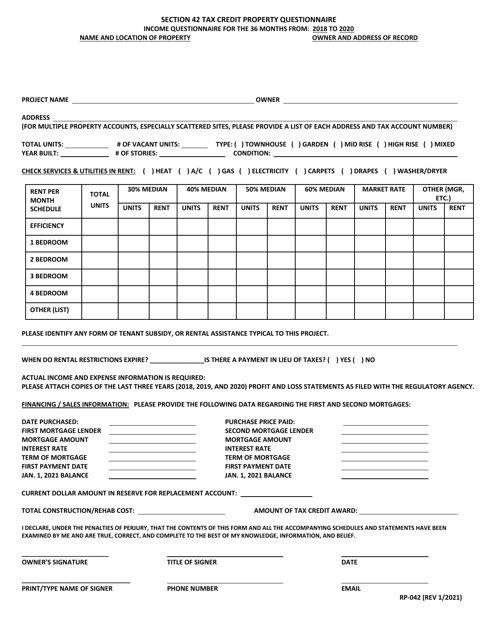

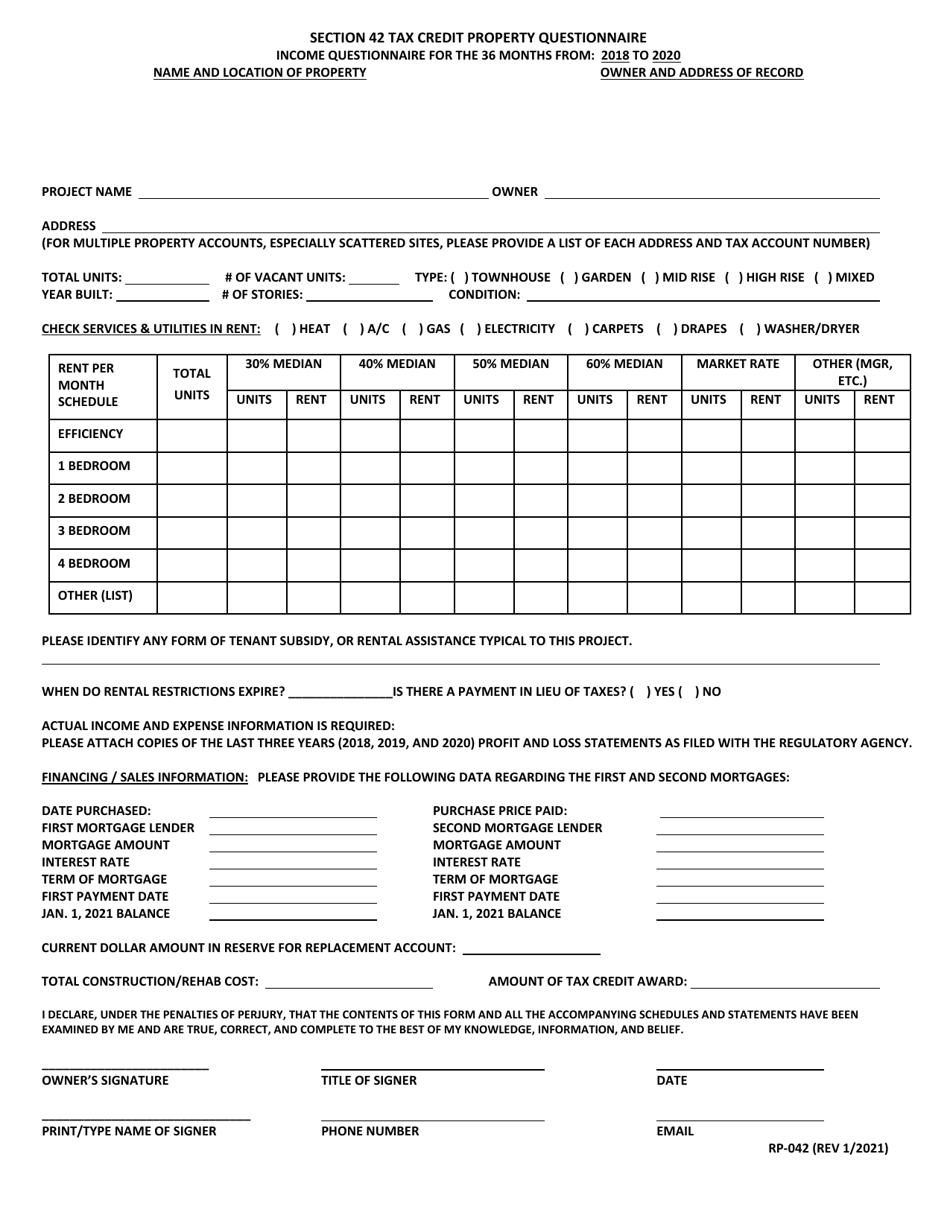

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-042

for the current year.

Form RP-042 Section 42 Tax Credit Property Questionnaire - Maryland

What Is Form RP-042?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-042?

A: Form RP-042 is a questionnaire for Section 42 tax credit properties in Maryland.

Q: Who needs to complete Form RP-042?

A: Owners or managers of Section 42 tax credit properties in Maryland need to complete this form.

Q: What is a Section 42 tax credit property?

A: A Section 42 tax credit property is a rental property that provides affordable housing to low-income individuals and families.

Q: What is the purpose of Form RP-042?

A: The purpose of Form RP-042 is to collect information about the Section 42 tax credit property, including tenant income and compliance with program requirements.

Q: When is Form RP-042 due?

A: The due date for Form RP-042 varies, but it is typically required to be filed annually.

Q: What happens if I don't complete Form RP-042?

A: Failure to complete Form RP-042 or provide false information can result in penalties or the loss of tax credits for the property.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RP-042 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.