This version of the form is not currently in use and is provided for reference only. Download this version of

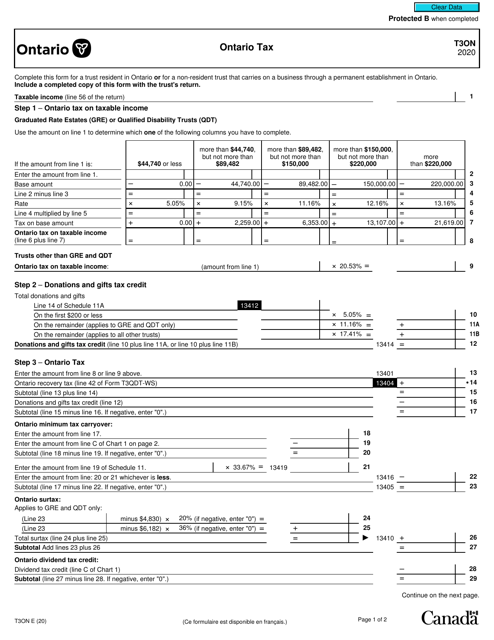

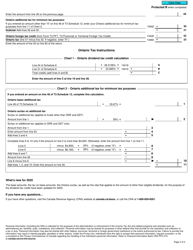

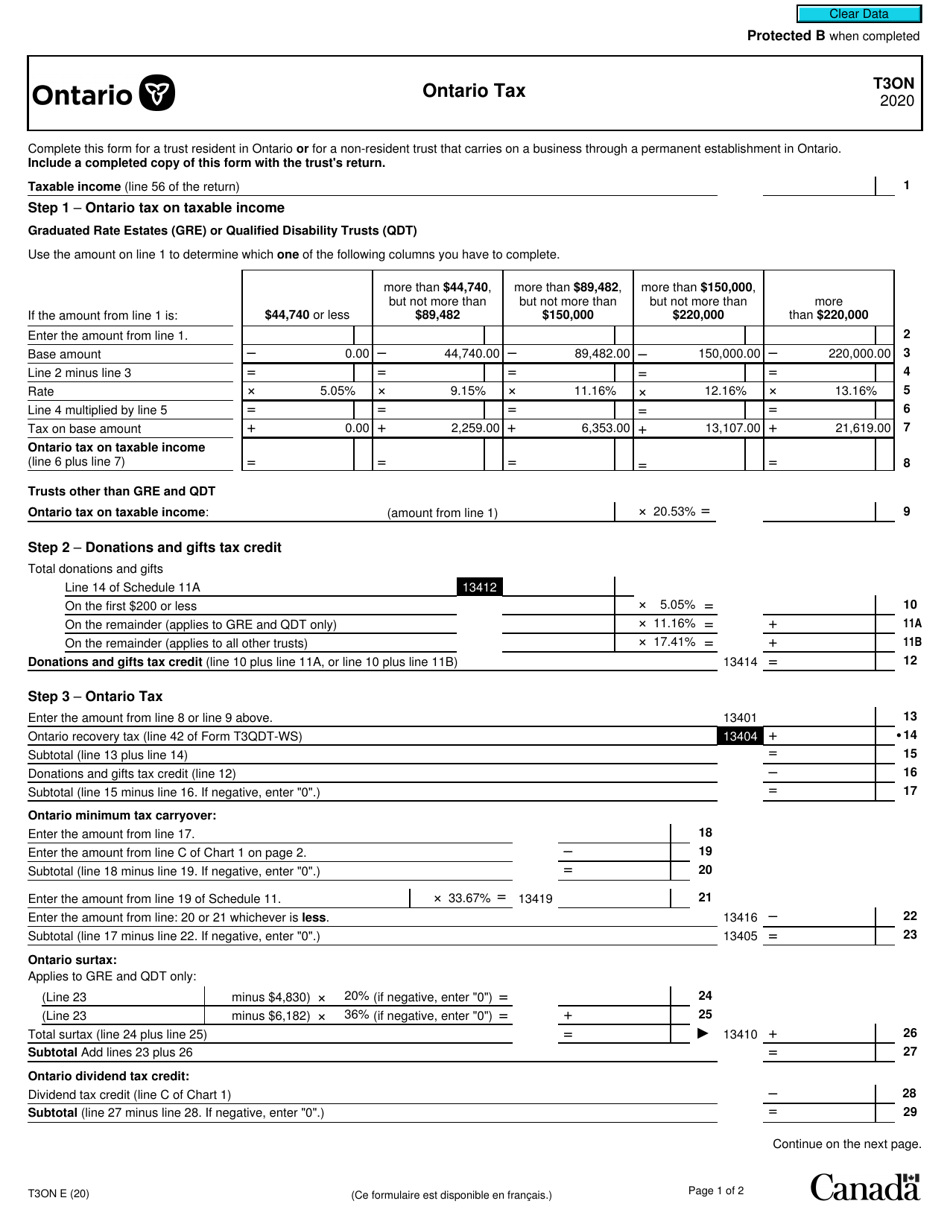

Form T3ON

for the current year.

Form T3ON Ontario Tax - Canada

Form T3ON is not a specific form in Canada. It is possible that there may be a typo in the question or there is confusion with the form name. Can you please provide more details or confirm the correct form name?

The Form T3ON Ontario Tax is filed by individuals who are residents of Ontario, Canada and have taxable income for the year.

FAQ

Q: What is Form T3ON?

A: Form T3ON is a tax form used in the province of Ontario, Canada.

Q: Who needs to file Form T3ON?

A: Individuals and organizations who have income from Ontario sources and are required to pay tax in Ontario need to file Form T3ON.

Q: What information is required on Form T3ON?

A: Form T3ON requires information about the taxpayer's income, deductions, and credits specific to Ontario.

Q: When is the deadline to file Form T3ON?

A: The deadline to file Form T3ON is usually April 30th of the following year, or the next business day if it falls on a weekend or holiday.

Q: Are there penalties for late filing of Form T3ON?

A: Yes, there may be penalties for late filing of Form T3ON. It is important to file the form on time to avoid penalties and interest charges.

Q: Do I need to include supporting documents with Form T3ON?

A: Yes, you may need to include supporting documents such as T-slips and receipts with Form T3ON to support the information you provide.

Q: Can I get help with filling out Form T3ON?

A: Yes, you can seek assistance from tax professionals or contact the Canada Revenue Agency for guidance in filling out Form T3ON.