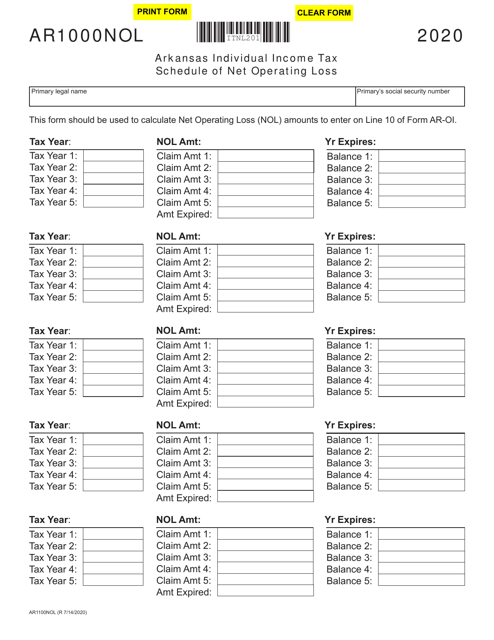

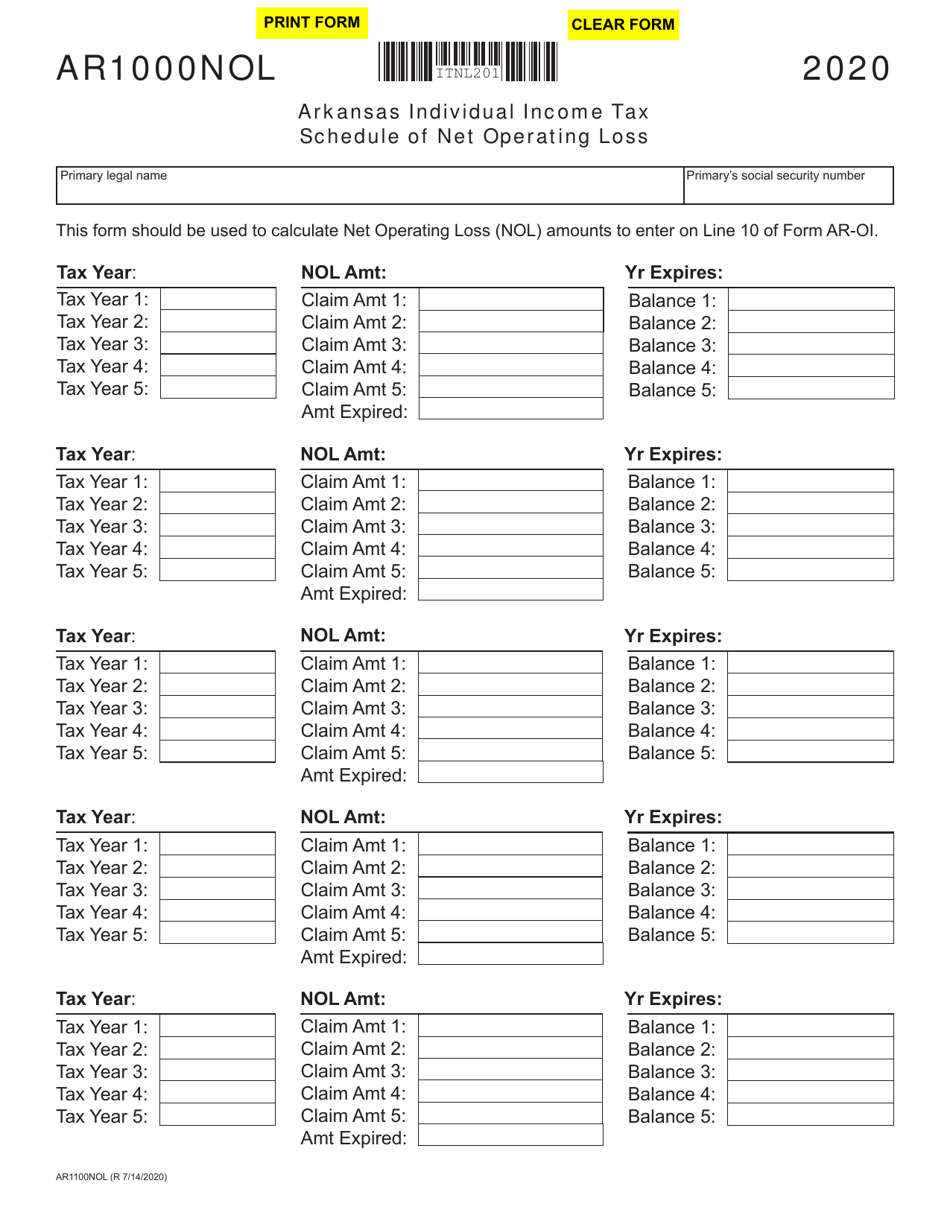

Form AR1000NOL Schedule of Net Operating Loss - Arkansas

What Is Form AR1000NOL?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

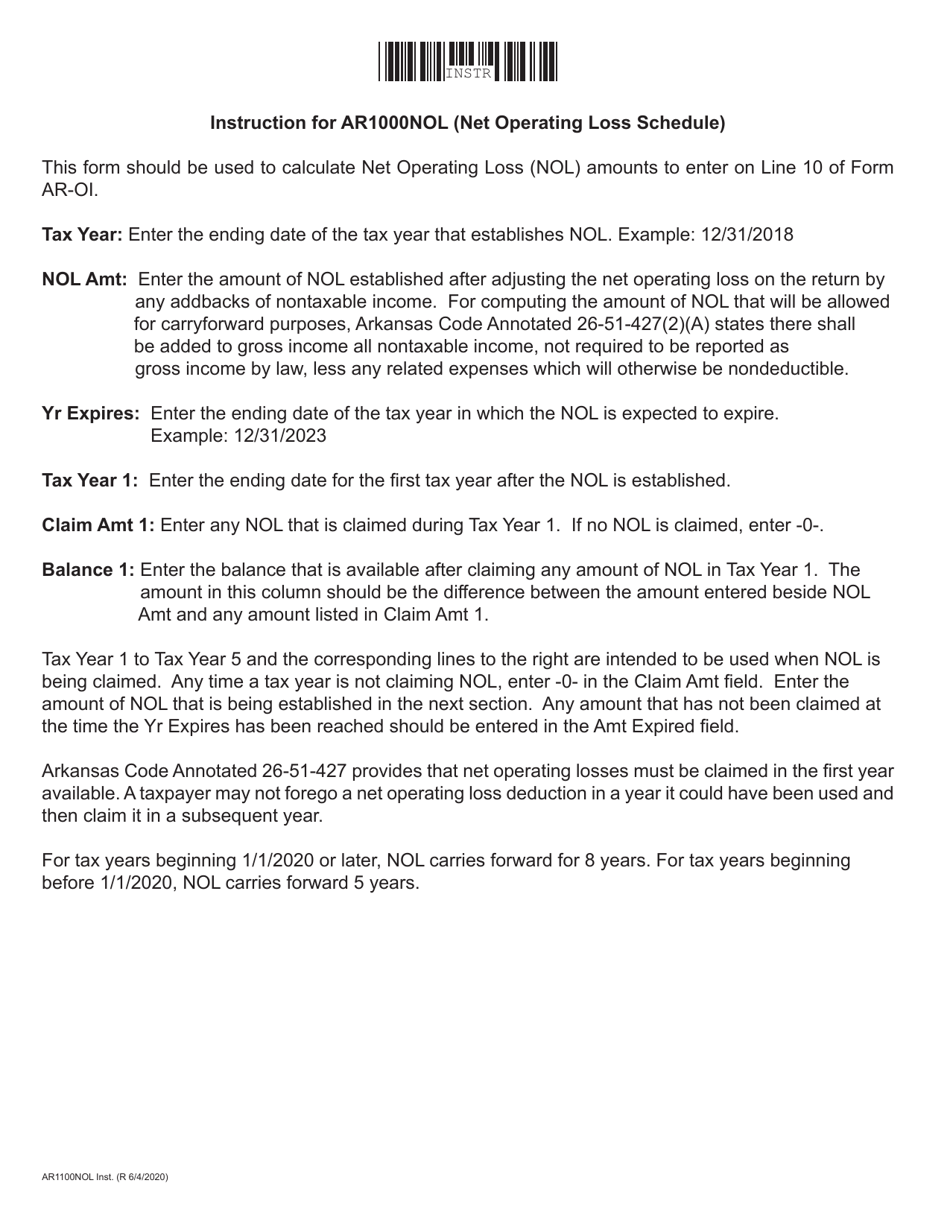

Q: What is form AR1000NOL?

A: Form AR1000NOL is a schedule used in Arkansas to report a net operating loss.

Q: What is a net operating loss?

A: A net operating loss occurs when a business's allowable deductions exceed its taxable income.

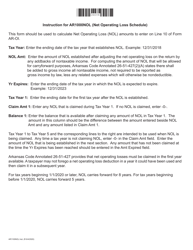

Q: How do I fill out form AR1000NOL?

A: You need to provide information about your business's net operating loss, including the amount, any carrybacks or carryforwards, and any related details.

Q: When is form AR1000NOL due?

A: The due date for form AR1000NOL in Arkansas is typically the same as the due date for the income tax return, which is April 15th.

Q: Can I file form AR1000NOL electronically?

A: Yes, Arkansas allows electronic filing of form AR1000NOL.

Q: Do I need to attach any other forms or documents with form AR1000NOL?

A: The specific requirements may vary, but generally you will need to attach a copy of your federal return and any supporting documentation related to the net operating loss.

Form Details:

- Released on July 14, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000NOL by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.