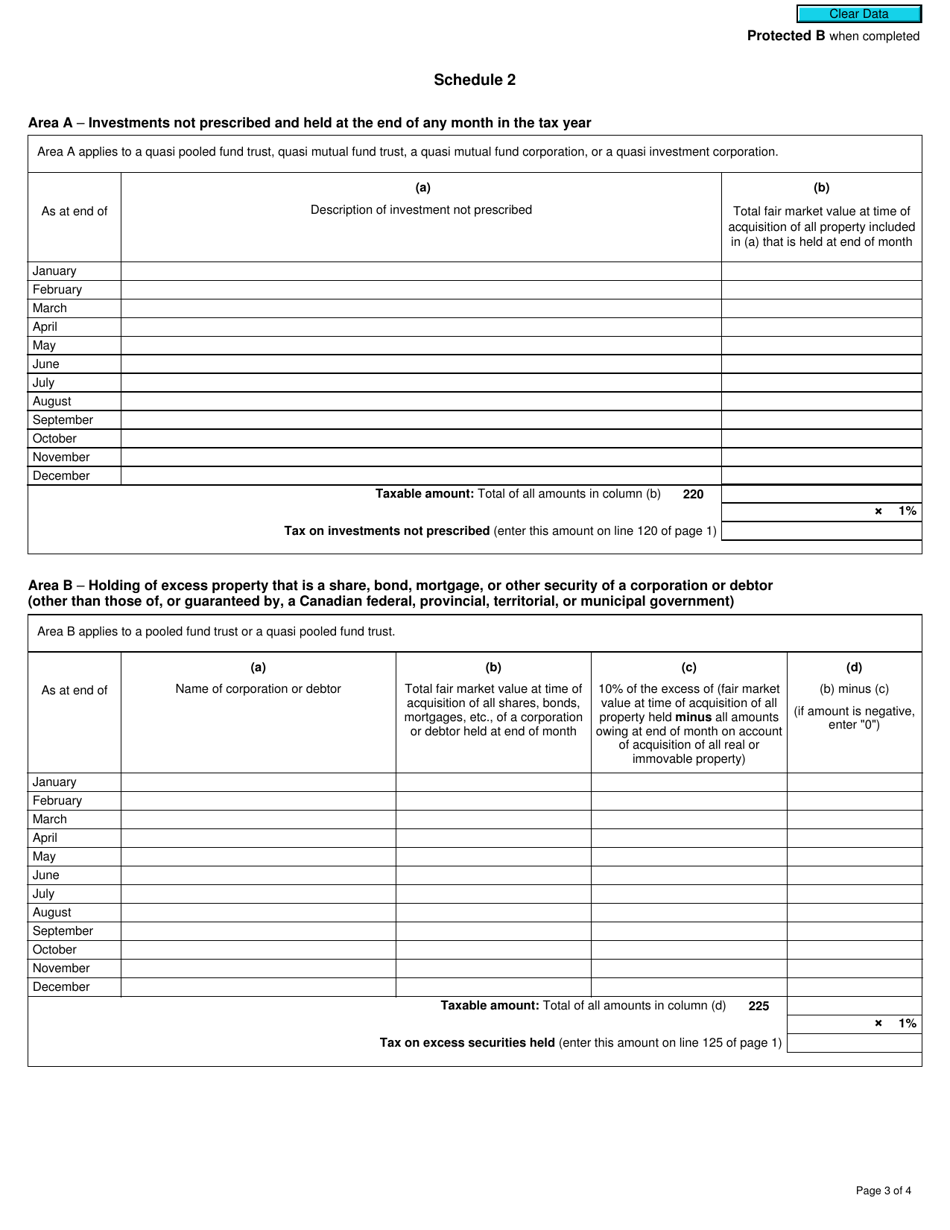

Form T3RI Registered Investment Income Tax Return - Canada

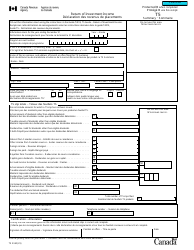

Form T3RI Registered Investment Income Tax Return is used in Canada to report income earned from registered investments such as Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs). This form is used by individuals to calculate and report their taxable investment income to the Canada Revenue Agency (CRA).

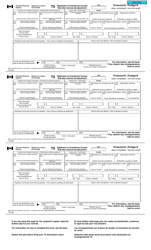

In Canada, the Form T3RI Registered Investment Income Tax Return is typically filed by trusts or certain estates that have received investment income.

FAQ

Q: What is a T3RI?

A: A T3RI is a Registered Investment Income Tax Return form in Canada.

Q: Who needs to file a T3RI?

A: Individuals, corporations, or trusts who have earned investment income in Canada need to file a T3RI.

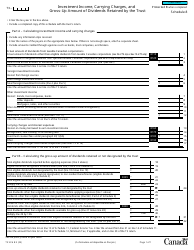

Q: What is considered investment income?

A: Investment income includes dividends, interest, capital gains, and rental income.

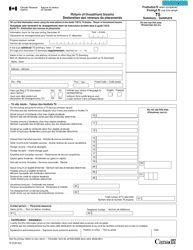

Q: What information is needed to complete a T3RI?

A: You will need information about the specific investments, such as the amounts earned and the type of investment.

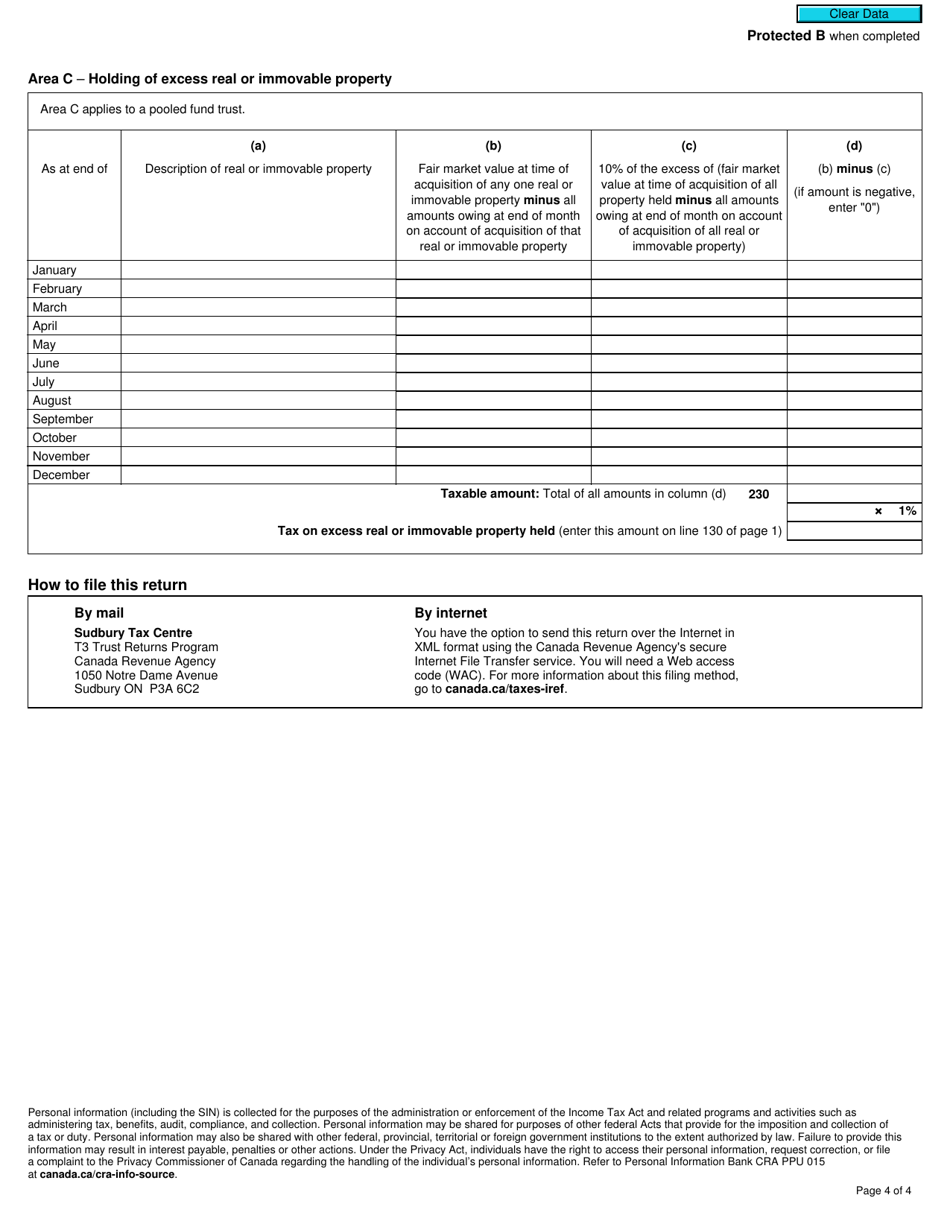

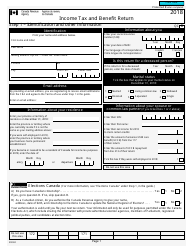

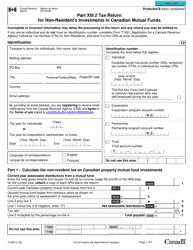

Q: How do I submit a T3RI?

A: You can submit your T3RI either electronically or by mail to the Canada Revenue Agency.

Q: When is the deadline for filing a T3RI?

A: The deadline for filing a T3RI is typically April 30th of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties and interest charged for late or incomplete filing of the T3RI.

Q: Can I get an extension for filing a T3RI?

A: Yes, you can apply for an extension if you are unable to file the T3RI by the deadline, but it should be done before the due date.