This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1157

for the current year.

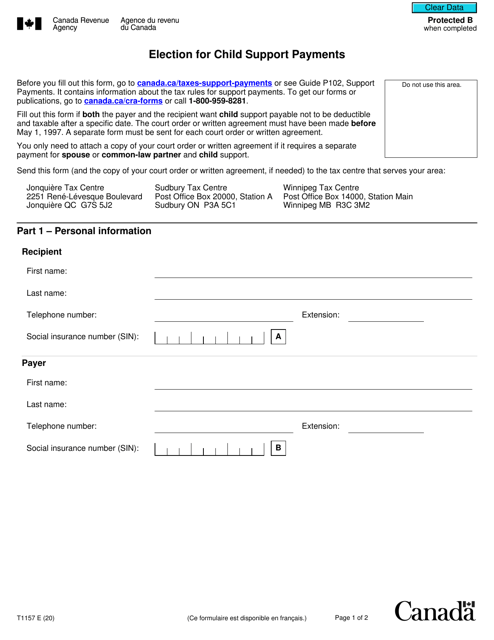

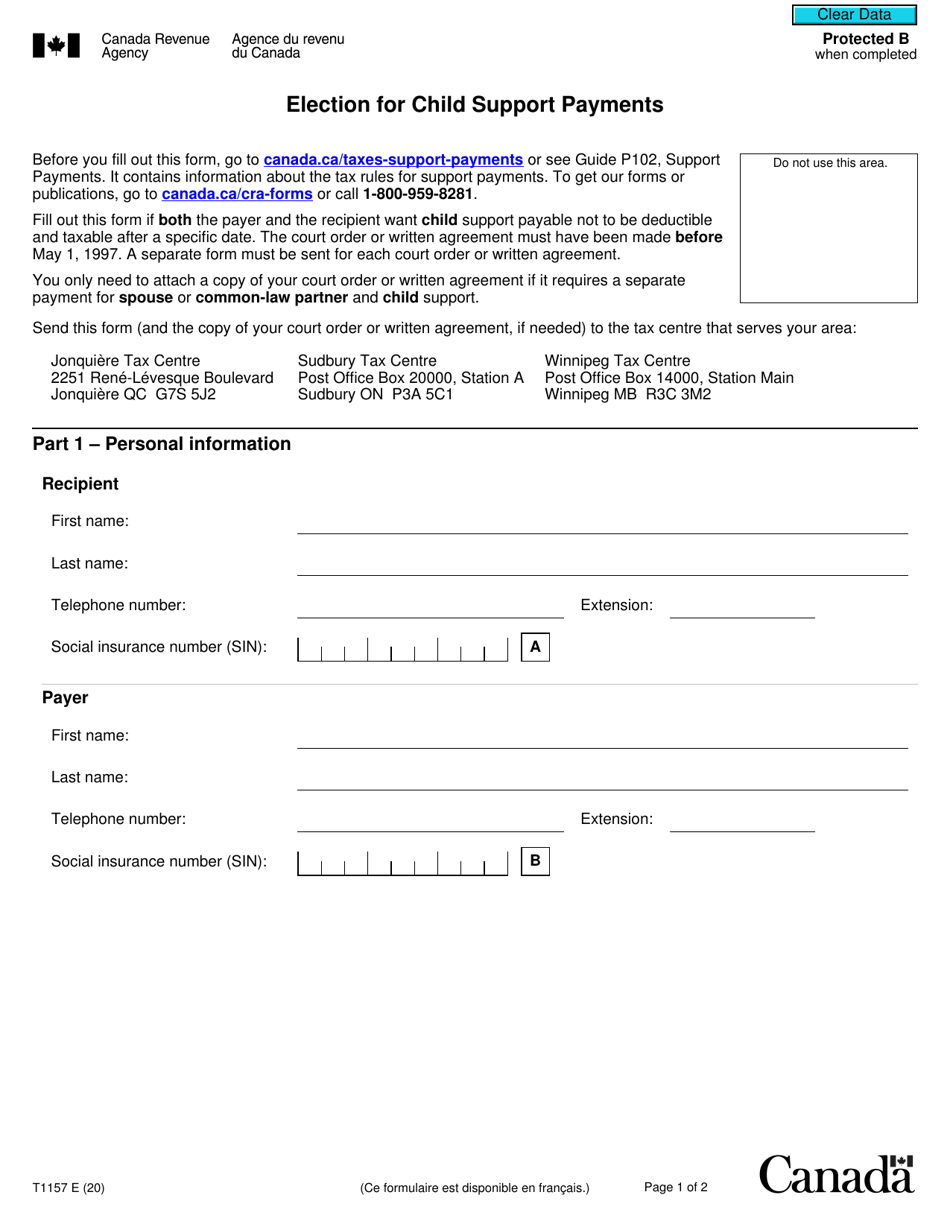

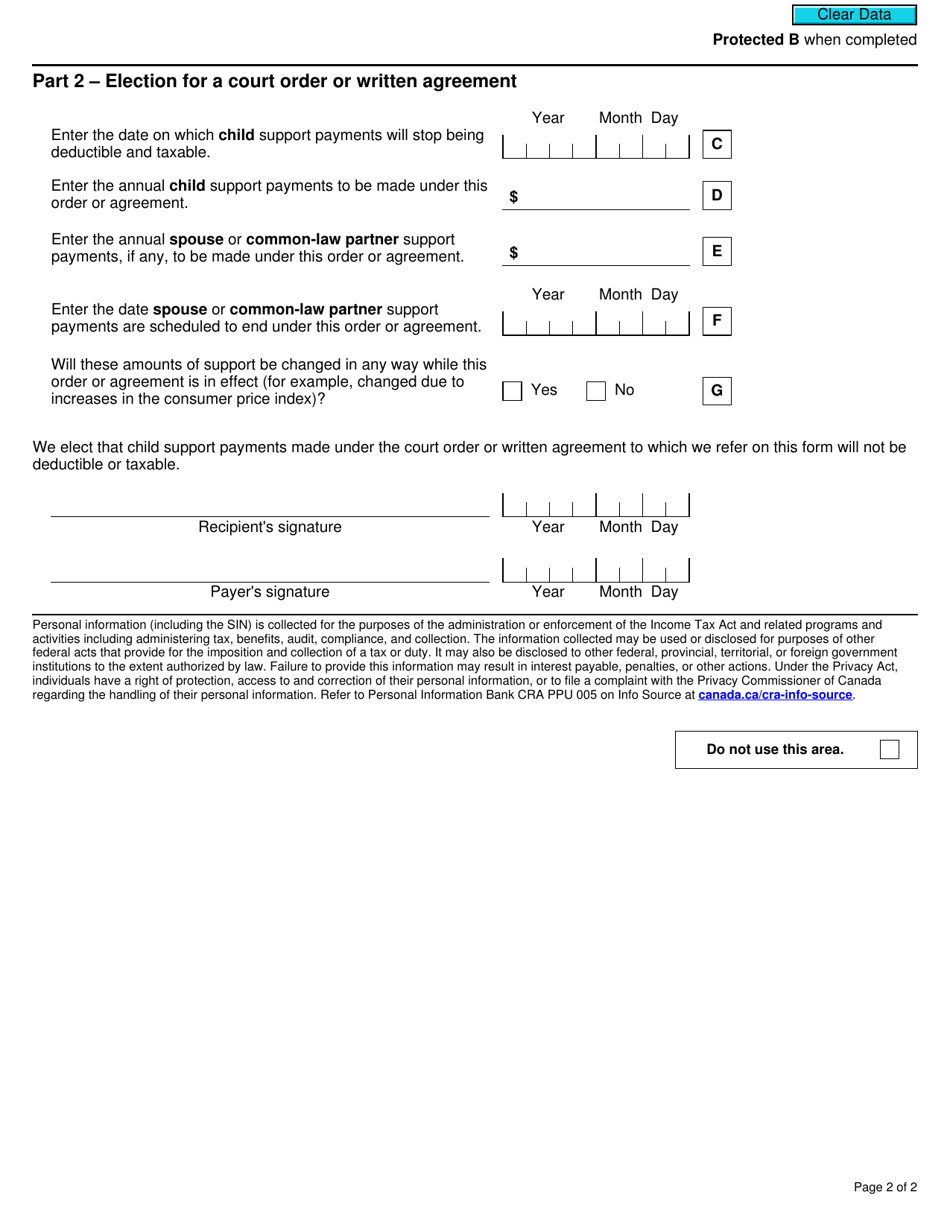

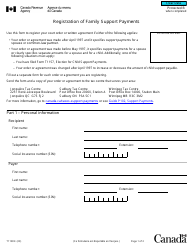

Form T1157 Election for Child Support Payments - Canada

Form T1157 Election for Child Support Payments is used in Canada for the purpose of allowing separated or divorced individuals to elect who will claim the eligible dependanttax credit or equivalent spousal or common-law partner amount for their child. It is used to determine which parent will be eligible to claim this tax benefit.

In Canada, the individual who is making child support payments files the Form T1157 Election for Child Support Payments.

FAQ

Q: What is Form T1157?

A: Form T1157 is a form used in Canada to make an election for child support payments.

Q: What is the purpose of Form T1157?

A: The purpose of Form T1157 is to allow the payer of child support to elect to deduct child support payments from their income for tax purposes.

Q: Who needs to fill out Form T1157?

A: The payer of child support needs to fill out Form T1157.

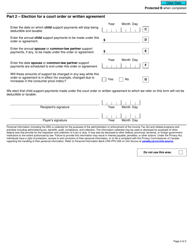

Q: What information is required on Form T1157?

A: Form T1157 requires information about the recipient of the child support payments, the amount of child support paid, and the court order or written agreement that sets out the child support obligation.

Q: When should Form T1157 be filed?

A: Form T1157 should be filed by the due date for your income tax return for the year the child support payments were made.

Q: What happens after I file Form T1157?

A: After filing Form T1157, the CRA will review the election and determine if the child support payments are eligible for tax deduction.

Q: Can the election made on Form T1157 be changed?

A: Yes, the election made on Form T1157 can be changed, but only with the consent of the recipient.

Q: What should I do if my child support payments change?

A: If your child support payments change after making the election on Form T1157, you must notify the CRA within 30 days and provide updated information.