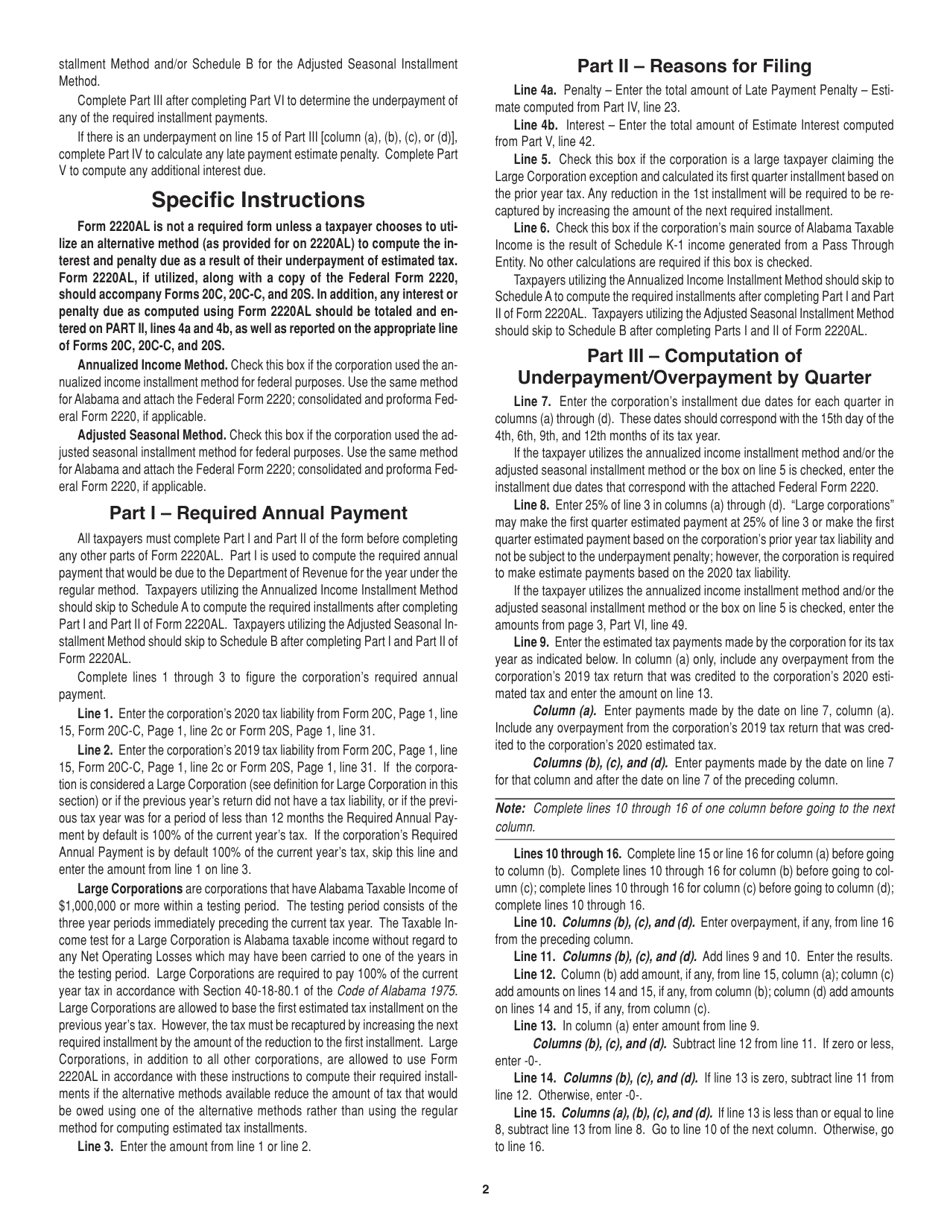

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 2220AL

for the current year.

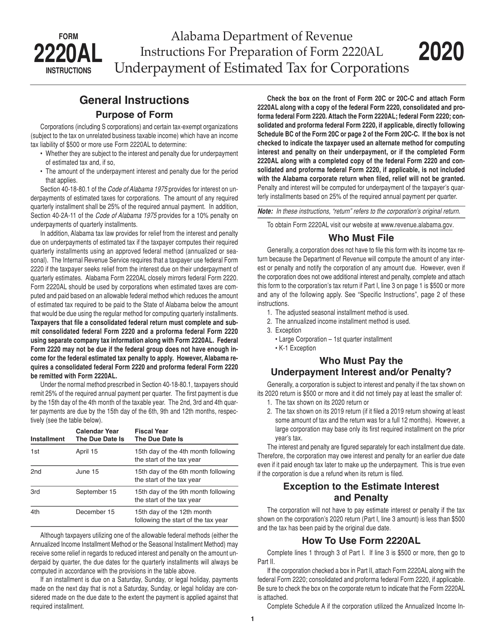

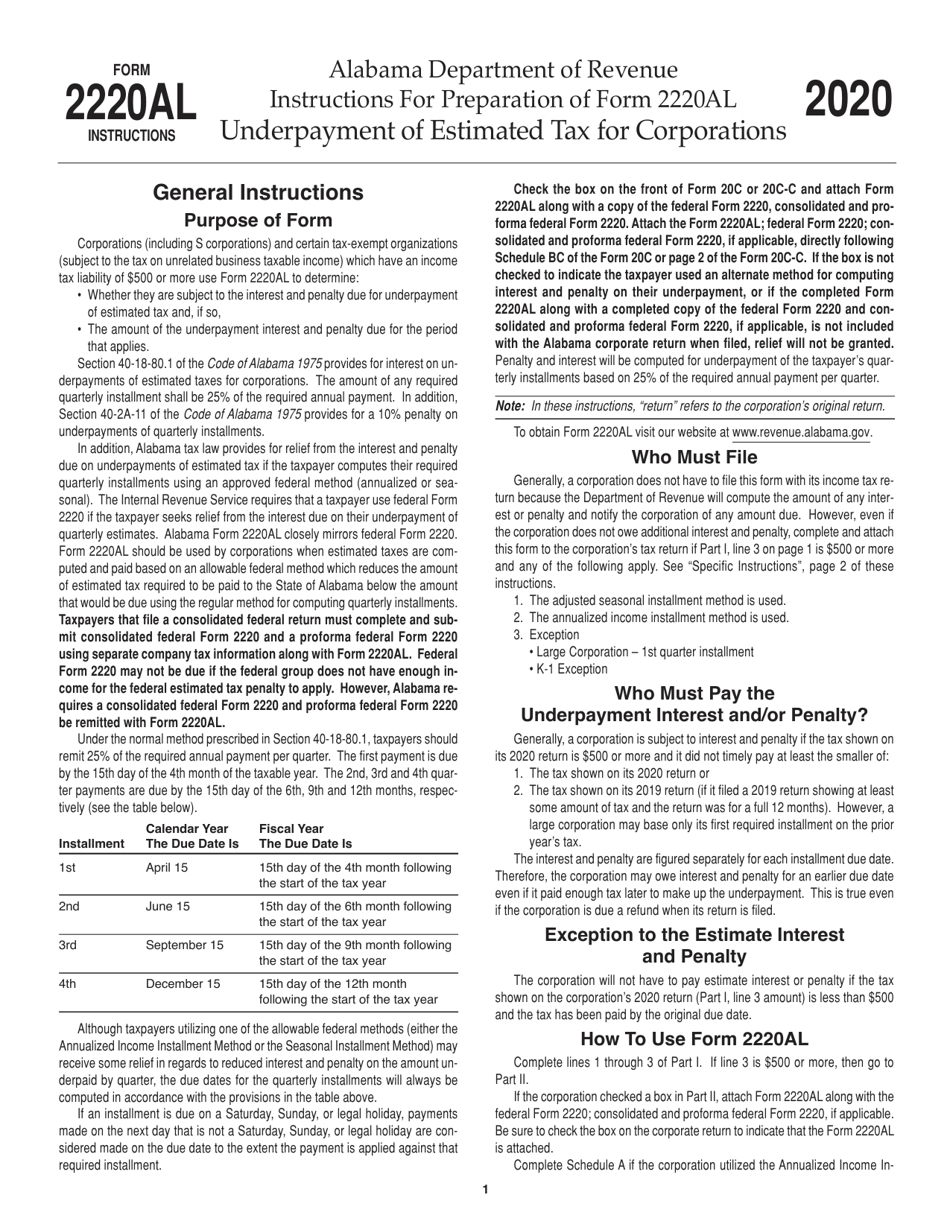

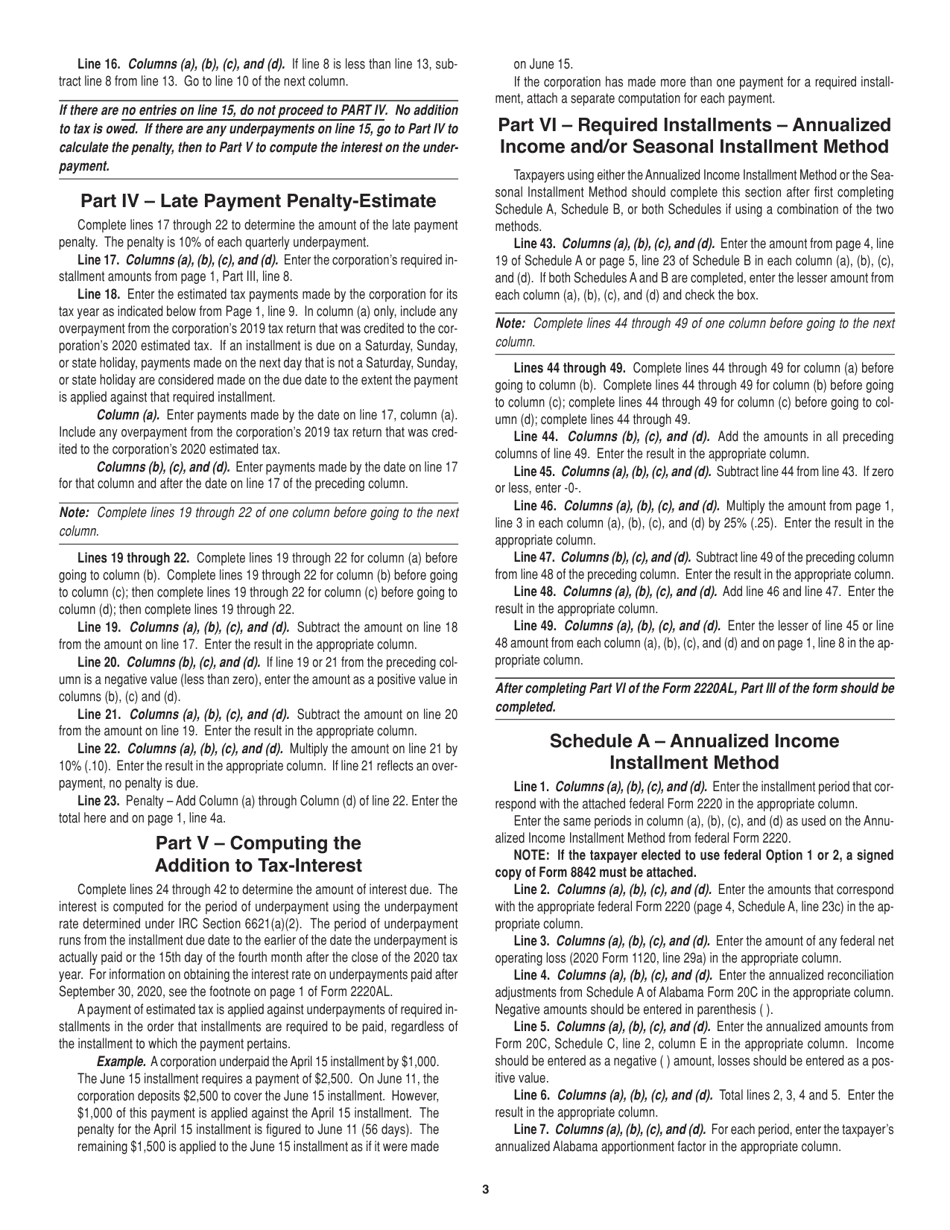

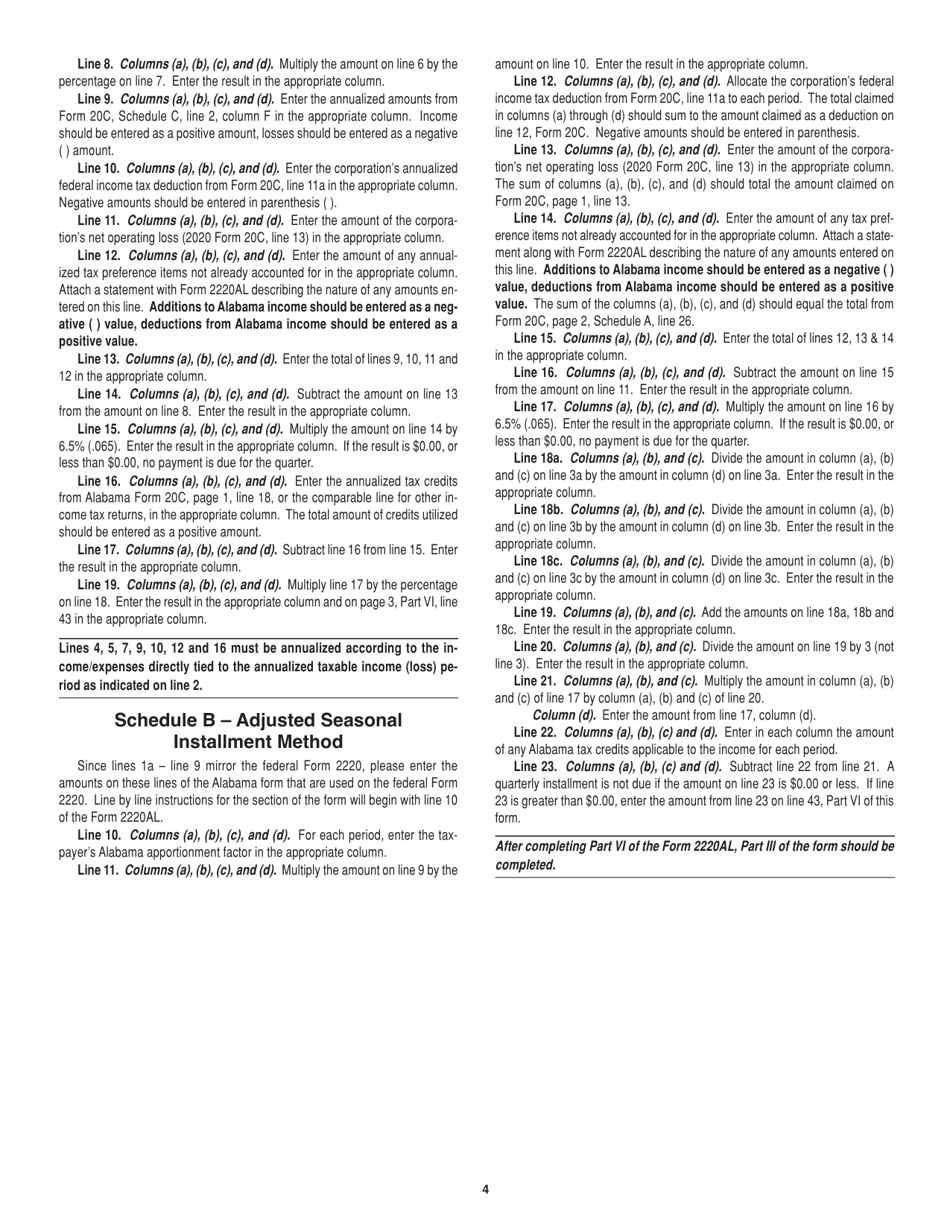

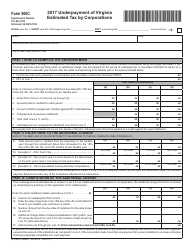

Instructions for Form 2220AL Underpayment of Estimated Tax for Corporations - Alabama

This document contains official instructions for Form 2220AL , Underpayment of Estimated Tax for Corporations - a form released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Form 2220AL?

A: Form 2220AL is used by corporations in Alabama to calculate and pay any underpayment of estimated tax.

Q: Who needs to file Form 2220AL?

A: Corporations in Alabama who have underpaid their estimated tax payments must file Form 2220AL.

Q: When is Form 2220AL due?

A: Form 2220AL is typically due on or before the 15th day of the third month following the close of the tax year.

Q: How is the underpayment penalty calculated?

A: The underpayment penalty is calculated based on the amount of the underpayment and the interest rate determined by the Alabama Department of Revenue.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.