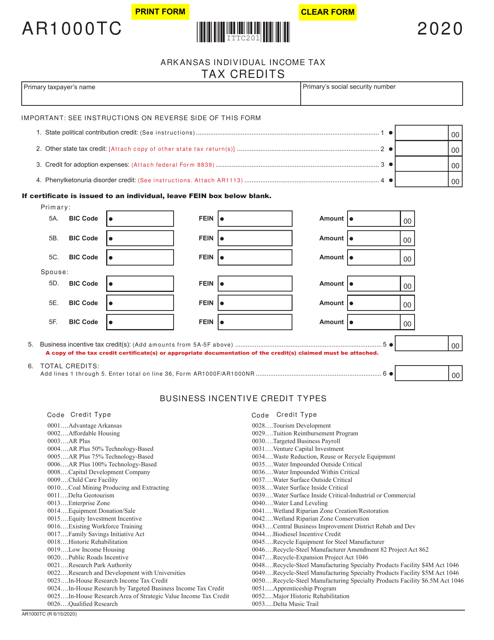

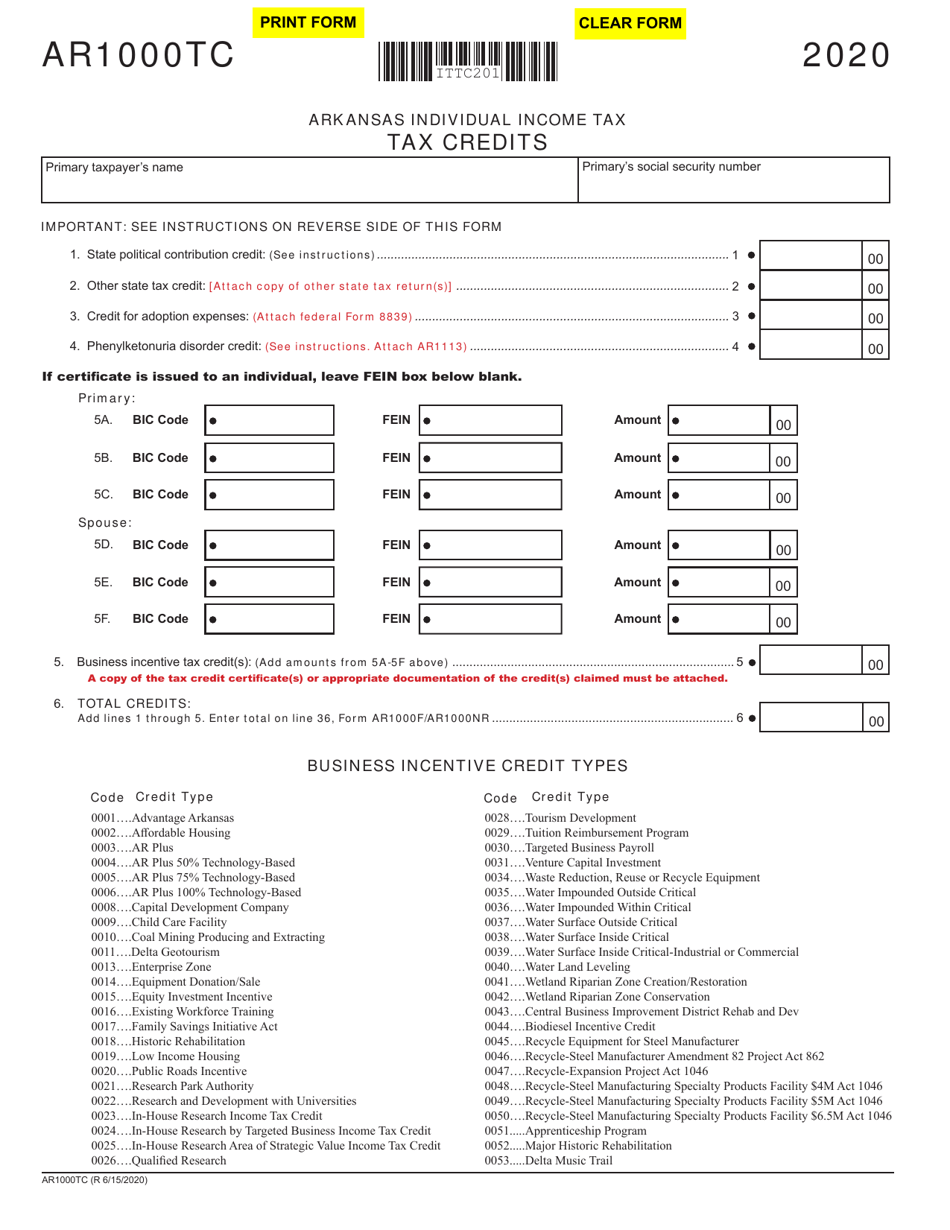

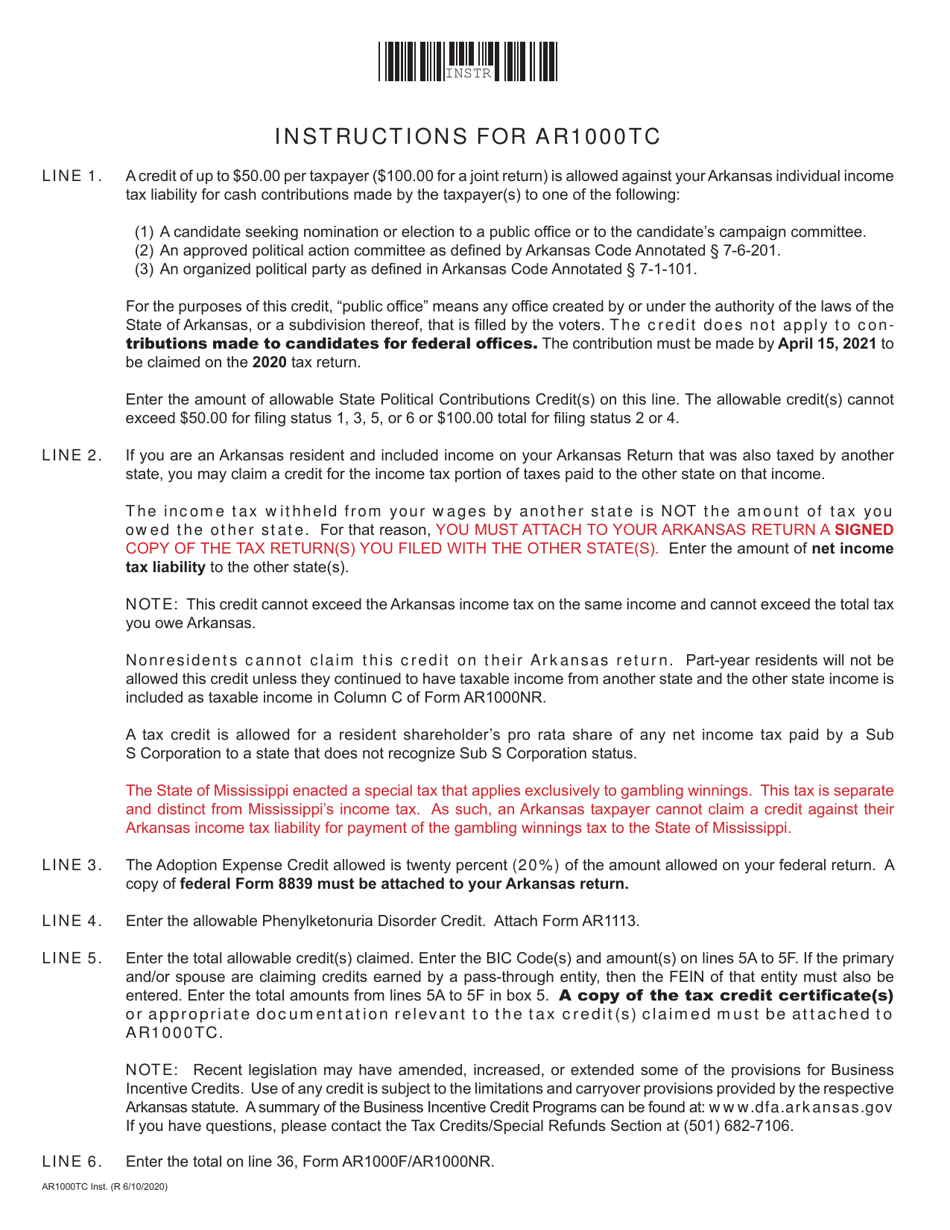

Form AR1000TC Tax Credits - Arkansas

What Is Form AR1000TC?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000TC?

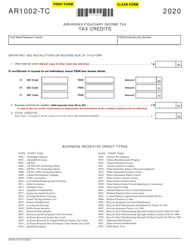

A: Form AR1000TC is a tax form used in Arkansas to claim various tax credits.

Q: What are tax credits?

A: Tax credits are incentives provided by the government to reduce the amount of tax owed.

Q: Who can use Form AR1000TC?

A: Residents of Arkansas who qualify for specific tax credits can use Form AR1000TC.

Q: What tax credits can be claimed on Form AR100TC?

A: Examples of tax credits that can be claimed on Form AR1000TC include the child care credit, property tax credit, and the film production credit.

Q: How do I fill out Form AR1000TC?

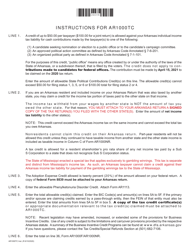

A: You must provide your personal information, indicate the tax credits you are claiming, and provide any supporting documentation as required.

Q: When is Form AR1000TC due?

A: The due date for Form AR1000TC is usually in conjunction with the deadline for filing your Arkansas state tax return, which is typically April 15th.

Q: Can I file Form AR1000TC electronically?

A: Yes, you can file Form AR1000TC electronically through the Arkansas Taxpayer Access Point (ATAP) system.

Q: Do I need to file Form AR1000TC every year?

A: You only need to file Form AR1000TC if you qualify for specific tax credits and want to claim them.

Q: Can I claim tax credits on my federal tax return as well?

A: Yes, you can claim federal tax credits on your federal tax return in addition to any state-specific tax credits you claim on Form AR1000TC.

Form Details:

- Released on June 15, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000TC by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.