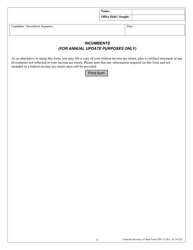

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPF-13

for the current year.

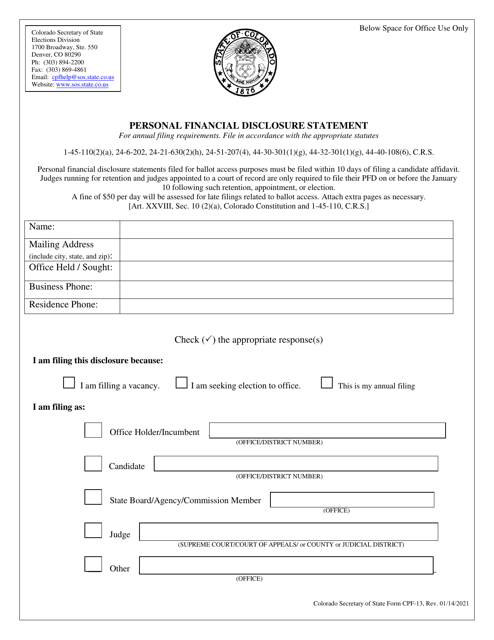

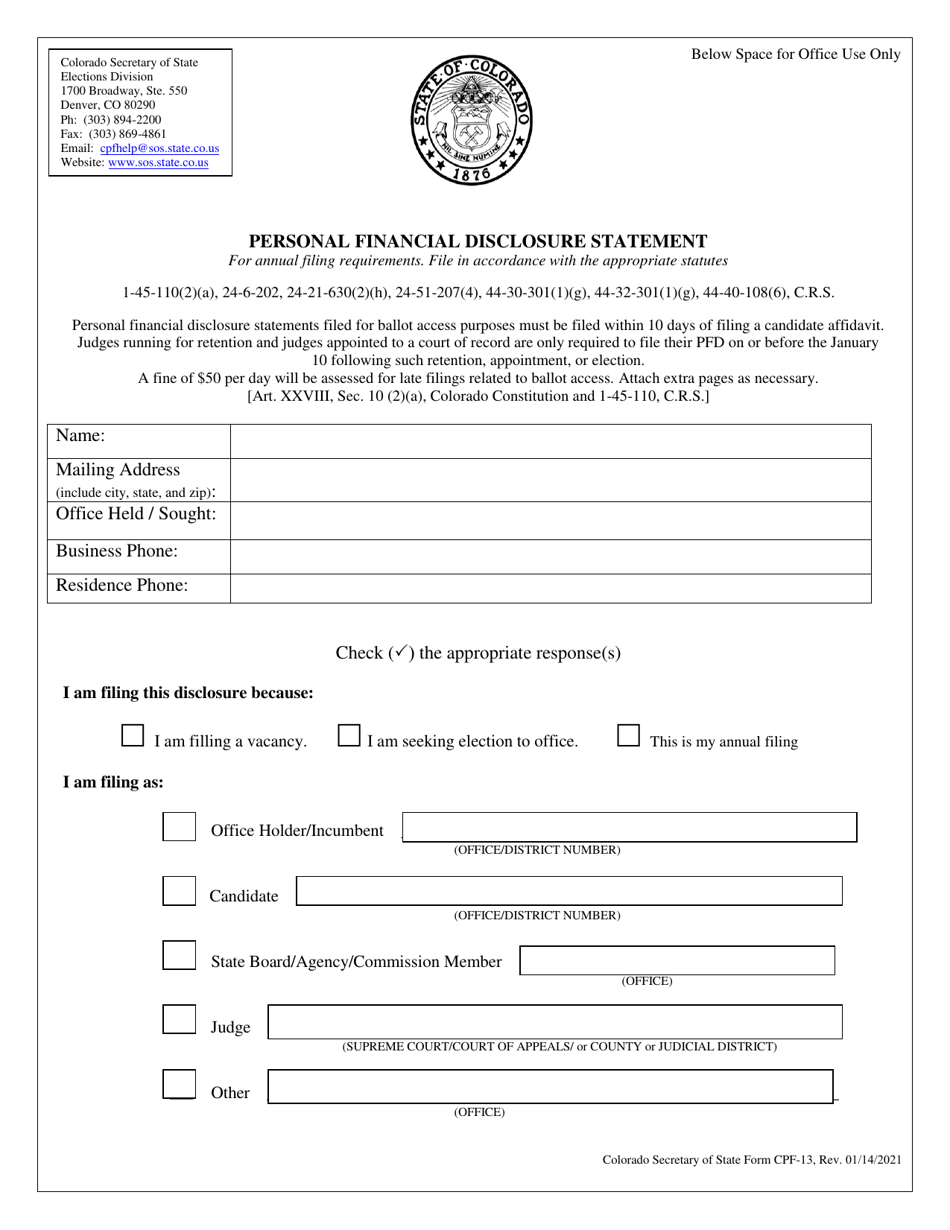

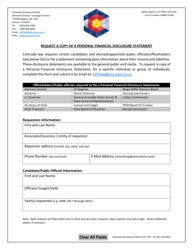

Form CPF-13 Personal Financial Disclosure Statement - Colorado

What Is Form CPF-13?

This is a legal form that was released by the Colorado Secretary of State - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CPF-13?

A: Form CPF-13 is the Personal Financial Disclosure Statement used in Colorado.

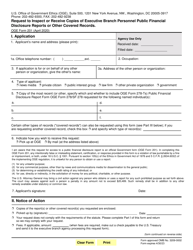

Q: Who needs to file Form CPF-13?

A: Certain public officials and candidates in Colorado are required to file Form CPF-13.

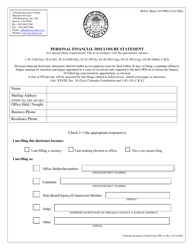

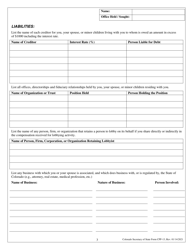

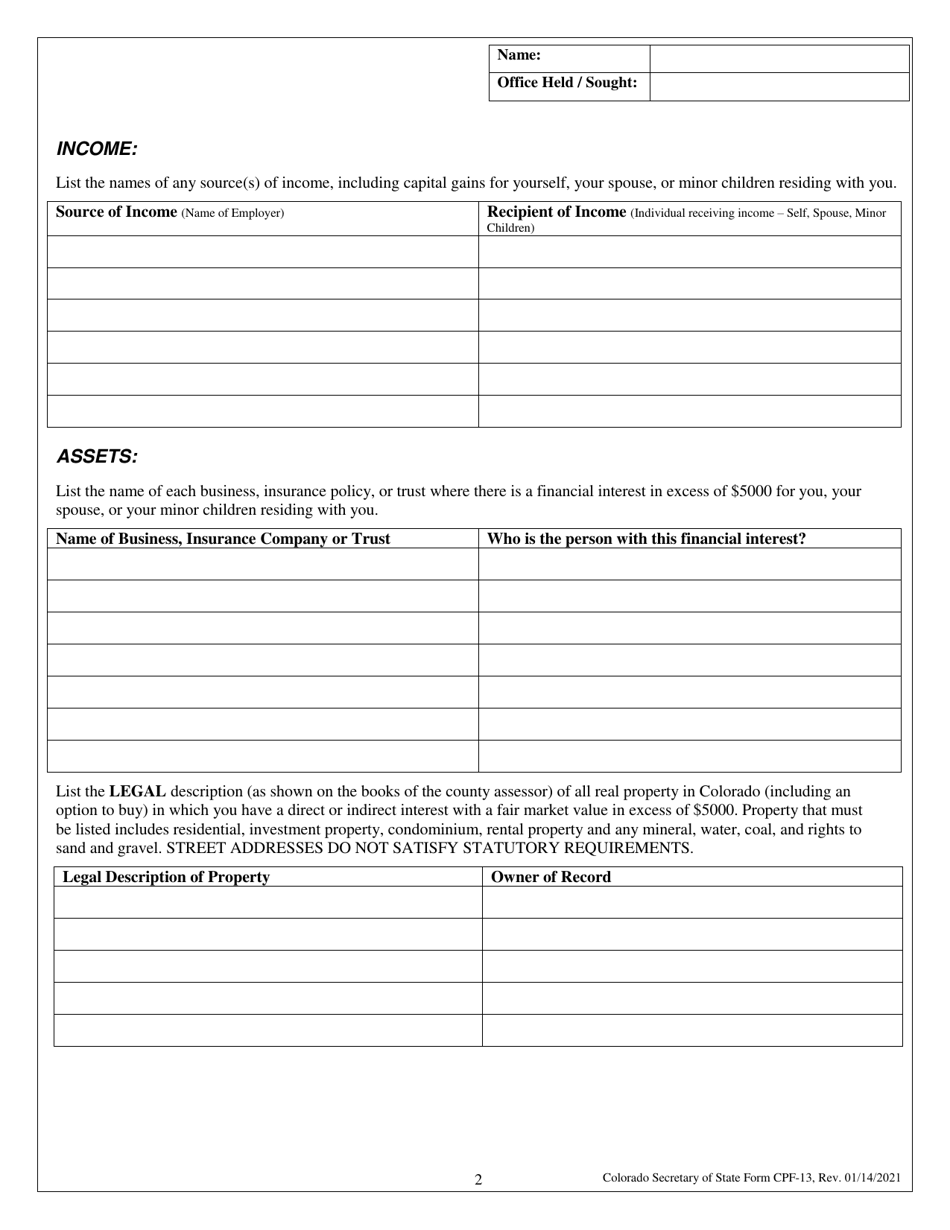

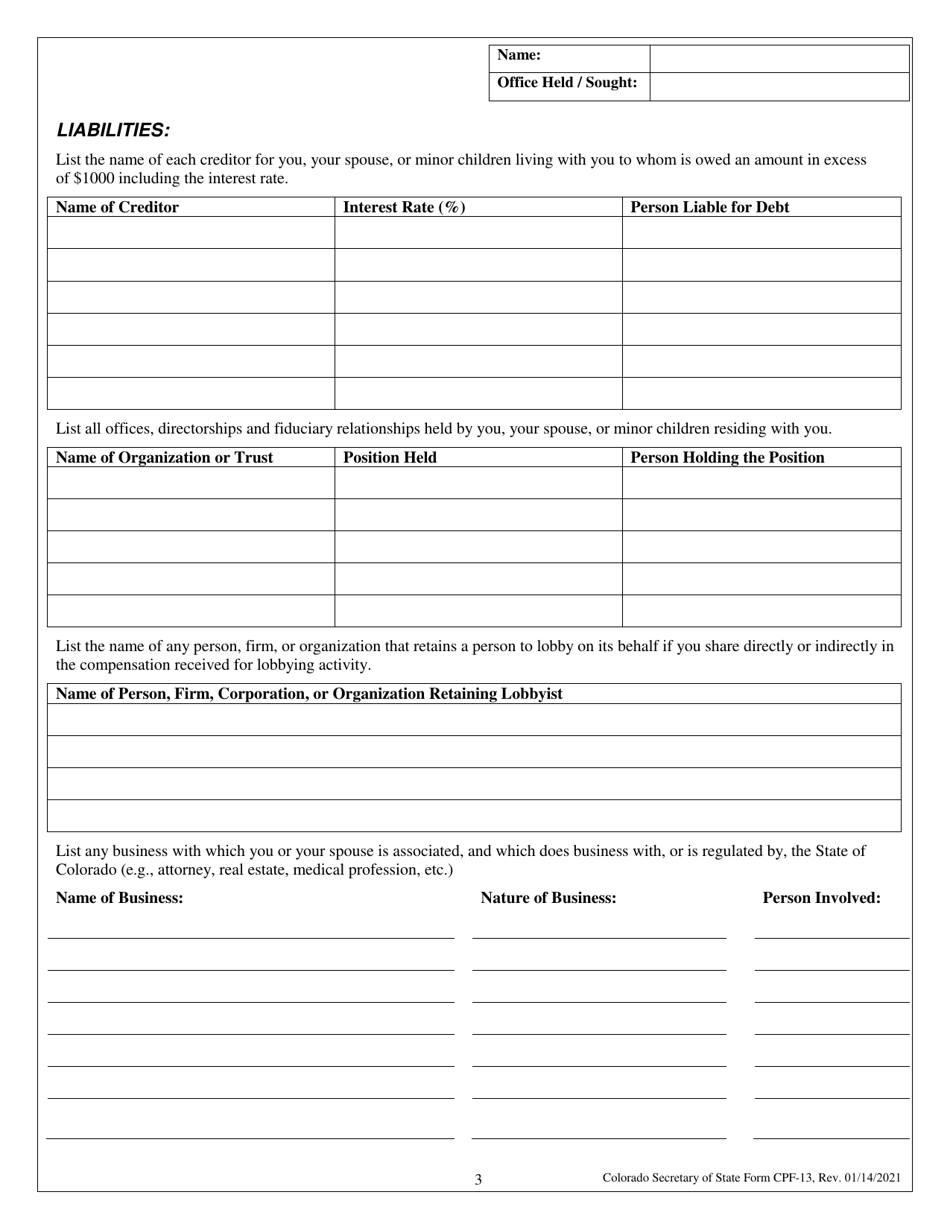

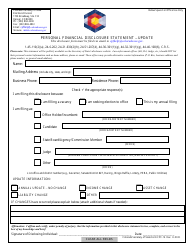

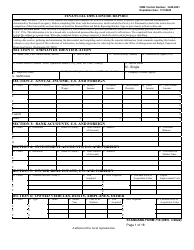

Q: What information is required on Form CPF-13?

A: Form CPF-13 requires information about the filer's sources of income, investments, real estate, and other financial interests.

Q: When is Form CPF-13 due?

A: Form CPF-13 is due annually by April 15th.

Q: Are there any penalties for not filing Form CPF-13?

A: Failure to file Form CPF-13 or providing false information can result in penalties, including fines and potential criminal charges.

Q: Can I request an extension to file Form CPF-13?

A: Yes, an extension can be requested, but it must be done prior to the original due date of April 15th.

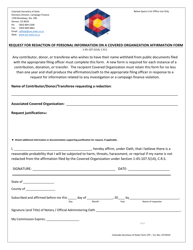

Q: Who has access to the information provided on Form CPF-13?

A: The information on Form CPF-13 is generally accessible to the public, although certain portions may be kept confidential.

Q: Is there a fee for filing Form CPF-13?

A: Yes, there is a filing fee associated with Form CPF-13. The fee amount may vary.

Q: Is Form CPF-13 the same as the federal financial disclosure form?

A: No, Form CPF-13 is specific to Colorado and is not the same as the federal financial disclosure form.

Form Details:

- Released on January 14, 2021;

- The latest edition provided by the Colorado Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CPF-13 by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.