This version of the form is not currently in use and is provided for reference only. Download this version of

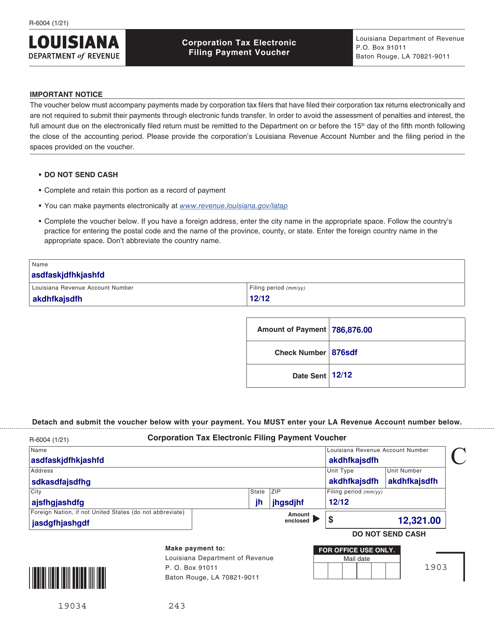

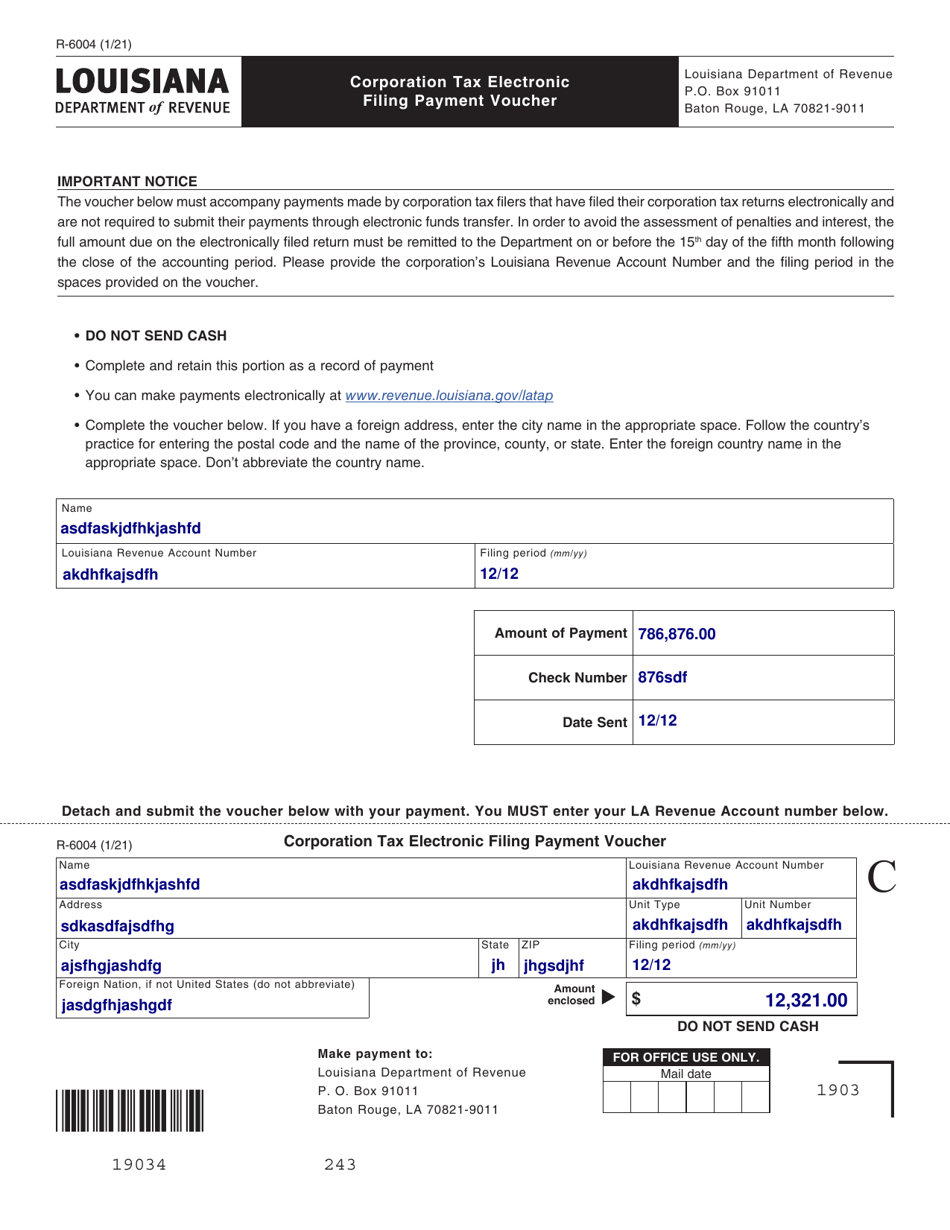

Form R-6004

for the current year.

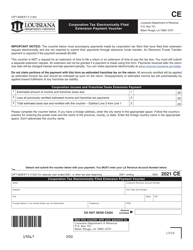

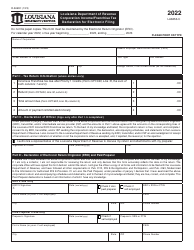

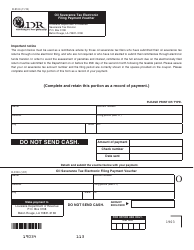

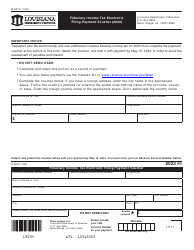

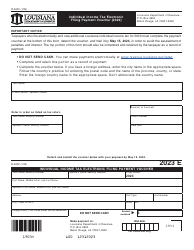

Form R-6004 Corporation Tax Electronic Filing Payment Voucher - Louisiana

What Is Form R-6004?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6004?

A: Form R-6004 is a Corporation TaxElectronic Filing Payment Voucher used in Louisiana.

Q: What is the purpose of Form R-6004?

A: The purpose of Form R-6004 is to make electronic tax payments for corporations in Louisiana.

Q: Who needs to file Form R-6004?

A: Corporations in Louisiana who are required to make tax payments electronically need to file Form R-6004.

Q: Are all corporations required to file Form R-6004?

A: No, only corporations in Louisiana that are required to make tax payments electronically need to file Form R-6004.

Q: Can Form R-6004 be filed electronically?

A: Yes, Form R-6004 can be filed electronically as it is a Corporation Tax Electronic Filing Payment Voucher.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6004 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.