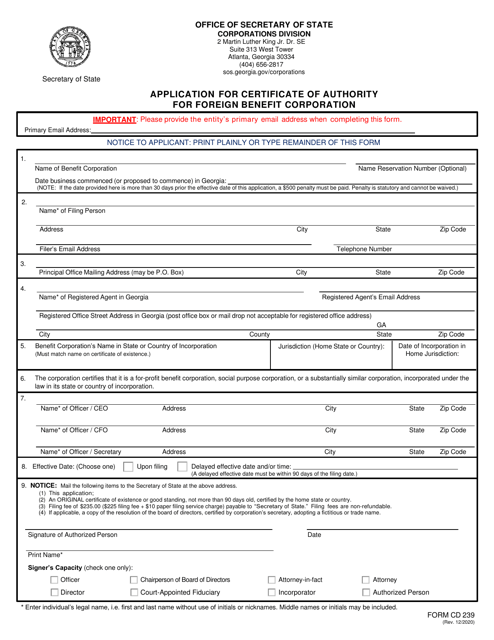

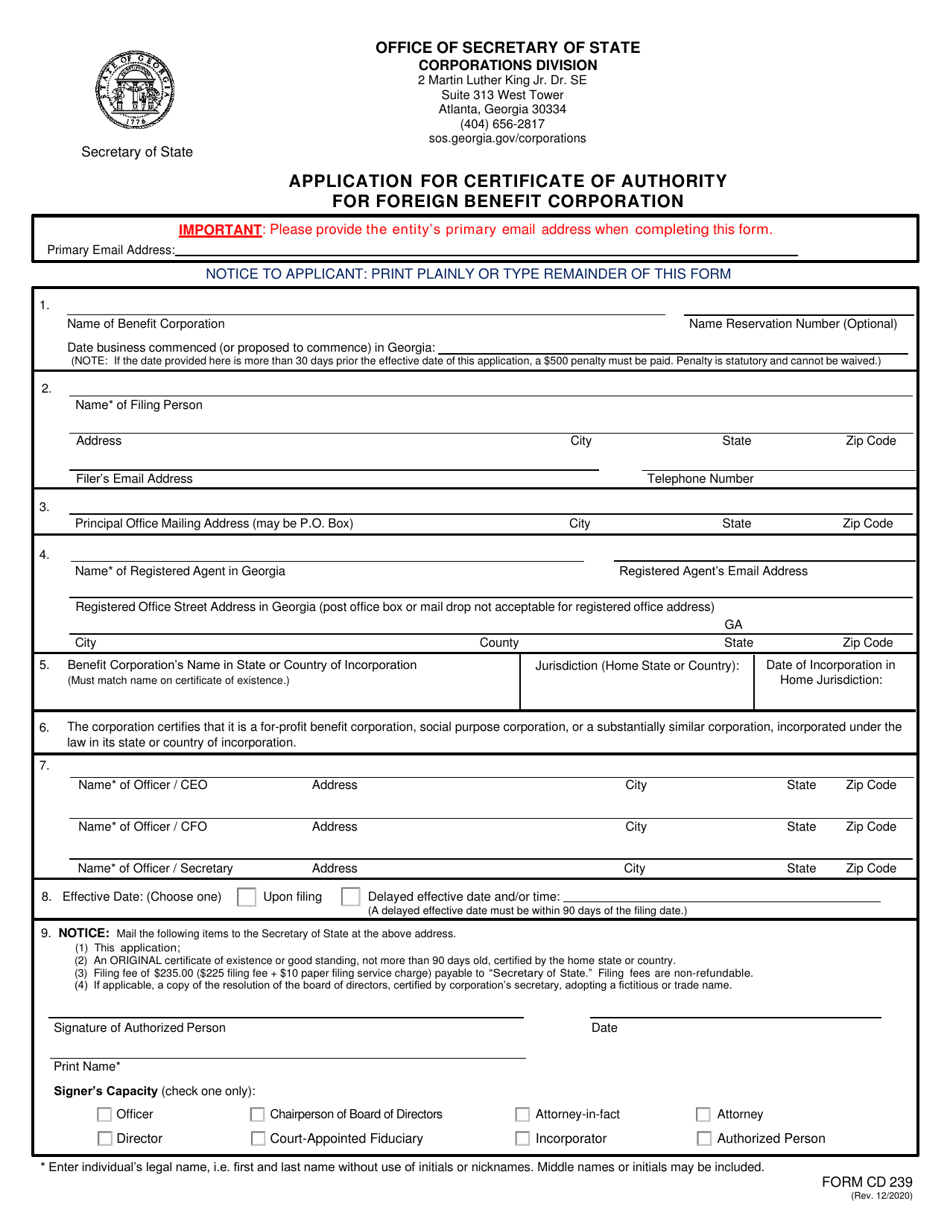

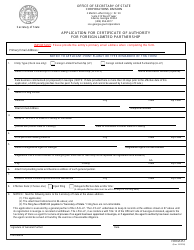

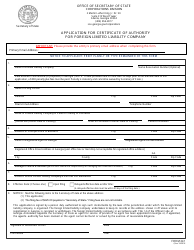

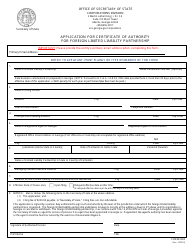

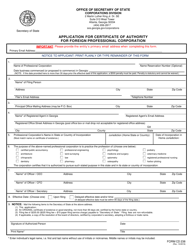

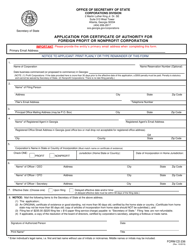

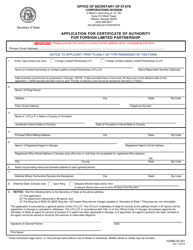

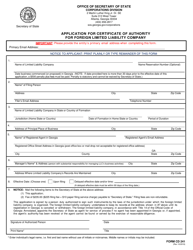

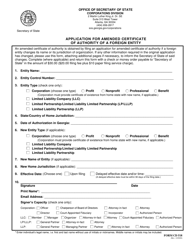

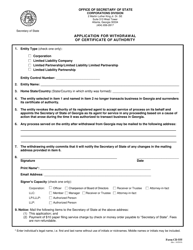

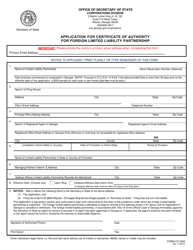

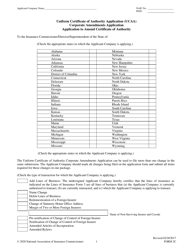

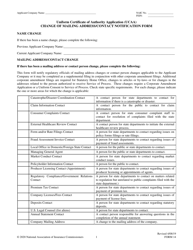

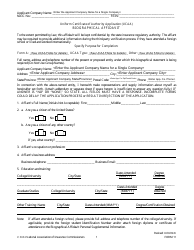

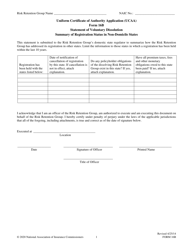

Form CD239 Application for Certificate of Authority for Foreign Benefit Corporation - Georgia (United States)

What Is Form CD239?

This is a legal form that was released by the Georgia Secretary of State - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD239?

A: Form CD239 is an application for a Certificate of Authority for a foreign benefit corporation in the state of Georgia, United States.

Q: What is a foreign benefit corporation?

A: A foreign benefit corporation is a corporation formed under the laws of a different state or country, seeking to conduct business in Georgia.

Q: Why do I need a Certificate of Authority for my foreign benefit corporation in Georgia?

A: A Certificate of Authority is required to legally conduct business in Georgia as a foreign benefit corporation.

Q: What information do I need to provide in Form CD239?

A: Form CD239 requires information such as the corporation's name, jurisdiction of formation, principal office address, registered agent information, and a statement of the corporation's purpose.

Q: What happens after I submit Form CD239?

A: After submitting Form CD239 and paying the required fees, the Georgia Secretary of State will review the application and issue a Certificate of Authority if approved.

Q: How long does it take to get a Certificate of Authority for a foreign benefit corporation in Georgia?

A: The processing time for a Certificate of Authority application may vary, but it typically takes a few weeks to receive a response from the Georgia Secretary of State.

Q: What are the consequences of operating a foreign benefit corporation in Georgia without a Certificate of Authority?

A: Operating a foreign benefit corporation without a Certificate of Authority may result in penalties, fines, and legal consequences. It is important to obtain the necessary authorization to do business in the state.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Georgia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD239 by clicking the link below or browse more documents and templates provided by the Georgia Secretary of State.