This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

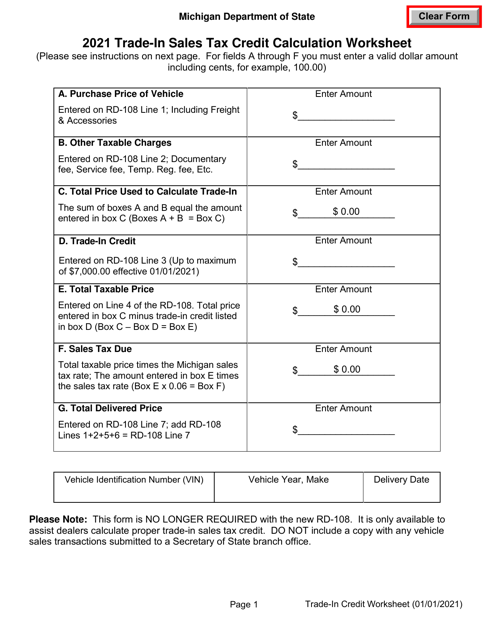

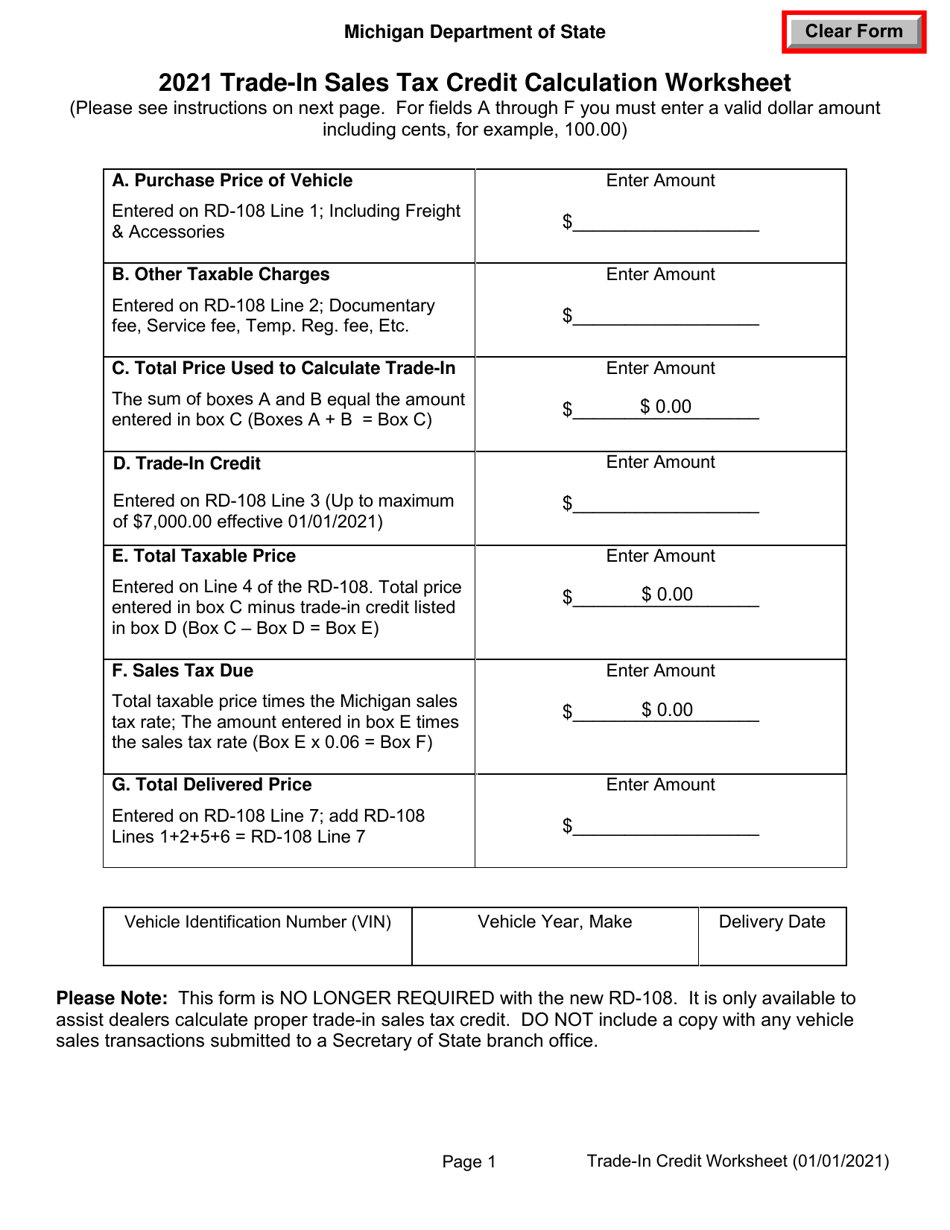

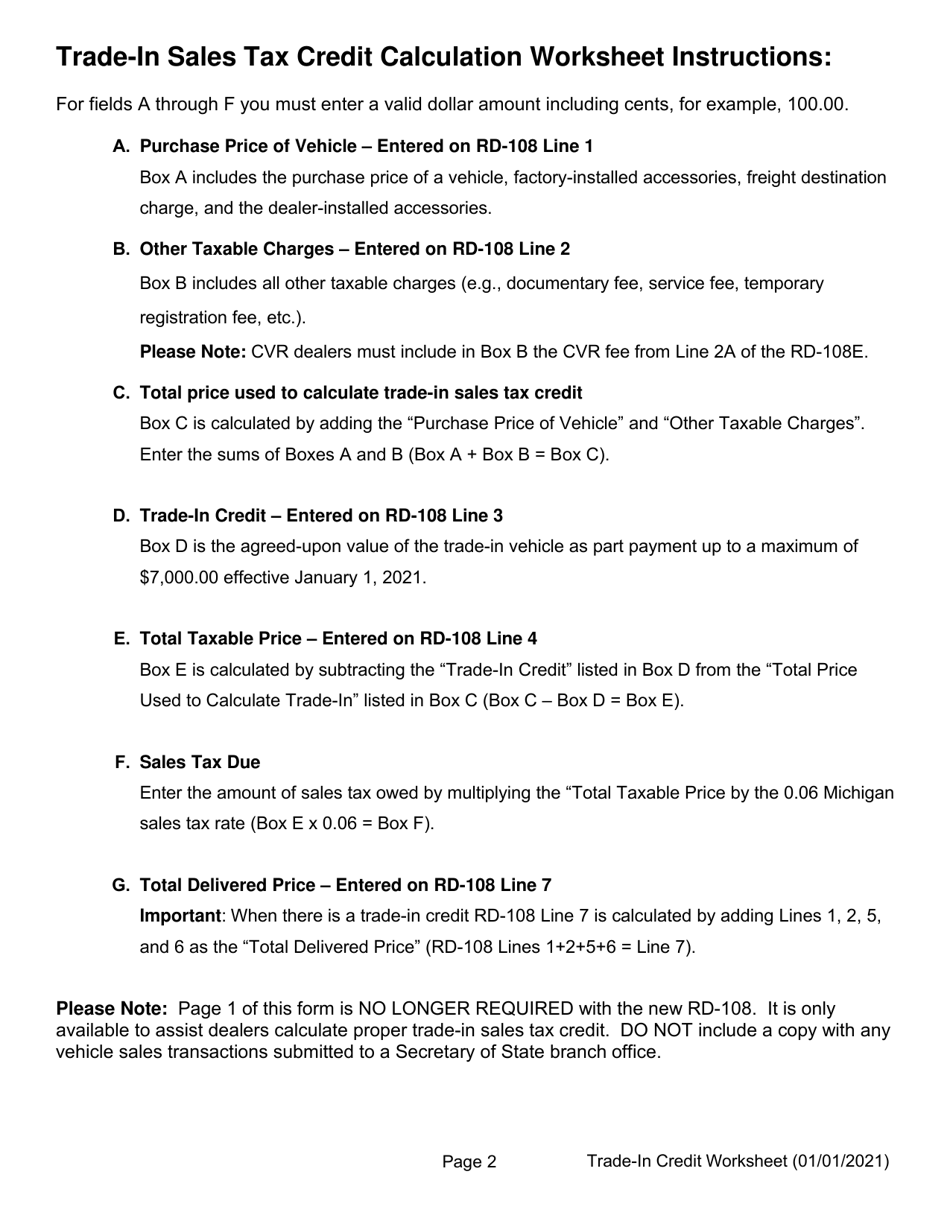

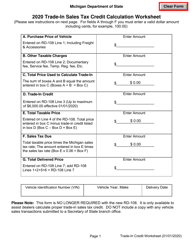

Trade-In Sales Tax Credit Calculation Worksheet - Michigan

Trade-In Sales Tax Credit Calculation Worksheet is a legal document that was released by the Michigan Department of State - a government authority operating within Michigan.

FAQ

Q: What is the Trade-In Sales Tax Credit?

A: The Trade-In Sales Tax Credit is a credit that allows you to reduce the sales tax paid on the purchase of a vehicle by the value of the trade-in vehicle.

Q: How is the Trade-In Sales Tax Credit calculated in Michigan?

A: The Trade-In Sales Tax Credit is calculated by subtracting the agreed-upon value of the trade-in vehicle from the total purchase price of the new vehicle.

Q: Is there a maximum amount for the Trade-In Sales Tax Credit in Michigan?

A: Yes, the maximum amount for the Trade-In Sales Tax Credit in Michigan is $3,500.

Q: Are all vehicles eligible for the Trade-In Sales Tax Credit in Michigan?

A: No, only passenger vehicles, motor homes, and pickup trucks weighing less than 8,000 pounds are eligible for the Trade-In Sales Tax Credit in Michigan.

Q: What documents are required to claim the Trade-In Sales Tax Credit in Michigan?

A: You will need to provide proof of ownership of the trade-in vehicle, such as the title or registration, as well as the purchase agreement or bill of sale for the new vehicle.

Q: Can I claim the Trade-In Sales Tax Credit for multiple trade-in vehicles?

A: No, the Trade-In Sales Tax Credit can only be claimed for one trade-in vehicle per new vehicle purchase.

Q: Do I need to itemize deductions to claim the Trade-In Sales Tax Credit in Michigan?

A: No, you do not need to itemize deductions to claim the Trade-In Sales Tax Credit in Michigan. It is a separate credit that can be claimed in addition to the standard deduction.

Q: Can I claim the Trade-In Sales Tax Credit if I purchased a vehicle in a different state?

A: No, the Trade-In Sales Tax Credit can only be claimed for vehicles purchased in Michigan.

Q: How do I claim the Trade-In Sales Tax Credit in Michigan?

A: To claim the Trade-In Sales Tax Credit in Michigan, you will need to complete the Trade-In Sales Tax Credit Calculation Worksheet and submit it with your Michigan income tax return.

Q: Is the Trade-In Sales Tax Credit refundable in Michigan?

A: No, the Trade-In Sales Tax Credit is not refundable in Michigan. It can only be used to offset the amount of sales tax owed on the new vehicle purchase.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Michigan Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of State.