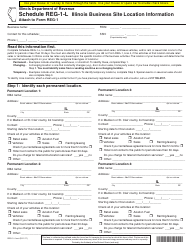

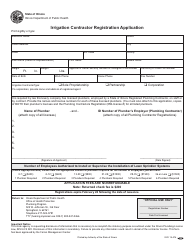

This version of the form is not currently in use and is provided for reference only. Download this version of

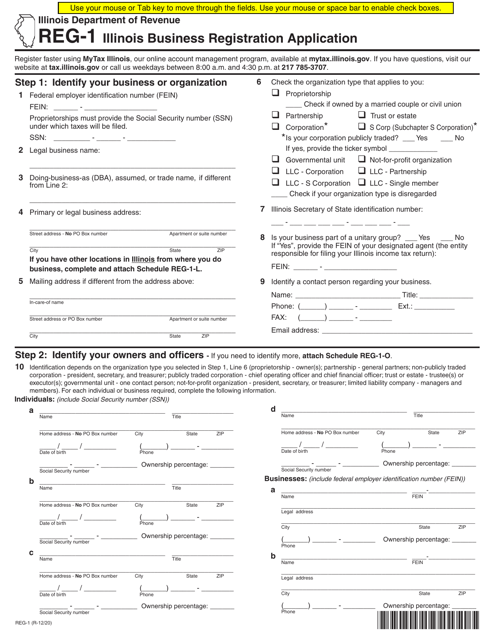

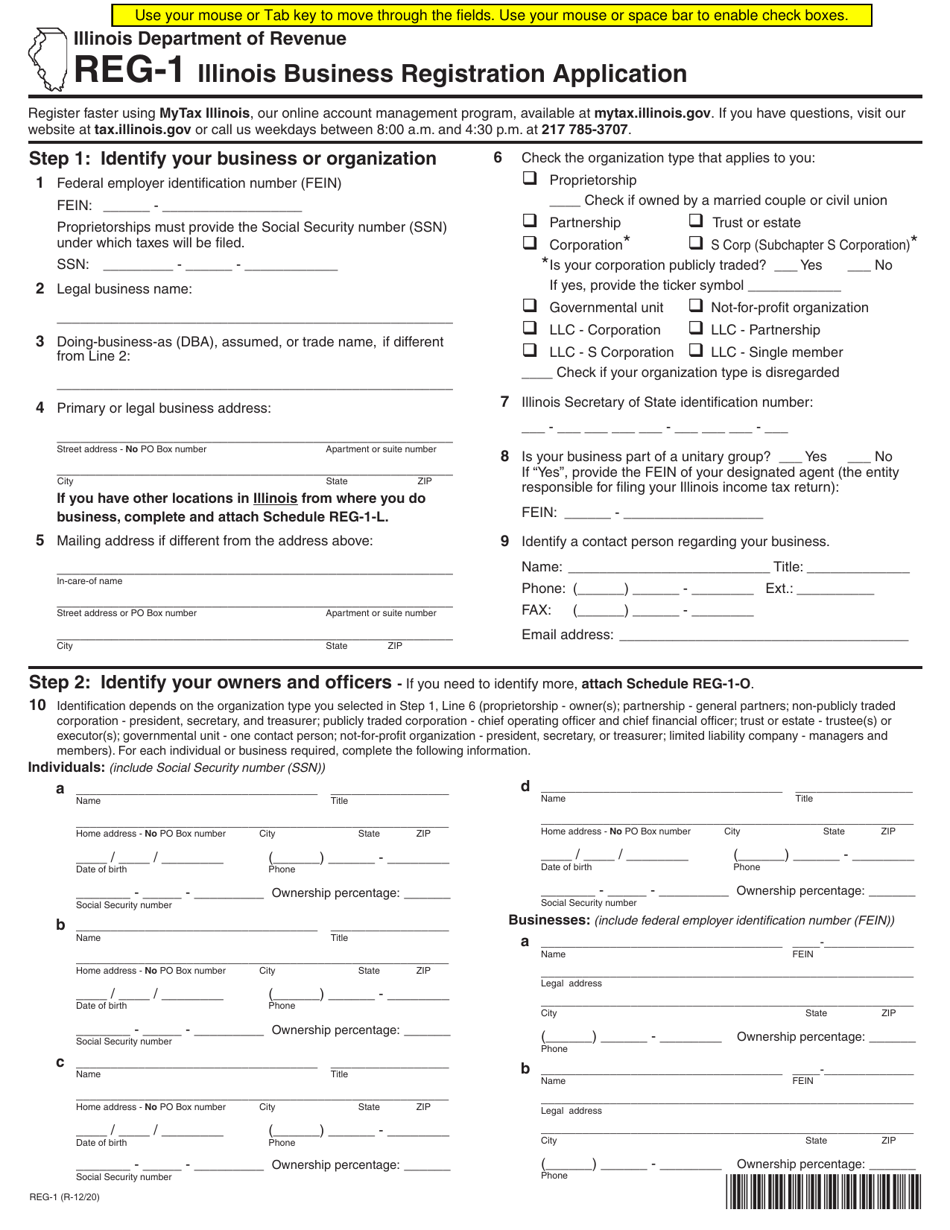

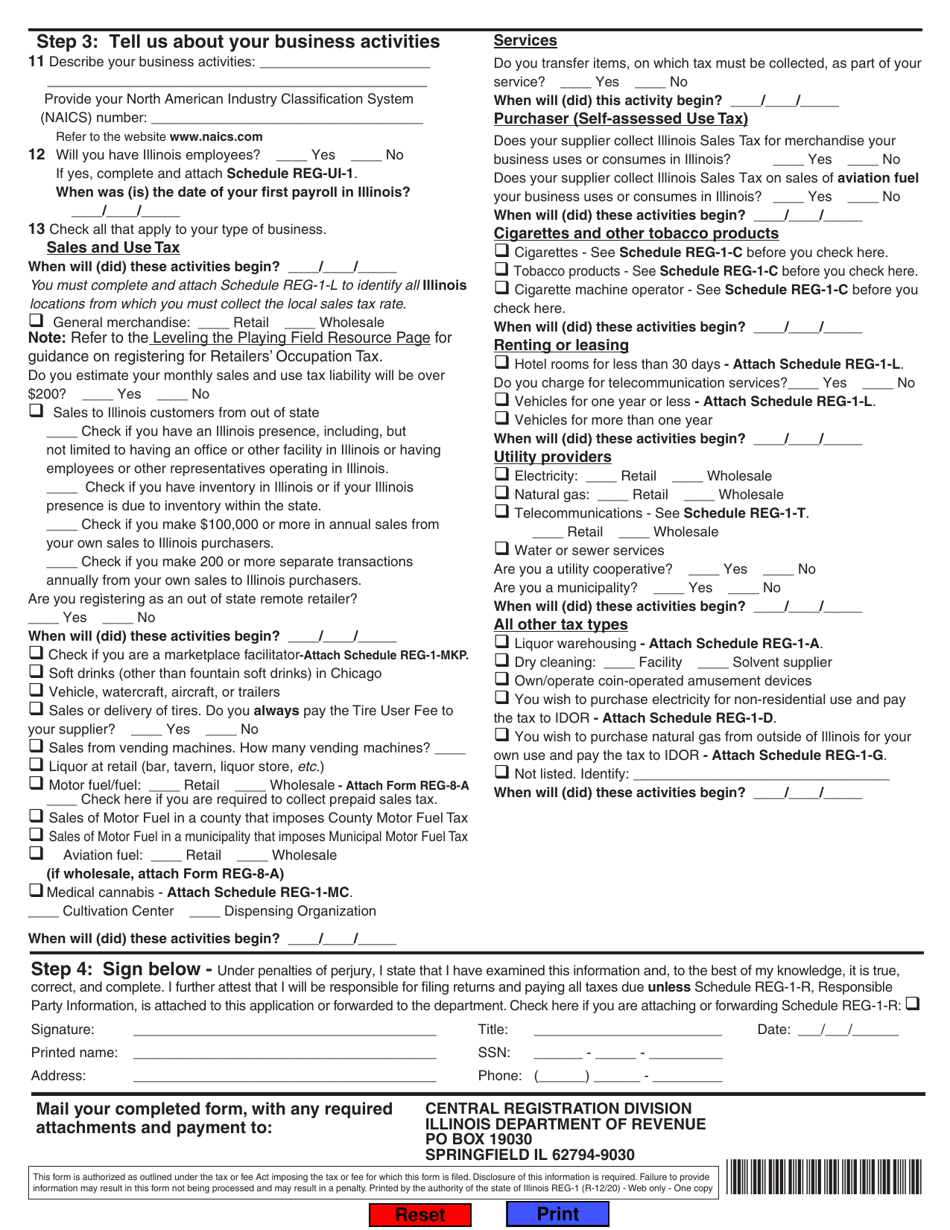

Form REG-1

for the current year.

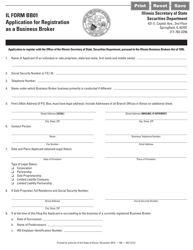

Form REG-1 Illinois Business Registration Application - Illinois

What Is Form REG-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-1?

A: Form REG-1 is the Illinois Business Registration Application.

Q: What is the purpose of Form REG-1?

A: The purpose of Form REG-1 is to register a business in the state of Illinois.

Q: Who needs to file Form REG-1?

A: Any individual or entity engaging in business activities in Illinois needs to file Form REG-1.

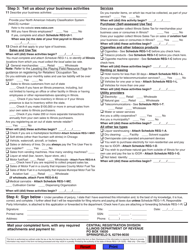

Q: What information is required on Form REG-1?

A: Form REG-1 requires information about the business, its owners, and its activities.

Q: Is there a fee to file Form REG-1?

A: Yes, there is a fee to file Form REG-1. The fee amount varies depending on the type of business.

Q: When should Form REG-1 be filed?

A: Form REG-1 should be filed before engaging in business activities in Illinois.

Q: What are the consequences of not filing Form REG-1?

A: Failure to file Form REG-1 may result in penalties and legal consequences.

Q: Is Form REG-1 specific to the state of Illinois?

A: Yes, Form REG-1 is specific to the state of Illinois and is used for registering businesses in Illinois.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.