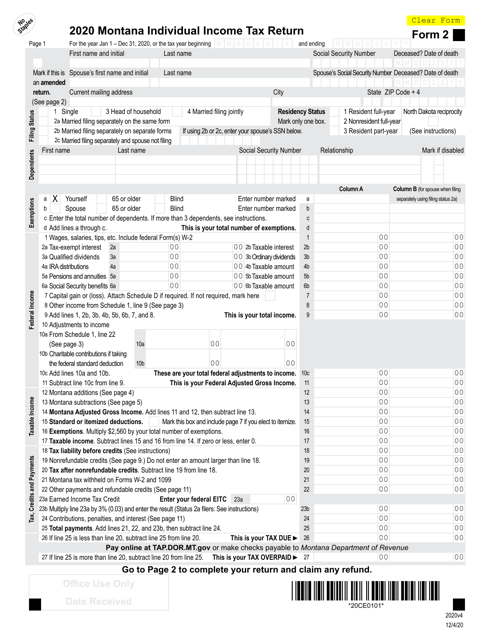

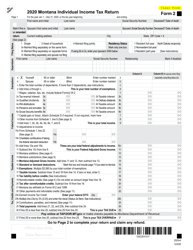

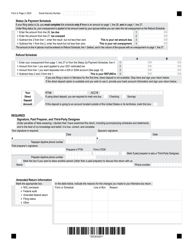

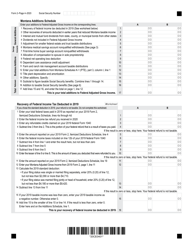

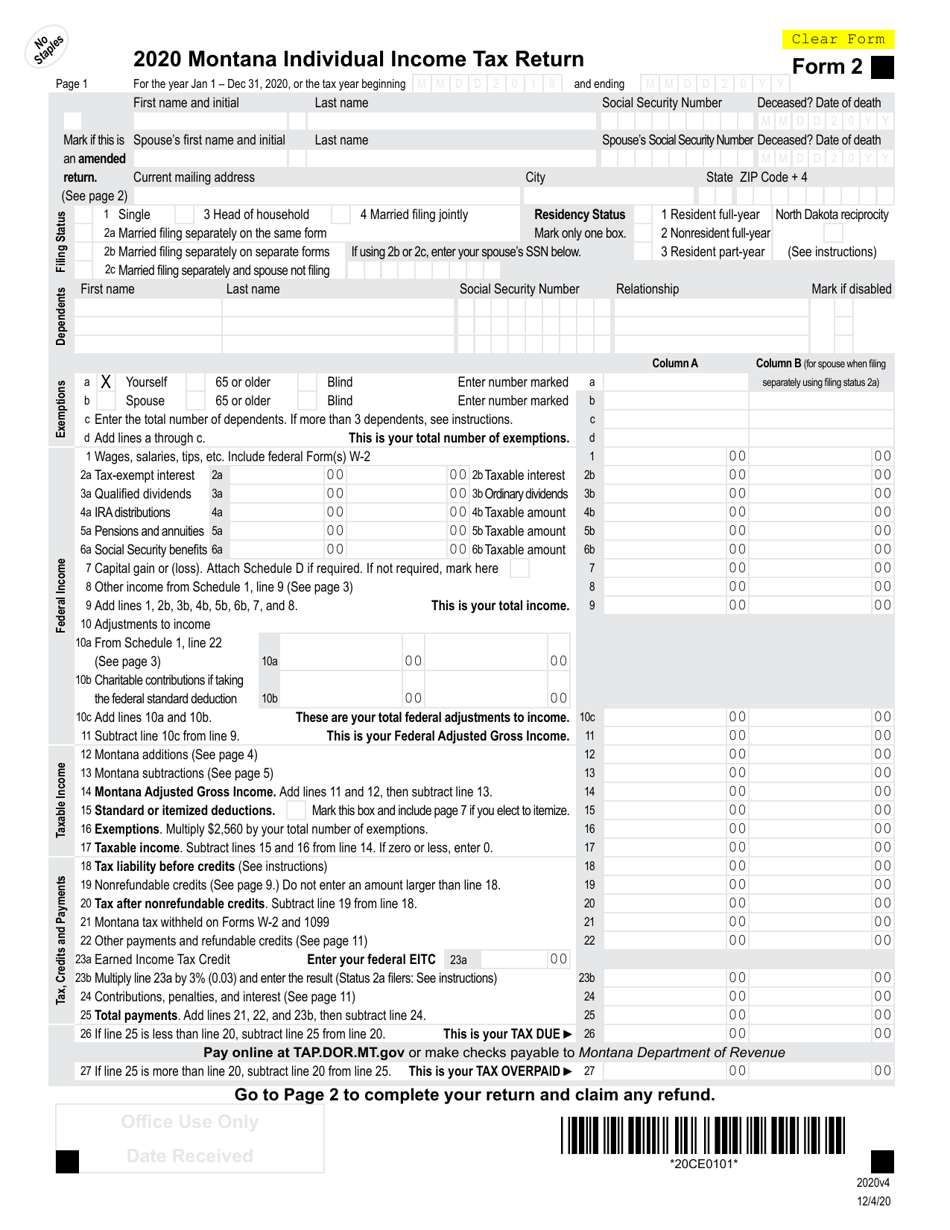

Form 2 Montana Individual Income Tax Return - Montana

What Is Form 2?

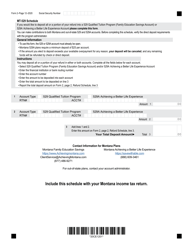

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2 Montana Individual Income Tax Return?

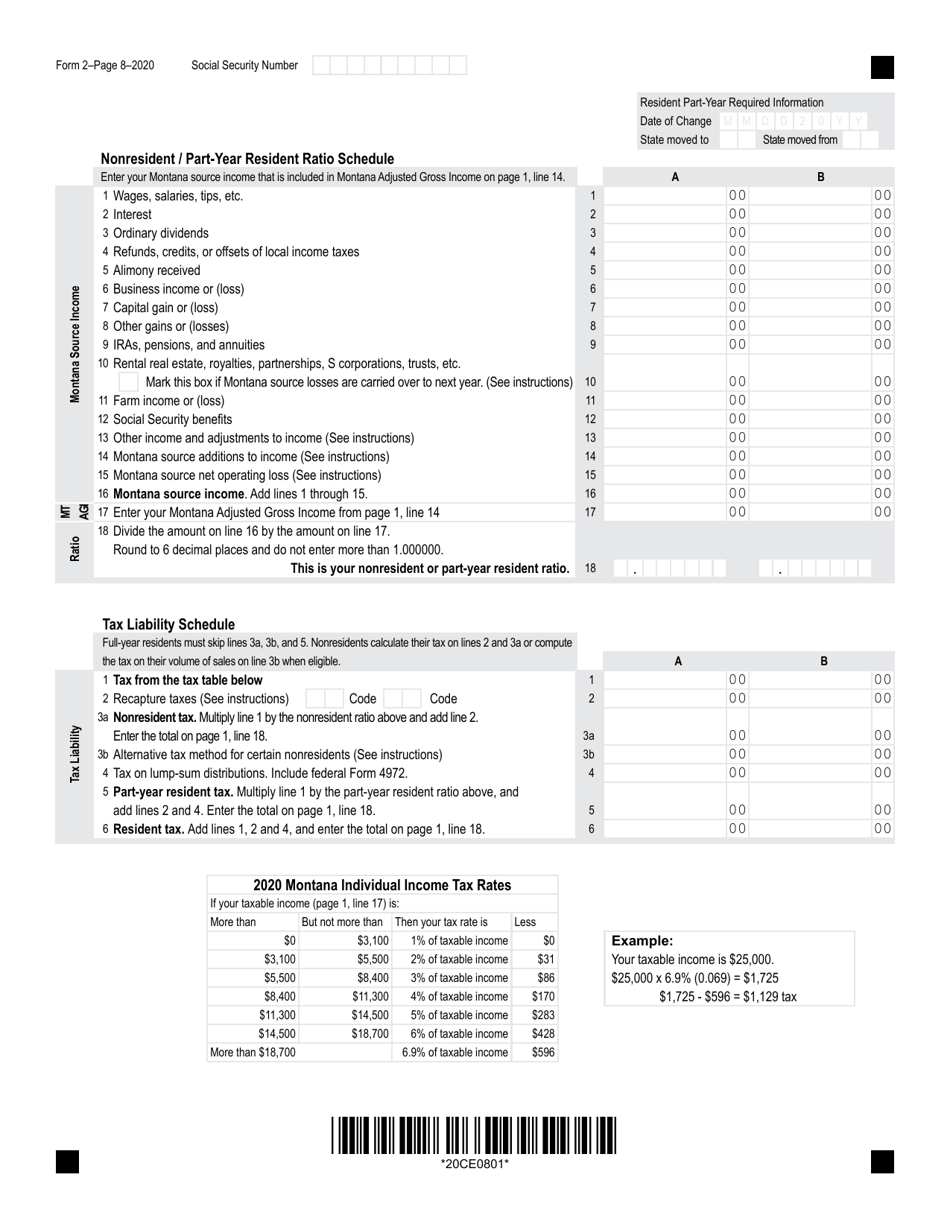

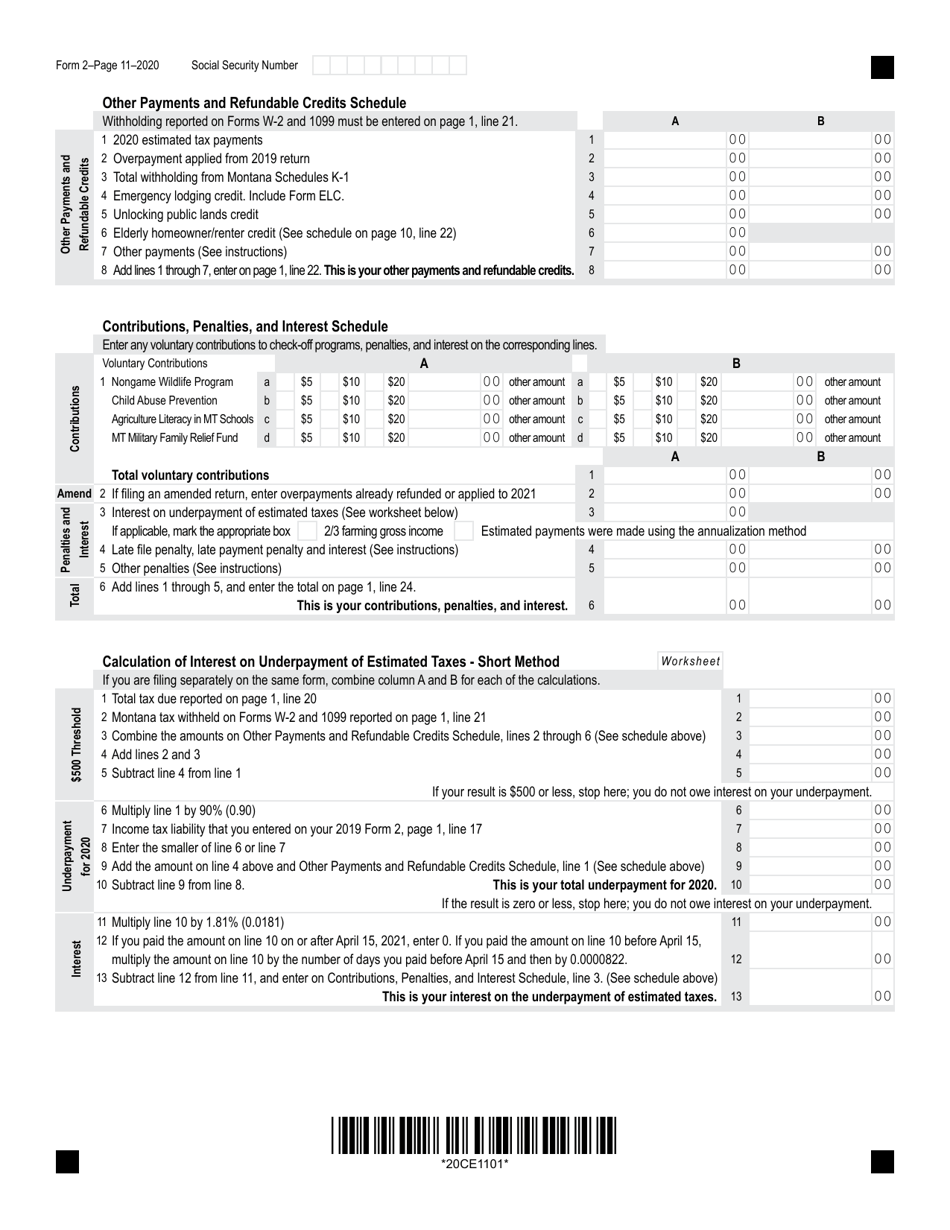

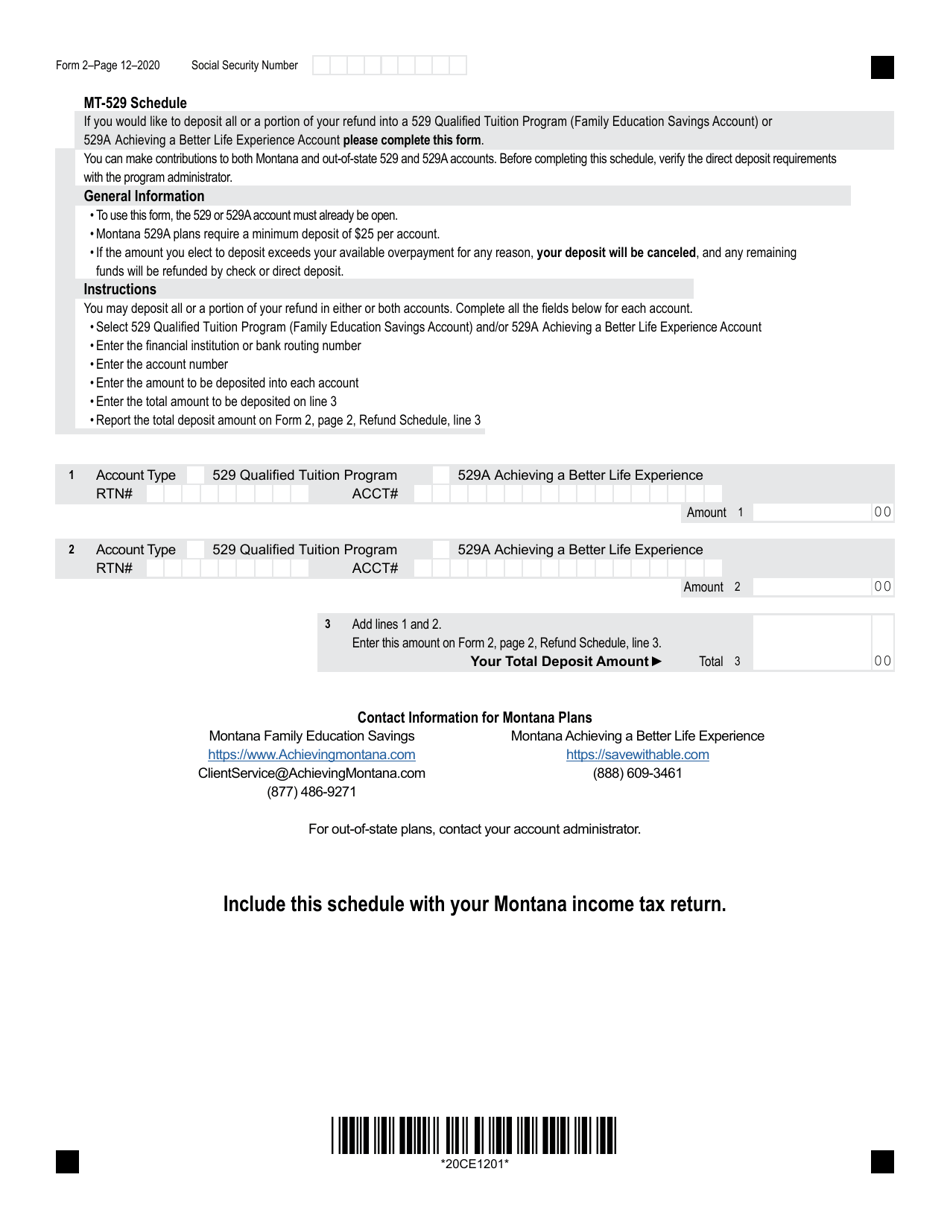

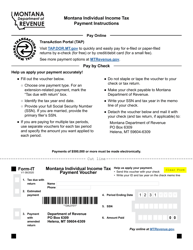

A: Form 2 Montana Individual Income Tax Return is a tax form used by residents of Montana to report their individual income and calculate the amount of tax owed.

Q: Who needs to file Form 2 Montana Individual Income Tax Return?

A: Residents of Montana who have earned income during the tax year and meet the filing requirements need to file Form 2 Montana Individual Income Tax Return.

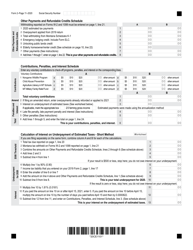

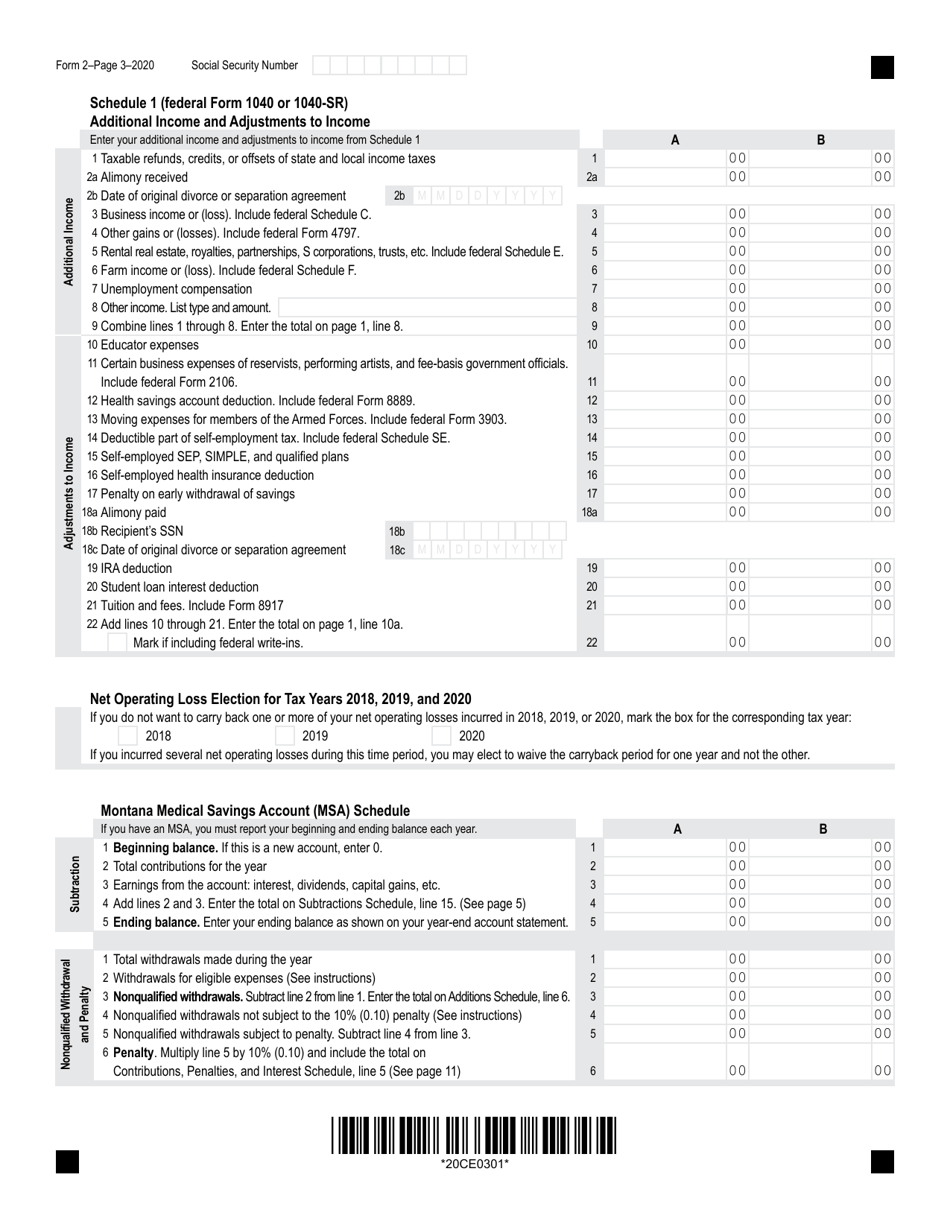

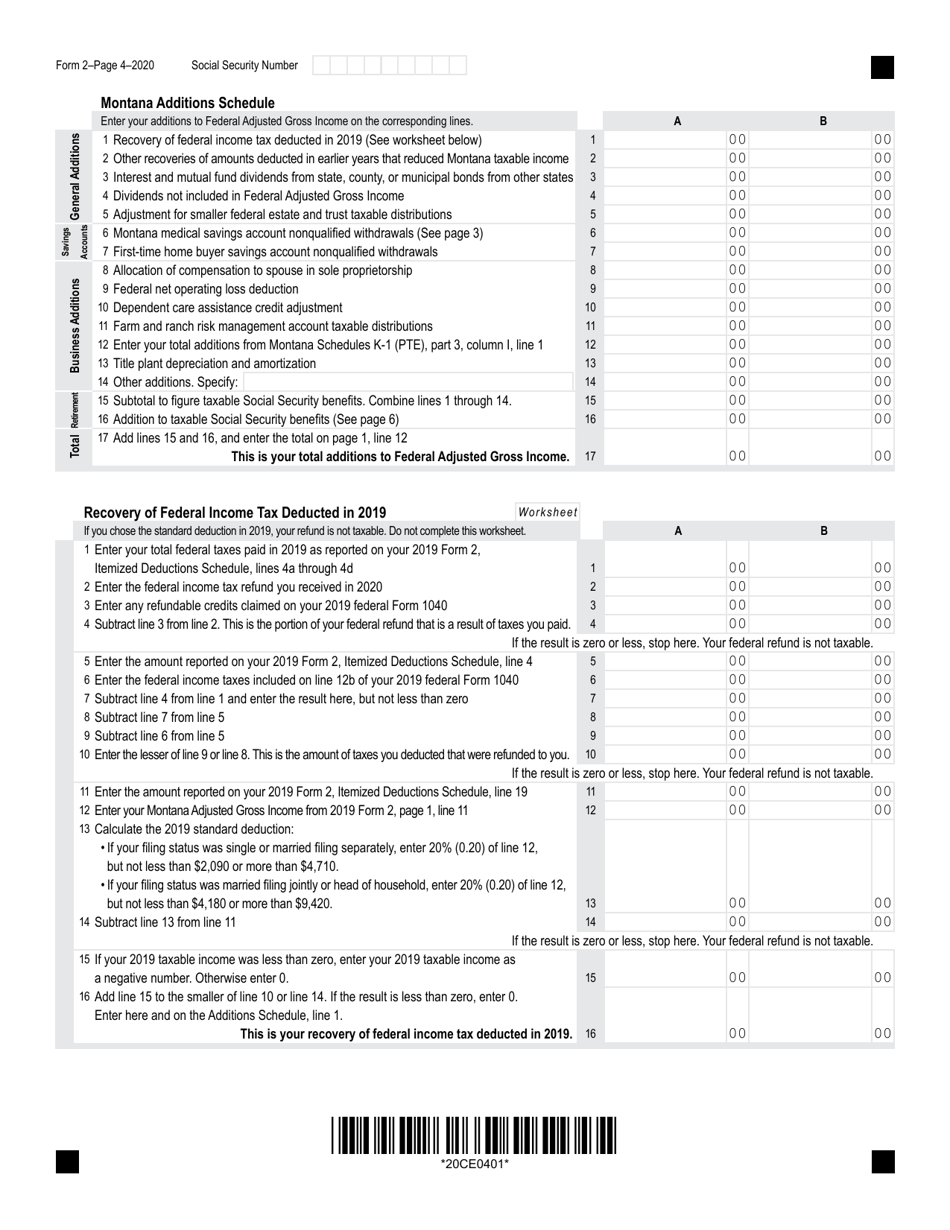

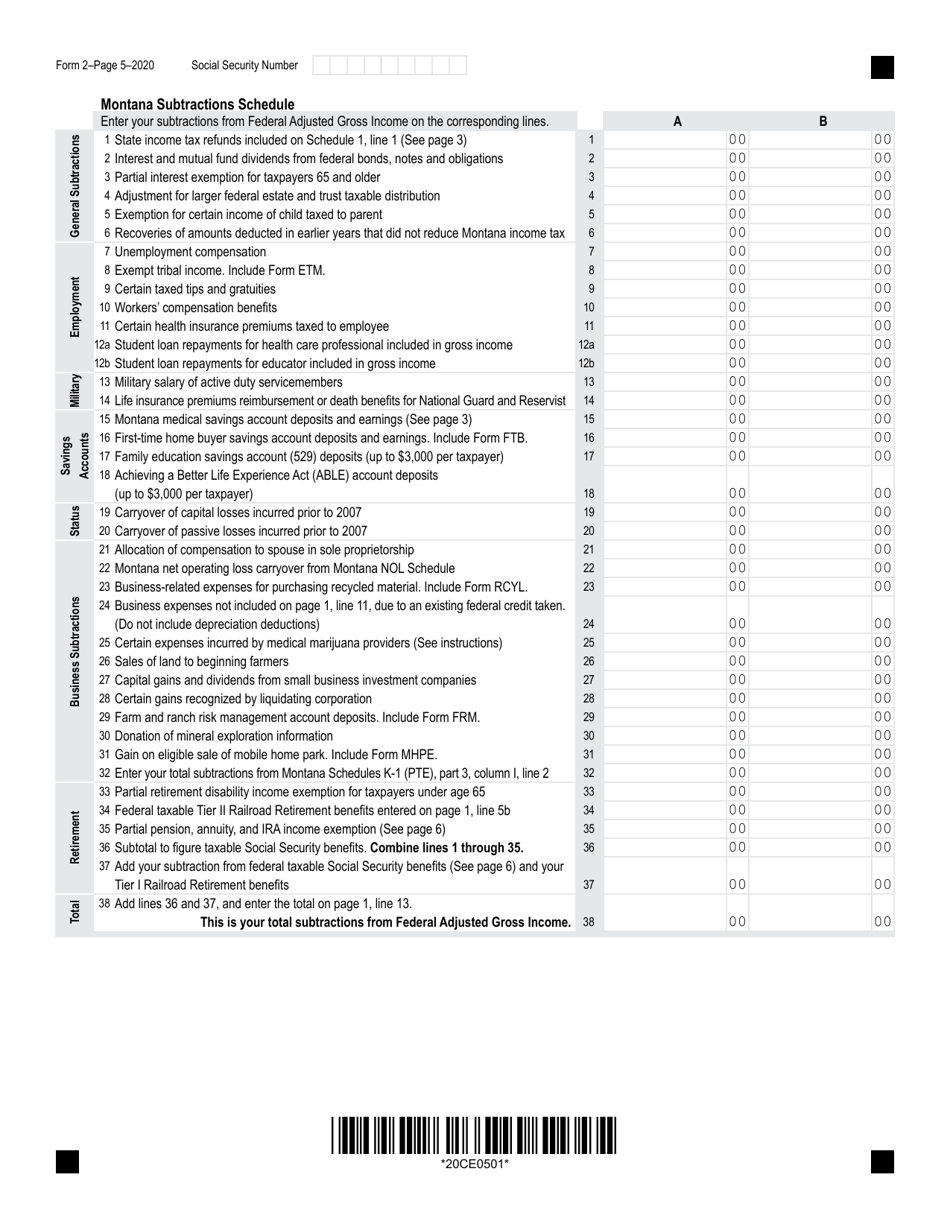

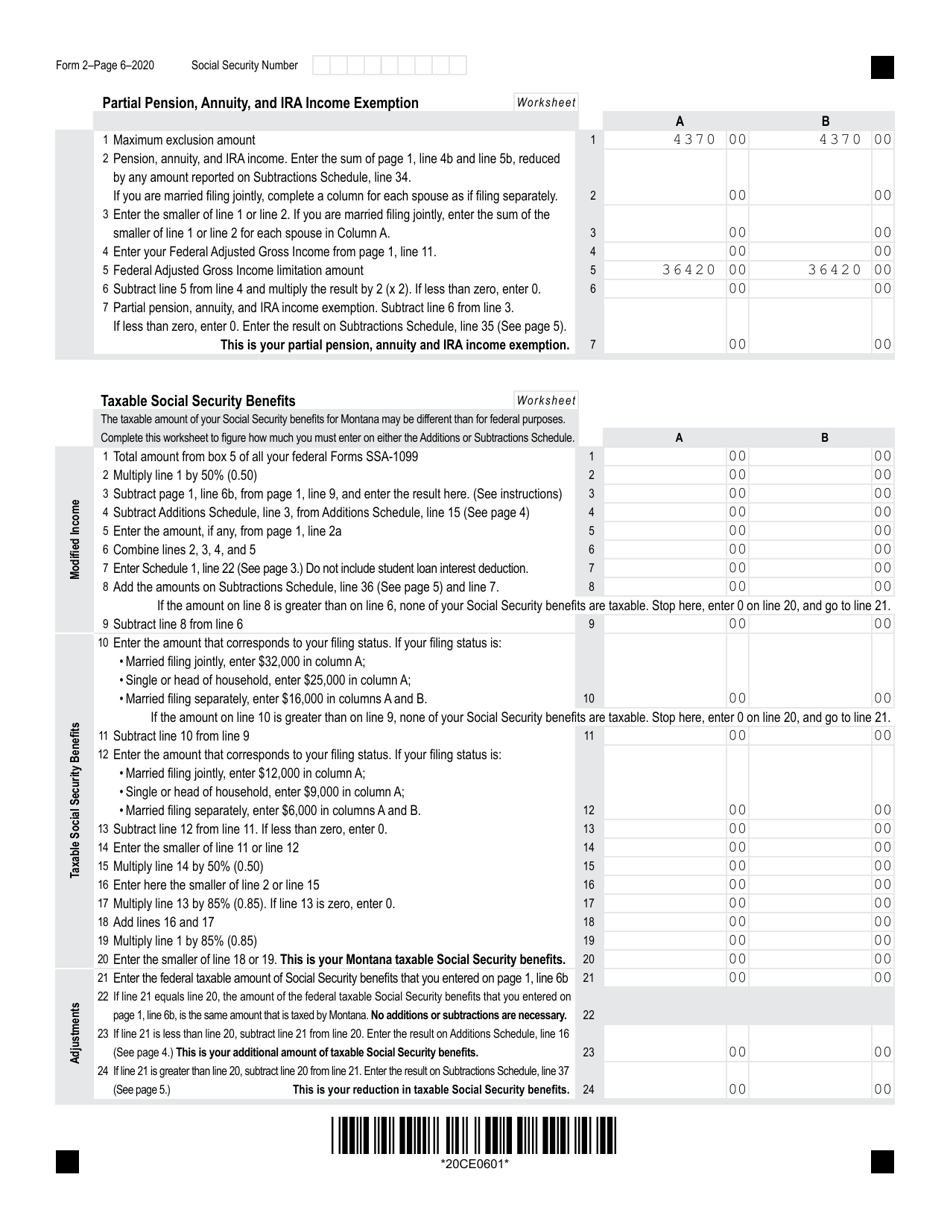

Q: What income should be reported on Form 2 Montana Individual Income Tax Return?

A: All types of income, including wages, self-employment income, rental income, and investment income, should be reported on Form 2 Montana Individual Income Tax Return.

Q: When is the deadline to file Form 2 Montana Individual Income Tax Return?

A: The deadline to file Form 2 Montana Individual Income Tax Return is usually April 15th of each year, unless it falls on a weekend or holiday, in which case the deadline is extended.

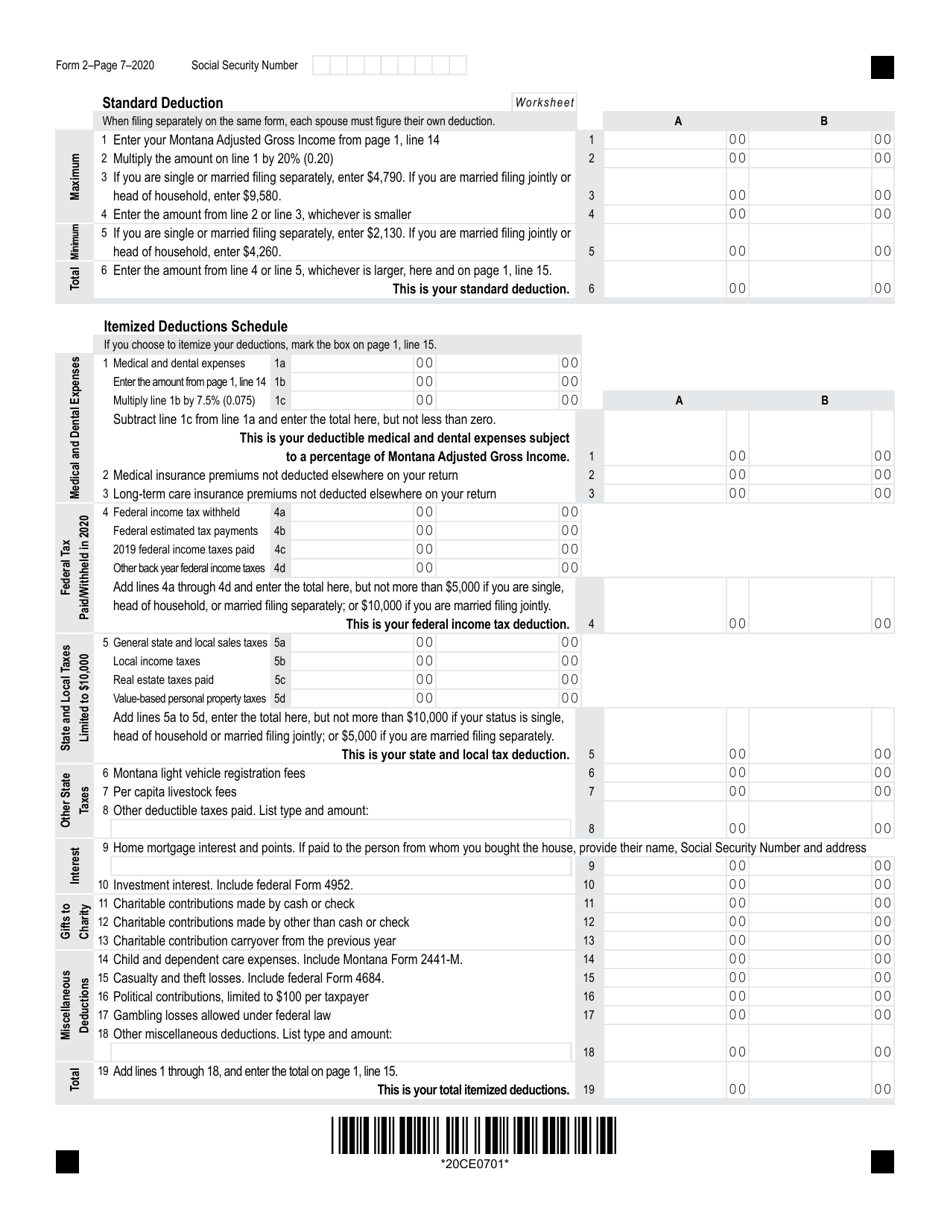

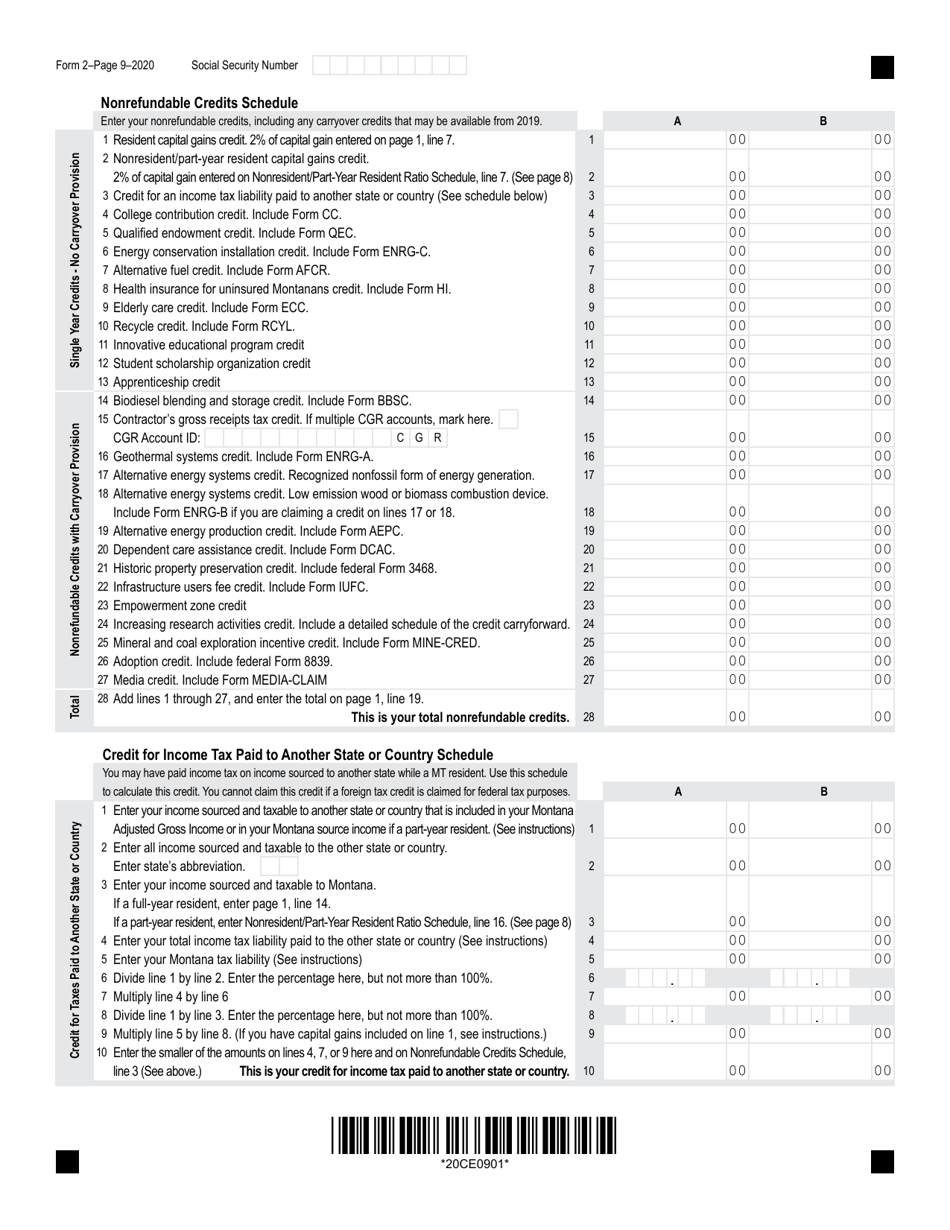

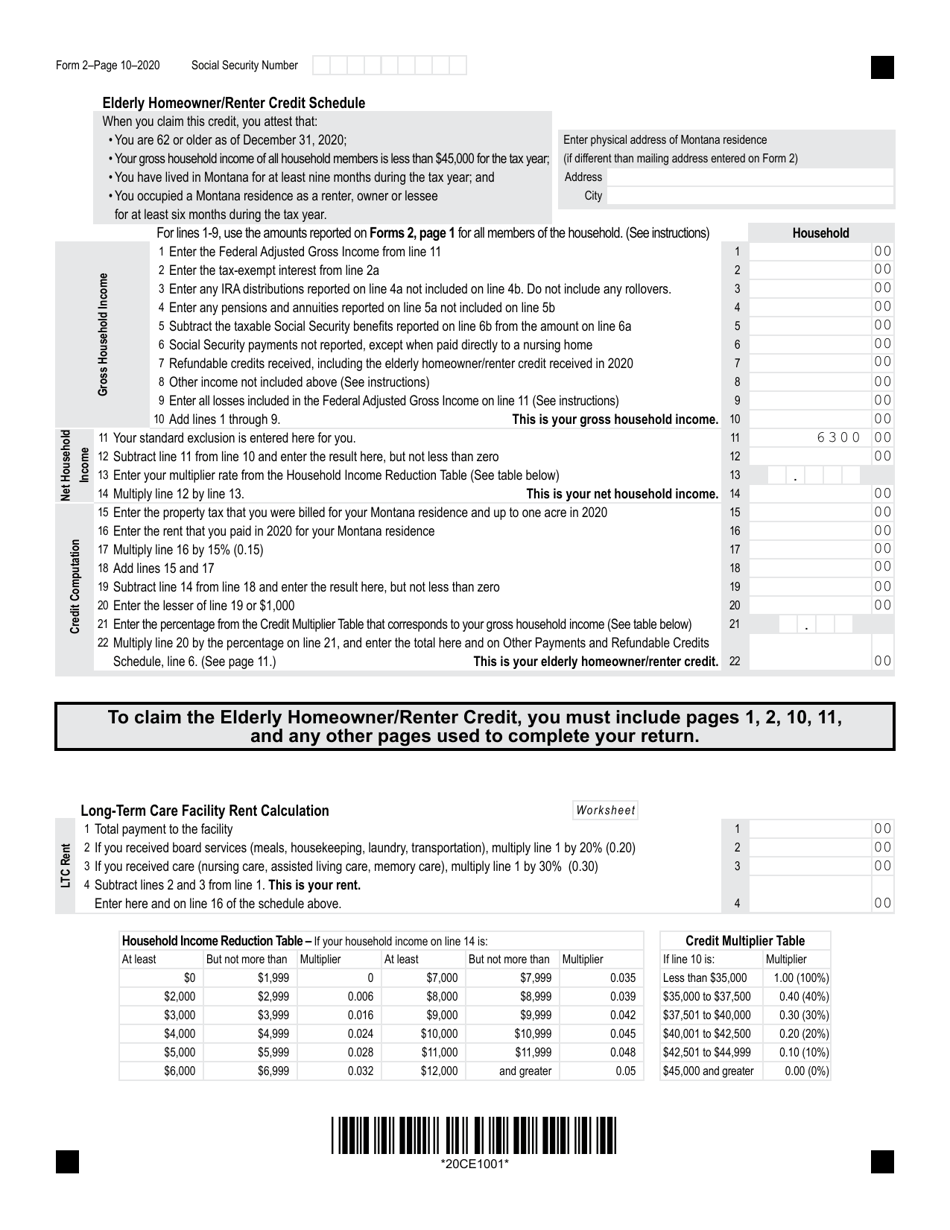

Q: Are there any deductions or credits available on Form 2 Montana Individual Income Tax Return?

A: Yes, there are various deductions and credits available on Form 2 Montana Individual Income Tax Return, such as the standard deduction, itemized deductions, and child tax credits.

Q: Do I need to include any supporting documents with Form 2 Montana Individual Income Tax Return?

A: It is generally not required to include supporting documents with Form 2 Montana Individual Income Tax Return, but you should keep them for your records in case of an audit.

Q: What happens if I don't file Form 2 Montana Individual Income Tax Return?

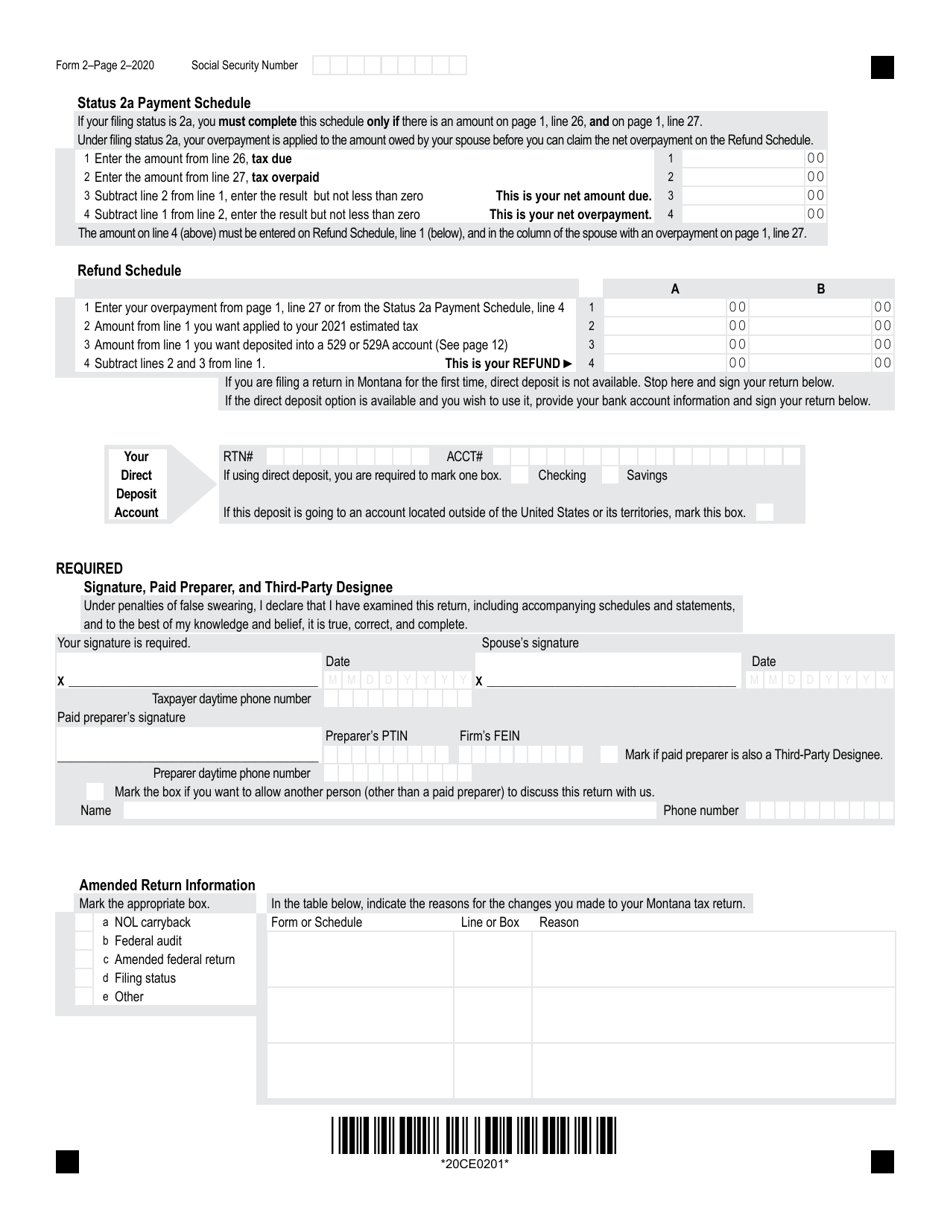

A: If you are required to file Form 2 Montana Individual Income Tax Return and fail to do so, you may face penalties and interest on the unpaid tax amount.

Q: Can I get an extension to file Form 2 Montana Individual Income Tax Return?

A: Yes, you can request an extension to file Form 2 Montana Individual Income Tax Return, which will give you extra time until October 15th to submit your return.

Form Details:

- Released on December 4, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.