This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3D

for the current year.

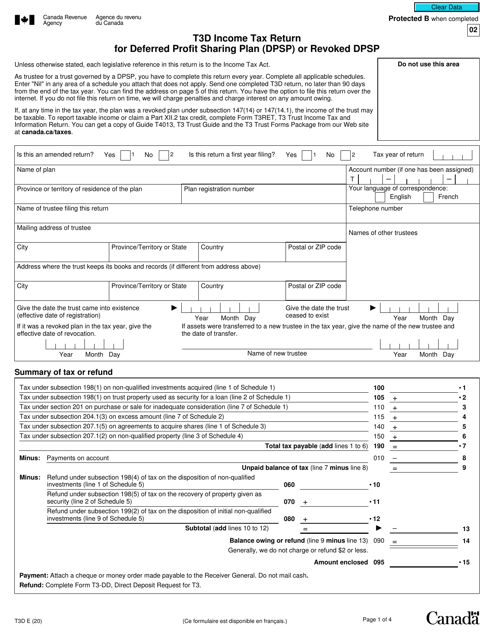

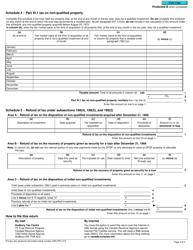

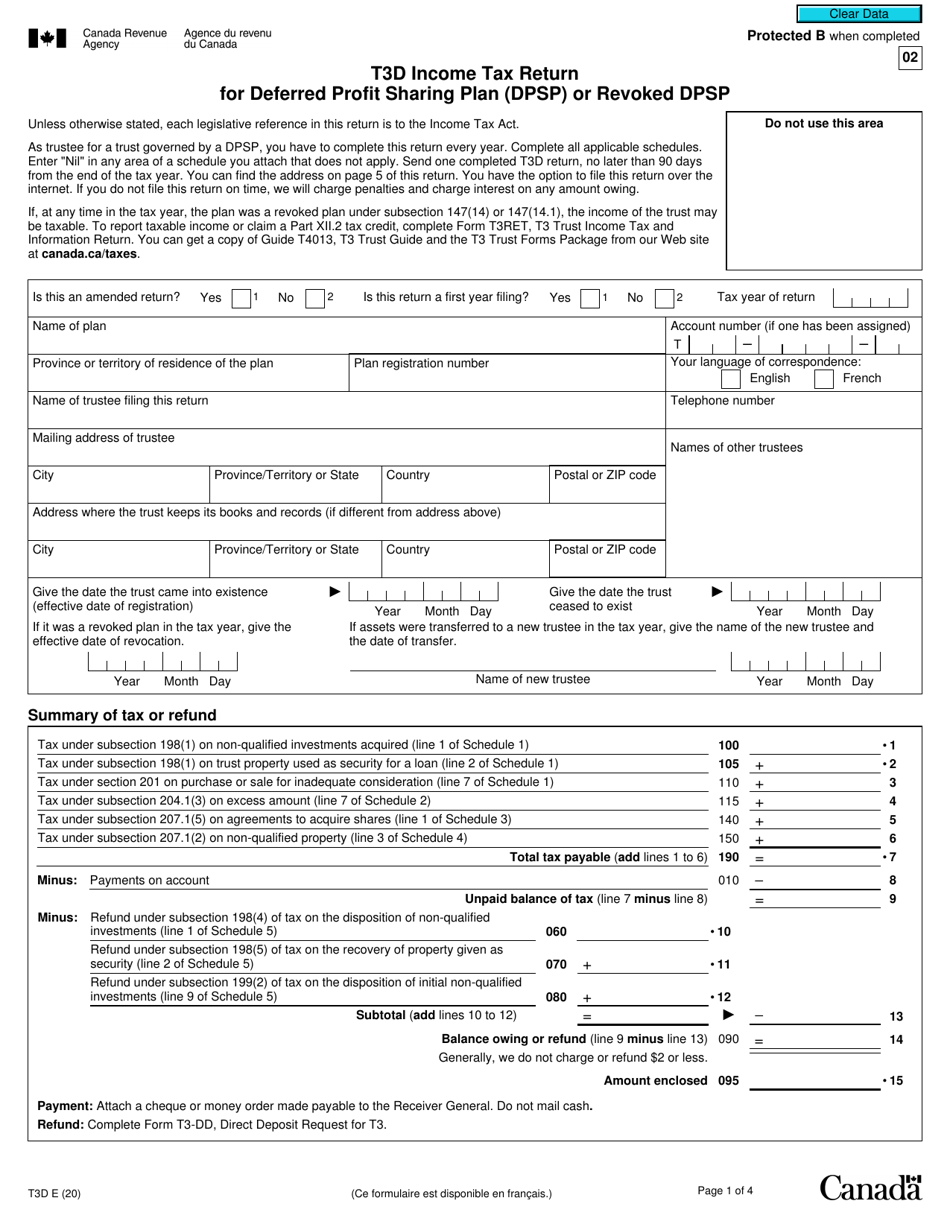

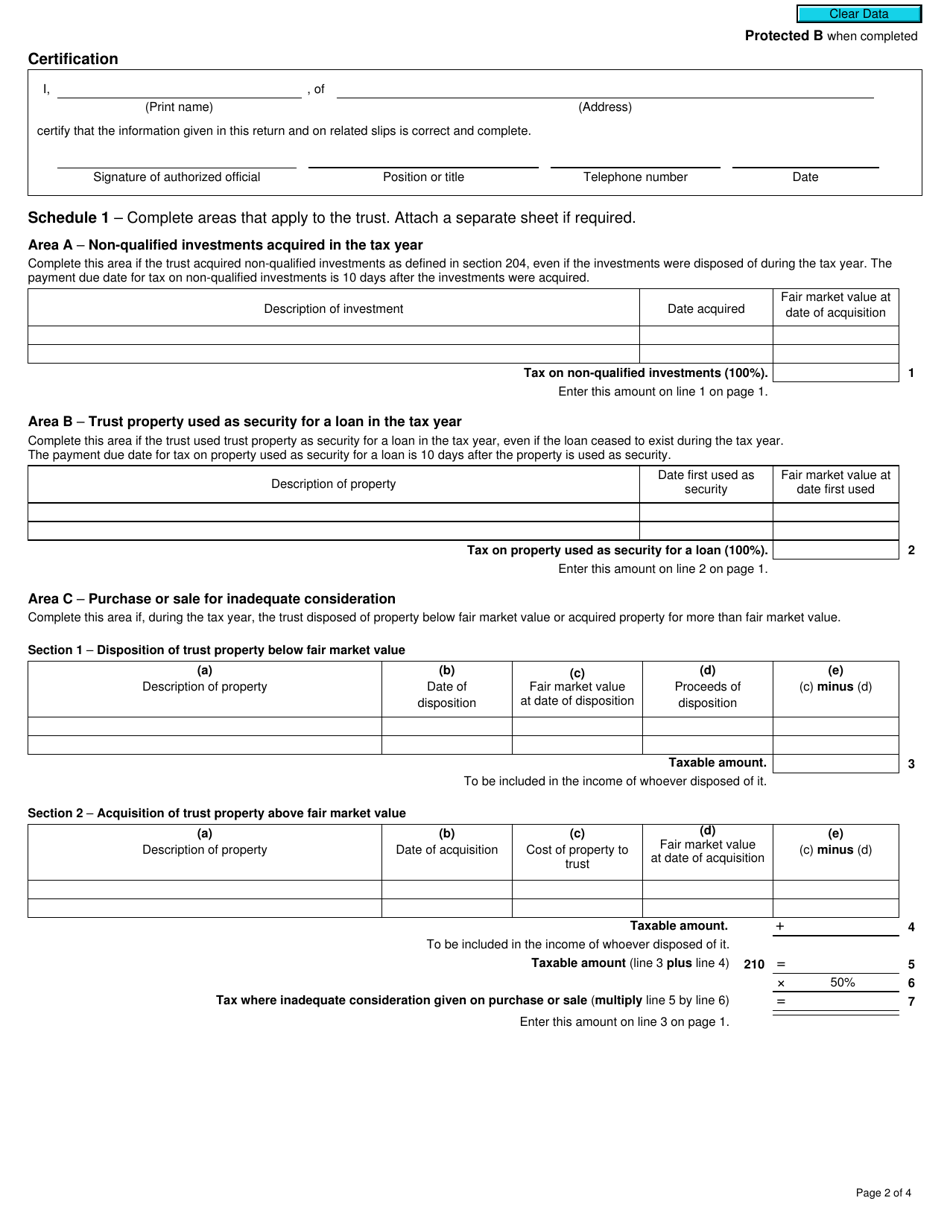

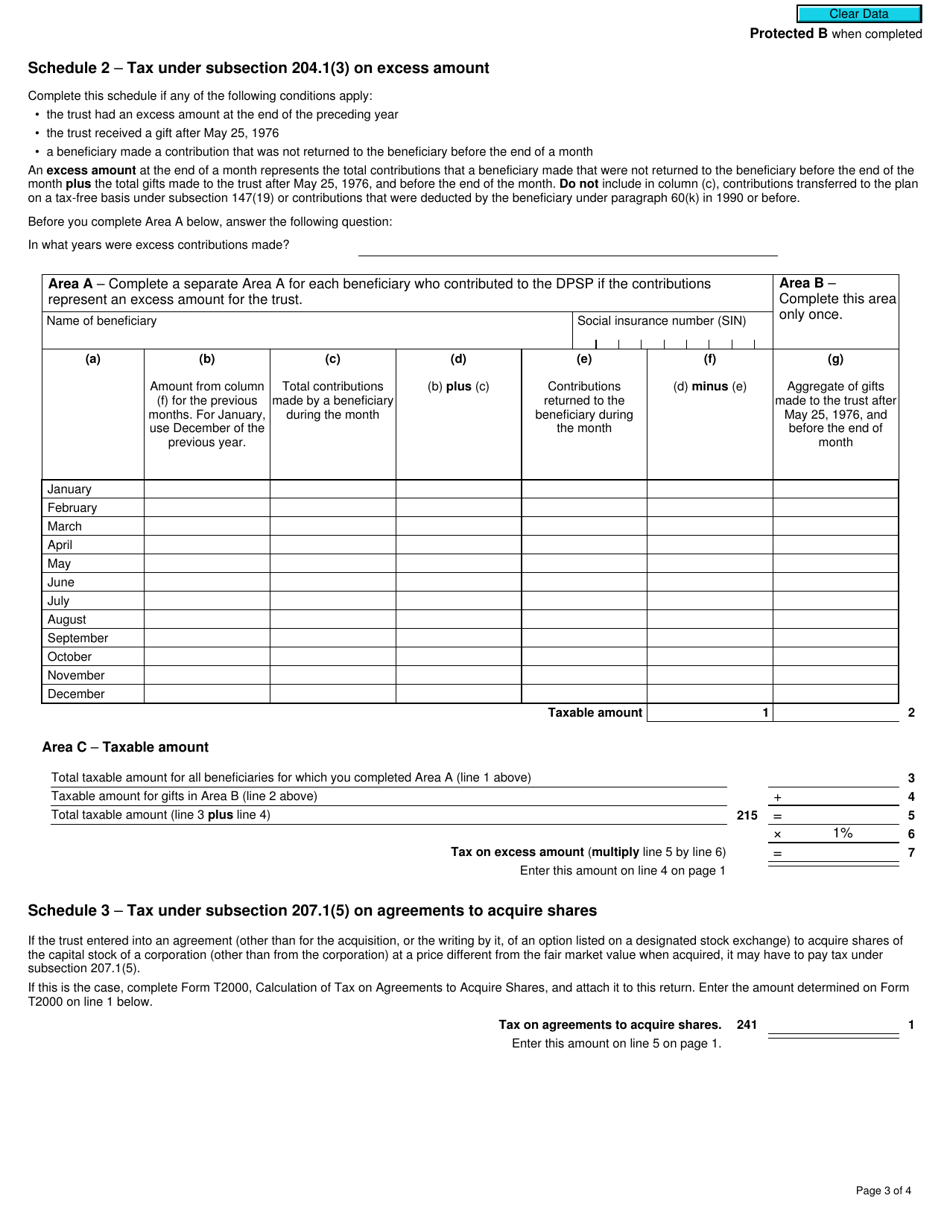

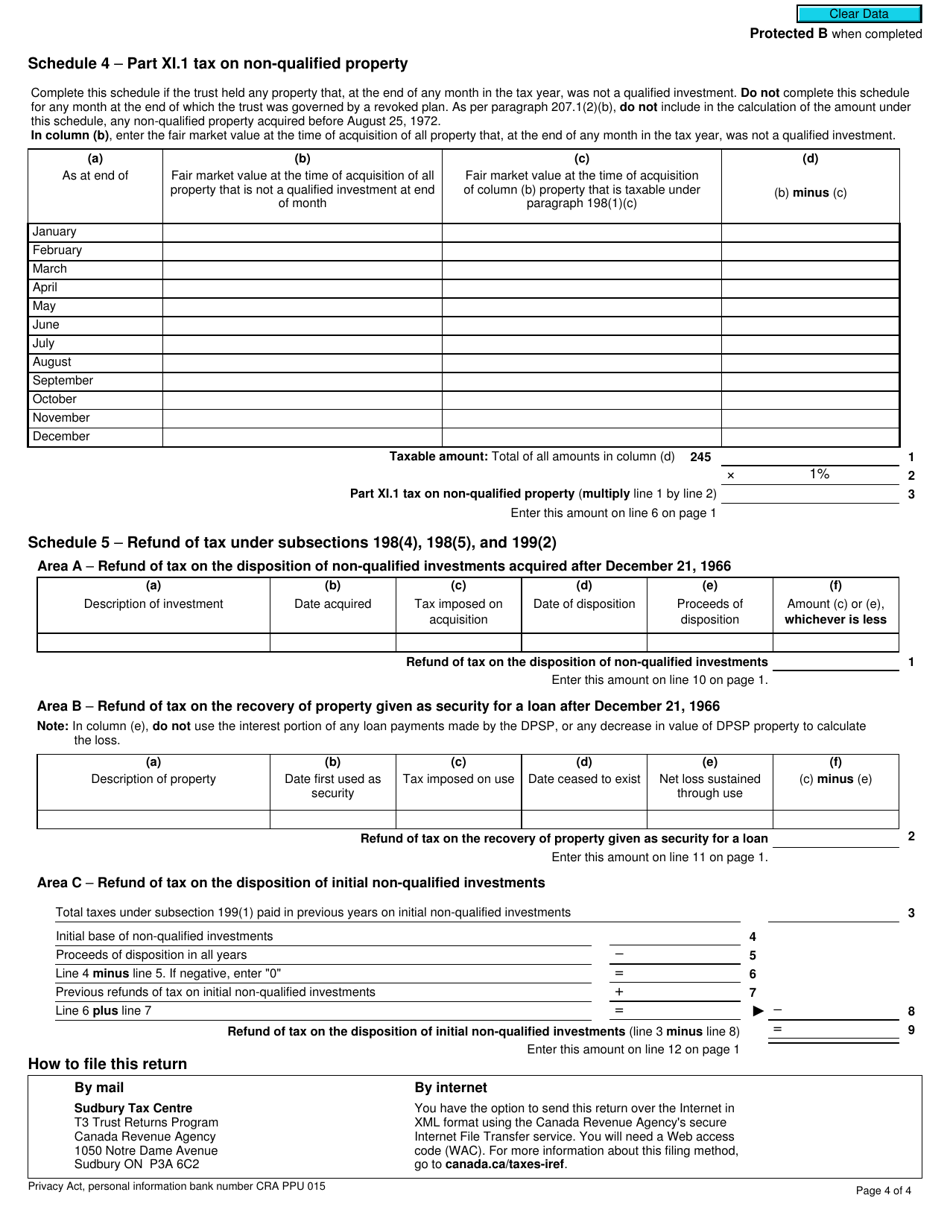

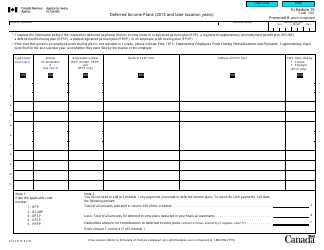

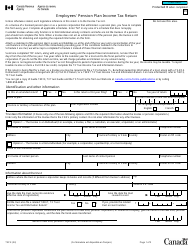

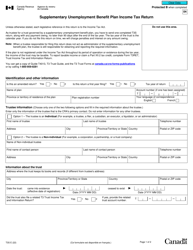

Form T3D Income Tax Return for Deferred Profit Sharing Plan (Dpsp) or Revoked Dpsp - Canada

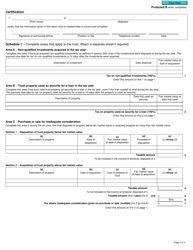

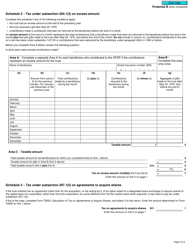

Form T3D Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP in Canada is used to report income earned through a deferred profit sharing plan or a revoked DPSP. This form is used by individuals or entities who are beneficiaries or administrators of these plans to report their income and claim any applicable deductions or credits.

The employer or plan administrator is responsible for filing the Form T3D income tax return for a Deferred Profit Sharing Plan (DPSP) or revoked DPSP in Canada.

FAQ

Q: What is Form T3D?

A: Form T3D is an income tax return that is used for reporting income and taxes for a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada.

Q: What is a Deferred Profit Sharing Plan (DPSP)?

A: A Deferred Profit Sharing Plan (DPSP) is a type of pension plan that allows employers to share profits with employees. It is a tax-deferred arrangement where the employer contributes to the plan and the funds grow tax-free until they are withdrawn.

Q: When do I need to use Form T3D?

A: You need to use Form T3D if you have a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada and need to report income and taxes related to this plan.

Q: What information do I need to complete Form T3D?

A: You will need information such as your name, address, social insurance number, details about the DPSP or revoked DPSP, and information about the contributions, earnings, and withdrawals made during the tax year.

Q: Are there any deadlines for filing Form T3D?

A: Yes, the deadline for filing Form T3D is generally within 90 days after the end of the tax year for which the form applies. However, it is always recommended to check with the CRA for the specific deadline.

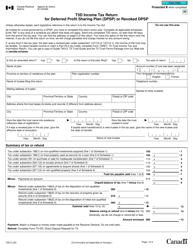

Q: Do I need to include any supporting documents with Form T3D?

A: Yes, you may need to include supporting documents such as T4 slips, T5 slips, and any other relevant forms or statements that provide information about the DPSP or revoked DPSP.

Q: What happens if I don't file Form T3D?

A: Failure to file Form T3D or reporting incorrect information may result in penalties or interest charges imposed by the CRA. It is important to fulfill your tax obligations and accurately report your income.