This version of the form is not currently in use and is provided for reference only. Download this version of

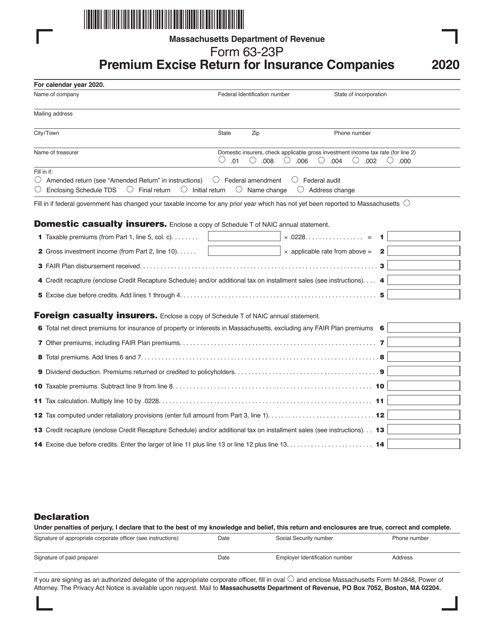

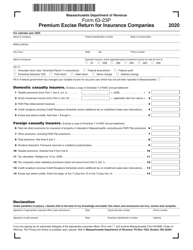

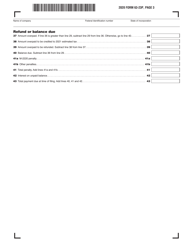

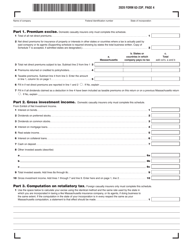

Form 63-23P

for the current year.

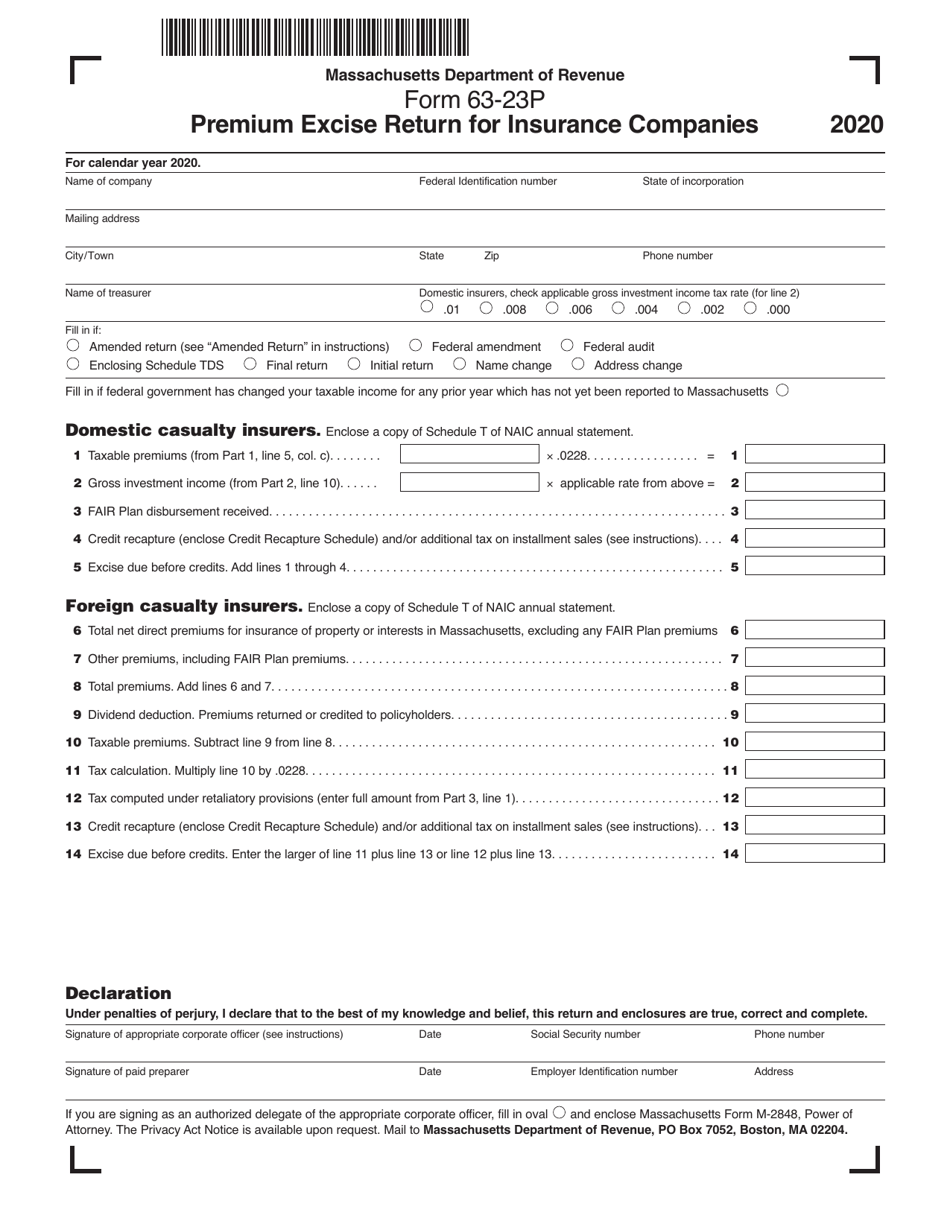

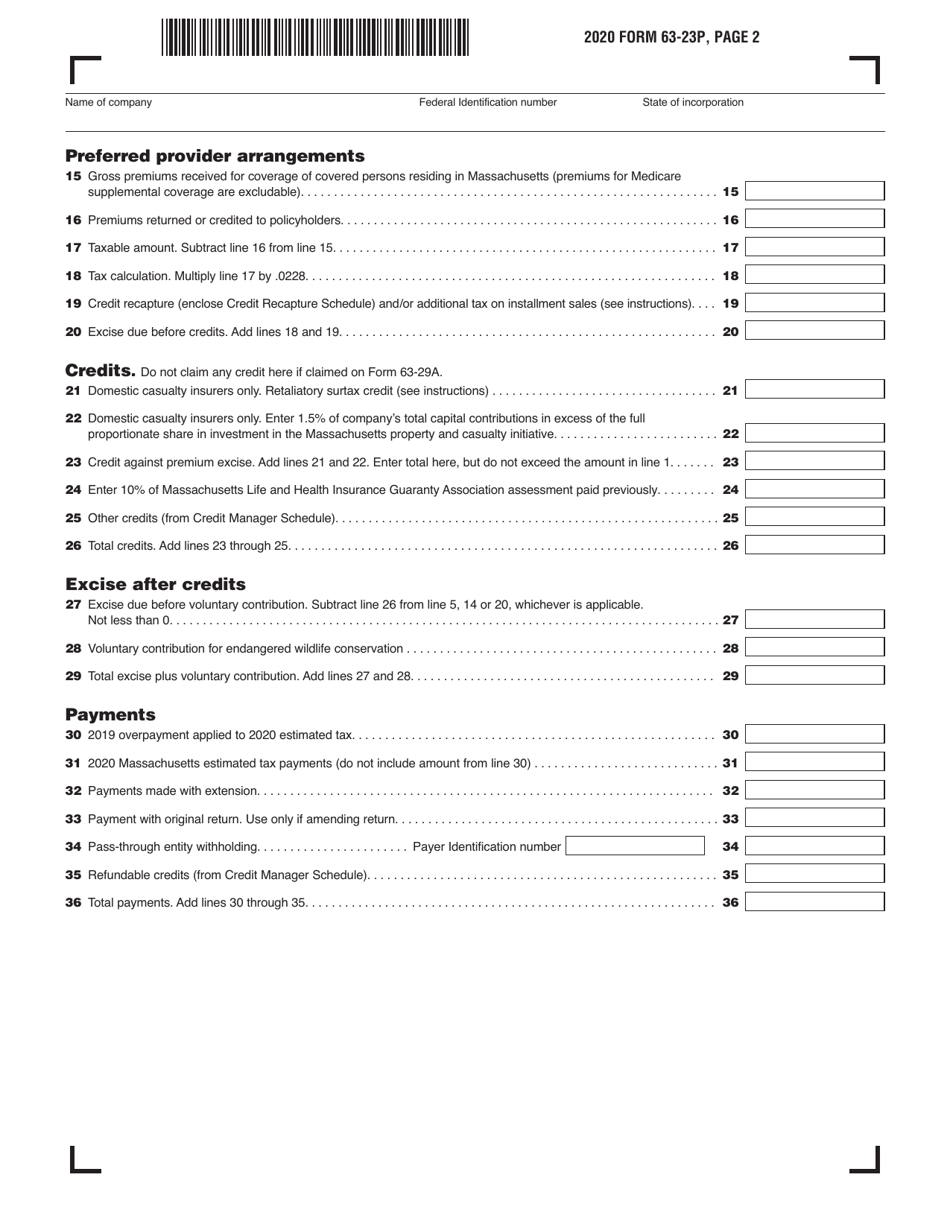

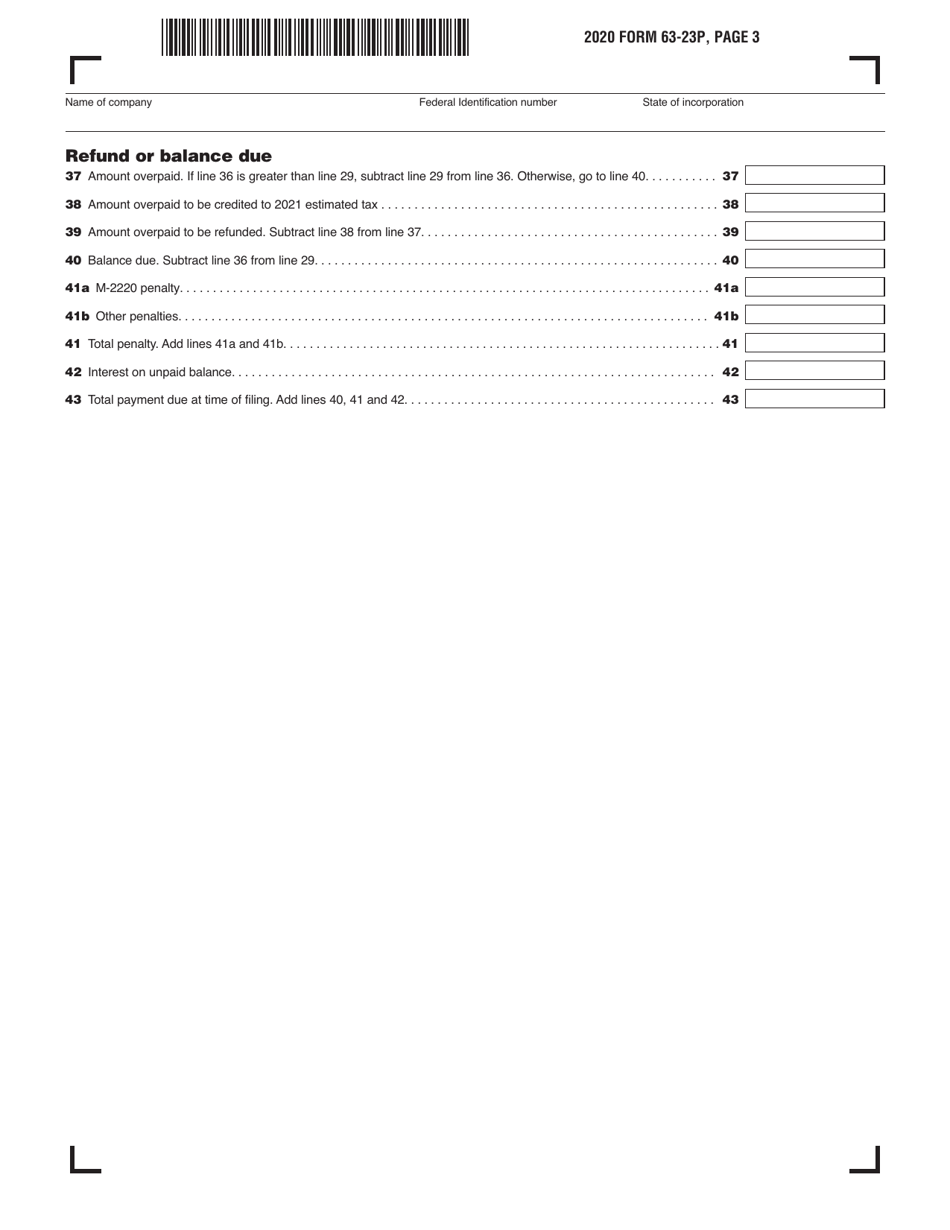

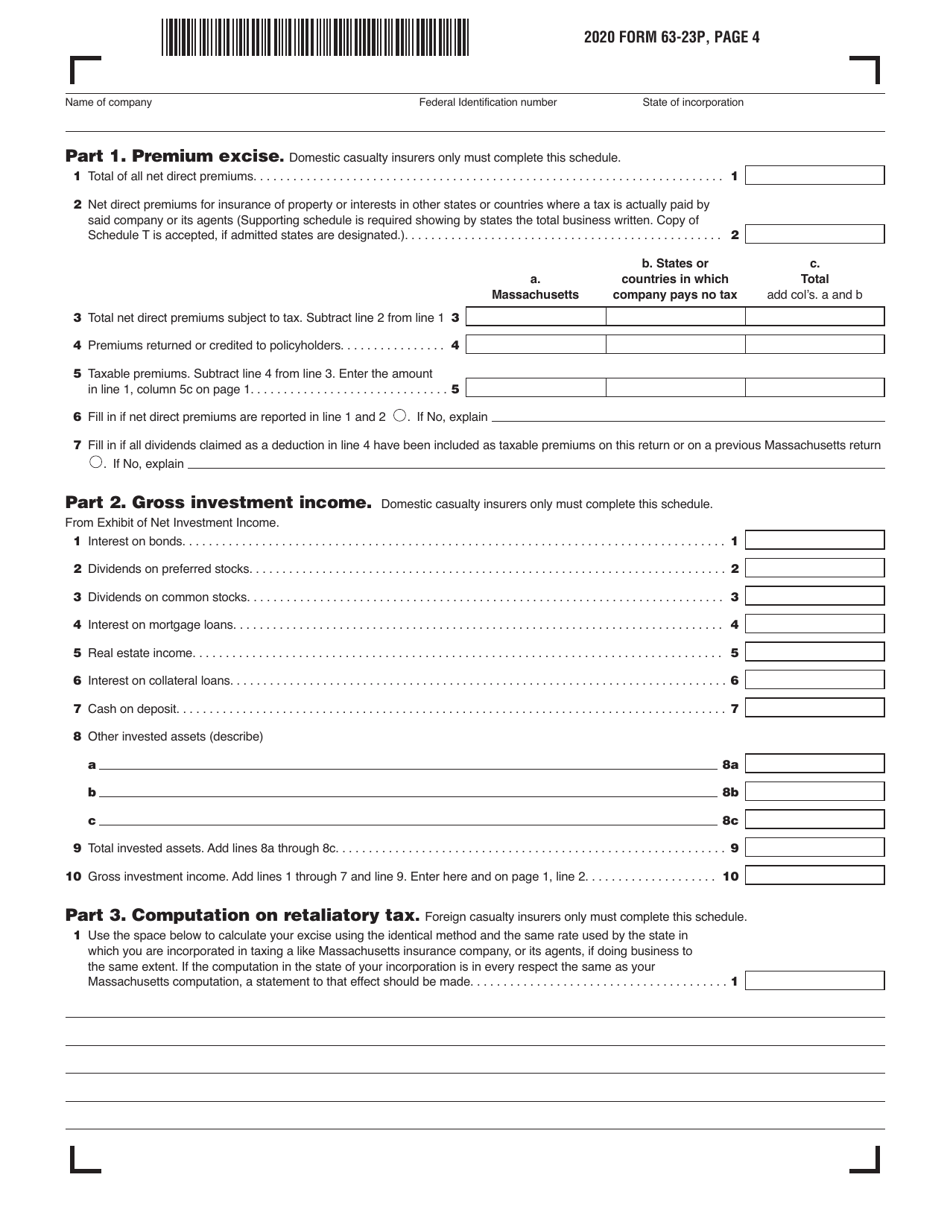

Form 63-23P Premium Excise Return for Insurance Companies - Massachusetts

What Is Form 63-23P?

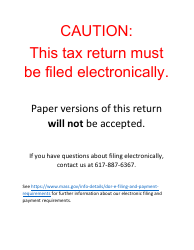

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 63-23P?

A: Form 63-23P is the Premium Excise Return for Insurance Companies in Massachusetts.

Q: Who needs to file Form 63-23P?

A: Insurance companies operating in Massachusetts need to file Form 63-23P.

Q: What is the purpose of Form 63-23P?

A: Form 63-23P is used to report and pay the premium excise tax by insurance companies in Massachusetts.

Q: When is Form 63-23P due?

A: Form 63-23P is due annually on or before March 15th.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the premium excise tax requirements. It is important to file and pay on time to avoid penalties.

Q: What are the consequences of not filing Form 63-23P?

A: Failure to file Form 63-23P or paying the premium excise tax can result in penalties and interest charges.

Q: Are there any exemptions or deductions available?

A: Yes, there are exemptions and deductions available for certain insurance companies. It is important to review the instructions and consult with a tax professional to determine eligibility.

Q: What should I do if I have questions or need assistance with Form 63-23P?

A: If you have questions or need assistance with Form 63-23P, you should contact the Massachusetts Department of Revenue for guidance and support.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-23P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.