This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-6466V

for the current year.

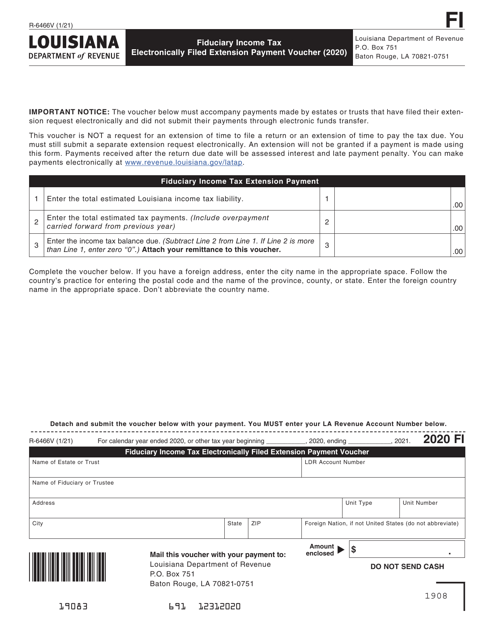

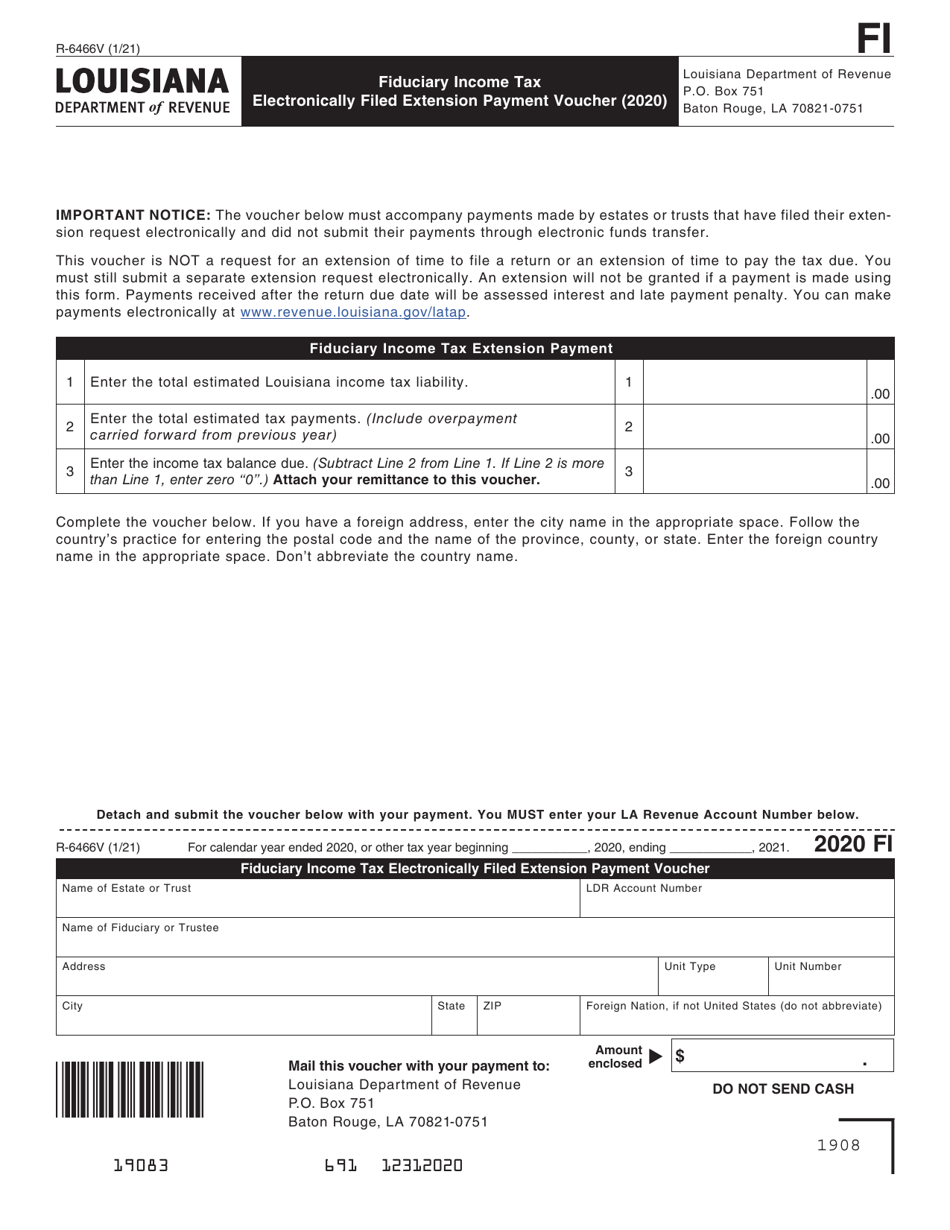

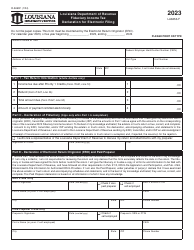

Form R-6466V Fiduciary Income Tax Electronically Filed Extension Payment Voucher - Louisiana

What Is Form R-6466V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6466V?

A: Form R-6466V is a Fiduciary Income Tax Electronically Filed Extension Payment Voucher used in Louisiana.

Q: What is the purpose of Form R-6466V?

A: The purpose of Form R-6466V is to make an extension payment for fiduciary income tax electronically.

Q: Who needs to use Form R-6466V?

A: Form R-6466V is used by fiduciaries who need to make an extension payment for their income tax in Louisiana.

Q: Is Form R-6466V specific to Louisiana?

A: Yes, Form R-6466V is specific to Louisiana and is used for fiduciary income tax payments in the state.

Q: Can Form R-6466V be filed electronically?

A: Yes, Form R-6466V is an electronically filed extension payment voucher for fiduciary income tax in Louisiana.

Q: What information is required on Form R-6466V?

A: Form R-6466V requires basic information such as taxpayer identification number, name, address, and the amount of the extension payment.

Q: When is Form R-6466V due?

A: Form R-6466V is due on or before the original due date of the fiduciary income tax return in Louisiana.

Q: Are there any penalties for late or non-payment using Form R-6466V?

A: Yes, there may be penalties for late or non-payment of the extension amount using Form R-6466V. It is important to file and pay on time to avoid penalties.

Q: Can Form R-6466V be used for any other tax payments?

A: No, Form R-6466V is specifically for fiduciary income tax extension payments in Louisiana and cannot be used for other tax types.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6466V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.