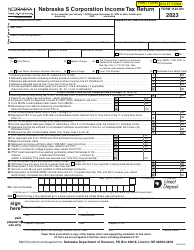

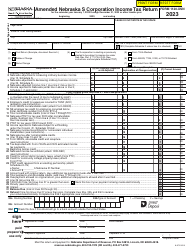

This version of the form is not currently in use and is provided for reference only. Download this version of

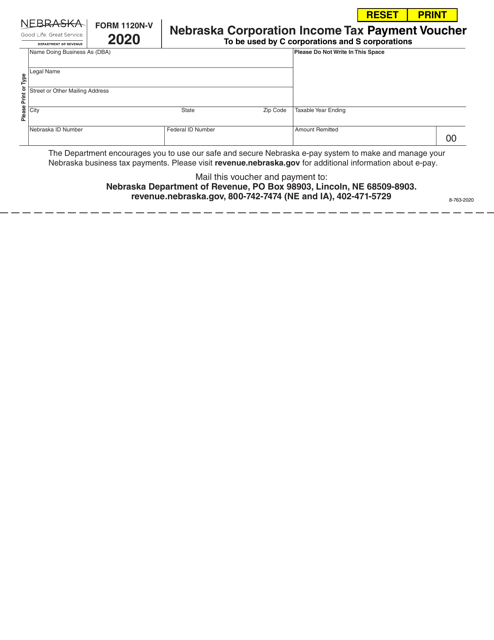

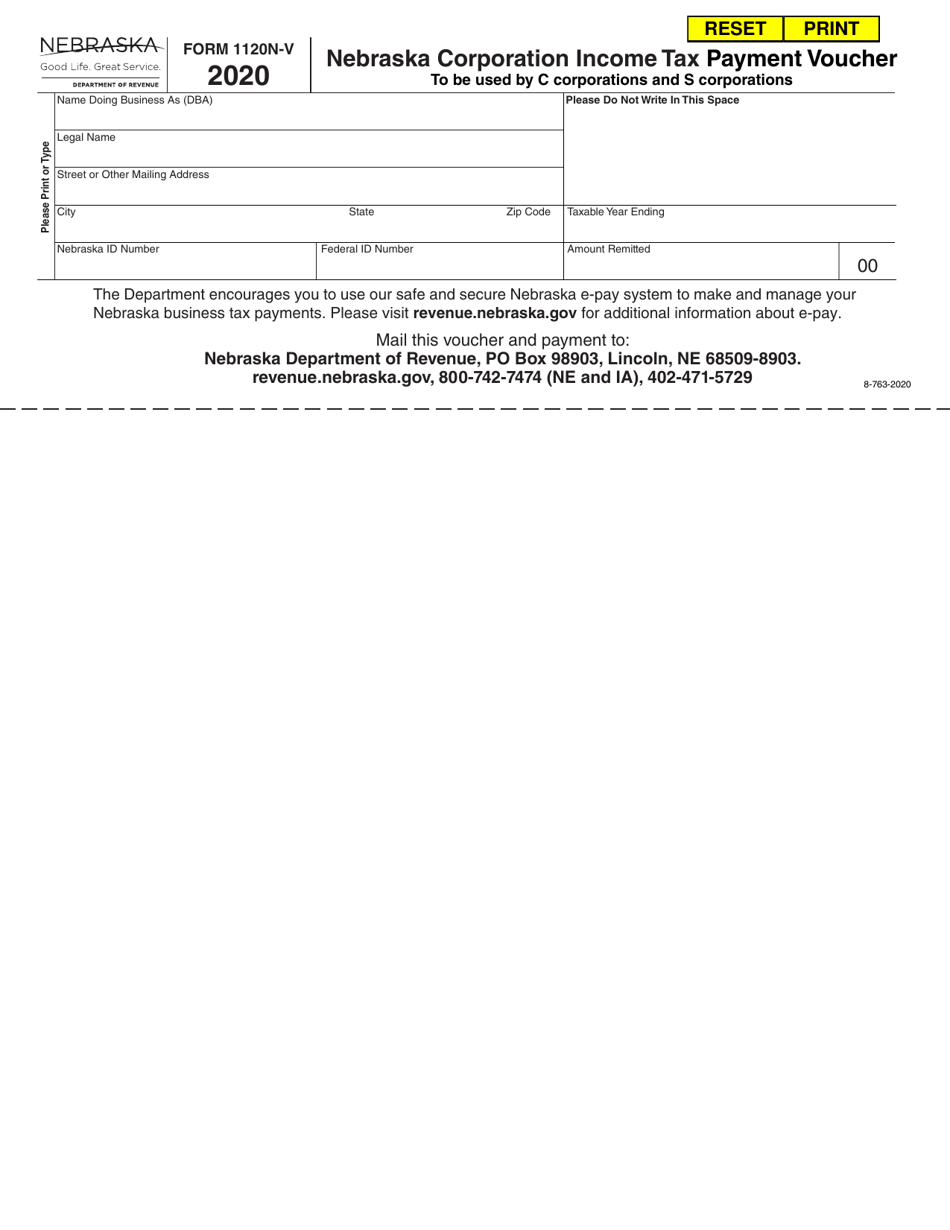

Form 1120N-V

for the current year.

Form 1120N-V Nebraska Corporation Income Tax Payment Voucher - Nebraska

What Is Form 1120N-V?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

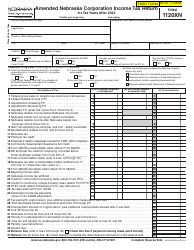

FAQ

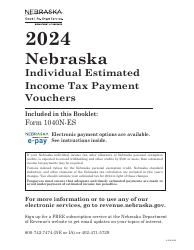

Q: What is Form 1120N-V?

A: Form 1120N-V is a payment voucher for Nebraska Corporation Income Tax.

Q: What is the purpose of Form 1120N-V?

A: The purpose of Form 1120N-V is to make a payment for Nebraska Corporation Income Tax.

Q: Who needs to file Form 1120N-V?

A: Nebraska corporations who owe income tax need to file Form 1120N-V to make a payment.

Q: How do I fill out Form 1120N-V?

A: You need to fill out your corporation's name, address, payment amount, and other required information.

Q: When is Form 1120N-V due?

A: Form 1120N-V is due on or before the 15th day of the 4th month following the close of the corporation's tax year.

Q: What happens if I don't file Form 1120N-V?

A: If you don't file Form 1120N-V or make the payment by the due date, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120N-V by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.