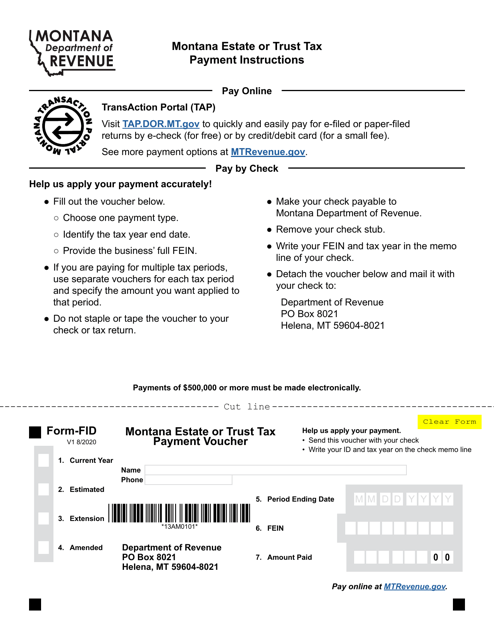

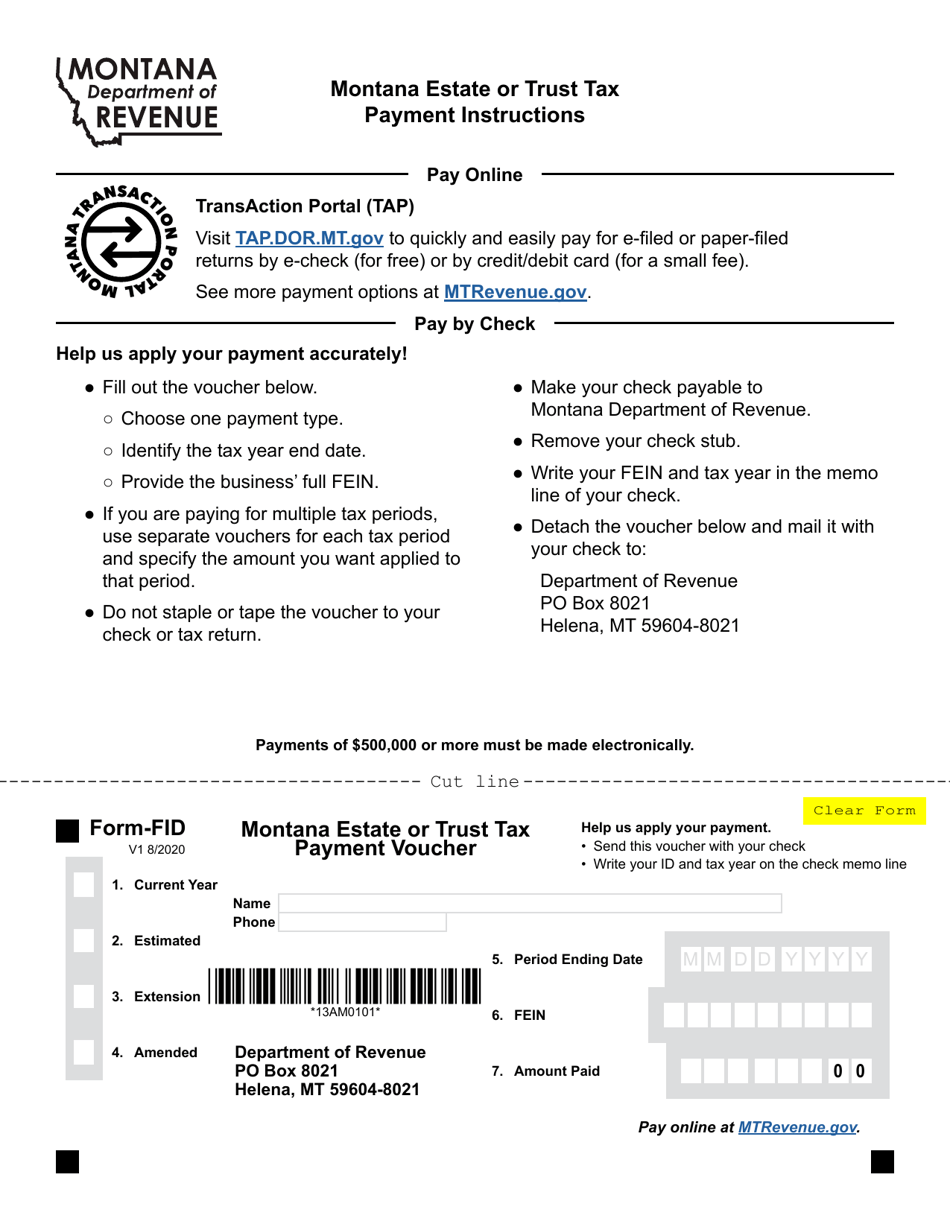

Form FID Montana Estate or Trust Tax Payment Voucher - Montana

What Is Form FID?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form FID?

A: Form FID is used to make tax payments for Montana Estate or Trust.

Q: Who needs to use Form FID?

A: Individuals who have an estate or trust in Montana and need to make tax payments.

Q: What information is required on Form FID?

A: Form FID asks for information such as the taxpayer's name, address, Social Security or Tax ID number, and the amount of the tax payment.

Q: When is Form FID due?

A: Form FID must be filed and payments made by the due date specified by the Montana Department of Revenue.

Q: What if I have questions or need help with Form FID?

A: If you have questions or need assistance with Form FID, you can contact the Montana Department of Revenue directly.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FID by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.