This version of the form is not currently in use and is provided for reference only. Download this version of

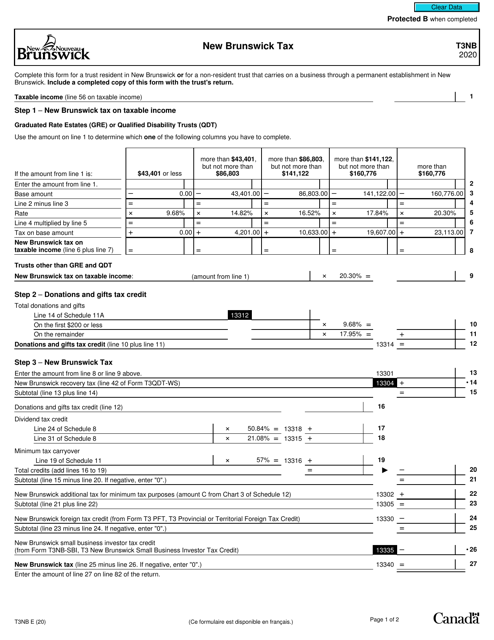

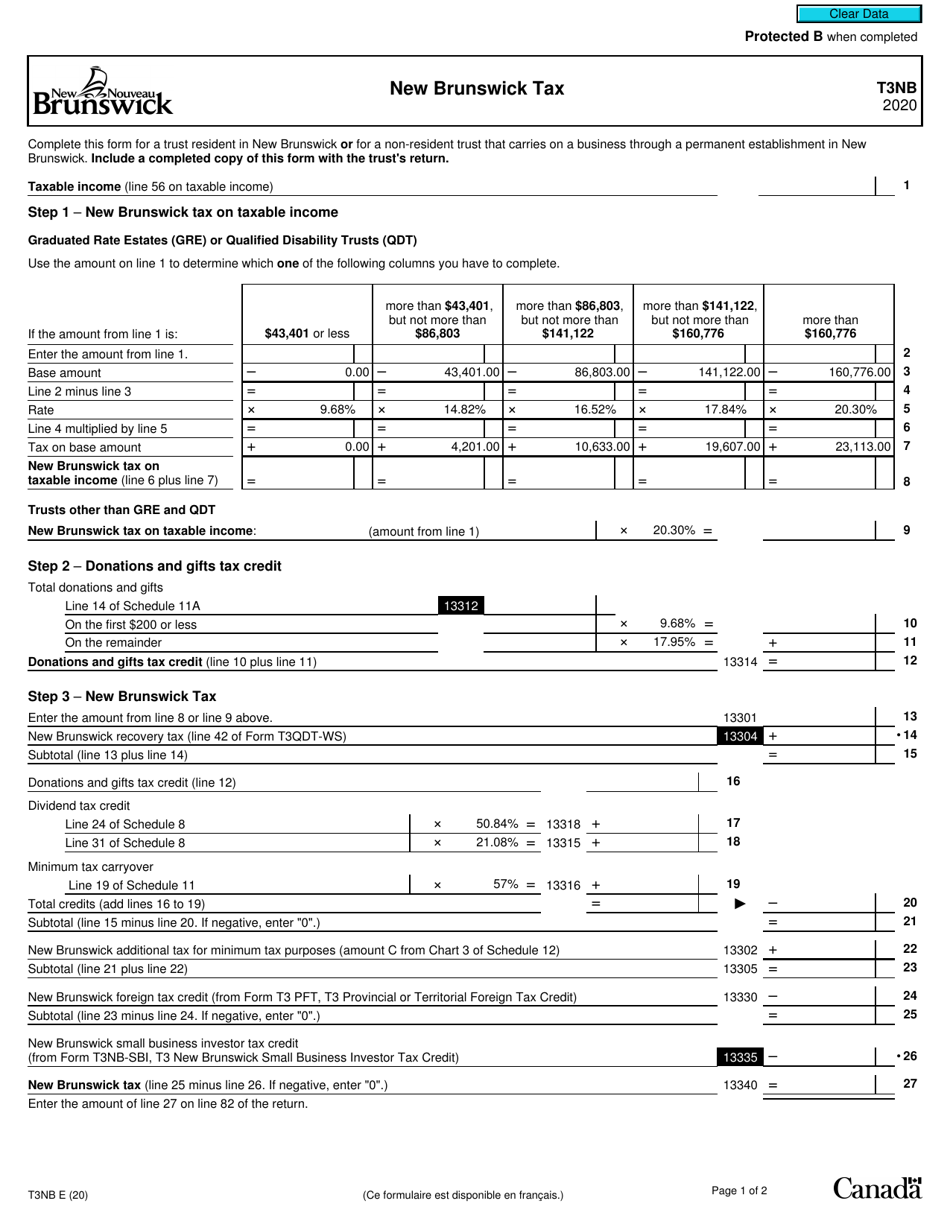

Form T3NB

for the current year.

Form T3NB New Brunswick Tax - Canada

Form T3NB is used for reporting income from New Brunswick sources for individuals who are non-residents of New Brunswick, but residents of Canada. This form is required to be filed with the Canada Revenue Agency (CRA) in order to calculate and pay any applicable taxes to the province of New Brunswick. It ensures that individuals are fulfilling their tax obligations based on their New Brunswick sourced income.

The Form T3NB New Brunswick Tax in Canada is filed by individuals who are residents of New Brunswick and have taxable income in the province.

FAQ

Q: What is Form T3NB?

A: Form T3NB is a tax form used in New Brunswick, Canada.

Q: Who needs to file Form T3NB?

A: Residents of New Brunswick, Canada who have taxable income need to file Form T3NB.

Q: What is the purpose of Form T3NB?

A: Form T3NB is used to report and pay provincial income tax in New Brunswick.

Q: When is the deadline to file Form T3NB?

A: The deadline to file Form T3NB is typically April 30th of the year following the tax year.

Q: Do I need to attach any documents with Form T3NB?

A: You may need to attach supporting documents such as T-slips and receipts with Form T3NB, depending on your individual tax situation.

Q: What happens if I don't file Form T3NB?

A: If you don't file Form T3NB, you may be subject to penalties and interest charges.

Q: Is Form T3NB the same as federal income tax forms?

A: No, Form T3NB is specific to provincial income tax in New Brunswick and is separate from federal income tax forms.