This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2

for the current year.

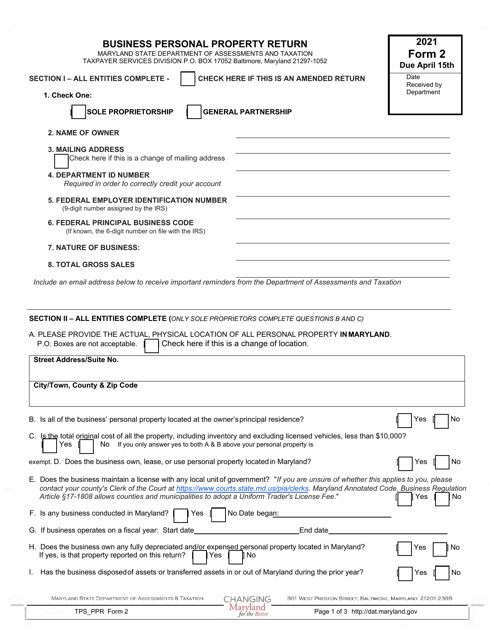

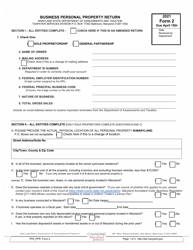

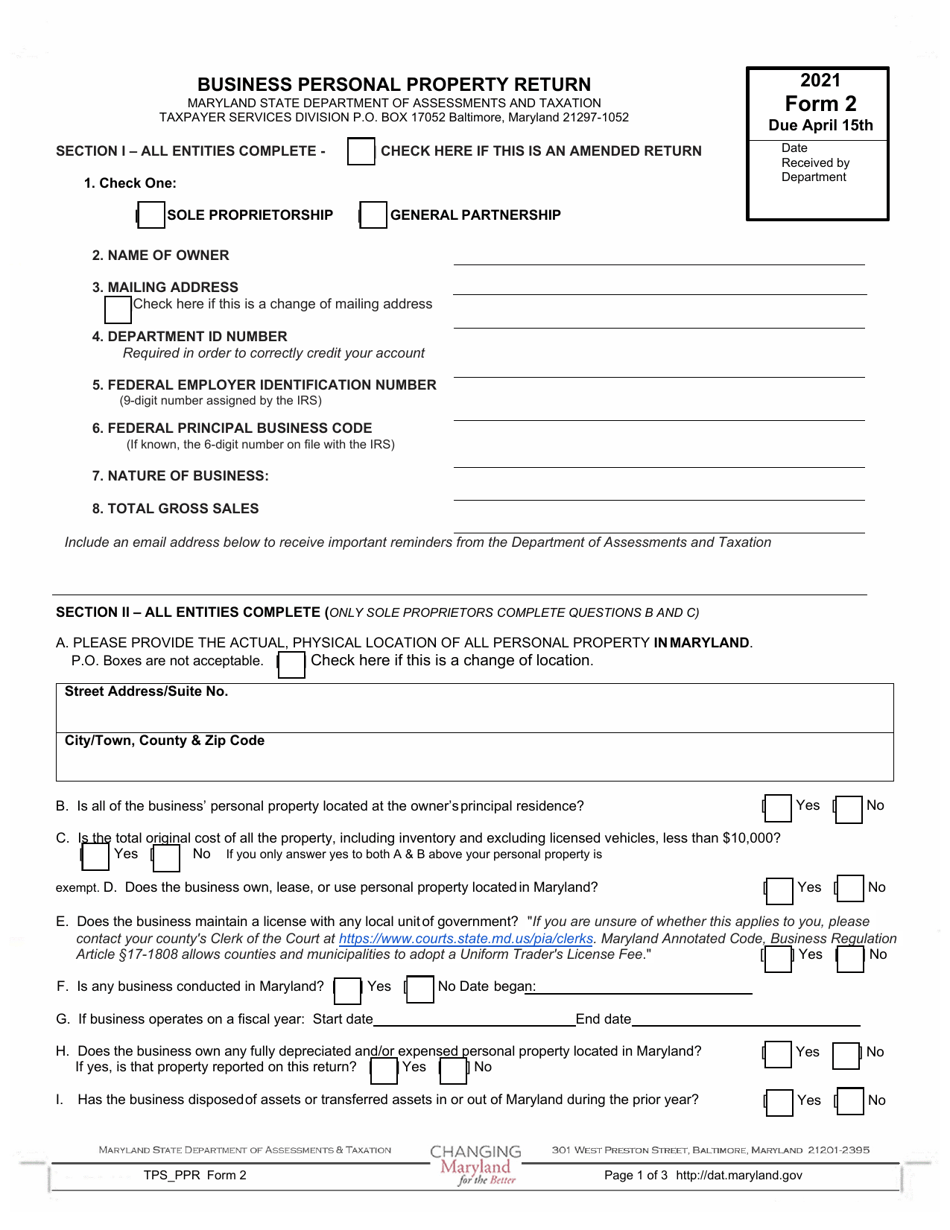

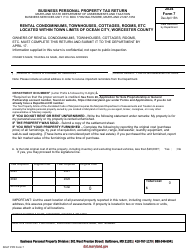

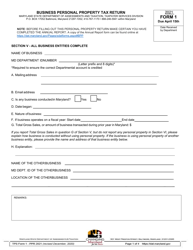

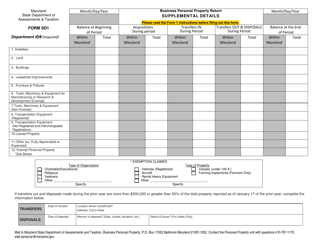

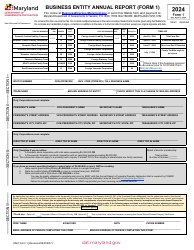

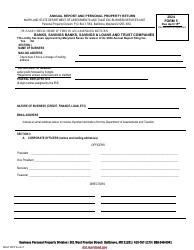

Form 2 Business Personal Property Return - Maryland

What Is Form 2?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a Form 2 Business Personal Property Return?

A: Form 2 is a form used in Maryland to report business personal property.

Q: Who needs to file a Form 2 Business Personal Property Return?

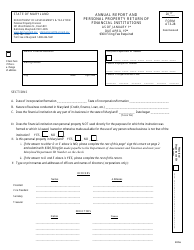

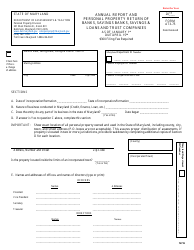

A: Businesses and individuals who own taxable personal property used in a trade or business in Maryland need to file this form.

Q: When is the deadline to file a Form 2 Business Personal Property Return?

A: The deadline to file a Form 2 Business Personal Property Return in Maryland is April 15th.

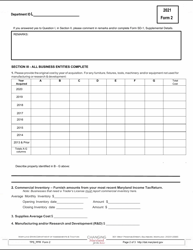

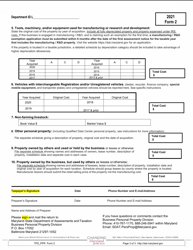

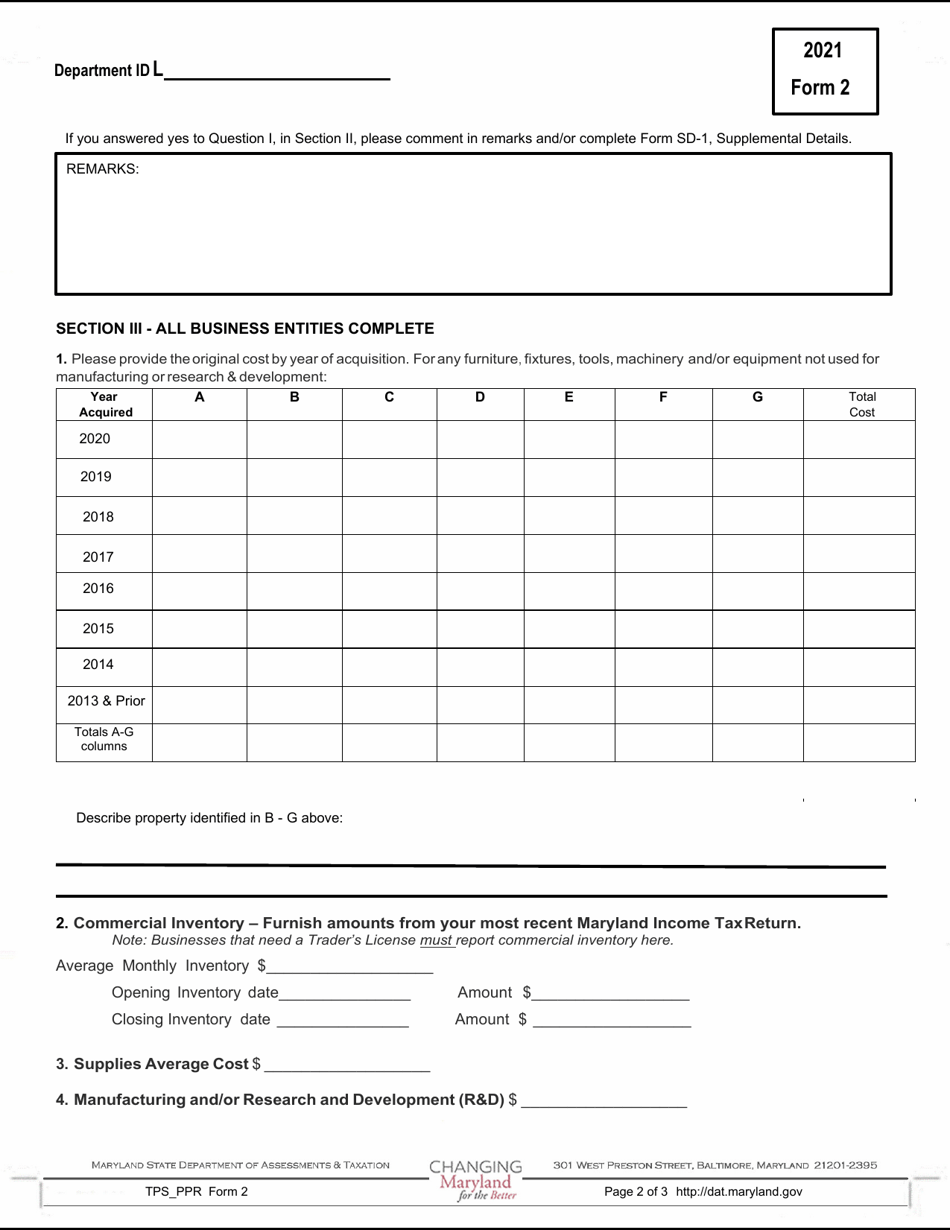

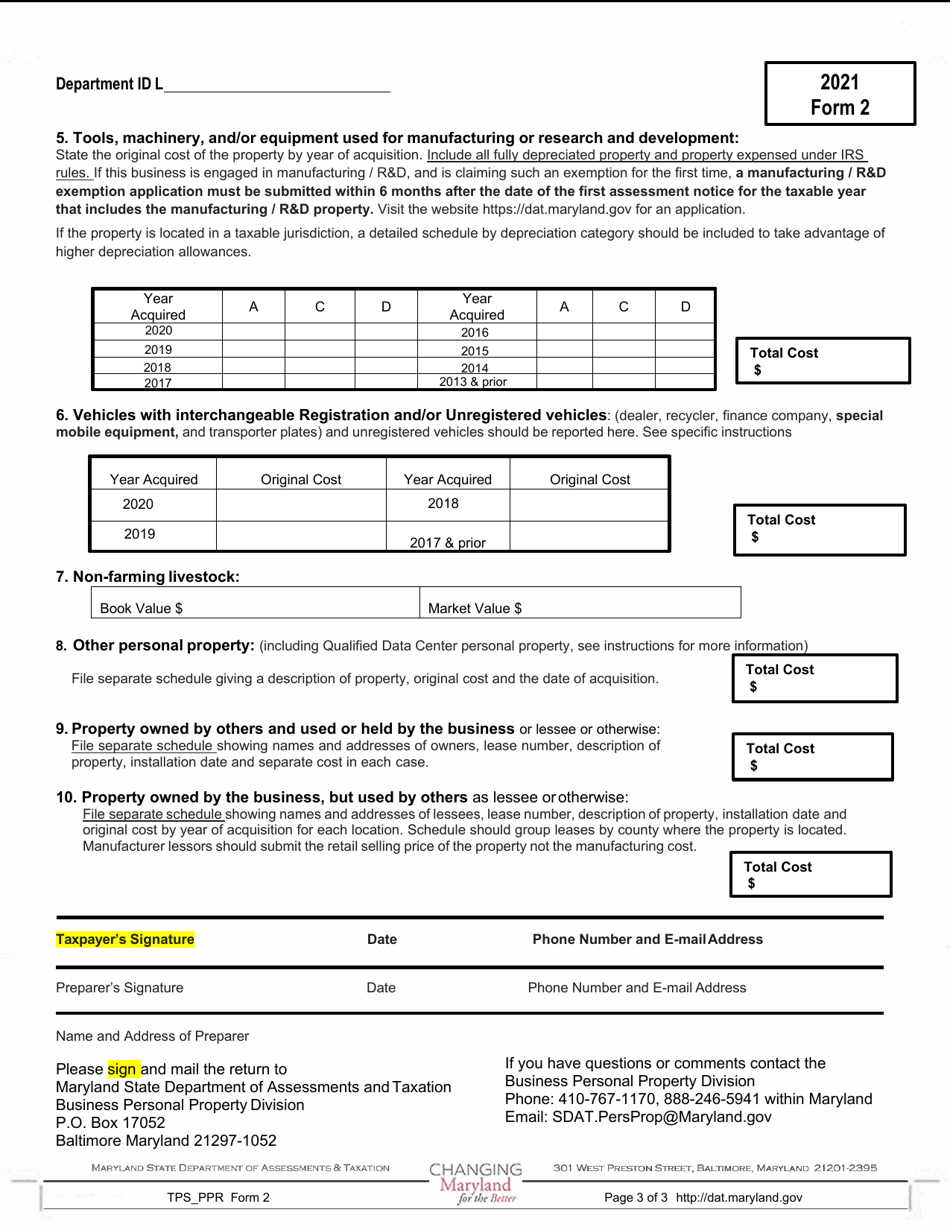

Q: What information is required on a Form 2 Business Personal Property Return?

A: The form requires information such as a detailed listing of business personal property, including its cost and acquisition date.

Q: Are there any exemptions for filing a Form 2 Business Personal Property Return?

A: Yes, there are exemptions for certain types of personal property, such as inventory held for sale or property used solely for residential purposes.

Q: Are there any penalties for not filing a Form 2 Business Personal Property Return?

A: Yes, failure to file or filing a late return may result in penalties and interest, as determined by the Maryland Comptroller's Office.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.