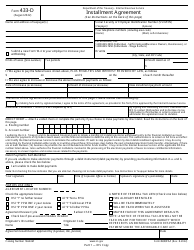

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 71-661

for the current year.

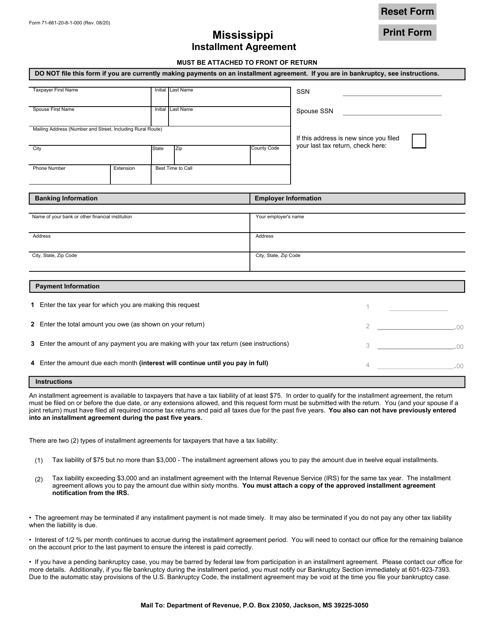

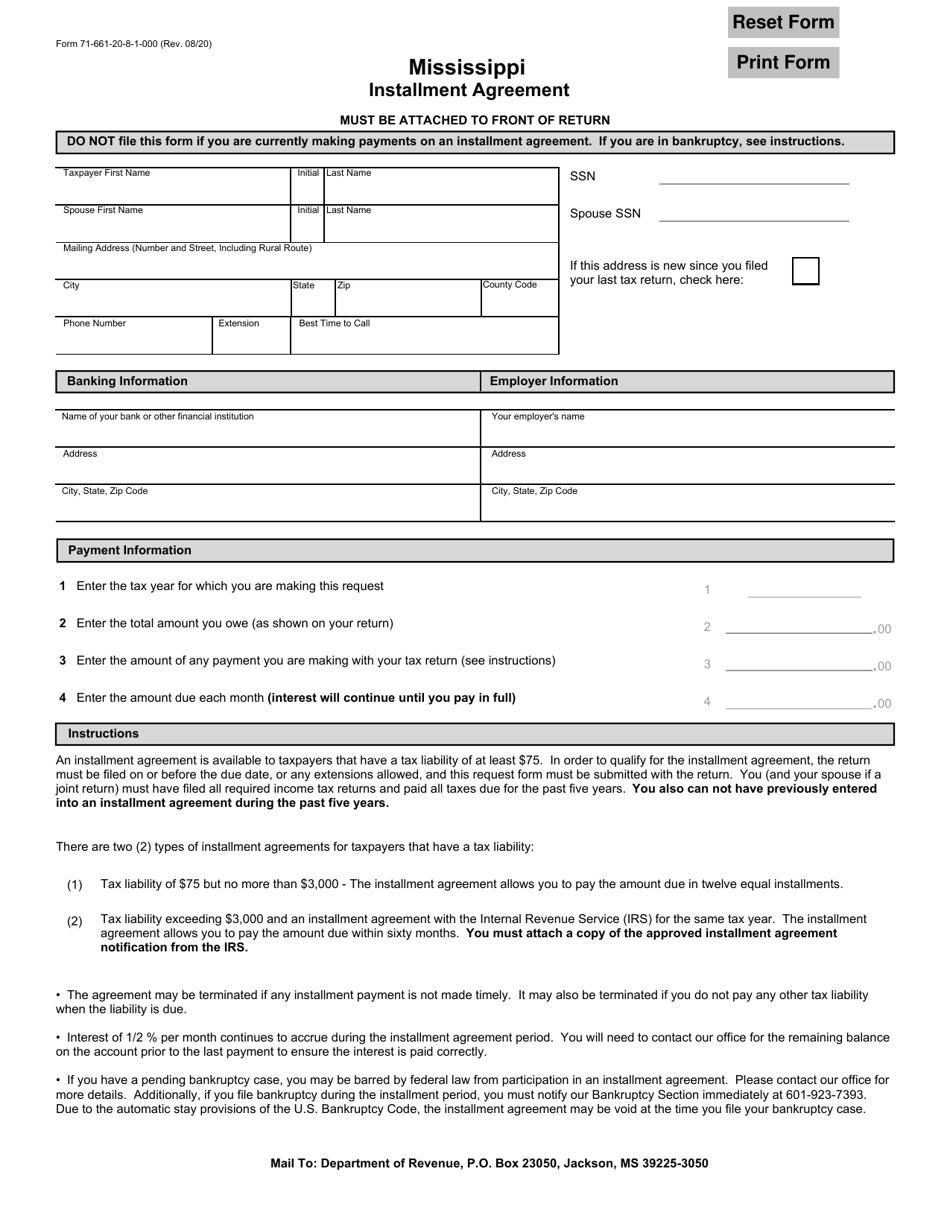

Form 71-661 Mississippi Installment Agreement - Mississippi

What Is Form 71-661?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

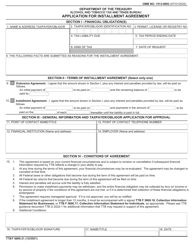

Q: What is Form 71-661?

A: Form 71-661 is the Mississippi Installment Agreement.

Q: What is the purpose of Form 71-661?

A: The purpose of Form 71-661 is to establish a payment plan for individuals who owe delinquent taxes to the State of Mississippi.

Q: Who is eligible to use Form 71-661?

A: Any individual who owes delinquent taxes to the State of Mississippi can use Form 71-661.

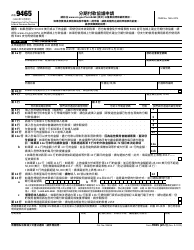

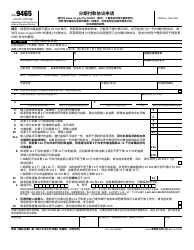

Q: What information is required on Form 71-661?

A: Form 71-661 requires information such as the taxpayer's name, address, social security number, tax period, and the amount due.

Q: How can Form 71-661 be filed?

A: Form 71-661 can be filed by mail or in person at the Mississippi Department of Revenue.

Q: Are there any fees associated with Form 71-661?

A: Yes, there is a $50 fee for setting up an installment agreement using Form 71-661.

Q: What happens if the taxpayer fails to make the installment payments?

A: If the taxpayer fails to make the installment payments, the Department of Revenue may take collection actions such as garnishing wages or seizing assets.

Q: Can Form 71-661 be used for business taxes?

A: No, Form 71-661 is only for individual delinquent taxes.

Q: Are there any other options for resolving delinquent taxes in Mississippi?

A: Yes, taxpayers may also be eligible for an Offer in Compromise or a Penalty Abatement based on their individual circumstances.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 71-661 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.