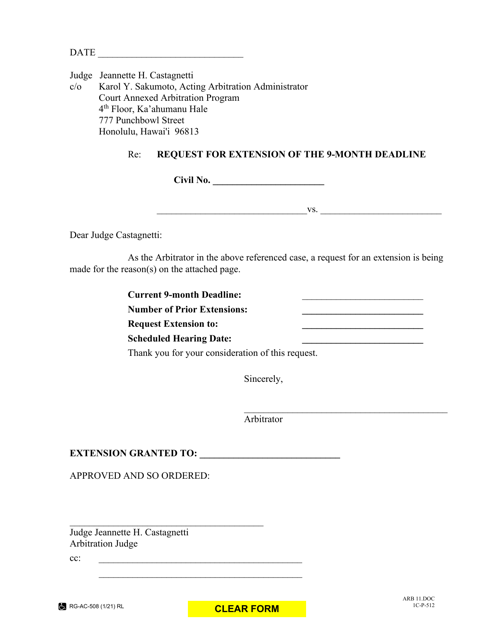

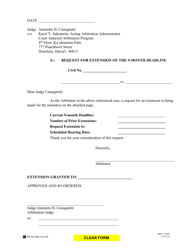

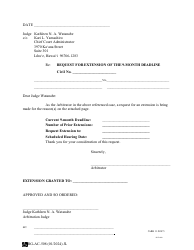

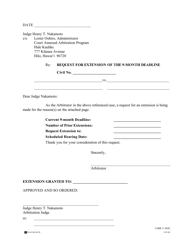

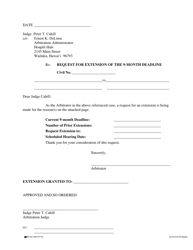

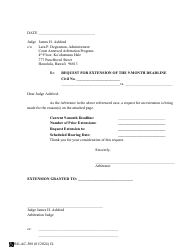

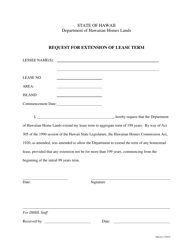

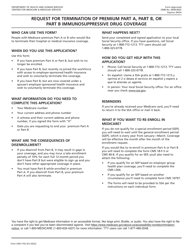

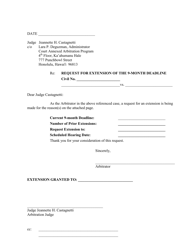

Form 1C-P-512 Request for Extension of the 9-month Deadline - Hawaii

What Is Form 1C-P-512?

This is a legal form that was released by the Hawaii Circuit Court - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

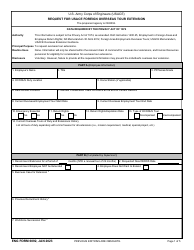

Q: What is Form 1C-P-512?

A: Form 1C-P-512 is a request for extension of the 9-month deadline in Hawaii.

Q: What is the purpose of Form 1C-P-512?

A: The purpose of Form 1C-P-512 is to request an extension of the 9-month deadline for filing tax returns in Hawaii.

Q: How do I use Form 1C-P-512?

A: To use Form 1C-P-512, you need to fill out the required information and submit it to the appropriate tax authority in Hawaii.

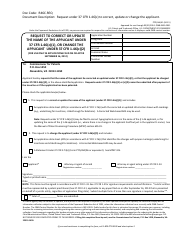

Q: What is the deadline for submitting Form 1C-P-512?

A: The deadline for submitting Form 1C-P-512 is 9 months from the original due date of your tax return in Hawaii.

Q: Can I request an extension for any type of tax return?

A: Yes, you can request an extension for any type of tax return using Form 1C-P-512 in Hawaii.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1C-P-512 by clicking the link below or browse more documents and templates provided by the Hawaii Circuit Court.