This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1-OVP-S

for the current year.

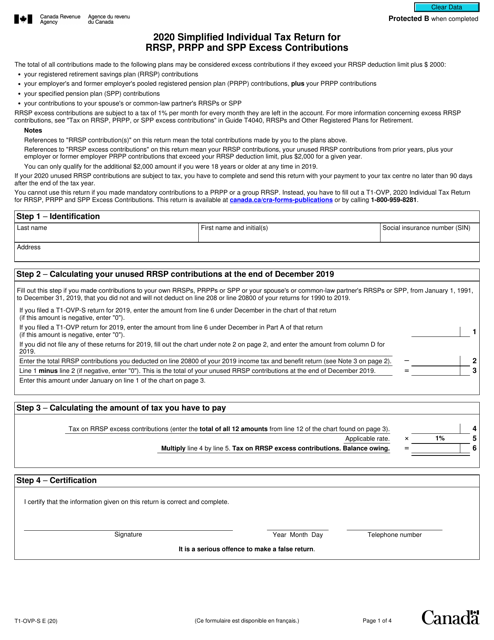

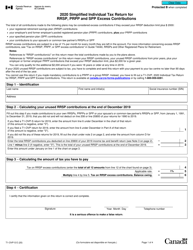

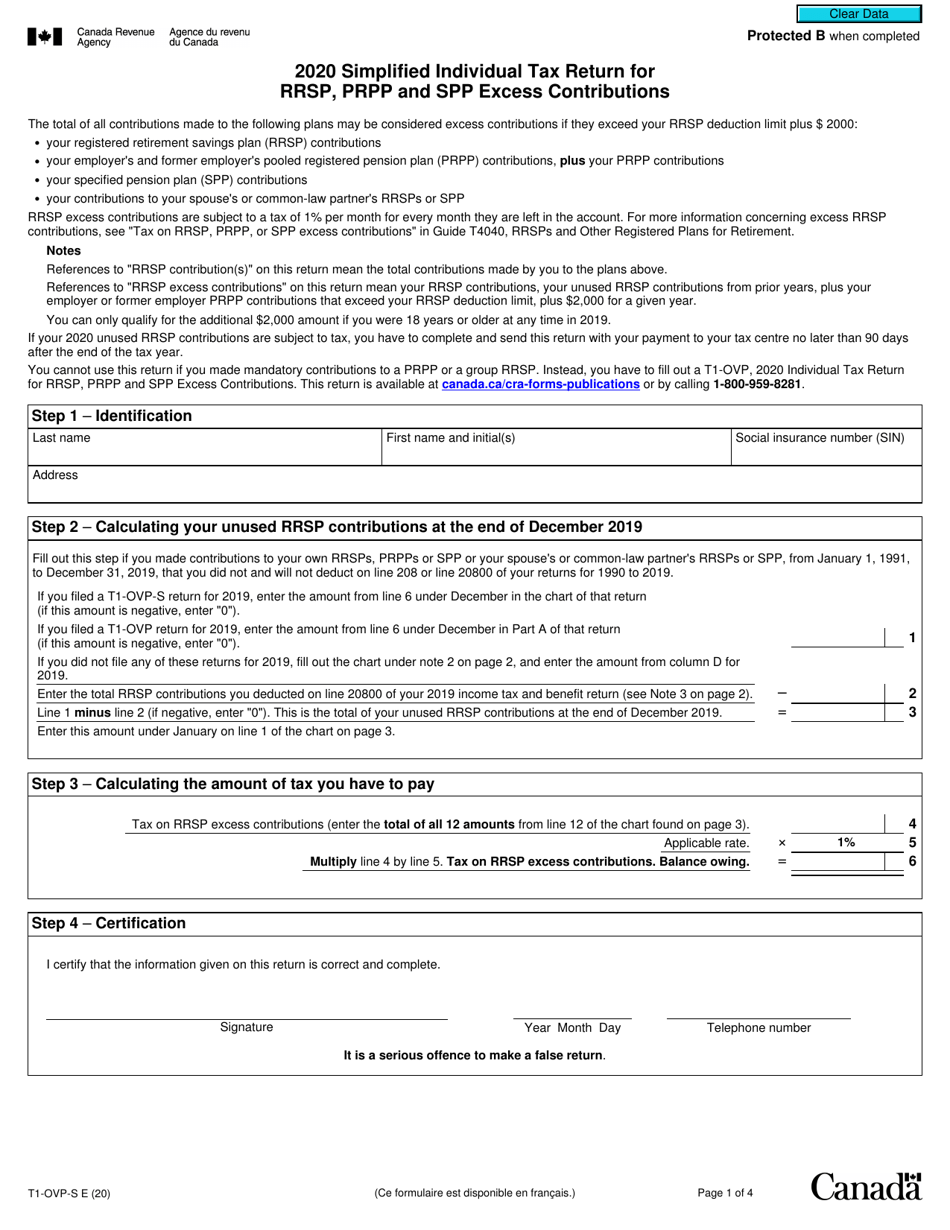

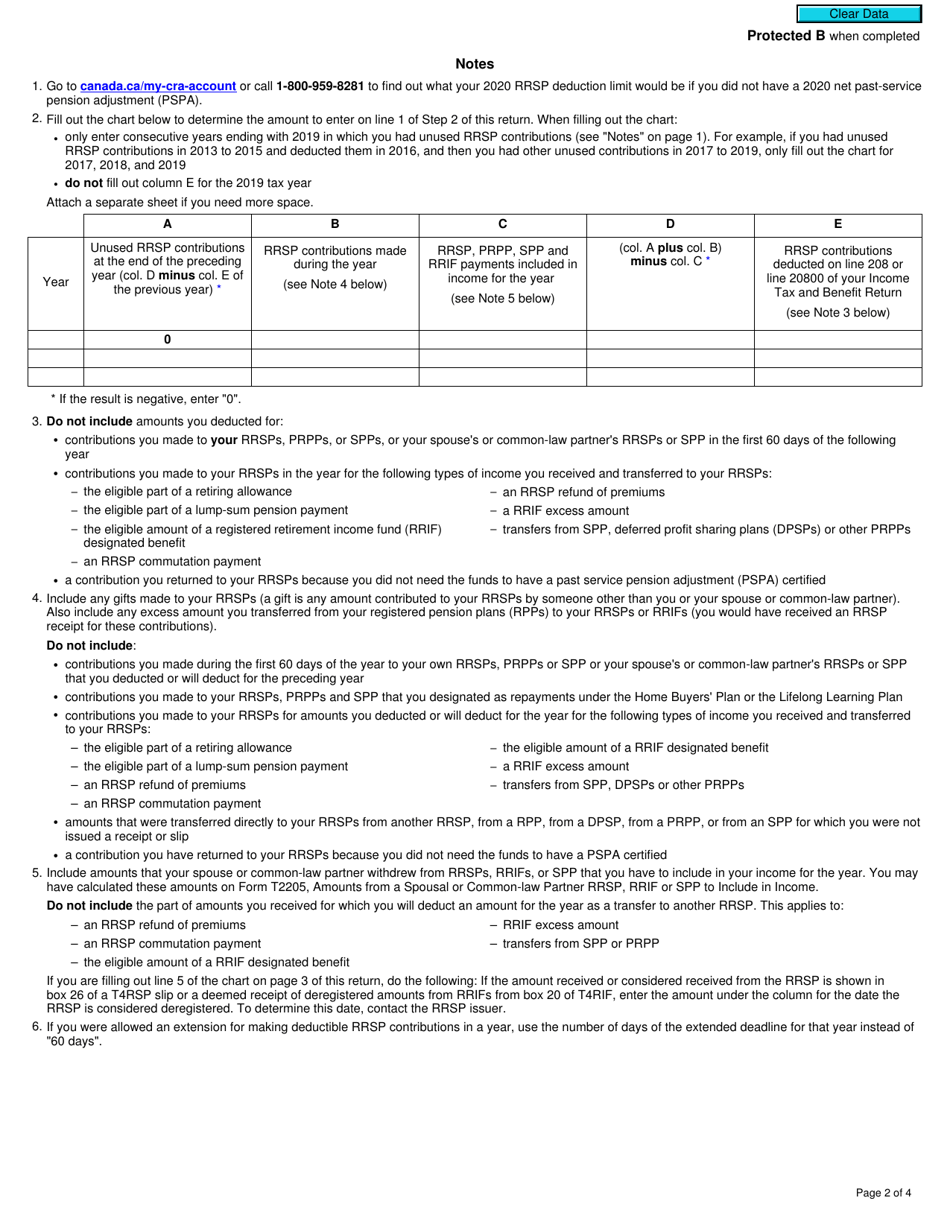

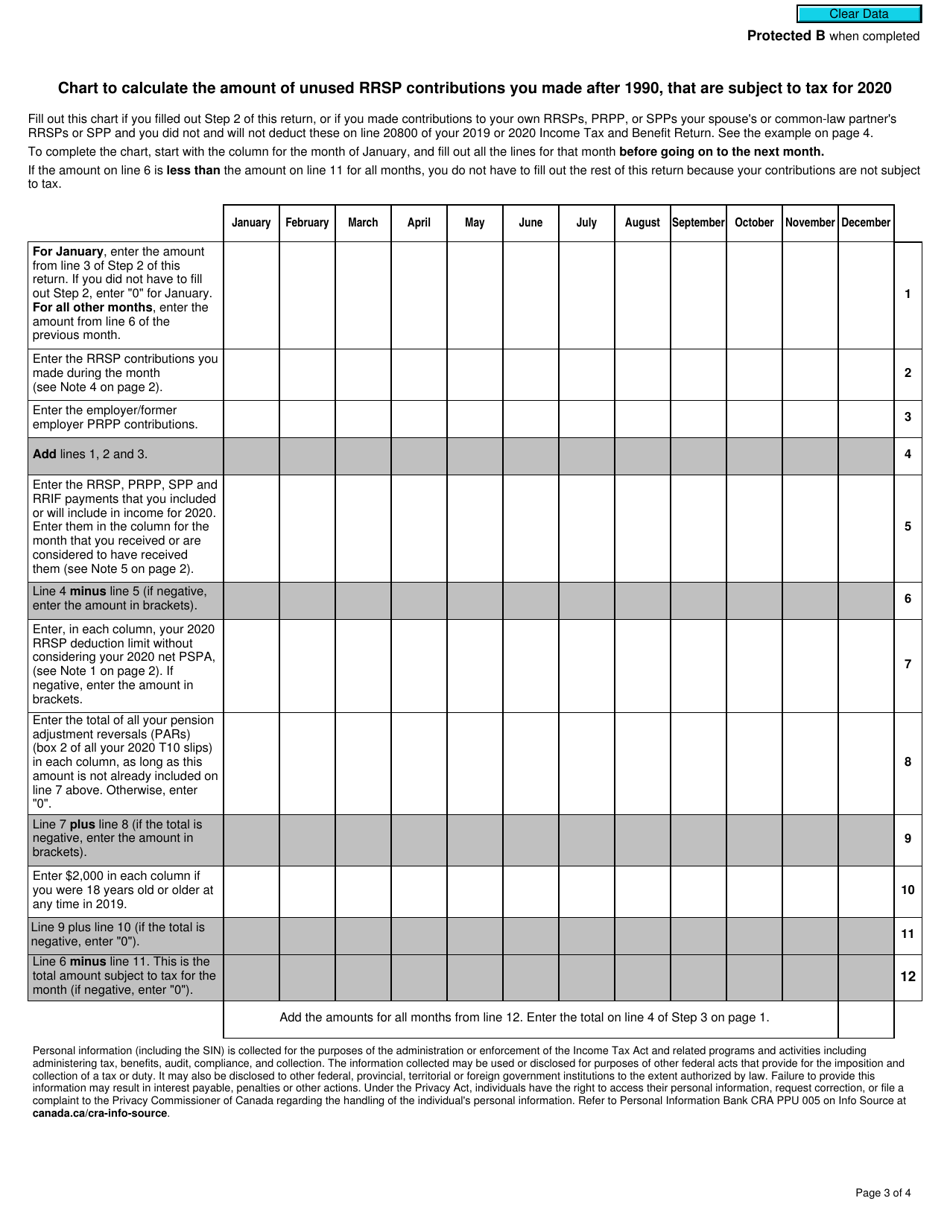

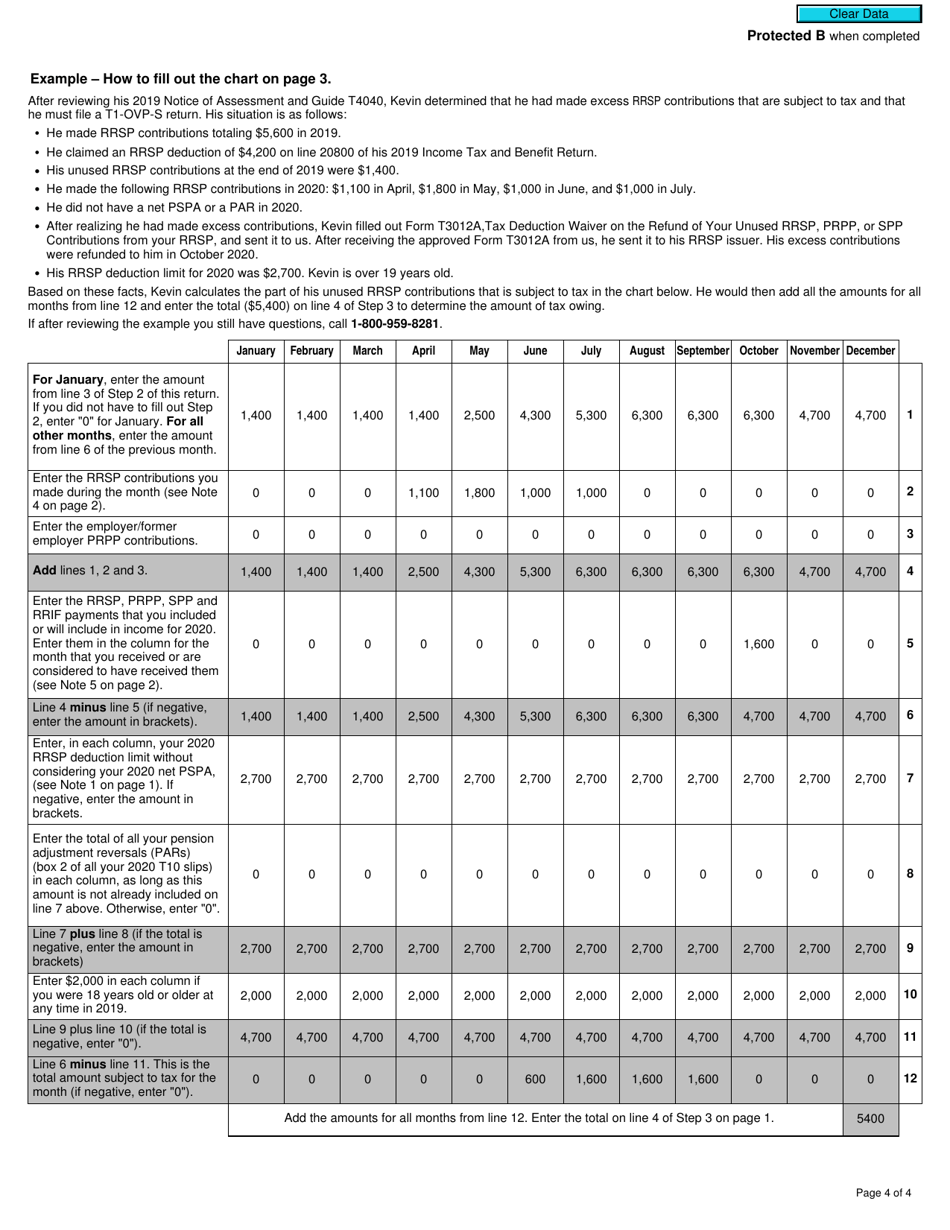

Form T1-OVP-S Simplified Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada

Form T1-OVP-S is the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions in Canada. This form is used to report and reconcile any excess contributions made to Registered Retirement Savings Plans (RRSP), Pooled Registered Pension Plans (PRPP), and Specified Pension Plans (SPP) in Canada. It ensures proper tax treatment for these contributions.

The individual taxpayer files the Form T1-OVP-S Simplified Individual Tax Return for RRSP, PRPP, and SPP excess contributions in Canada.

FAQ

Q: What is the T1-OVP-S form?

A: The T1-OVP-S form is used to report excess contributions made to RRSPs, PRPPs, and SPPs in Canada.

Q: Who should use the T1-OVP-S form?

A: Individuals who have made excess contributions to RRSPs, PRPPs, or SPPs in Canada should use the T1-OVP-S form.

Q: What are RRSPs, PRPPs, and SPPs?

A: RRSPs (Registered Retirement Savings Plans), PRPPs (Pooled Registered Pension Plans), and SPPs (Specified Pension Plans) are retirement savings accounts in Canada.

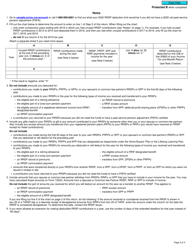

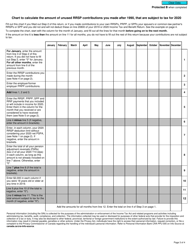

Q: What are excess contributions?

A: Excess contributions are contributions made to RRSPs, PRPPs, or SPPs that exceed the annual contribution limit set by the Canadian government.

Q: Why do I need to report excess contributions?

A: Reporting excess contributions ensures that you are aware of any penalties or taxes that may be applicable and allows you to correct any over-contributions.

Q: When is the deadline to file the T1-OVP-S form?

A: The deadline to file the T1-OVP-S form is usually the same as the deadline for filing your annual income tax return in Canada, which is April 30th.

Q: What happens if I don't report excess contributions?

A: If you fail to report excess contributions, you may be subject to penalties and taxes on the excess amount.

Q: Can I withdraw excess contributions without penalty?

A: Yes, you can withdraw excess contributions without penalty, but you may still be responsible for taxes on the excess amount.

Q: Can I carry forward excess contributions to future years?

A: No, excess contributions cannot be carried forward to future years. They must be reported and addressed in the current tax year.