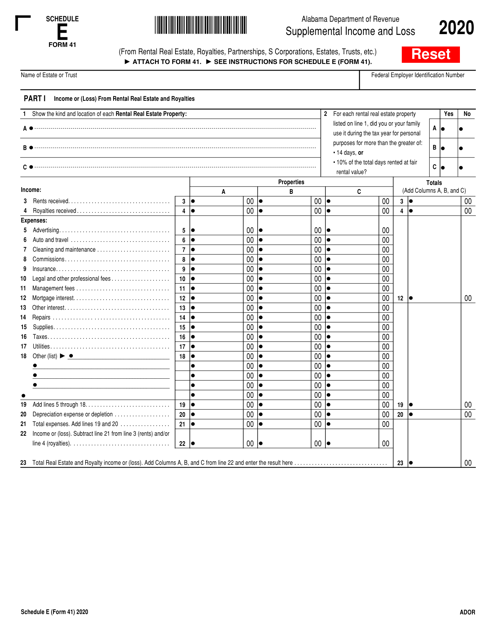

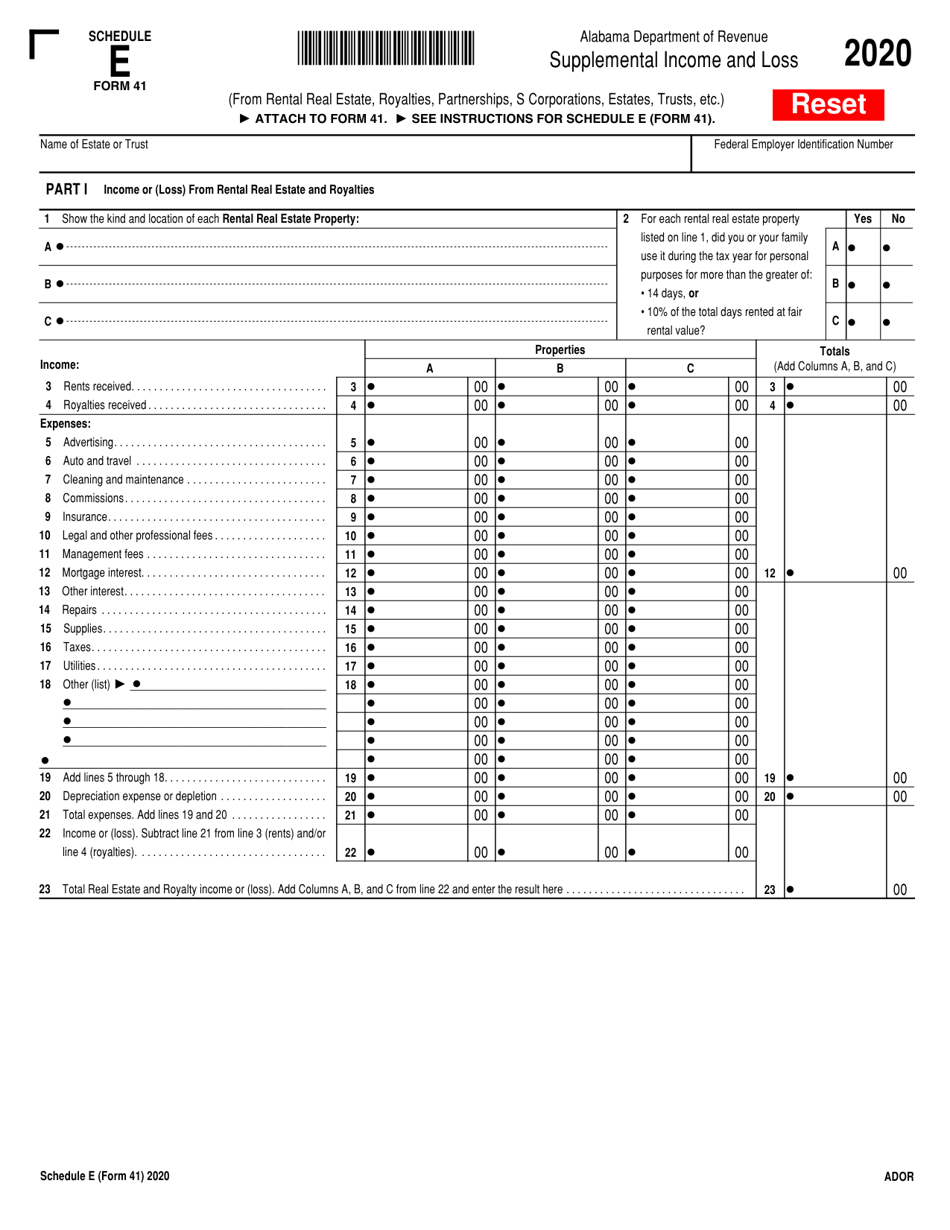

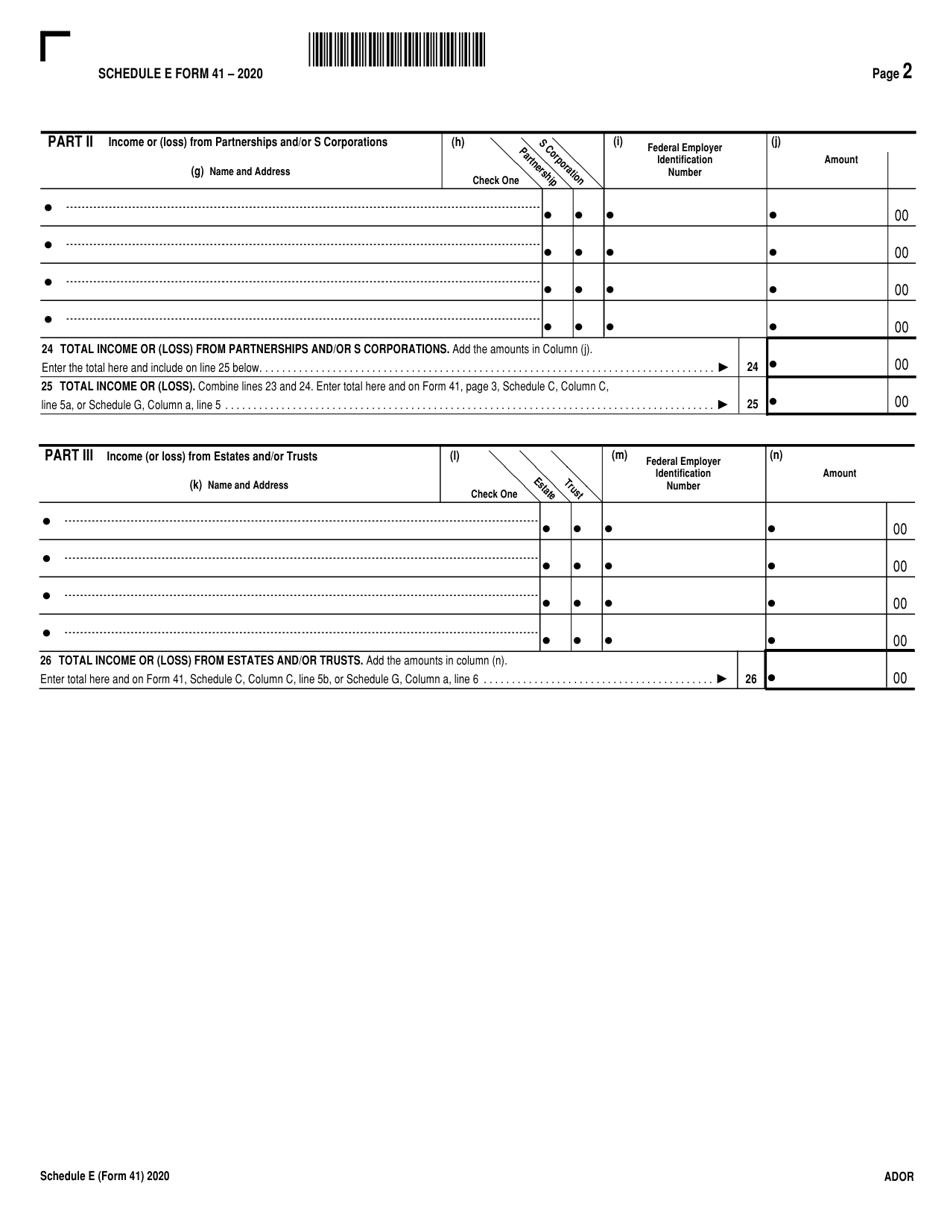

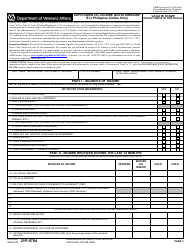

Form 41 Schedule E Supplemental Income and Loss - Alabama

What Is Form 41 Schedule E?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama.The document is a supplement to Form 41, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41 Schedule E?

A: Form 41 Schedule E is a supplemental form used to report supplemental income and loss for individuals in Alabama.

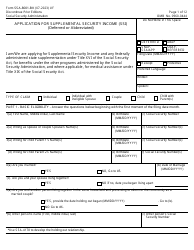

Q: Who needs to file Form 41 Schedule E?

A: Individuals who have supplemental income and loss in Alabama need to file Form 41 Schedule E.

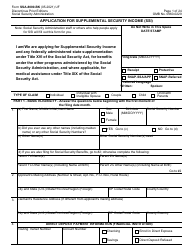

Q: What is supplemental income and loss?

A: Supplemental income and loss refers to income or loss generated from sources other than regular employment, such as rental property, royalties, partnerships, or S corporations.

Q: What information is required to complete Form 41 Schedule E?

A: The form requires information about the source of supplemental income or loss, the amount earned or lost, and any deductions or expenses related to that income or loss.

Q: Is Form 41 Schedule E specific to Alabama residents only?

A: Yes, Form 41 Schedule E is specific to residents of Alabama only.

Q: When is the deadline for filing Form 41 Schedule E?

A: The deadline for filing Form 41 Schedule E generally coincides with the deadline for filing the individual tax return, which is usually April 15th of each year.

Q: Are there any penalties for not filing Form 41 Schedule E?

A: Yes, failing to file Form 41 Schedule E or filing it late may result in penalties and interest charges imposed by the Alabama Department of Revenue.

Q: Can I e-file Form 41 Schedule E?

A: Yes, it is possible to e-file Form 41 Schedule E for convenience and faster processing, but make sure to check if the Alabama Department of Revenue accepts electronic filing for this specific form.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41 Schedule E by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.