This version of the form is not currently in use and is provided for reference only. Download this version of

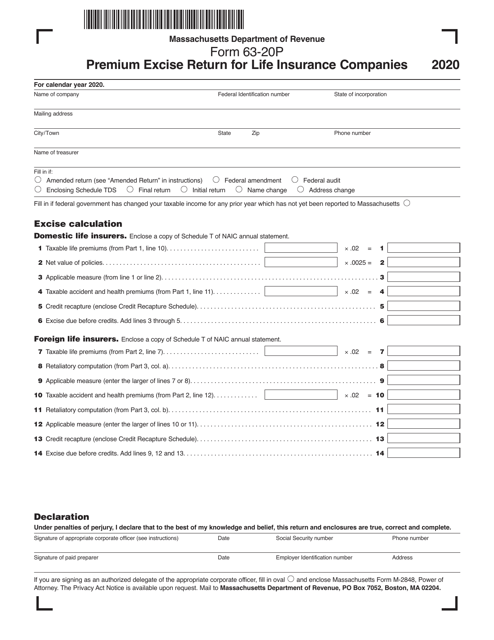

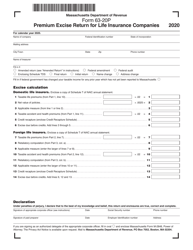

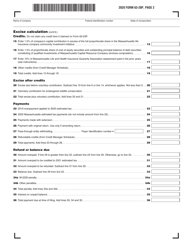

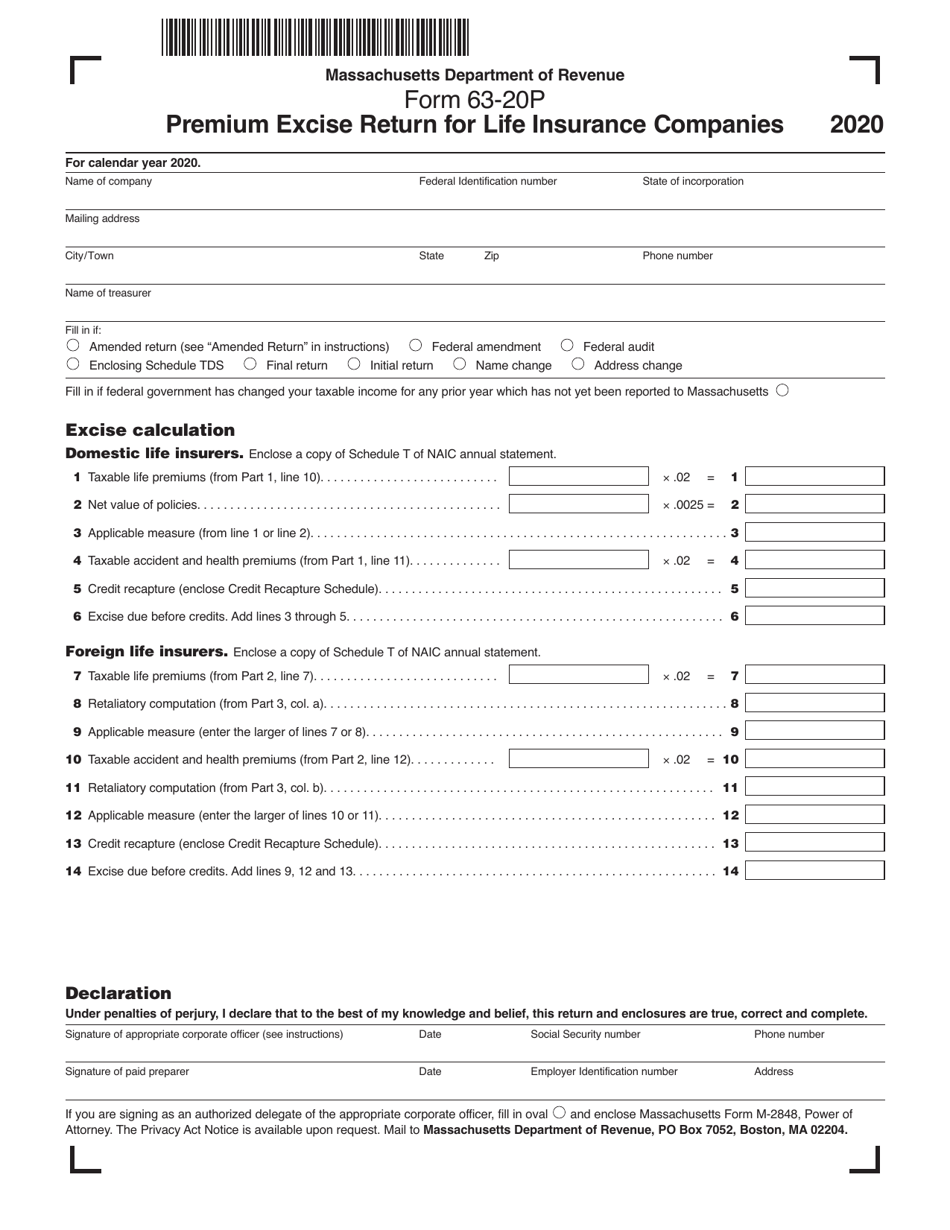

Form 63-20P

for the current year.

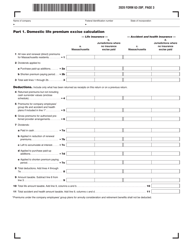

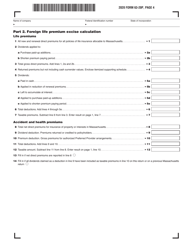

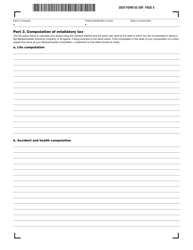

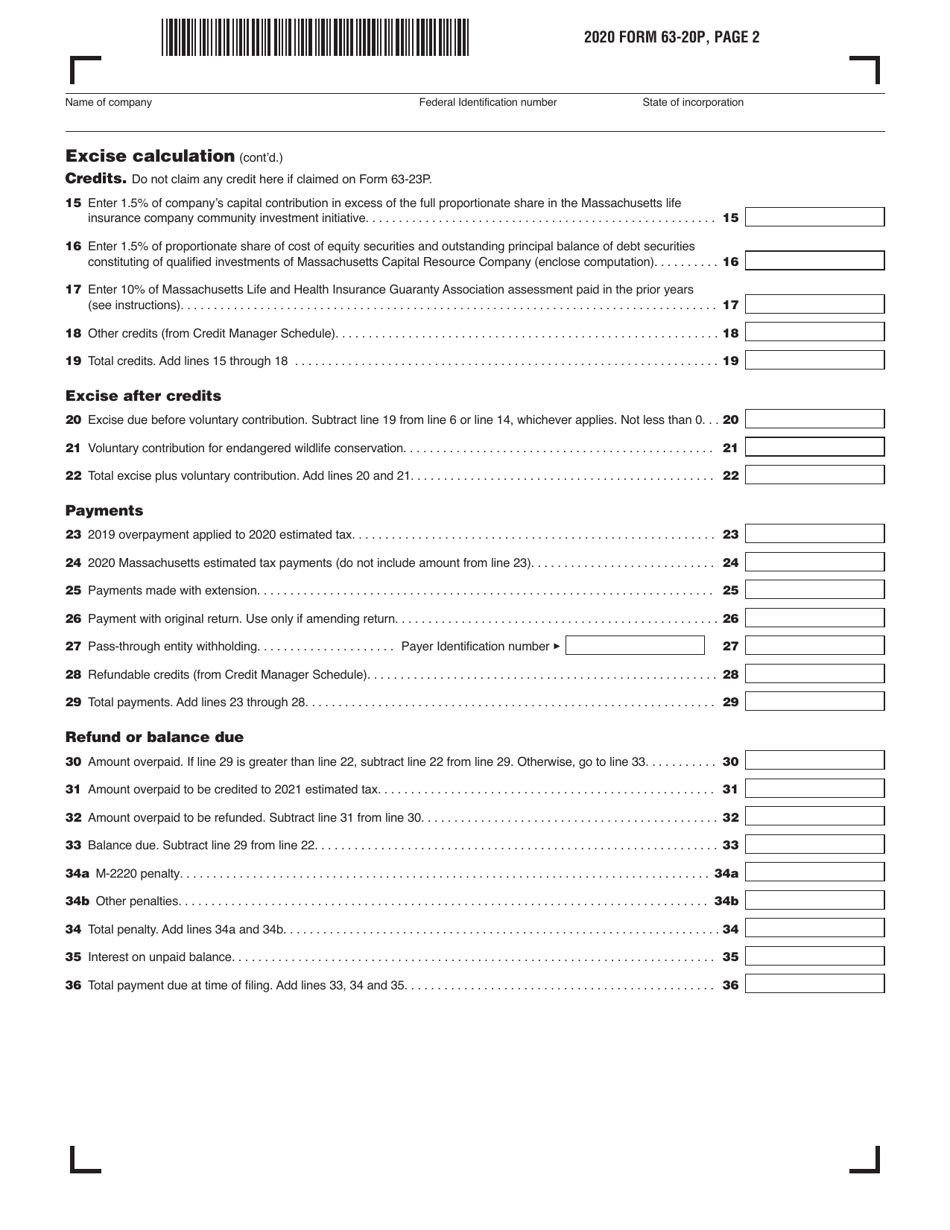

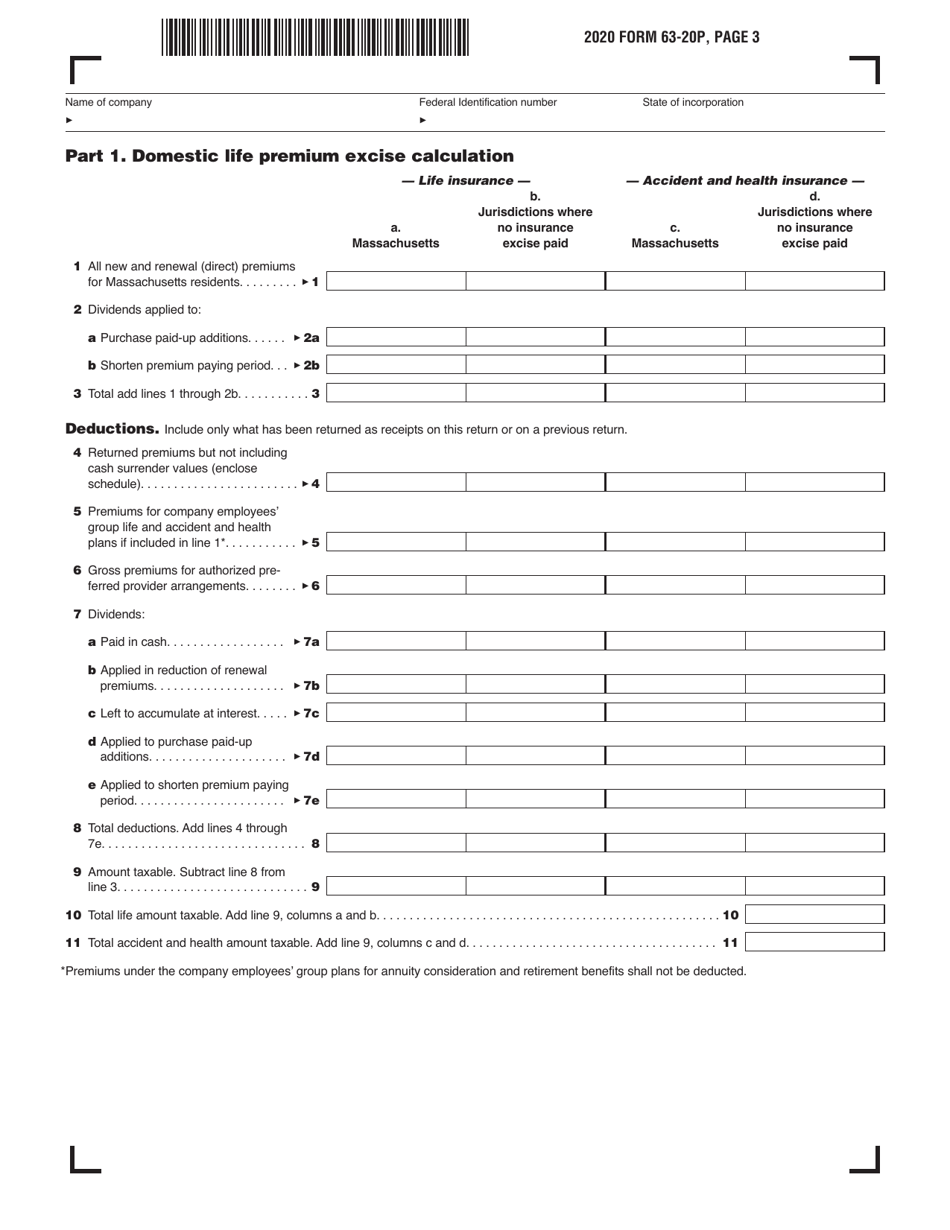

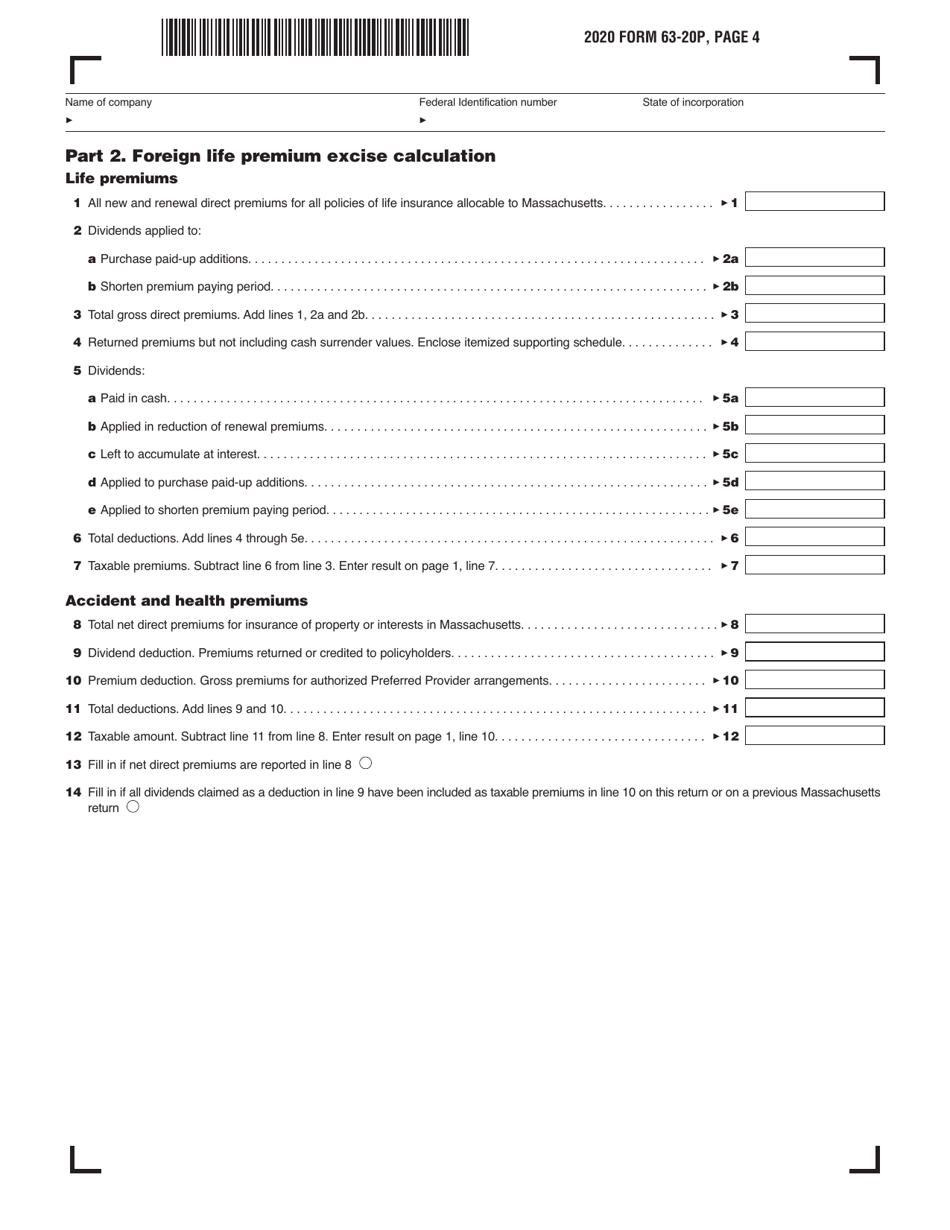

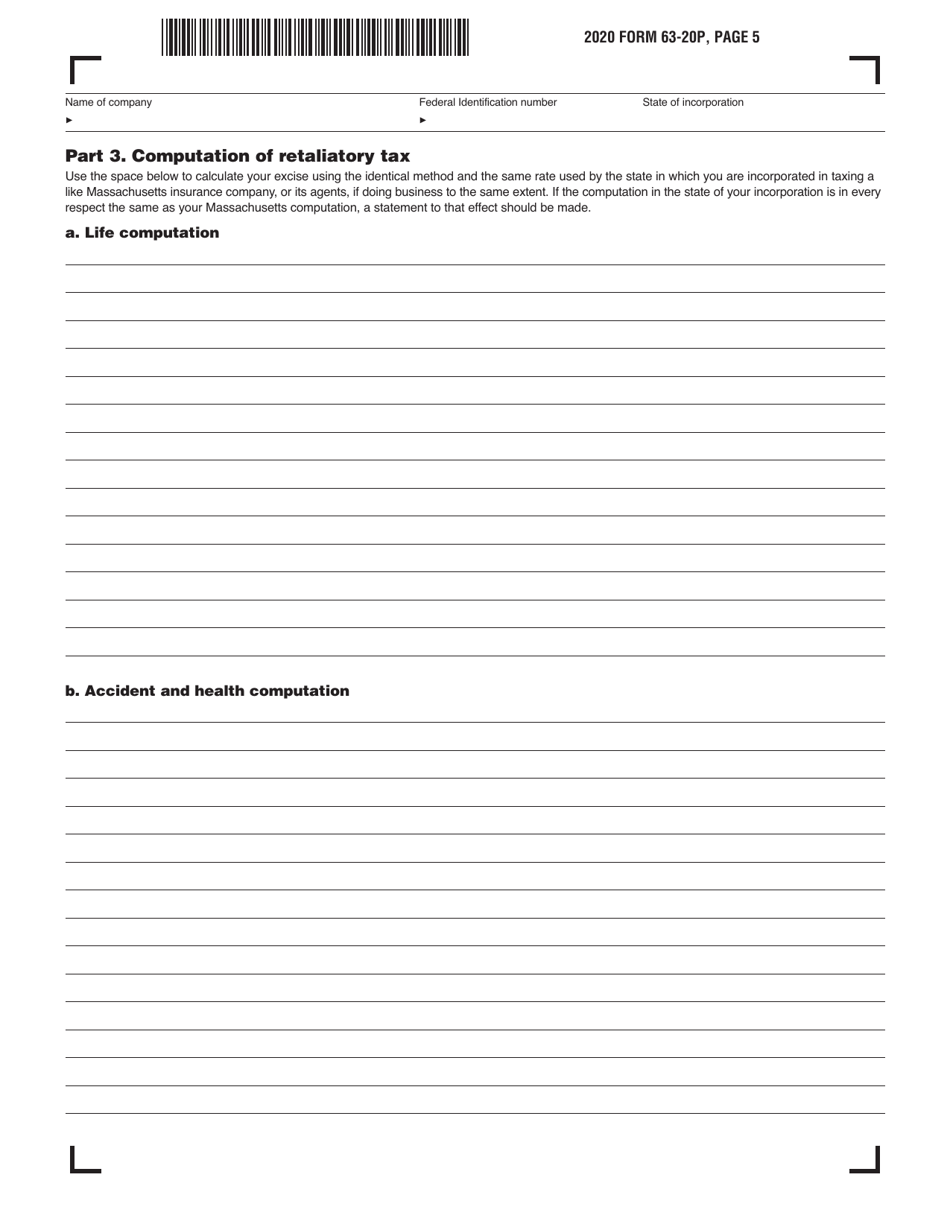

Form 63-20P Premium Excise Return for Life Insurance Companies - Massachusetts

What Is Form 63-20P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 63-20P?

A: Form 63-20P is the Premium Excise Return for Life Insurance Companies in Massachusetts.

Q: Who is required to file Form 63-20P?

A: Life insurance companies in Massachusetts are required to file Form 63-20P.

Q: What is the purpose of Form 63-20P?

A: The purpose of Form 63-20P is for life insurance companies to report and pay the premium excise tax in Massachusetts.

Q: When is Form 63-20P due?

A: Form 63-20P is generally due on or before March 15th of the year following the taxable year.

Q: Are there any penalties for late filing of Form 63-20P?

A: Yes, there may be penalties for late filing or failure to file Form 63-20P.

Q: Is Form 63-20P specific to Massachusetts?

A: Yes, Form 63-20P is specific to life insurance companies in Massachusetts.

Q: Are there any exemptions for filing Form 63-20P?

A: Certain life insurance companies may be eligible for exemptions from filing Form 63-20P.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-20P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.