This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1043

for the current year.

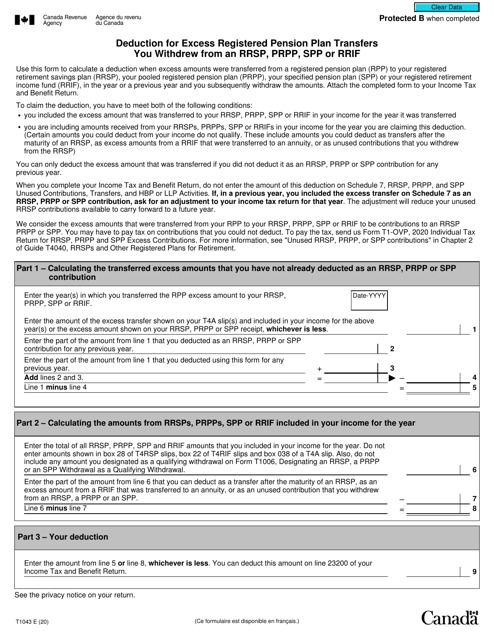

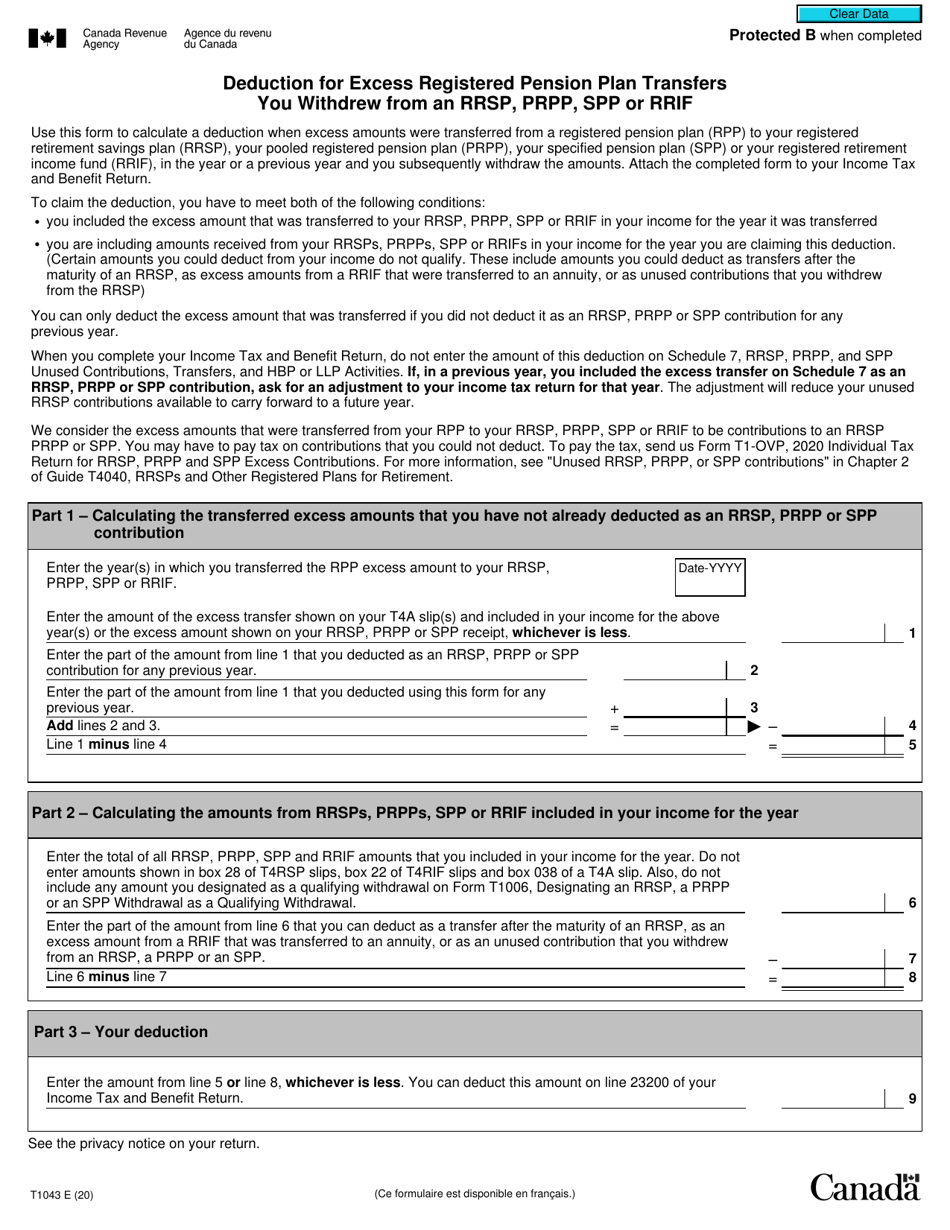

Form T1043 Deduction for Excess Registered Pension Plan Transfers You Withdrew From an Rrsp, Prpp, Spp or Rrif - Canada

Form T1043 - Deduction for Excess Registered Pension Plan Transfers You Withdrew from an RRSP, PRPP, SPP or RRIF in Canada is used to claim a deduction for any excess amount withdrawn from your registered pension plan. This form is specifically for reporting the deduction on your Canadian tax return. The purpose of the deduction is to ensure that you are not taxed on the exceeded amount that was withdrawn from your registered pension plan.

In Canada, the individual who withdraws excess registered pension plan transfers from an RRSP, PRPP, SPP, or RRIF is responsible for filing Form T1043 for the deduction.

FAQ

Q: What is Form T1043?

A: Form T1043 is a tax form used in Canada to claim a deduction for excess registered pension plan transfers.

Q: What does the form cover?

A: The form covers deductions for excess transfers from an RRSP, PRPP, SPP, or RRIF.

Q: What is an excess transfer?

A: An excess transfer is when you withdraw more money from your registered pension plan than allowed.

Q: Who can use Form T1043?

A: Any individual in Canada who has made excess pension plan transfers can use this form.

Q: What is the purpose of claiming this deduction?

A: The purpose is to reduce your taxable income by deducting the excess pension plan transfers.

Q: Are there any limitations to claiming this deduction?

A: Yes, there are specific rules and limits for claiming this deduction, so it is important to consult the instructions and seek professional advice if needed.

Q: When should I file Form T1043?

A: You should file this form along with your annual tax return, on or before the filing due date.

Q: What supporting documentation should I include with the form?

A: You should include any necessary documents, such as a statement from your pension plan administrator, to support your deduction claim.

Q: Can I e-file Form T1043?

A: No, Form T1043 cannot be e-filed. You must mail it to the CRA.

Q: What happens after I file Form T1043?

A: The CRA will review your form and documentation and determine if you are eligible for the deduction. If approved, the deduction will be applied to your taxable income.