This version of the form is not currently in use and is provided for reference only. Download this version of

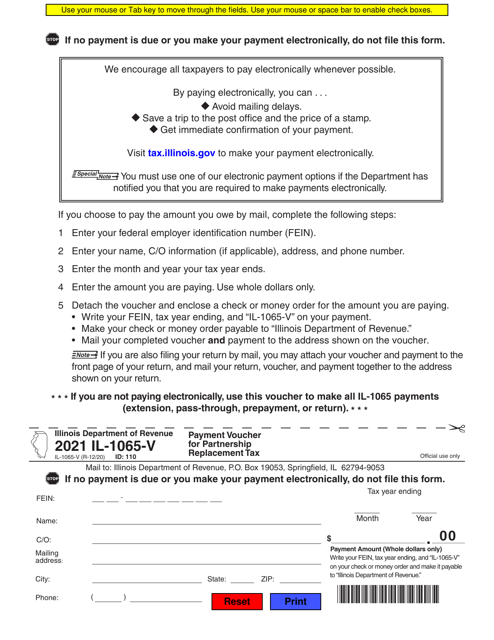

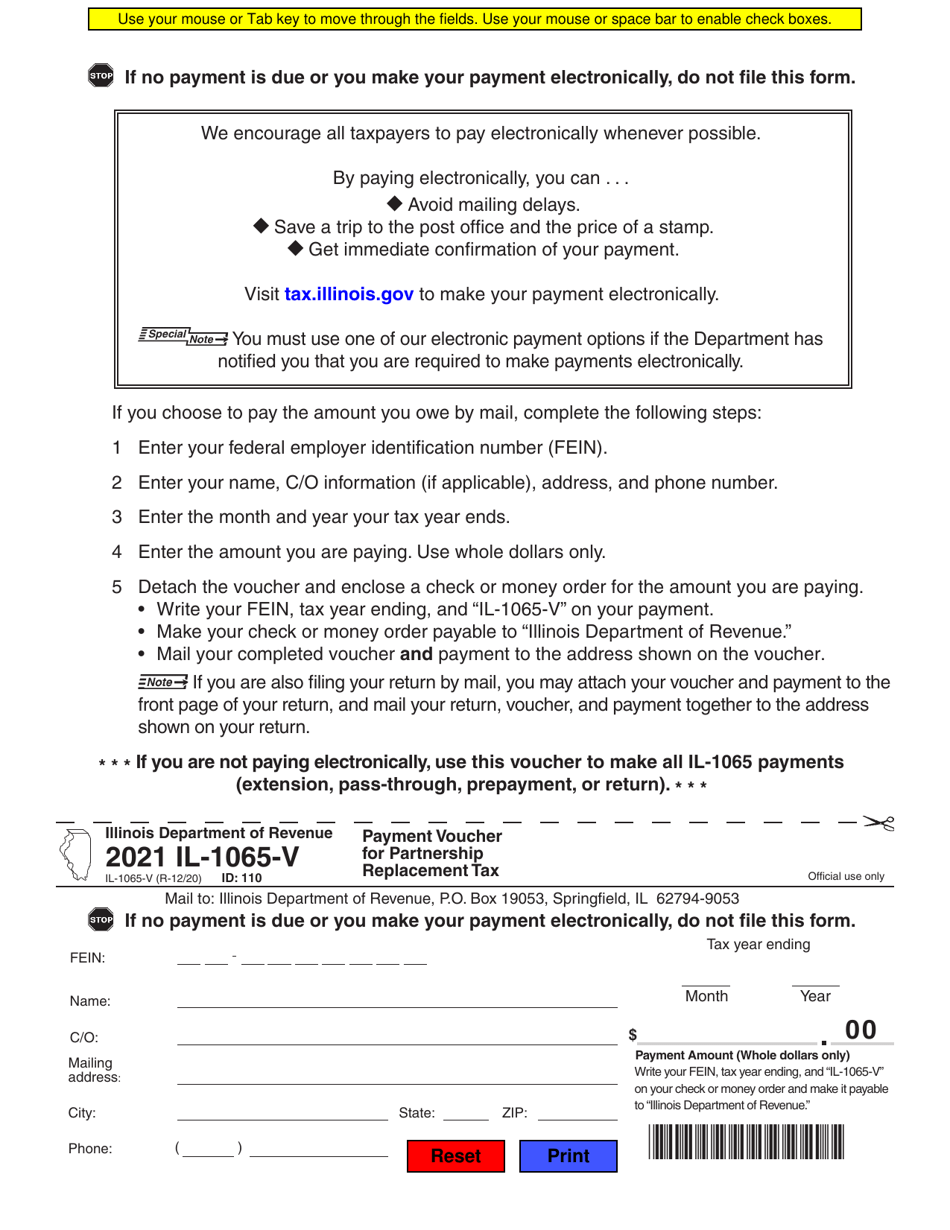

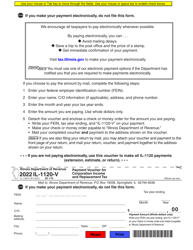

Form IL-1065-V

for the current year.

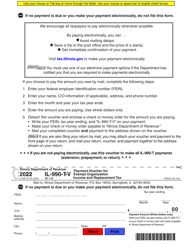

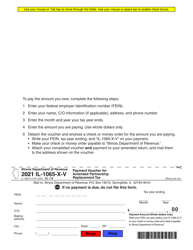

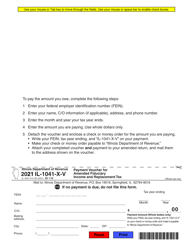

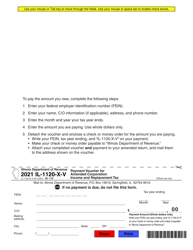

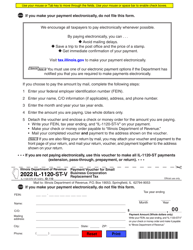

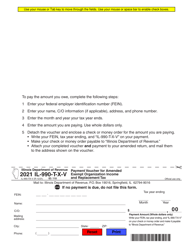

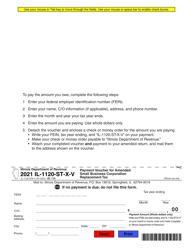

Form IL-1065-V Payment Voucher for Partnership Replacement Tax - Illinois

What Is Form IL-1065-V?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IL-1065-V?

A: Form IL-1065-V is a payment voucher for Partnership Replacement Tax in Illinois.

Q: What is Partnership Replacement Tax?

A: Partnership Replacement Tax is a tax imposed on partnerships in Illinois.

Q: Why do I need to use Form IL-1065-V?

A: You need to use Form IL-1065-V to submit payment for Partnership Replacement Tax.

Q: What information do I need to fill out Form IL-1065-V?

A: You will need to provide your partnership's name, address, tax year, and payment amount.

Q: When is the due date for Form IL-1065-V?

A: The due date for Form IL-1065-V is the same as the due date for filing your partnership tax return, usually on or before April 15th.

Q: What if I don't submit Form IL-1065-V or pay the Partnership Replacement Tax?

A: Failure to submit Form IL-1065-V or pay the tax can result in penalties and interest charges.

Q: Are there any exceptions or exemptions to the Partnership Replacement Tax?

A: There may be exceptions or exemptions available, depending on your specific circumstances. You should consult with a tax professional or the Illinois Department of Revenue for more information.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1065-V by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.