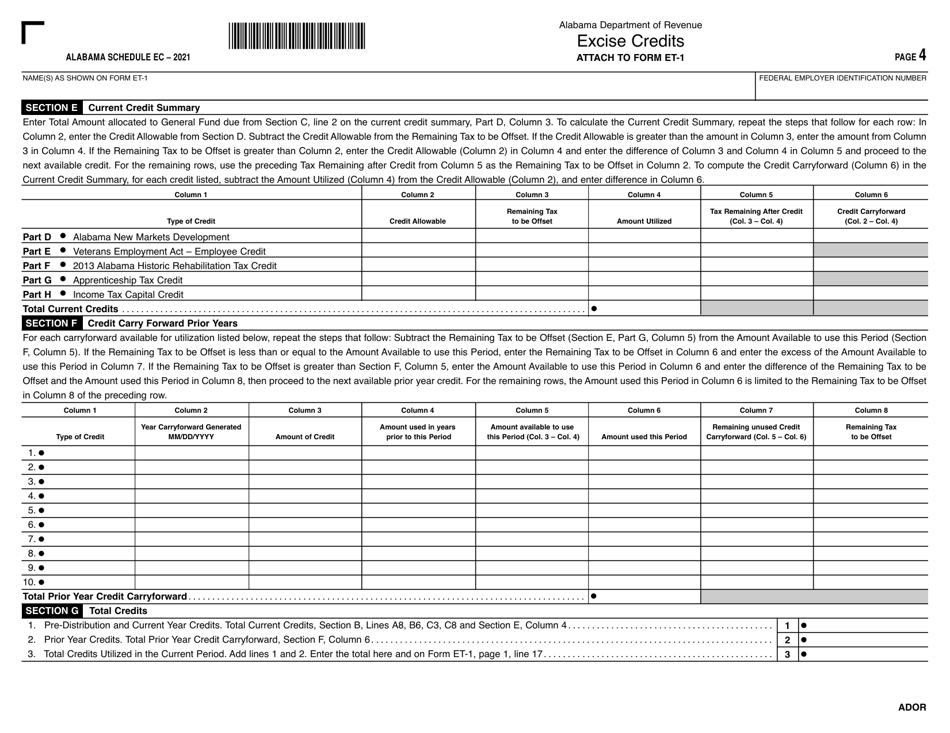

This version of the form is not currently in use and is provided for reference only. Download this version of

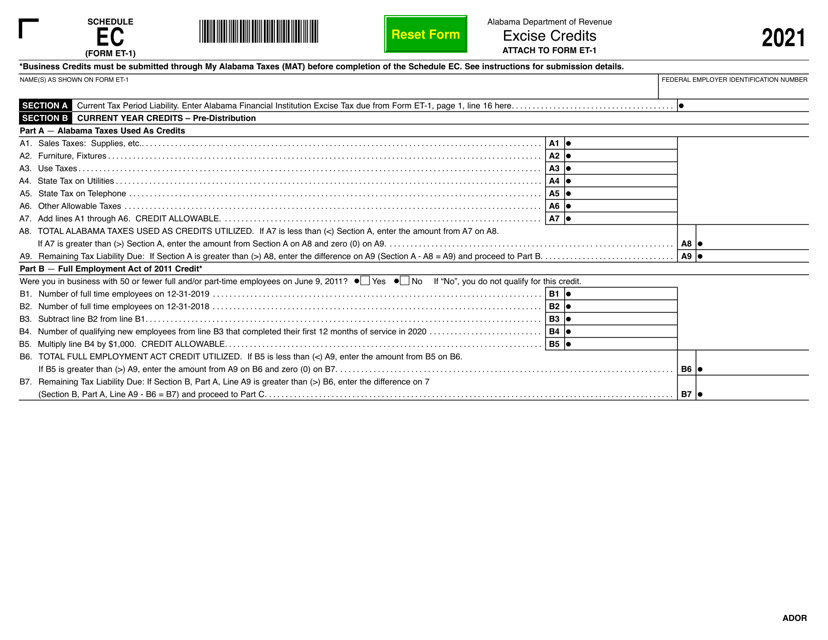

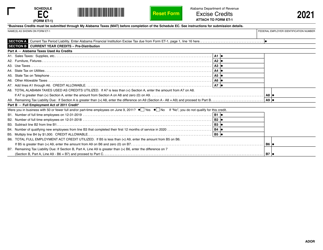

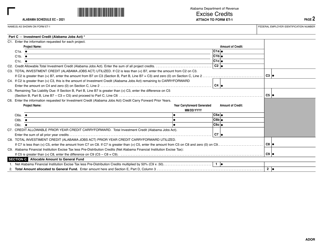

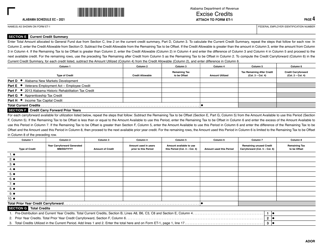

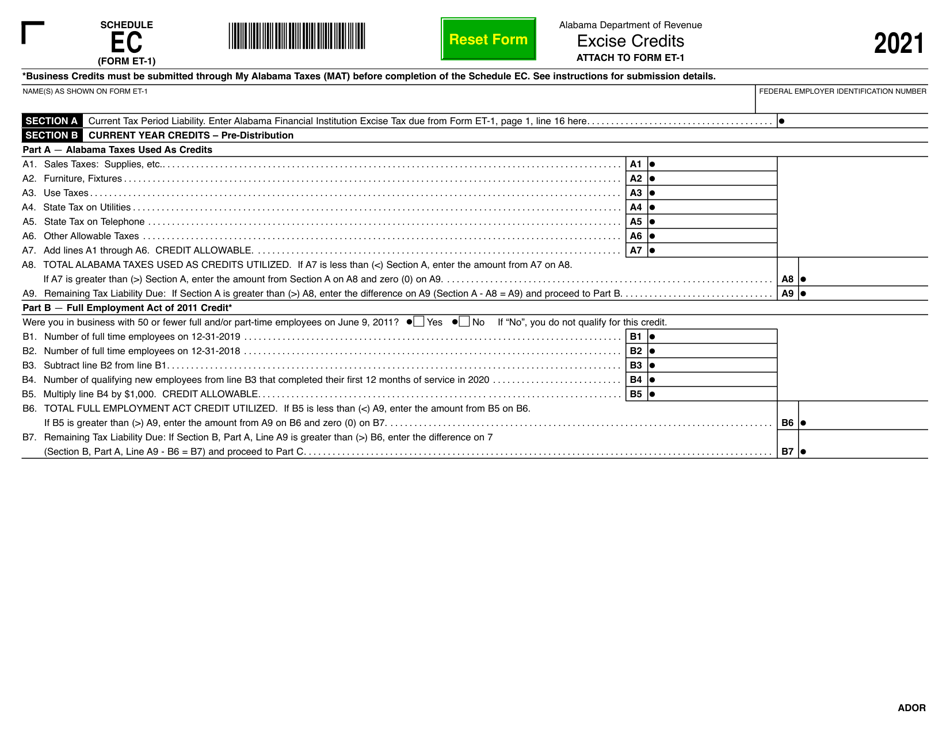

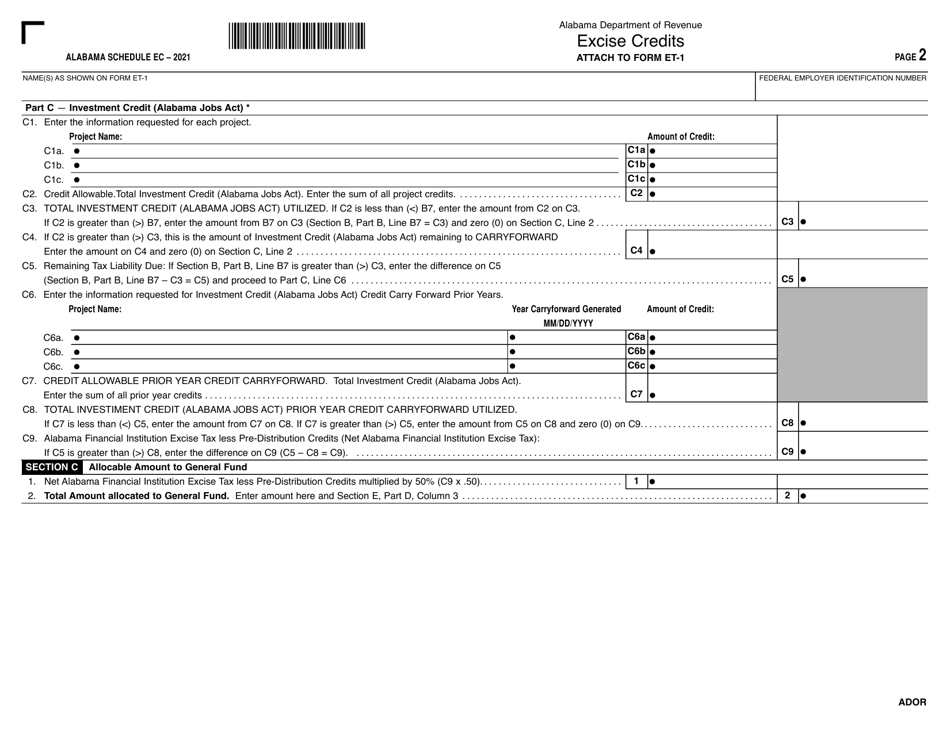

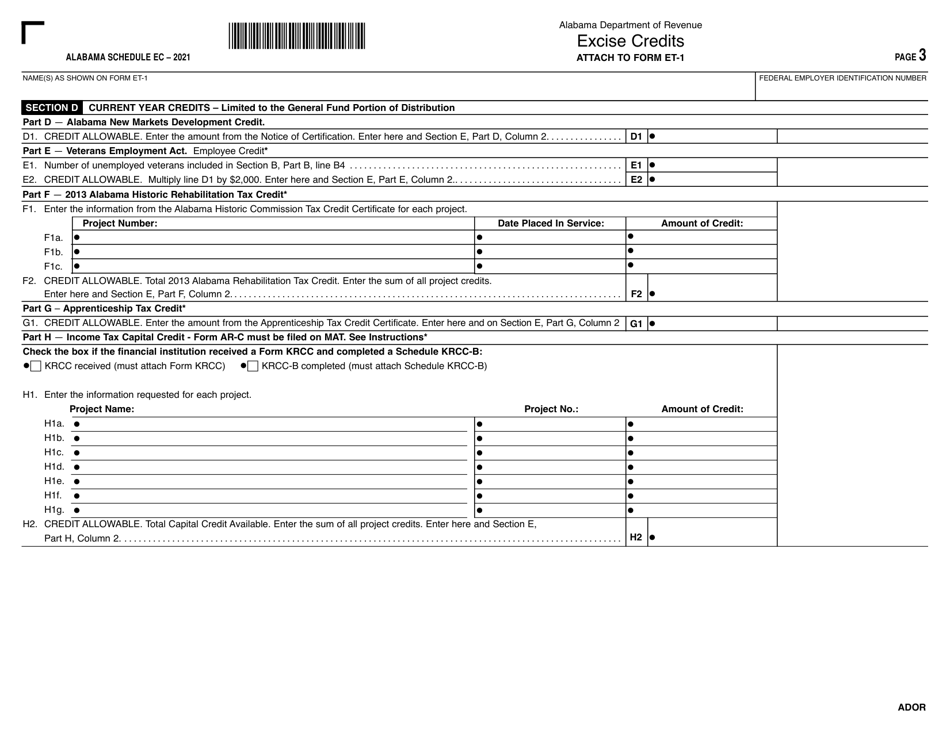

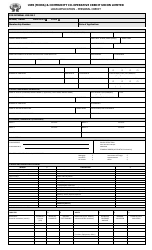

Form ET-1 Schedule EC

for the current year.

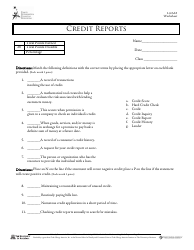

Form ET-1 Schedule EC Excise Credits - Alabama

What Is Form ET-1 Schedule EC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama.The document is a supplement to Form ET-1, Alabama Financial Institution Excise Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC is a form used in Alabama to claim Excise Credits.

Q: What are Excise Credits?

A: Excise Credits are credits that can be applied to reduce the amount of excise tax owed.

Q: Who can use Form ET-1 Schedule EC?

A: Any taxpayer in Alabama who is eligible for excise credits can use Form ET-1 Schedule EC.

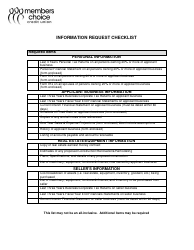

Q: What information is required on Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC requires you to provide information about the type of excise credits you are claiming and the amount.

Q: When is the deadline to file Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC is generally due on the same date as the original tax return, which is the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for late filing of Form ET-1 Schedule EC?

A: Yes, there may be penalties for late filing of Form ET-1 Schedule EC. It is important to file the form on time to avoid any potential penalties or interest charges.

Q: Can I claim Excise Credits for multiple tax years on Form ET-1 Schedule EC?

A: No, Form ET-1 Schedule EC is used to claim Excise Credits for a single tax year. If you have Excise Credits from multiple tax years, you will need to file separate forms for each year.

Q: Can I amend Form ET-1 Schedule EC?

A: Yes, if you need to make changes to a previously filed Form ET-1 Schedule EC, you can file an amended form, Form ET-1 Schedule EC-A.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1 Schedule EC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.