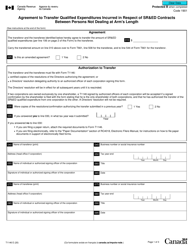

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2030

for the current year.

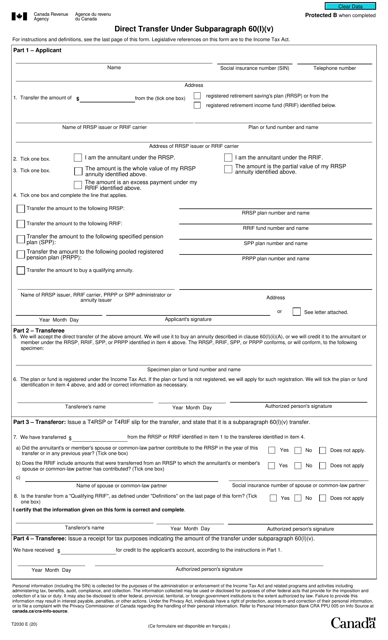

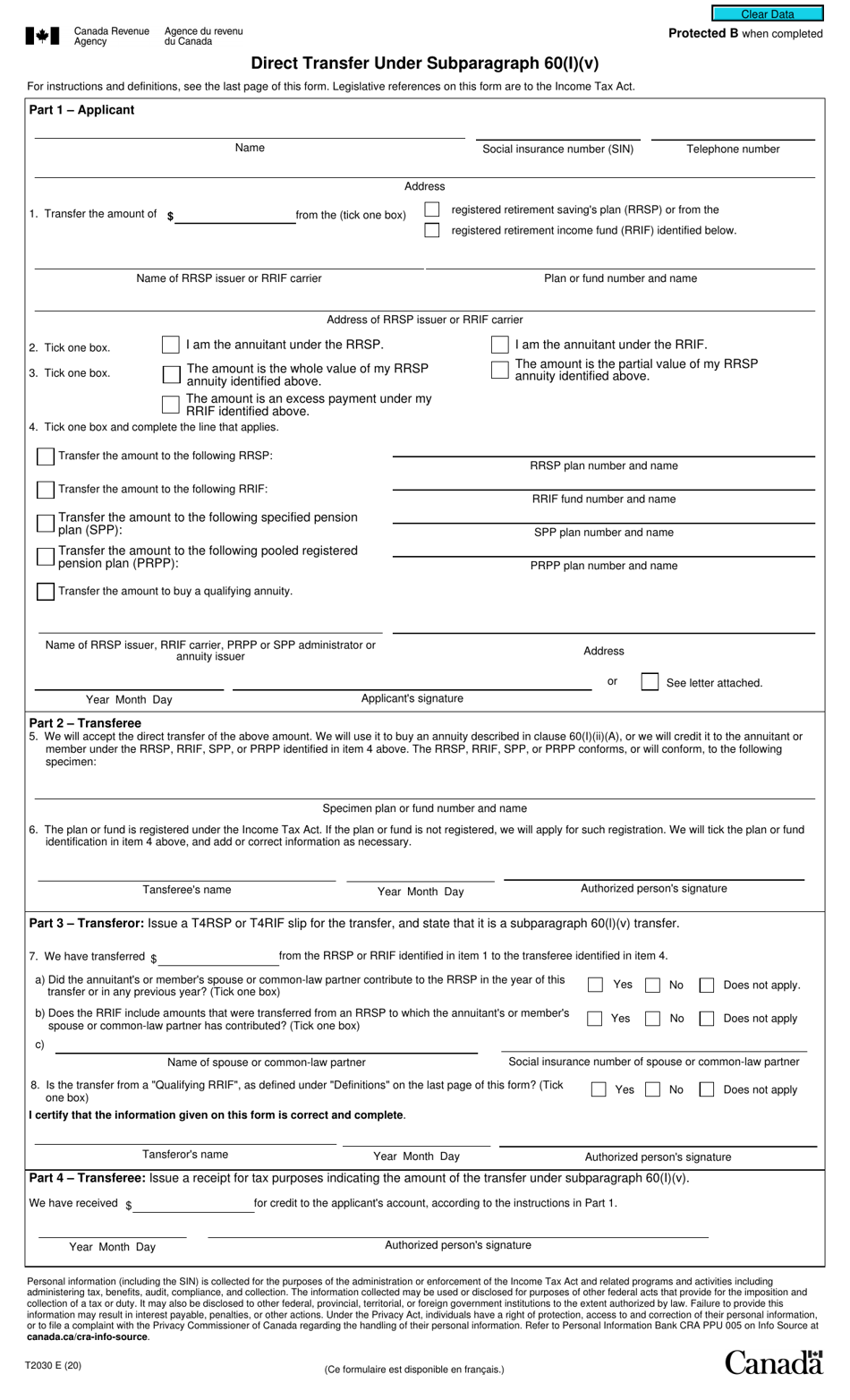

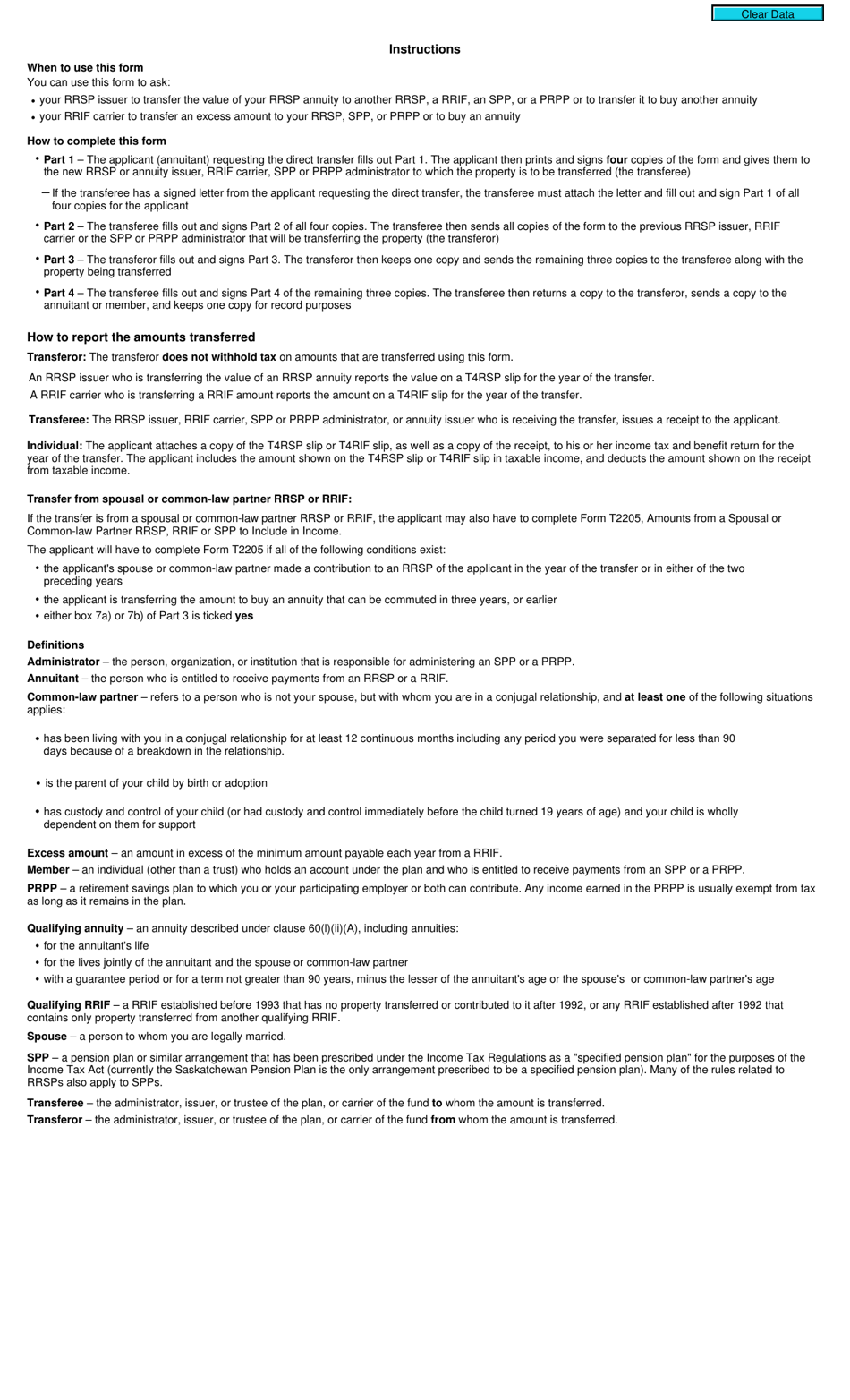

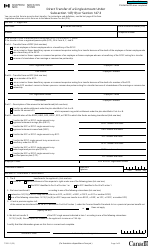

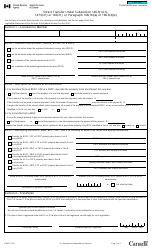

Form T2030 Direct Transfer Under Subparagraph 60(I)(V) - Canada

Form T2030 Direct Transfer Under Subparagraph 60(I)(V) in Canada is used for facilitating the transfer of pension or retirement funds from one registered plan to another without tax consequences. It allows individuals to transfer their funds directly from one plan to another without incurring tax liabilities.

The employer or plan administrator files the Form T2030 for direct transfer under subparagraph 60(i)(v) in Canada.

FAQ

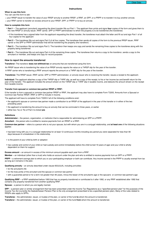

Q: What is Form T2030?

A: Form T2030 is a form used in Canada for making direct transfers under subparagraph 60(i)(v) of the Income Tax Act.

Q: What is a direct transfer under subparagraph 60(i)(v)?

A: A direct transfer under subparagraph 60(i)(v) refers to the transfer of funds from one registered plan to another registered plan without tax consequences.

Q: When is Form T2030 used?

A: Form T2030 is used when you want to transfer funds from one registered plan to another registered plan under subparagraph 60(i)(v).

Q: Are there any tax consequences for a direct transfer?

A: No, a direct transfer under subparagraph 60(i)(v) does not trigger any tax consequences.

Q: Can I use Form T2030 for transfers between Canada and the United States?

A: No, Form T2030 is specific to transfers within Canada. Transfers between Canada and the United States may require a different form or process.

Q: Do I need to include any additional documentation with Form T2030?

A: The Canada Revenue Agency may require additional documentation depending on the nature of the transfer. It is advisable to contact the CRA or a tax professional for guidance.

Q: Can I file Form T2030 electronically?

A: Yes, you can file Form T2030 electronically through the CRA's My Account service or through a certified tax preparation software.

Q: Is there a deadline for filing Form T2030?

A: There is no specific deadline for filing Form T2030, but it is recommended to submit the form as soon as possible to ensure timely processing of the transfer.

Q: What should I do if I have more questions about Form T2030?

A: If you have more questions about Form T2030, it is best to contact the Canada Revenue Agency directly or consult with a tax professional.