This version of the form is not currently in use and is provided for reference only. Download this version of

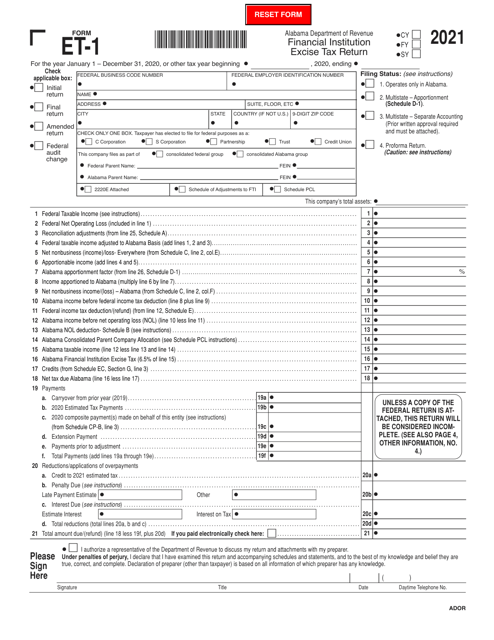

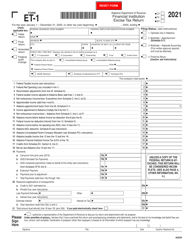

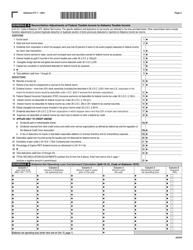

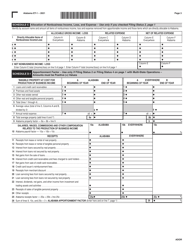

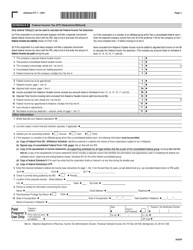

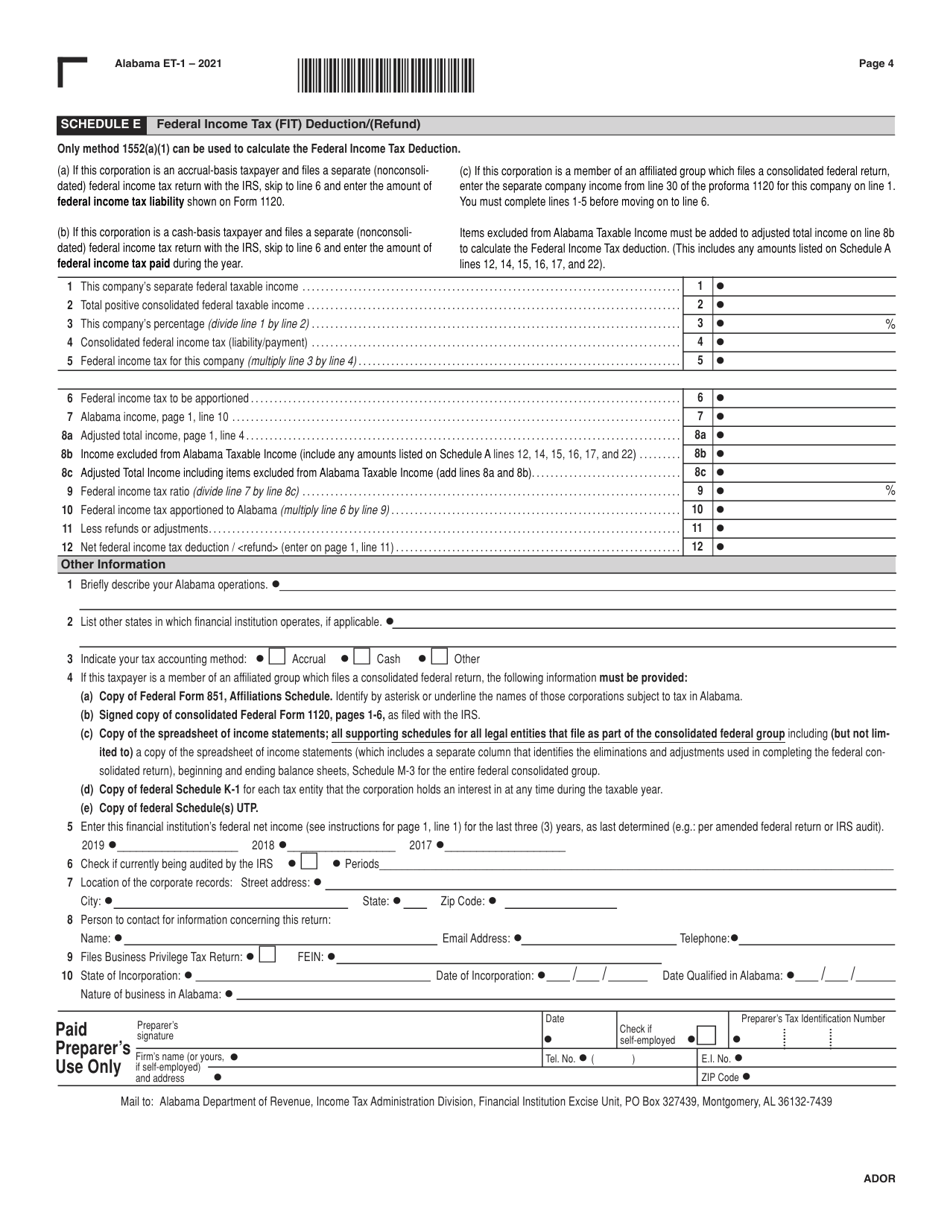

Form ET-1

for the current year.

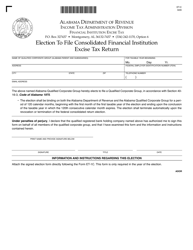

Form ET-1 Alabama Financial Institution Excise Tax Return - Alabama

What Is Form ET-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-1?

A: Form ET-1 is the Alabama Financial Institution Excise Tax Return.

Q: Who needs to file Form ET-1?

A: Financial institutions in Alabama need to file Form ET-1.

Q: What is the purpose of Form ET-1?

A: Form ET-1 is used to report and pay the financial institution excise tax in Alabama.

Q: What is the due date for filing Form ET-1?

A: Form ET-1 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: How can I file Form ET-1?

A: Form ET-1 can be filed electronically through the Alabama Department of Revenue's e-filing system or by paper mail.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.