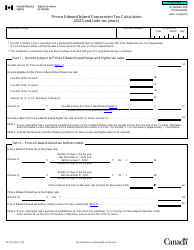

This version of the form is not currently in use and is provided for reference only. Download this version of

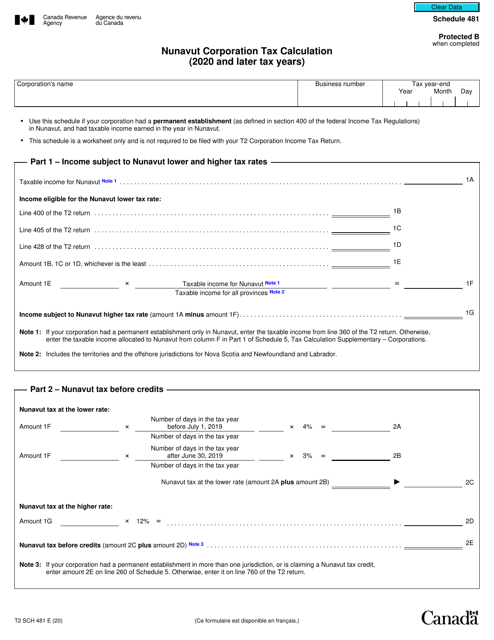

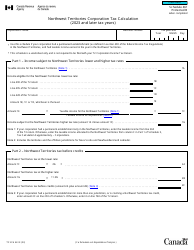

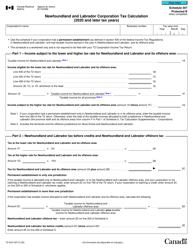

Form T2 Schedule 481

for the current year.

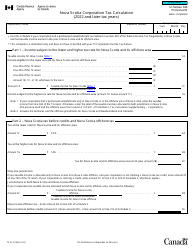

Form T2 Schedule 481 Nunavut Corporation Tax Calculation (2020 and Later Tax Years) - Canada

Form T2 Schedule 481 Nunavut Corporation Tax Calculation (2020 and Later Tax Years) is used by corporations in Nunavut, Canada to calculate their tax liability.

The Nunavut Corporation files the Form T2 Schedule 481 Nunavut Corporation Tax Calculation (2020 and Later Tax Years) in Canada.

FAQ

Q: What is Form T2 Schedule 481?

A: Form T2 Schedule 481 is a tax calculation form for Nunavut corporations in Canada for tax years 2020 and later.

Q: Who needs to file Form T2 Schedule 481?

A: Nunavut corporations in Canada need to file Form T2 Schedule 481.

Q: What does Form T2 Schedule 481 calculate?

A: Form T2 Schedule 481 calculates the Nunavut corporation tax for tax years 2020 and later.

Q: Can individuals use Form T2 Schedule 481?

A: No, Form T2 Schedule 481 is specifically for Nunavut corporations and cannot be used by individuals.

Q: Are there any specific requirements or changes for tax years 2020 and later?

A: Yes, Form T2 Schedule 481 is specifically for tax years 2020 and later, indicating that there are specific changes or requirements for these tax years.