This version of the form is not currently in use and is provided for reference only. Download this version of

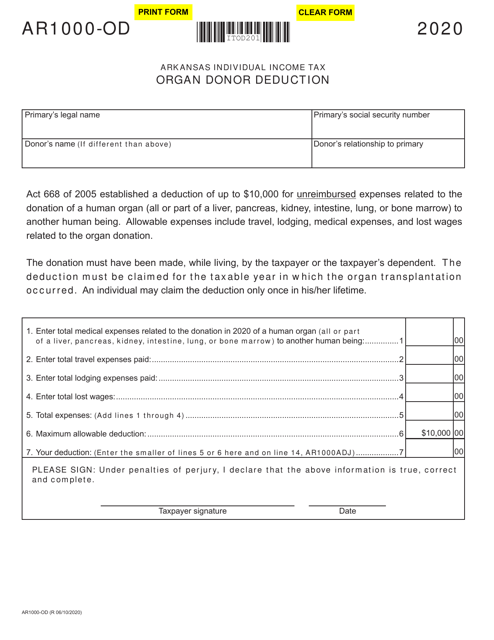

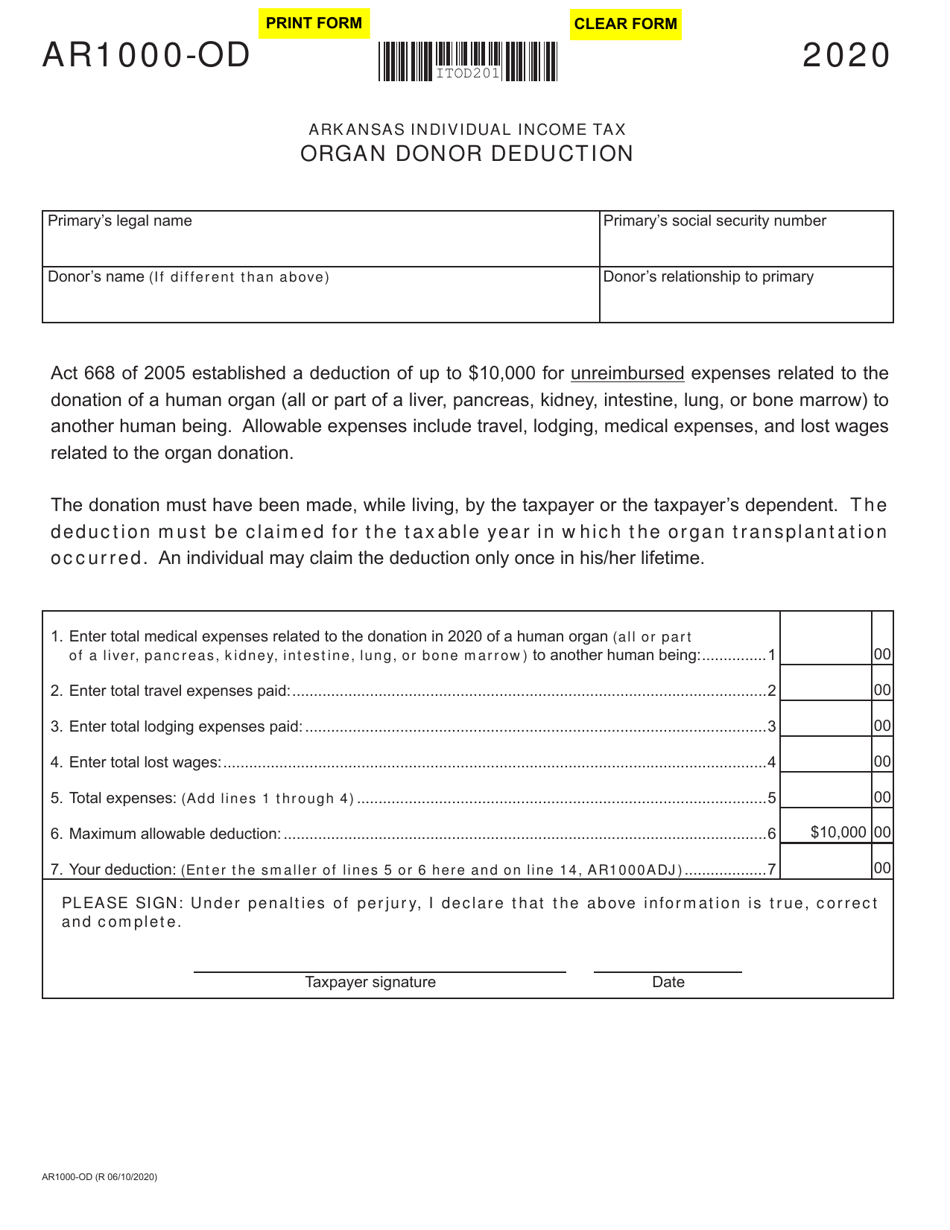

Form AR1000-OD

for the current year.

Form AR1000-OD Organ Donor Deduction - Arkansas

What Is Form AR1000-OD?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000-OD?

A: Form AR1000-OD is a tax form used in Arkansas for claiming the Organ Donor Deduction.

Q: What is the Organ Donor Deduction?

A: The Organ Donor Deduction is a tax deduction for individuals who have made an organ donation.

Q: Who can claim the Organ Donor Deduction?

A: Any individual who has made an organ donation can claim the Organ Donor Deduction.

Q: How do I claim the Organ Donor Deduction in Arkansas?

A: To claim the Organ Donor Deduction in Arkansas, you need to complete Form AR1000-OD and include it with your state tax return.

Q: Is the Organ Donor Deduction available in other states besides Arkansas?

A: Yes, some other states also offer a similar tax deduction for organ donations.

Q: Are there any requirements to qualify for the Organ Donor Deduction?

A: In Arkansas, there are no specific requirements other than making an organ donation.

Q: Is there a limit to how much I can deduct for the Organ Donor Deduction?

A: The maximum deduction amount for the Organ Donor Deduction in Arkansas is $10,000.

Q: Can I claim the Organ Donor Deduction if I donated blood or platelets?

A: No, the Organ Donor Deduction is specifically for organ donations, not blood or platelet donations.

Q: Do I need to provide any documentation to claim the Organ Donor Deduction?

A: In Arkansas, you do not need to provide any documentation when claiming the Organ Donor Deduction, but you should keep records in case of an audit.

Form Details:

- Released on June 10, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000-OD by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.