This version of the form is not currently in use and is provided for reference only. Download this version of

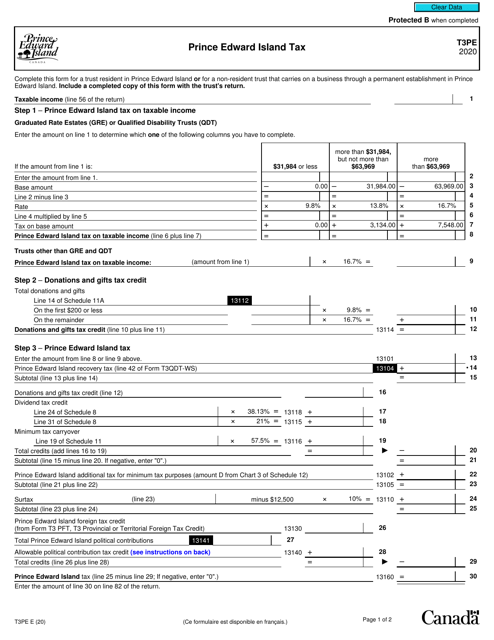

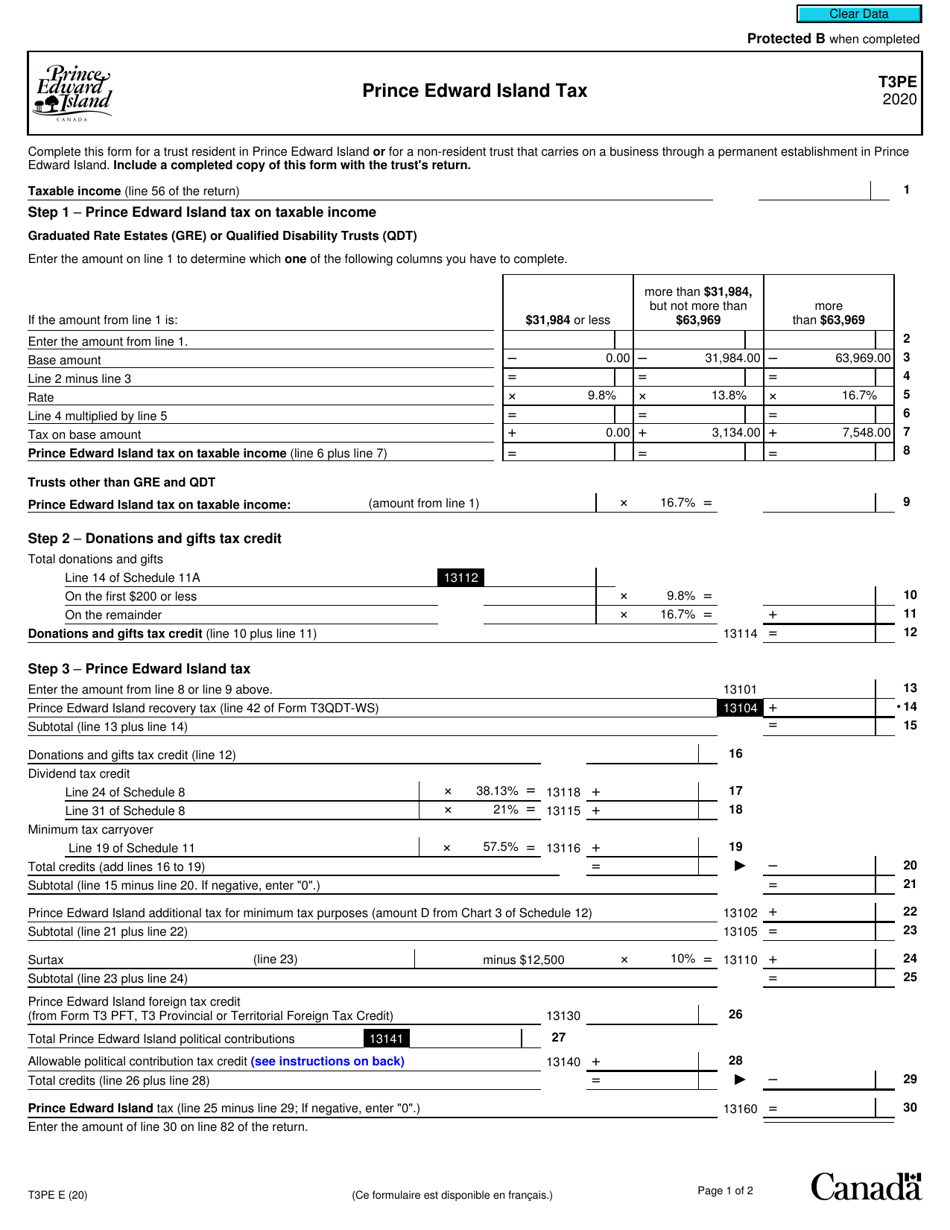

Form T3PE

for the current year.

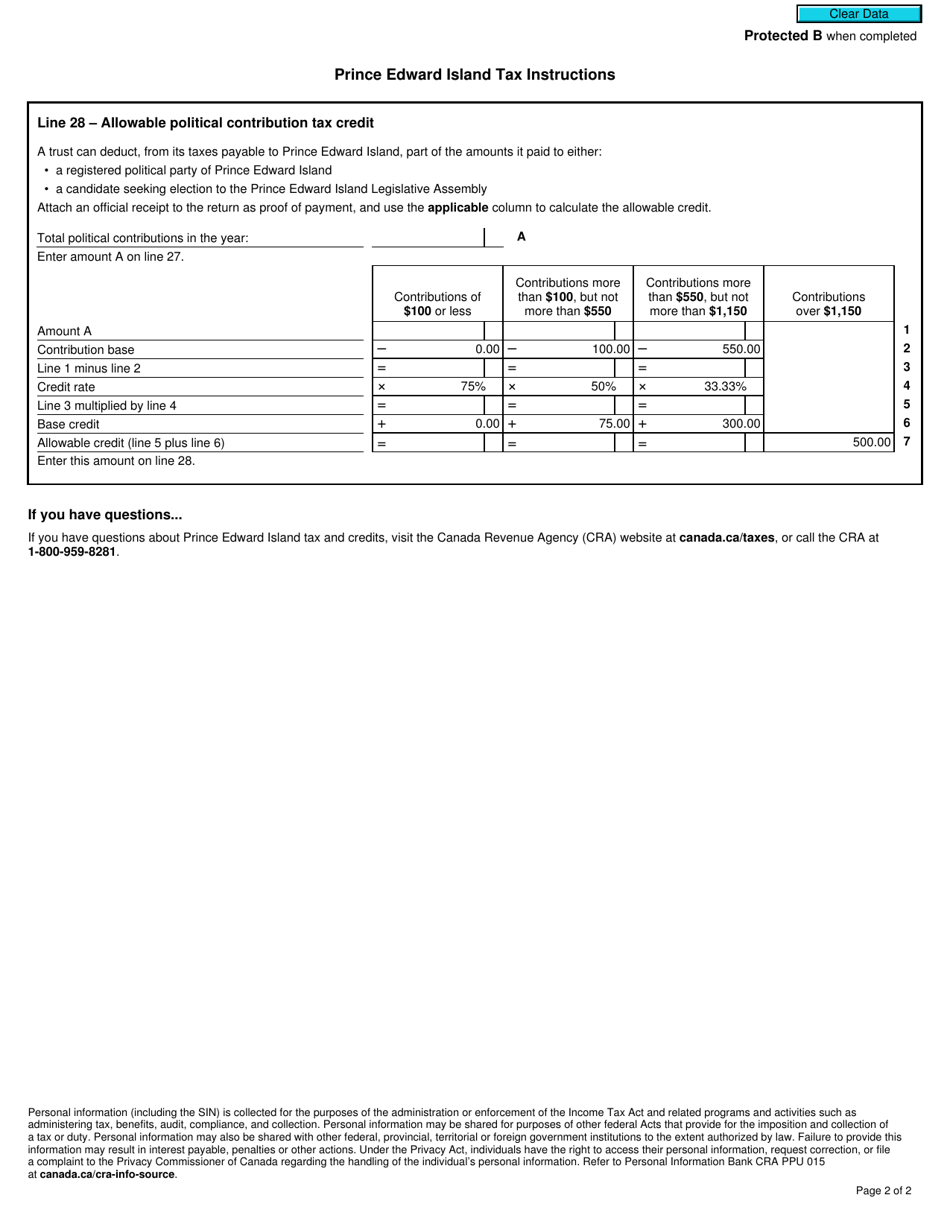

Form T3PE Prince Edward Island Tax - Canada

Form T3PE is used for reporting and paying Prince Edward Island tax in Canada. It is specifically used by individuals or businesses who have taxable income or property in Prince Edward Island.

The Form T3PE Prince Edward Island Tax in Canada is filed by individuals who are residents of Prince Edward Island and need to report their provincial taxes.

FAQ

Q: What is Form T3PE?

A: Form T3PE is the Prince Edward Island Tax form in Canada.

Q: Who needs to file Form T3PE?

A: Residents of Prince Edward Island in Canada who have taxable income need to file Form T3PE.

Q: What is the purpose of Form T3PE?

A: The purpose of Form T3PE is to report your taxable income and calculate the amount of tax you owe to the province of Prince Edward Island.

Q: When is the deadline to file Form T3PE?

A: The deadline to file Form T3PE is April 30th of the following year, same as the federal income tax deadline.

Q: Are there any penalties for late filing of Form T3PE?

A: Yes, if you fail to file Form T3PE by the deadline, you may be subject to penalties and interest charges on the amount of tax owing.

Q: Is Form T3PE refundable?

A: Yes, if you paid more tax than you owe, you may be eligible for a refund when you file Form T3PE.

Q: What supporting documents do I need to include with Form T3PE?

A: You may need to include documents such as T4 slips, investment statements, and receipts for deductions and credits.

Q: Can I file Form T3PE electronically?

A: Yes, you can file Form T3PE electronically using netfile or through a certified tax software.