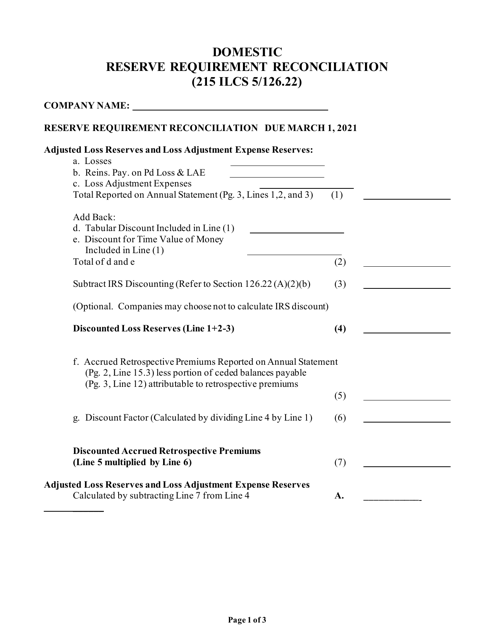

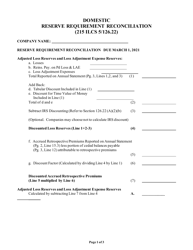

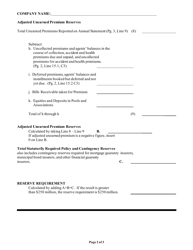

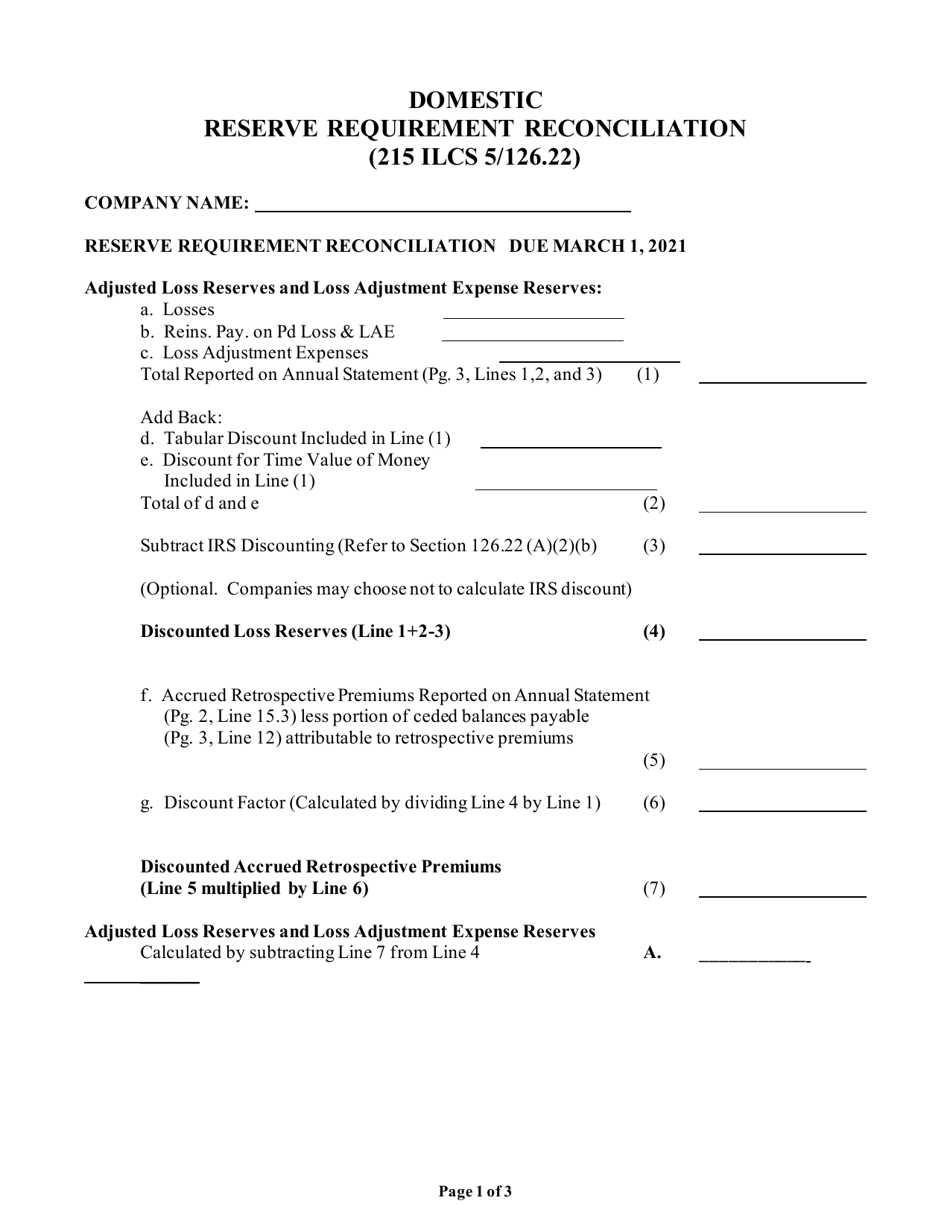

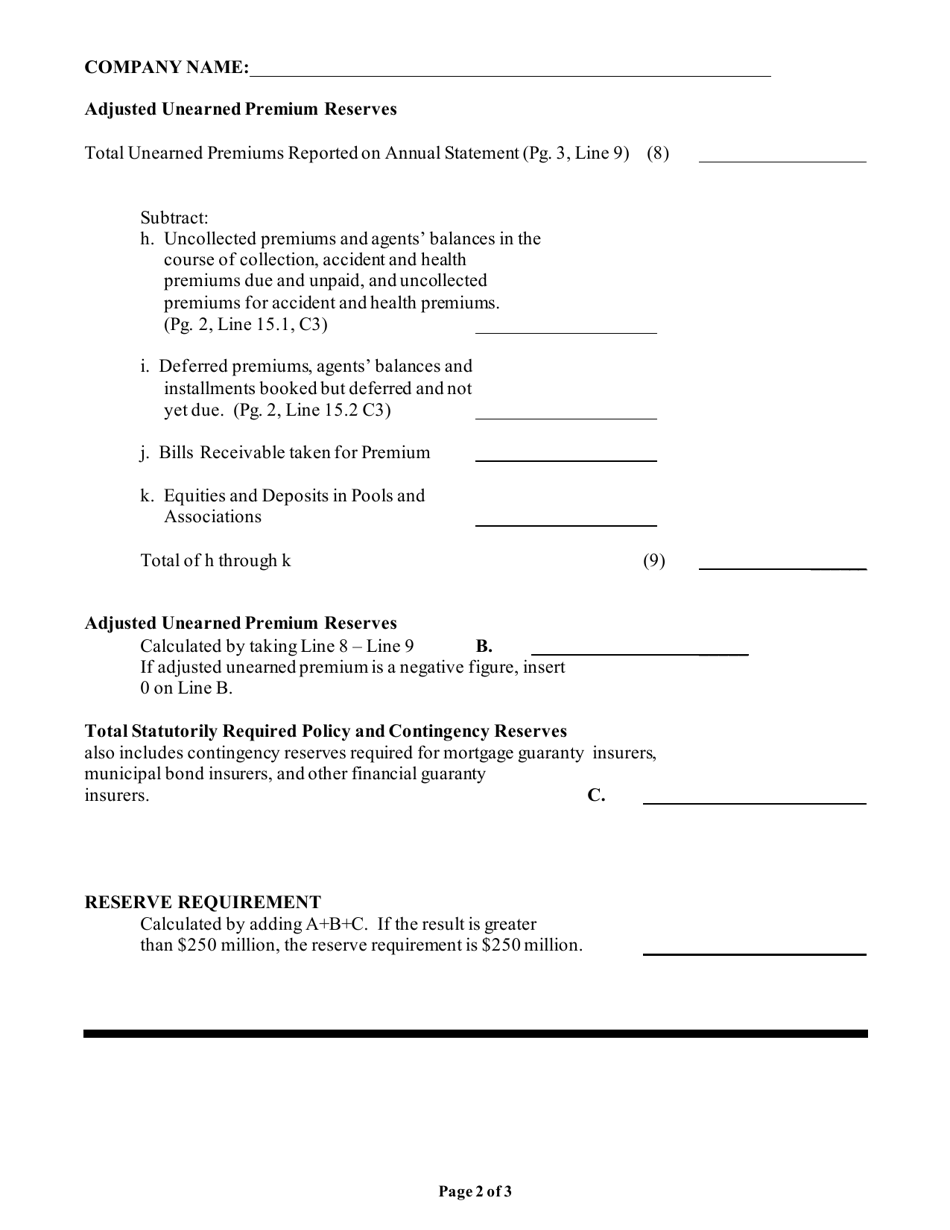

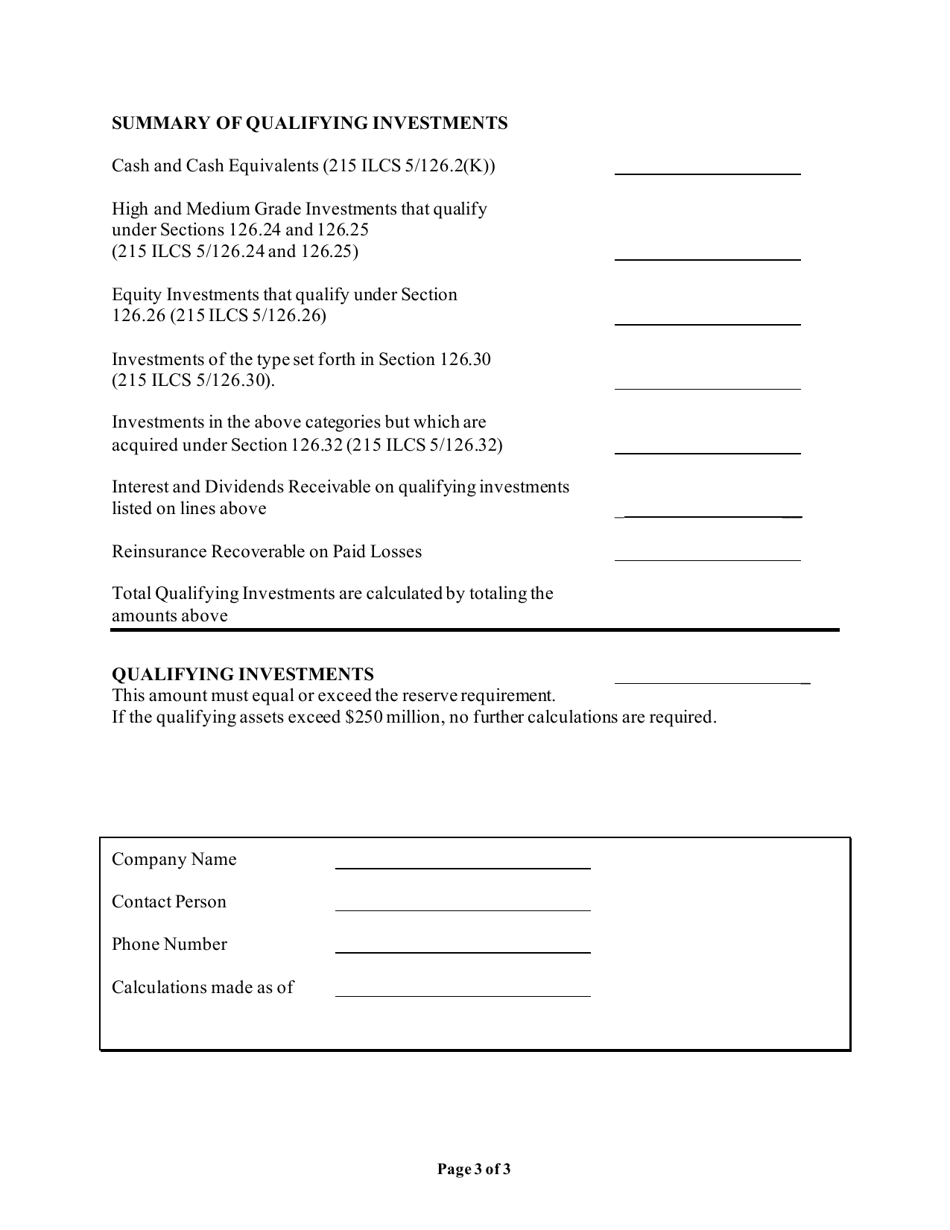

Reserve Requirement Reconciliation - Illinois

Reserve Requirement Reconciliation is a legal document that was released by the Illinois Department of Insurance - a government authority operating within Illinois.

FAQ

Q: What is reserve requirement reconciliation?

A: Reserve requirement reconciliation is a process used by banks to ensure that they are maintaining the required amount of reserves.

Q: What are reserves?

A: Reserves are funds held by banks that are set aside to meet withdrawal demands from customers and other obligations.

Q: Why is reserve requirement reconciliation important?

A: Reserve requirement reconciliation is important to ensure that banks have enough funds to meet customer demands and maintain stability in the financial system.

Q: How is reserve requirement reconciliation conducted?

A: Reserve requirement reconciliation is conducted by comparing the reserves held by banks with the required reserve ratio set by the central bank.

Q: Who sets the required reserve ratio?

A: The required reserve ratio is set by the central bank, such as the Federal Reserve in the United States and the Bank of Canada in Canada.

Q: What happens if a bank fails to meet the reserve requirement?

A: If a bank fails to meet the reserve requirement, it may face penalties and restrictions on its operations.

Q: Is reserve requirement reconciliation specific to Illinois?

A: No, reserve requirement reconciliation is a standard practice followed by banks across the United States and Canada, not limited to Illinois.

Form Details:

- The latest edition currently provided by the Illinois Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.