This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC519

for the current year.

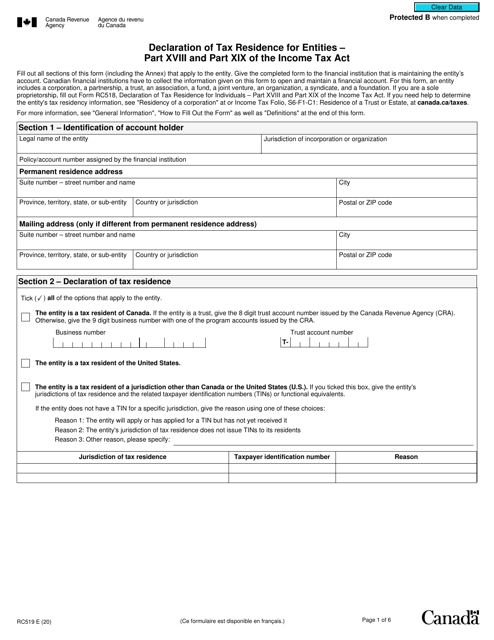

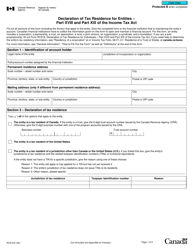

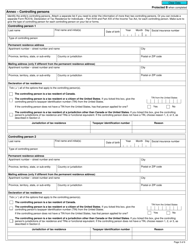

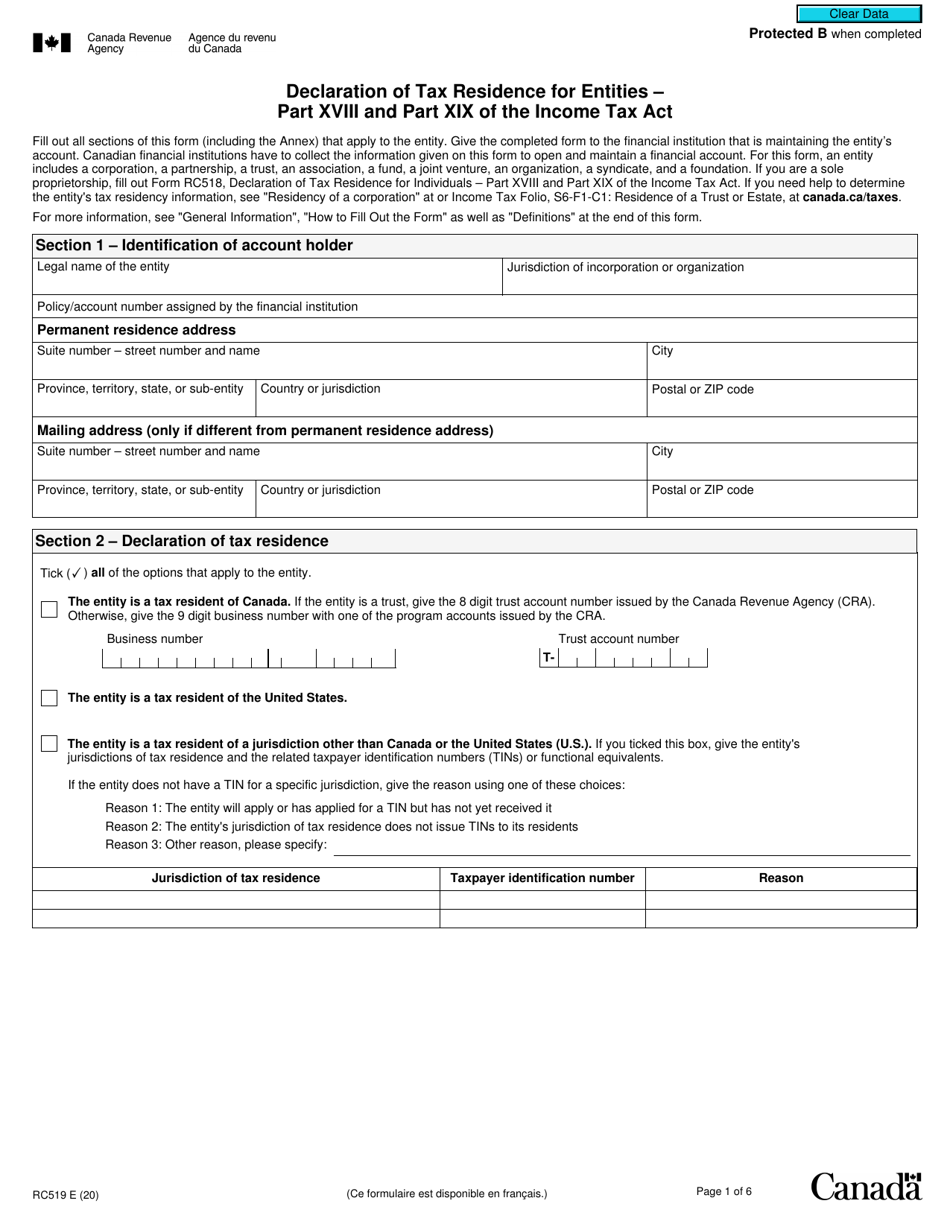

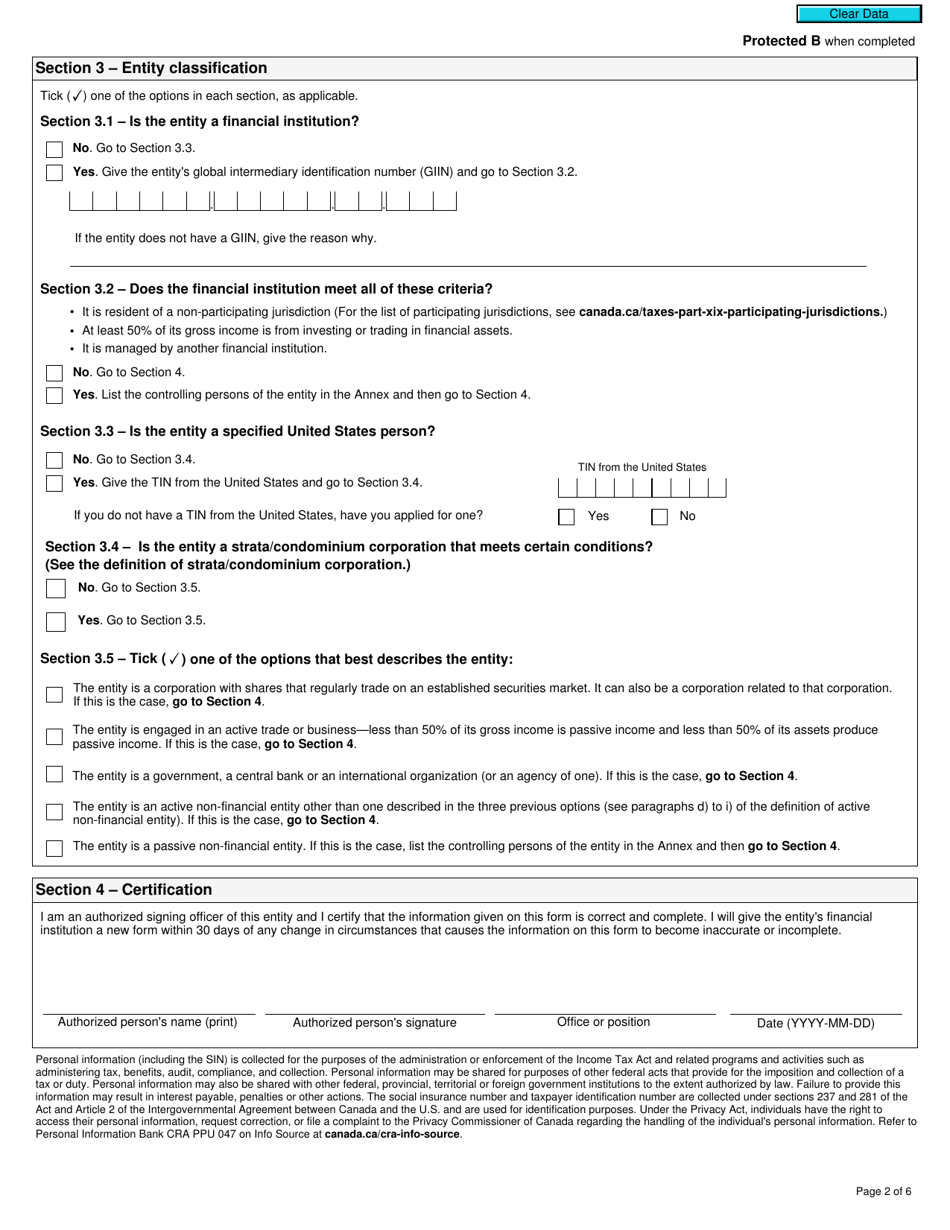

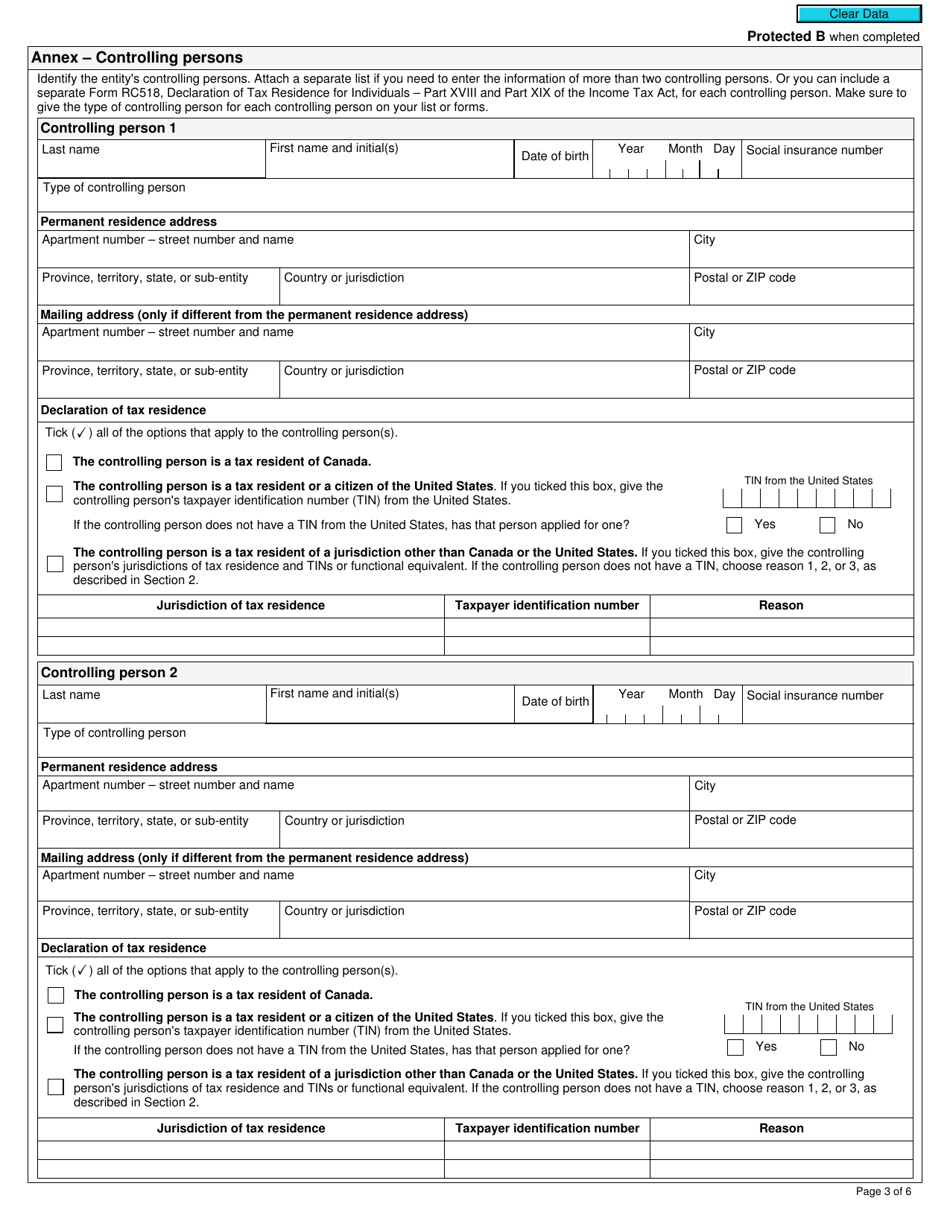

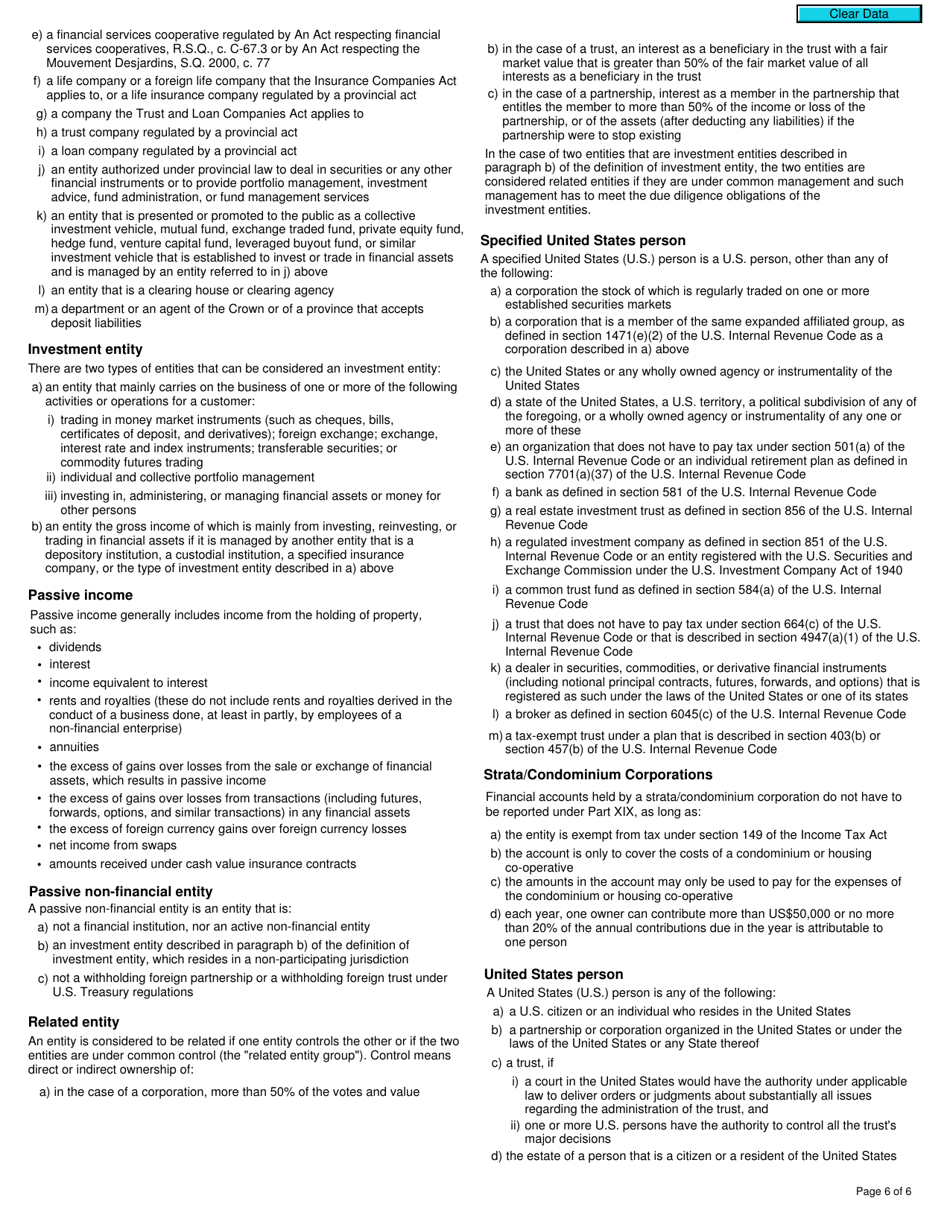

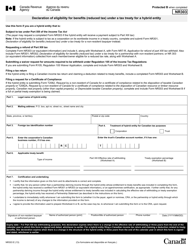

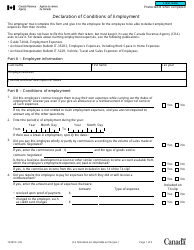

Form RC519 Declaration of Tax Residence for Entities - Part Xviii and Part Xix of the Income Tax Act - Canada

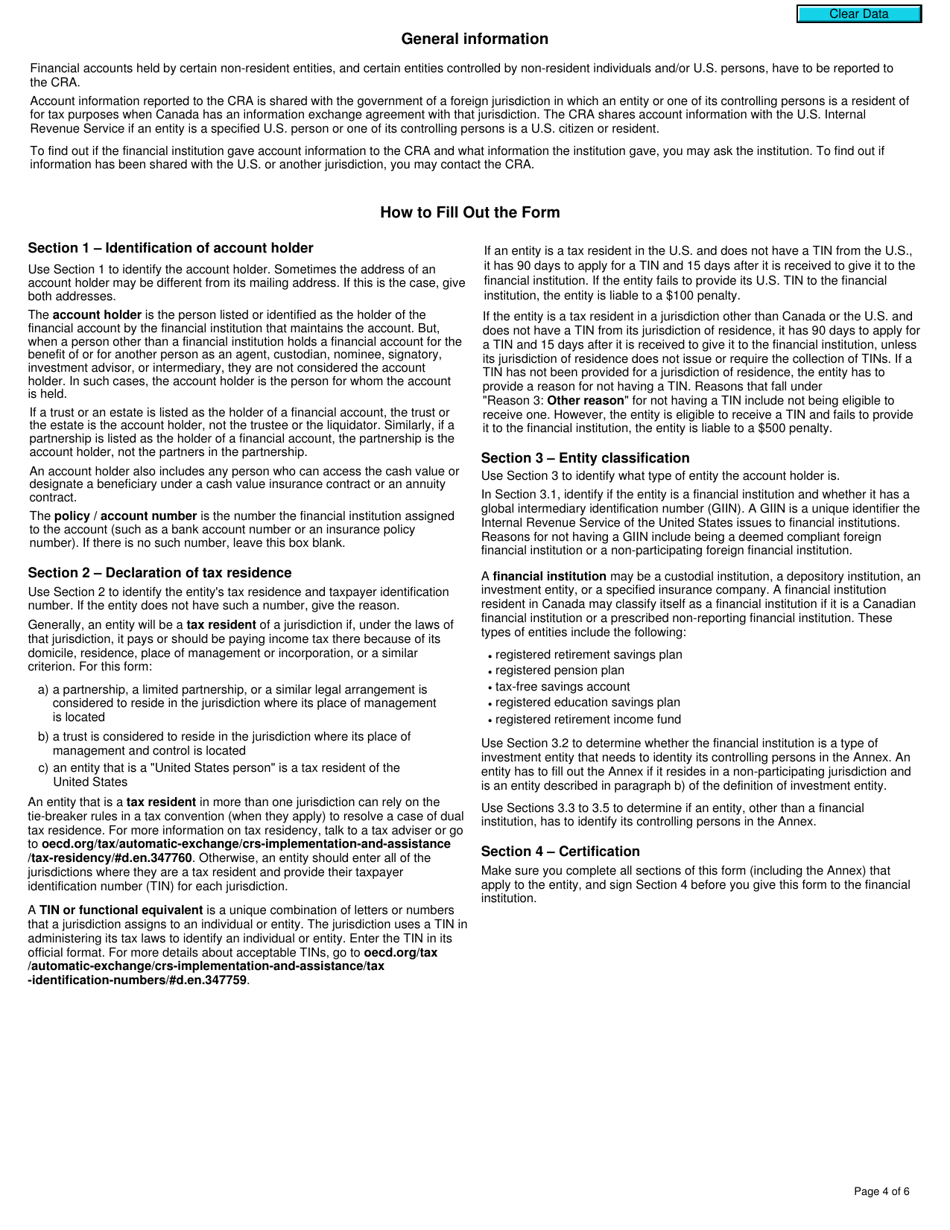

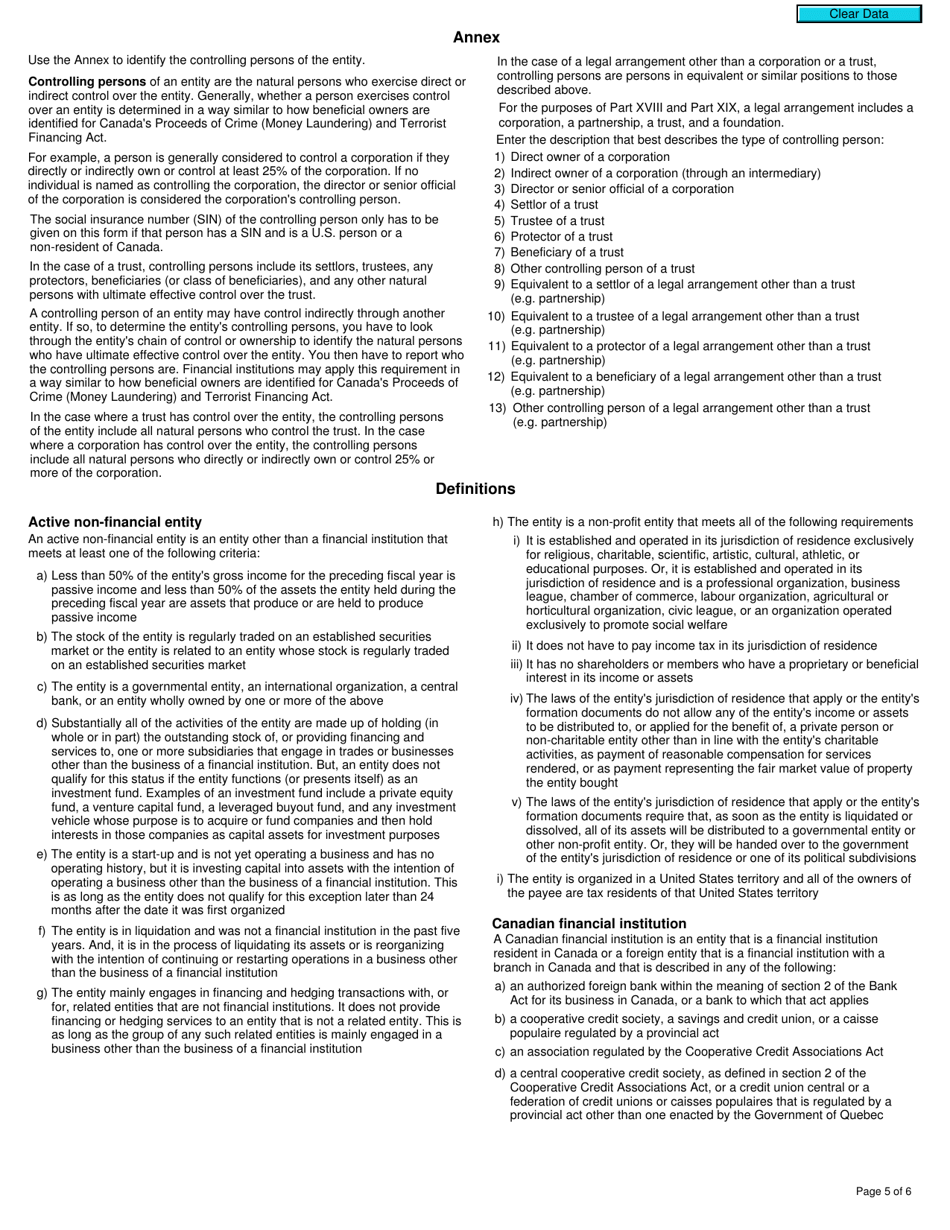

Form RC519 Declaration of Tax Residence for Entities - Part XVIII and Part XIX of the Income Tax Act - Canada is used to declare the tax residence status of an entity for tax purposes. It helps determine whether the entity is considered a resident of Canada or another country for taxation purposes.

The Form RC519 Declaration of Tax Residence for Entities - Part XVIII and Part XIX of the Income Tax Act - Canada is usually filed by entities that need to declare their tax residence in Canada.

FAQ

Q: What is Form RC519?

A: Form RC519 is a declaration form for tax residence for entities in Canada.

Q: What is Part XVIII of the Income Tax Act?

A: Part XVIII of the Income Tax Act in Canada deals with international taxation and tax treaties.

Q: What is Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act in Canada deals with non-resident withholding tax.

Q: Who needs to use Form RC519?

A: Entities that need to declare their tax residence in Canada.

Q: What information is required in Part XVIII of Form RC519?

A: Part XVIII requires information related to foreign tax identification number, tax treaty benefits, and other relevant details.

Q: What information is required in Part XIX of Form RC519?

A: Part XIX requires information related to non-resident withholding tax, such as gross amounts subject to tax and amount of tax withheld.

Q: What should I do after completing Form RC519?

A: After completing Form RC519, it should be filed with the CRA according to the instructions provided.

Q: Is Form RC519 mandatory?

A: Yes, if you are an entity required to declare your tax residence in Canada, Form RC519 is mandatory.

Q: Can I make changes to Form RC519 after submitting it?

A: If you need to make changes to Form RC519 after submitting it, you should contact the CRA for further instructions.