This version of the form is not currently in use and is provided for reference only. Download this version of

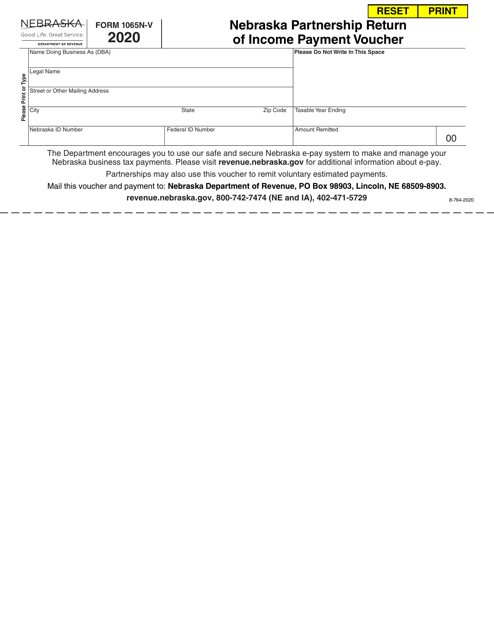

Form 1065N-V

for the current year.

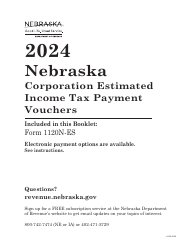

Form 1065N-V Nebraska Partnership Return of Income Payment Voucher - Nebraska

What Is Form 1065N-V?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1065N-V?

A: Form 1065N-V is a payment voucher for the Nebraska Partnership Return of Income.

Q: Who needs to file Form 1065N-V?

A: Partnerships in Nebraska who are filing their income tax return need to file Form 1065N-V if they are making a payment.

Q: What is the purpose of Form 1065N-V?

A: Form 1065N-V is used to accompany a payment towards the Nebraska Partnership Return of Income.

Q: When is Form 1065N-V due?

A: The due date for Form 1065N-V coincides with the filing deadline for the Nebraska Partnership Return of Income, which is typically April 15th of the following year.

Q: Can Form 1065N-V be filed electronically?

A: Yes, Form 1065N-V can be filed electronically if you choose to file your Nebraska Partnership Return of Income electronically.

Q: What should I do if I make a mistake on Form 1065N-V?

A: If you make a mistake on Form 1065N-V, you should correct the error and resubmit the form as soon as possible.

Q: Are there any penalties for not filing Form 1065N-V?

A: Yes, there may be penalties for not filing Form 1065N-V or for making late payments.

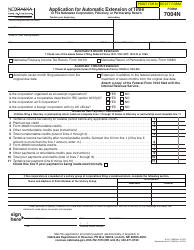

Q: Can I request an extension to file Form 1065N-V?

A: Yes, you can request an extension to file Form 1065N-V. However, any tax payments are still due by the original deadline.

Q: What should I do with Form 1065N-V after filing?

A: After filing Form 1065N-V, you should keep a copy for your records and submit any requested payment to the Nebraska Department of Revenue.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1065N-V by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.